Did you know that the total investor count rose to 5.49 crore in May 2025, with around 3.19 lakh new investors added in India that month?

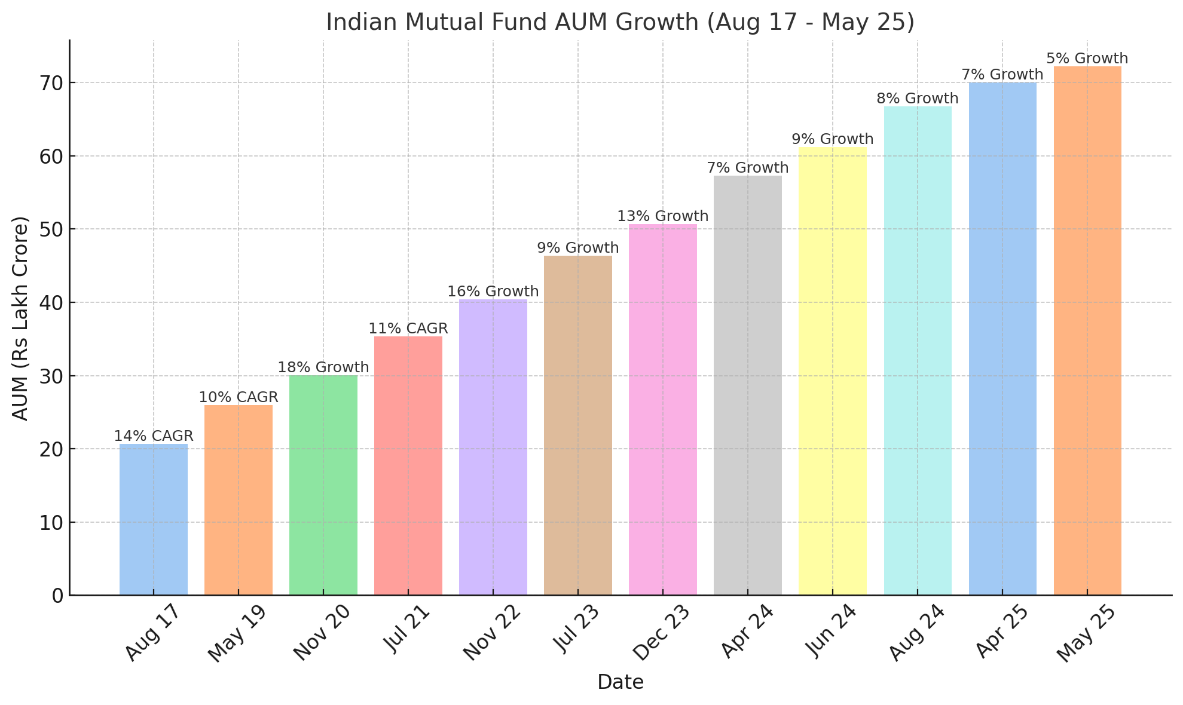

Yes, these numbers have supported the industry's AUM growth reach 20% CAGR in the past 10 years and 24% CAGR in last 5 year, as per the press release made by on of the largest AMCs, the Franklin Templeton India Mutual Fund.

However, "Do you know who the major contributor to this immense growth is?" It is none other than the domestic mutual funds, adding over Rs.13.3 lakh crore to tier AUM in the past year alone.

Now, if you compare this to the US mutual fund industry growth, it is going with a much slower pace, at 8% CAGR over the past decade.

The mutual fund industry in India has now become a key player, with net inflows of Rs.6 lakh crore from domestic institutional investors (DIIs) over the past 12 months, while foreign institutional investors (FIIs) saw net outflows of Rs.3.1 lakh crore.

The share of Mutual Funds asset as a percentage of bank deposits has grown significantly, from 12.6% in 2015 to over 31% in May 2025, as shown in the graph below:

Some of the key growth areas are:

-

Smaller Cities

The mutual fund industry’s growth is no longer limited to the top 15 cities. The share of assets from B15 cities increased from 25% in March 2020 to 35% in March 2025. Furthermore, B30 cities are growing faster than T30 cities, with their share rising from 16% in Dec 2020 to 18% in May 2025.

-

Regional Growth

States like Maharashtra, Delhi, Karnataka and Gujarat remain the top contributors to AUM, but Telangana (32.08%) and Haryana (27.90%) have seen the highest growth rates.

As much as 89 lakh new investors were added in the last 12 months vs 78 lakh in the same period last year. The sectoral/Thematic Mutual Funds’ category witnessed the highest gross/ net sales over the last 12 months. Most equity categories witnessed positive net sales in May 2025.