Table of Contents

- Overview of SBI Contra Fund

- SBI Contra Fund Returns and Performance Analysis

- Introduction of the Fund Manager of SBI Contra Fund

- Investment Strategy of SBI Contra Fund's Manager

- SBI Contra Fund Portfolio Composition

- Top Current Holdings of SBI Contra Fund

- Stock Quality Analysis of SBI Contra Fund

- SBI Contra Fund Review: Risk and Reward

- Is the SBI Contra Fund Good for Your 2026 Portfolio?

- Concluding SBI Contra Fund Review

Did you know that the SBI Contra Fund has become one of the largest contra funds with a current AUM of over Rs 49,000 crore? Yes, this is true, but that's not all. As per the recent data, it has delivered 18.19% returns in 3 years and such rolling returns are pretty impressive for a contra fund scheme.

This recalls a famous saying by Warren Buffett, "Be fearful when others are greedy and greedy when others are fearful," commenting on the contrarian philosophy that says market panics can be an excellent chance for low-priced investments.

In this blog, you will get a detailed SBI Contra Fund Review, including its recent performance analysis and the factors behind its success. So, let us begin with an in-depth overview of this contra mutual fund and see if it fits your 2026 portfolio.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Overview of SBI Contra Fund

The SBI Contra Fund is one of the open-ended Equity Mutual Funds. It follows a contrarian investment strategy that works for achieving long-term capital appreciation. The strategy is to invest in stocks and sectors that are currently undervalued or out of favor with the market but have strong long-term growth potential.

This fund falls under the category of contrarian funds or value-oriented equity funds that have a very high risk level, but are a high-rewarding option. It is best suited for investors with a long-term investment horizon (at least 5-7 years).

Look at the basic details of the SBI Contra Fund below:

| Factors | Value |

|---|---|

| AMC | SBI Mutual Fund |

| AUM | Rs 49,837 Crore |

| Current NAV | Rs 436 (as of 23 December) |

| Benchmark | Nifty 500 TRI |

| Expense Ratio | 0.68% |

| Exit Load | 0.25% if redeemed within 30 days and 0.10% if redeemed after 30 days but on or before 90 days |

| Risk Level | Very High |

| Returns Since Inception | 16.5% – 19.2% |

| Minimum SIP Amount | Rs 500 |

| Minimum Lump Sum Amount | Rs 5,000 |

Now, let us look at the returns of this fund and see how it performed before.

Best Mutual Funds for 2026 Backed by Expert Research

SBI Contra Fund Returns and Performance Analysis

The SBI Contra Fund has a proven track record and has consistently beaten its benchmark (Nifty 500 TRI) with a strong long-term performance. Let us analyse its performance in detail with its:

Rolling Returns

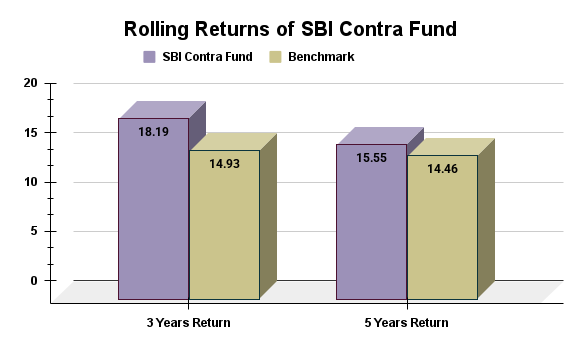

Look at the graph below that compares the rolling returns of the fund with its benchmark:

The above comparison shows that the fund has easily beaten its benchmark for the rolling returns with 18.19% and 15.55% over 3-year and 5-year periods, respectively, where the benchmark was only at 14.93% (3-year) and 14.46% (5-year).

These returns show that the SBI Contra Fund has delivered stronger performance than its benchmark, but with lower consistency over 3-year periods. However, the fund made a comeback over 5 years, showing that patience pays off with this fund.

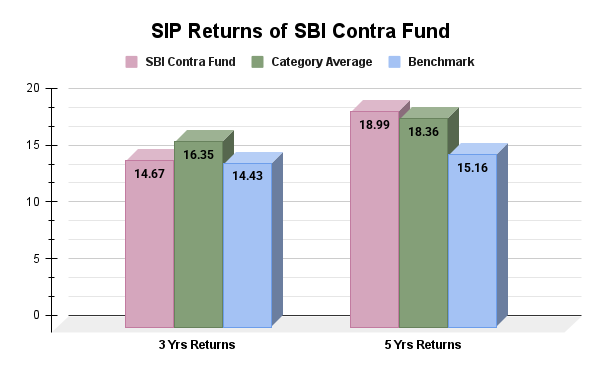

SIP Returns

Over 3 years, the fund has given 14.67% SIP returns, which is slightly ahead of its benchmark (14.43%), but behind the contra category average of 16.35%. This shows that the peers have done better in this phase. But on a 5-year basis, the fund looks stronger, delivering 18.99% SIP returns, beating its benchmark (15.16%) by a wide margin as well as surpassing its peers (18.36%). This SIP returns shows that its contrarian investment choices have succeeded well over a complete market cycle.

These numbers tell that although the fund lags in the short to medium term, it is rewarding for investors with longer investment horizons.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Next, you will get to know the ones who manage your money in this fund. So, stay tuned.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Introduction of the Fund Manager of SBI Contra Fund

One of the largest Contra Mutual Funds, with around Rs 49,000 crore AUM (Assets Under Management), the SBI Contra Fund takes a lot of its strength from its fund manager, Dinesh Balachandran and his disciplined contrarian style. He has been the lead manager of this fund since May 2018, with strong qualifications and over 15 years of experience in equity research and fund management.

He looks for businesses that are undervalued and temporarily overlooked but have strong fundamentals, instead of following popular trends. His strategy is to diversify the fund's portfolio across 80-85 stocks, with the top 10 making up around one-third of the total assets. The low turnover of the fund shows a proper buy-and-hold approach focused on long-term recovery.

Previously, he has also worked with Fidelity Investments, USA, for 10 years as a Research Analyst. His patience and unique style have helped the fund deliver strong 5-year-plus outcomes, particularly after market corrections, where contrarian bets in areas like PSU banks or metals have paid off.

In the heading, let us understand Balachandran's investment strategy in more detail.

Investment Strategy of SBI Contra Fund's Manager

The fund manager of the SBI Contra Fund follows a contrarian investment strategy that targets the stocks or sectors that are presently not performing so well but hold great potential to grow in the future. As the name suggests, this strategy is the opposite of investing in the stocks that are currently performing very well.

It combines broad top-down views of different sectors with a detailed bottom-up research process on company finances, cash flow and management quality. This strategy is highly suitable for patient investors who can stay invested through full market cycles.

The majority of investors usually ignore these undervalued sectors or stocks, but experts or experienced investors can identify them with great precision. That is where the SBI Contra Fund's regular growth is better than others.

Must Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

Let us proceed further in this SBI Contra Fund review and talk about its portfolio allocations.

SBI Contra Fund Portfolio Composition

Here is a detailed overview of the SBI Contra Fund portfolio allocations in various sectors, asset classes and market capitalisations:

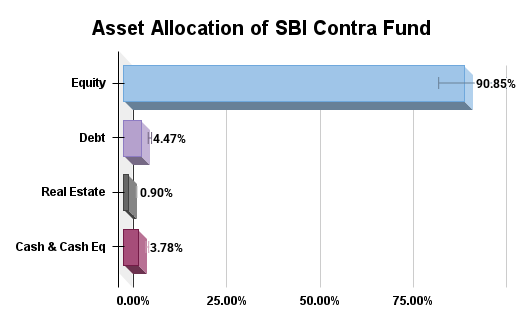

Asset Allocation

More than 90% of the fund's assets are allocated to equity funds. Hence, it was earlier said that the SBI Contra Fund largely falls under the equity fund category. In addition, the reason is that equity funds hold the potential to provide greater returns. Moreover, the fund has also allocated assets in debt (4.47%), cash and its equivalents (3.78%) and real estate (0.90%).

Such an asset allocation showcases the conviction of SBI Mutual Fund to provide investors with maximum returns.

Market Cap Allocation

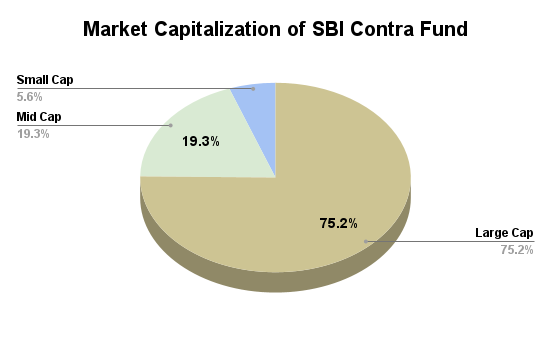

The market capitalisation structure of the SBI Contra Fund can be described as large-cap heavy with selective mid-small contrarian hints. Look at the graph below:

The fund is focused on the stability of the well-established large-cap companies with 75.19% allocation, making it suitable for investors who want value opportunities without taking extreme level risks.

The fund also has a meaningful part reserved for higher-growth ideas with 19.26% mid-cap and 5.55% small-cap allocations.

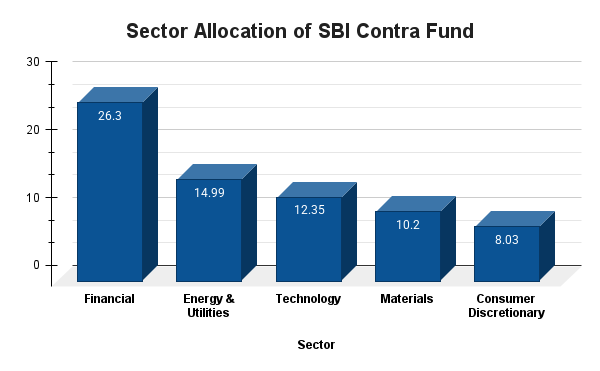

Sector Allocation

Sector allocation can tell how diverse a portfolio is, which helps investors assess the risk as well. Look at the sector allocation of this fund:

The largest share, 26.3%, of the SBI Contra Fund has been invested in the financial sector. And nearly 14% and 12% of the fund has been invested in energy & utilities and technology sectors, respectively. All three of these sectors hold strong potential in the future.

SBI Contra Fund has also invested in materials (10.2%) and consumer discretionary (8.03%) as well. Such a vast diversity of portfolio indicates that SBI Mutual Fund has some talented people.

In the next part, let us explore the top holdings of the SBI Contra Fund.

Top Current Holdings of SBI Contra Fund

The following is the list of the top 5 holdings of the SBI Contra Fund with their total allocations in the fund:

| Rank | Stock / Instrument | Approx. Allocation |

|---|---|---|

| 1 | TREPS (Cash & Equivalents) | 14–15% |

| 2 | HDFC Bank Ltd. | 8.2% |

| 3 | Reliance Industries Ltd. | 6.2% |

| 4 | Punjab National Bank | 2.8% |

| 5 | Kotak Mahindra Bank Ltd. | 2.7% |

Also Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

Moving on, it is time to check whether this fund has the quality that makes it worth your investment or not.

Stock Quality Analysis of SBI Contra Fund

The earnings growth ratio of 14.25 shows that the underlying companies that the fund has invested in are growing at an impressive rate. Furthermore, the sales growth ratio and cash flow growth ratio are 9.85 and 7.11, respectively. Moreover, the P/E ratio for the scheme is 15.53.

You will find the fundamental ratios along with their values in the table below:

| Fundamental Ratios | Values |

|---|---|

| Sales Growth | 9.76% |

| Earnings Growth | 8.37% |

| Cash Flow Growth | 7.86% |

| P/E Ratio (Valuations) | 20.6 |

All these fundamental ratios indicate healthy growth of the SBI Contra Fund. This analysis shows that Mr. Balachandran holds efficient expertise in identifying undervalued yet promising stocks for the scheme.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Now, let us analyse the risk factors of this contra mutual fund.

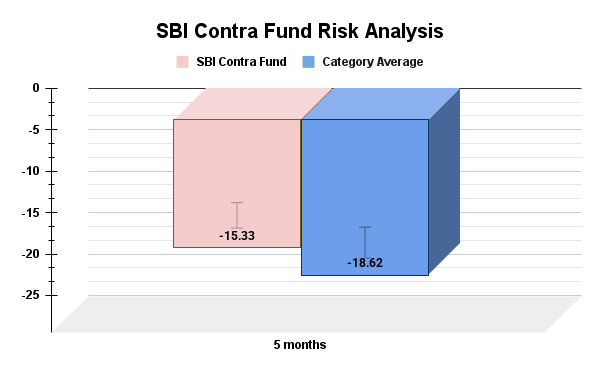

SBI Contra Fund Review: Risk and Reward

The SBI Contra Fund has a risk profile that is more balanced compared to others in its category. It offers similar risk-adjusted returns but experiences less severe losses. The fund’s standard deviation is 12.15, less than the category average, which means its returns have been a little less volatile than peers.

The Sharpe ratio is 0.99, almost identical to the category’s 0.98, indicating similar risk-adjusted performance. The fund has a max drawdown of 15.33% which is better than the category’s 18.62%, suggesting somewhat shallower falls in sharp corrections.

The SBI Contra Fund can offer similar returns to its category while avoiding extra volatility. It also tends to behave better during downturns.

This led to another question, “Is this contra fund good to invest in 2026?” The following section will give you the answer to that.

Is the SBI Contra Fund Good for Your 2026 Portfolio?

The SBI Contra Fund can be a beneficial addition to an investor's portfolio in 2026, but only for those who are comfortable with the risks associated with equity investments and market fluctuations. The fund has a strong long-term track record, thanks to its strategy of buying undervalued stocks that are currently out of favor but are expected to increase in value later.

However, it is classified as a very high-risk fund because it invests in areas where the market sentiment is low. It also includes mid and small-cap stocks, which can experience sharp price changes in the short term.

As we enter 2026, equity markets are close to their highest levels. This usually leads to more price swings and the chance of a market drop. A contrarian strategy like the SBI Contra Fund, which goes against the trend, can help during these times by buying quality stocks at lower prices. This approach may protect the portfolio from losses and position it for a stronger recovery when the market improves.

Smart Investments, Bigger Returns

Concluding SBI Contra Fund Review

To sum up, based on the above discussion and the data regarding past performance, it can be said that the SBI Contra Fund regular growth can be a good scheme to invest in 2025.

This can be attributed to the expert fund managers and investors' trust, which has helped the fund grow this far. You can start a SIP as per your financial objectives and set a long-term goal so that you can have maximum benefits.

Related Blogs:

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

- SBI Small Cap Fund Review: Should You Invest in 2026?

FAQs

-

Who should invest in the SBI Contra Fund in 2026?

The SBI Contra Fund suits investors who are comfortable with volatility, can stay invested for the long term and are seeking potential growth.

-

Who should avoid the SBI Contra Fund?

Conservative investors, those who are close to their financial goals or anyone needing liquidity within 3–5 years, should avoid this fund.

-

Is 2026 a good time to start a SIP in the SBI Contra Fund?

Starting a SIP in 2026 can be a good choice if you treat the fund as a long term growth option with high risk in your portfolio.

-

Can SBI Contra Fund help in a market at all time highs?

When markets are near their peak, contrarian funds can invest in undervalued areas that are often overlooked, protecting during downturns.

-

How should I decide whether to invest in the SBI Contra Fund now?

Consider your risk appetite, time horizon and existing portfolio mix before investing and align them with the chosen fund.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)