Table of Contents

- 360 ONE Multi Asset Allocation Fund Key Info

- Will 360 ONE Mutual Fund Use the Best Asset Allocation Strategy?

- Is it Good to Invest in 360 ONE Multi Asset Allocation Fund NFO for 2025?

- Are Multi Asset Mutual Funds High Risk Investments?

- What is the 360 ONE Multi Asset Allocation Fund NFO Suitability?

- To Conclude 360 ONE Multi Asset Allocation Fund Review

Are you ready for the new reality? If yes, introducing you to the newly launched scheme, the 360 ONE Multi Asset Allocation Fund NFO presents a VUCA world, a global perspective stands for "Volatility + Uncertainty + Complexity + Ambiguity".

But, "What makes this new fund offer unique?" Well, the world that you knew is no longer the same, markets are now shaped by forces beyond traditional economic cycles.

Yes, that's why you need a Multi Asset Allocation Fund category in your portfolio. On that note, subscribe for this latest NFO, which started on 30th July and will be closing on 13th August 2025.

Now, without any further ado, let's start the 360 ONE Multi Asset Allocation Fund Review to see if it could be the best NFO 2025 or not.

360 ONE Multi Asset Allocation Fund Key Info

The below table covers the basic details about the newly launched NFO by 360 ONE Mutual Fund in the multi asset funds category 2025:

| Scheme Name | 360 ONE Multi Asset Allocation Fund |

|---|---|

| Issue Open Date | 30th July, 2025 |

| Issue Close Date | 13th August, 2025 |

| Category | Hybrid: Multi Asset Allocation |

| Benchmark | BSE 500 TRI (25%) + Nifty Composite Debt Index (45%) + Domestic Prices of Gold and Silver (30%) |

| Minimum Application Amount | Rs. 1,000 |

| Fund Managers | Mr. Mayur Patel, Mr. Milan Mody & Mr. Rahul Khetawat |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum / SIP / SWP |

Will 360 ONE Mutual Fund Use the Best Asset Allocation Strategy?

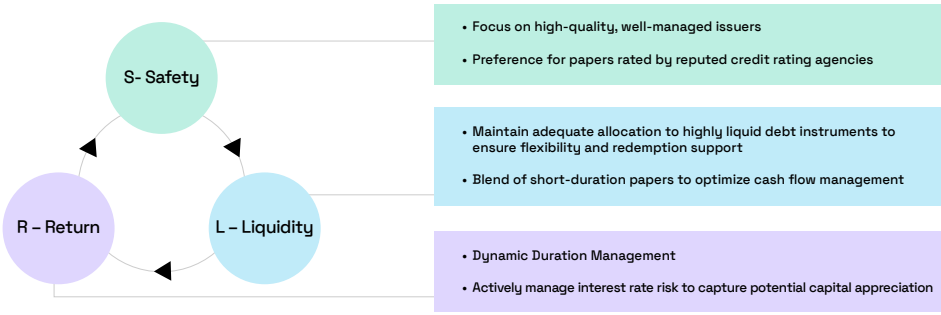

This newly launched New Fund Offer has adopted an all-time best asset allocation strategy where safety, liquidity and returns are balanced into one single framework called, "SLR approach." Let's see what this SLR framework stands for:

S: Safety

L: Liquidity

R: Return

To make their approach the best asset allocation strategy, the fund manager, Mr. Mayur Patel, has strategically broken the investment process into four simple steps:

- Step 1: The Asset Allocation Committee (AAC) is to guide and oversee the asset allocation.

- Step 2: Fund managers will drive the allocation of stocks/securities for individual asset classes.

- Step 3: Final portfolio construction.

- Periodic review and rebalancing of the portfolio.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Is it Good to Invest in 360 ONE Multi Asset Allocation Fund NFO for 2025?

Here are some strong points that make this latest NFO 2025 under the Multi Asset Allocation Funds category that makes it worthy:

-

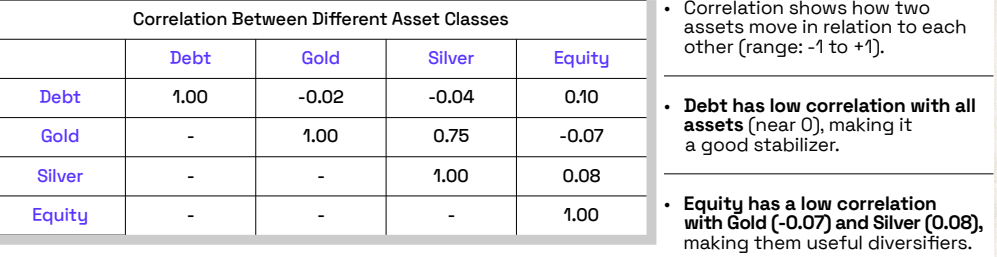

Low or Negative Correlation Between Asset Classes

Investing in different types of assets that don’t move in sync with each other can help lower the ups and downs in a portfolio. For example, debt (like bonds) tends to move differently from most other assets, making it a good way to keep things stable. On the other hand, stocks (equity) don’t usually follow the same pattern as Gold or Silver, so they can act as a useful backup when things get shaky.

-

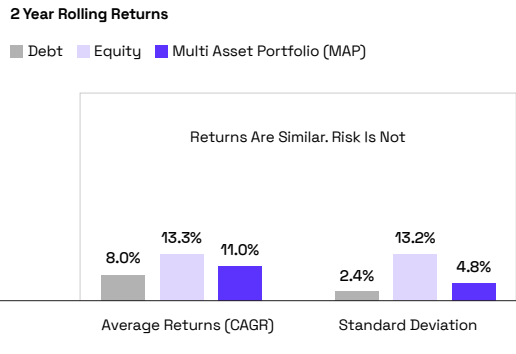

Stable Returns with Less Risk

The chart below compares how debt and equity perform over time compared to a Multi-Asset Allocation fund. The Multi-Asset Fund gives returns similar to equity but with a lot less risk, making it a great option for reducing risk, especially when the market is unpredictable.

-

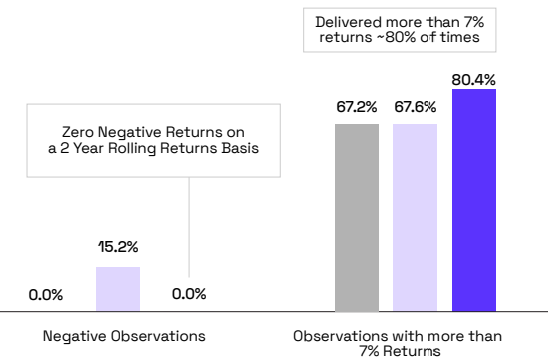

More Frequent 7% Returns

Between December 31, 2008, and June 30, 2025, the Multi-Asset Fund earned returns above 7% 80.4% of the time. This is better than both debt 67.2% and equity 67.6%. Plus, like debt, the Multi-Asset Fund has never experienced a negative return during this period, offering more reliable returns even when the market is volatile.

-

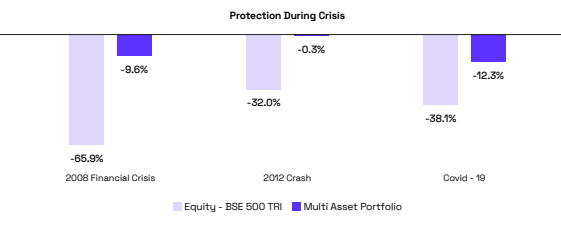

Smaller Losses During Market Downturns

In times when the market drops, the Multi-Asset Portfolio has shown smaller losses compared to the broader market. This strategy, made up of 25% BSE 500 TRI, 45% Nifty Composite Debt Index, and 30% Gold & Silver, has proven to be tough during tough market conditions.

-

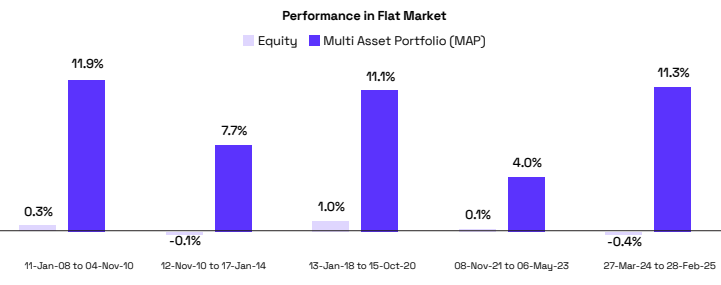

Outperformance in Flat Markets

Even when the market isn’t going up or down much, the Multi Asset Funds has been able to provide steady, positive returns, proving it can handle all kinds of market cycles.

* Source: 360 ONE AMC, data as on 31st March 2025. Equity represented by BSE 200 TRI, Multi asset portfolio is constructed using 25% BSE 500 TRI, 45% nifty Composite debt index and 30% Gold & Silver Prices.

Are Multi Asset Mutual Funds High Risk Investments?

Well, unlike any other category in Mutual Funds, the 360 ONE Multi Asset Allocation Fund NFO aims for optimum risk-adjusted returns, offering lower risk by investing in multiple asset classes.

Here is how this new fund offer has taken some precautionary steps to lower risk:

- Invested in equity up to 15-35%, aiming to provide long-term growth.

- Invested in debt securities up to 25-50%, aiming to provide relative stability.

- Gold/silver is allocated up to 25-40%, aiming to give a hedge against global uncertainties.

- Invested in REITs/InVITs up to 0-10%, aiming to provide exposure to real estate.

What is the 360 ONE Multi Asset Allocation Fund NFO Suitability?

This newly launched NFO is best suited for following type of risk appetite seekers:

- Investors seeking stability in volatile markets.

- If you aim for better-than-debt returns while keeping volatility in check, this multi-asset allocation fund NFO is the perfect fit.

- Goal-based investors looking for medium-to-long-term investment (3-5 years +) like children's education, wealth accumulation or early retirement.

- Investors are looking for diversity across multiple asset classes.

Smart Investments, Bigger Returns

To Conclude 360 ONE Multi Asset Allocation Fund Review

To sum up, in a world that keeps on changing, the newly launched 360 ONE Multi Asset Allocation Fund NFO might come in handy. Why?

Well, this multi asset allocation fund will shape the markets while finding balance between equity, debt and precious metals.

But, “Do you know what the best way to benefit from this NFO is?” Well starting a SIP (Systematic investment plan) presents an easy, flexible way to build your wealth over time.

So if you are planning for your goals or simply want a reliable, all-weather investment, the 360 ONE Multi Asset Allocation Fund review says it could be a smart place to start. Let your money grow steadily—one SIP at a time.

.png&w=3840&q=75)

.webp&w=3840&q=75)