Table of Contents

- What are Special Opportunities Funds?

- Motilal Oswal Special Opportunities Fund NFO Basic Details

- What is the Strategy of Motilal Oswal Special Opportunities Fund?

- Is Motilal Oswal Special Opportunities Fund Good Investment Now?

- How will Motilal Oswal Special Opportunities Fund Manage Risk?

- Who Should Invest in Motilal Oswal Special Opportunities Fund?

- To Conclude Motilal Oswal Special Opportunities Fund Review

The newly launched Motilal Oswal Special Opportunities Fund NFO is up for grabs, started on 25th July and will be closing its subscription on 8th August 2025.

So, what are you waiting for? This latest NFO circles around the idea promoted by the Motilal Oswal Mutual Fund, "Think Equity, Think Motilal Oswal."

However, this newly launched scheme falls under the thematic fund category of the equity mutual funds.

Now, without more delay, let's delve into the Motialal Oswal Special Opportunities Fund Review to find if it could be the best NFO 2025 for you or not.

What are Special Opportunities Funds?

Well, simply put, special situation is the name given to this category based on unique opportunities like government policy change, global events, mergers, innovations that can arise in a company, sector or economy.

Now that you got that covered, let’s cover the key information on this new fund offer in the next heading.

Motilal Oswal Special Opportunities Fund NFO Basic Details

Here is the key information about the newly launched NFO by Motilal Oswal Mutual Fund in 2025:

| Scheme Name | Motilal Oswal Special Opportunities Fund |

|---|---|

| Issue Open Date | 25th July 2025 |

| Issue Close Date | 8th August 2025 |

| Category | Equity: Thematic Fund |

| Benchmark | Nifty 500 Total Return Index |

| Minimum Application Amount | Rs.100 |

| Fund Managers | Mr Ajay Khandelwal & Mr Atul Mehra |

| Plans & Options | Regular and Direct Plans with Growth and Dividend Options |

| Facilities Offered | Lumpsum/SIP/SWP |

What is the Strategy of Motilal Oswal Special Opportunities Fund?

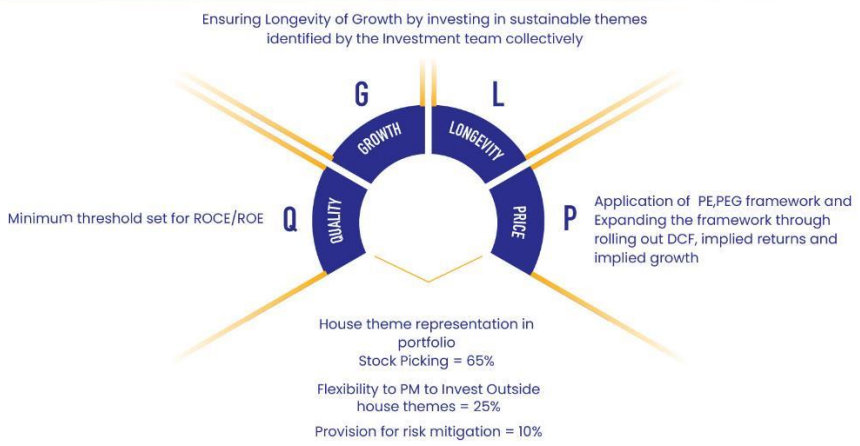

The Motilal Oswal Special Opportunities Fund uses a unique investment approach called "QGLP". It is the standard investment philosophy of Motilal Oswal AMC. It stands for:

- Q: Quality

- G: Growth

- L: Longevity

- P: Price

This New Fund Offer strives to give you a mix blend of Hi-Quality + Hi-Growth for maximum returns for your portfolios.

The Motilal Oswal house theme is picking 65% of quality stocks, 25% is kept for flexible investment in outside themes and the remaining 10% is structured to lower risk.

Is Motilal Oswal Special Opportunities Fund Good Investment Now?

Let's straight out point out the reasons that make Motilal Oswal Special Opportunities Fund a worthy investment for your portfolio:

-

Backed by the Government

The Modi government 2.0 has gone under various regulatory reforms, including introducing Rs.1.61 lakh crores PLI (Production-linked Incentives), Rs .14 lakh crores in production, Rs .5.31 lakh crores in exports and generating Rs .11.5 lakh jobs.

Here is a list of approved PLI outlay by the government, strengthening the scope for service opportunities Mutual Funds:

-

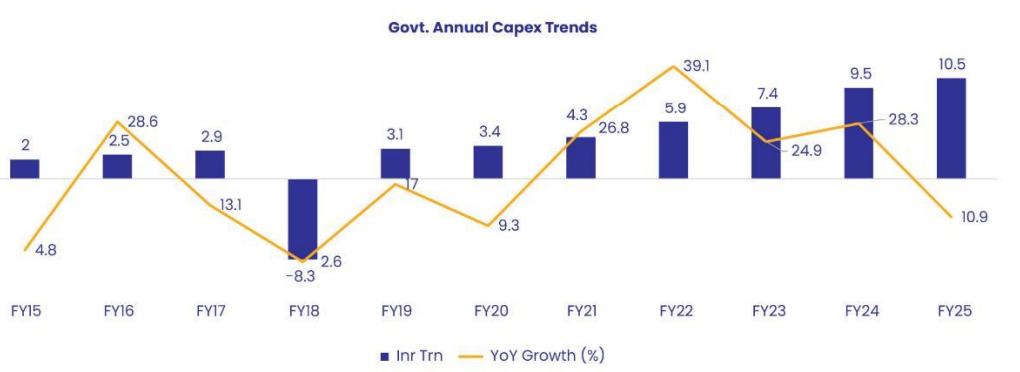

Capex Cycle Revival

The government annual capex trends keep on changing, benefiting the Motilal Oswal Special Opportunities Fund NFO, with capital expenses reaching Rs .2.4 trillion in March 2025. This marked a 68% year-on-year increase and contributed around 23% of the central government's total capex for FY25.

Let's take a look at the graph below to experience this immense growth with your own eyes:

Also note, for FY26, the government has set a capex target of INR 11.2 trillion, expecting a growth of 6.5% year-on-year. This means investing in this newly launched NFO 2025 might not be such a bad idea for your portfolio.

-

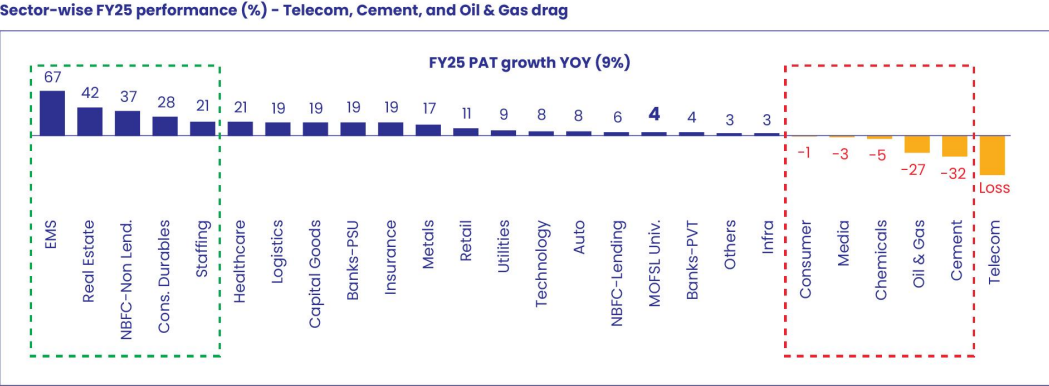

Volatility Gives Opportunity

The market upswings can present opportunities to make higher returns by investing in new, emerging and trending sectors.

See the below graph for sector-wise performance for FY25:

* Note: Telecom sector losses declined significantly from INR126b in FY24 to INR26b in FY25.

How will Motilal Oswal Special Opportunities Fund Manage Risk?

This latest NFO 2025 by the Motilal Oswal Mutual Fund has applied a strong risk management framework to increase the overall sustainability in the portfolio:

-

Stock Sizing

This new NFO has put a lot of focus on stock weightage and stock sizing, keeping minimum and maximum exposure limits set in advance.

-

Sector Sizing

The limits set in the sector deviations, which are relative to the NFO's benchmark, are yet another step to prevent risk from the market volatility.

-

Diversification

The Motilal Oswal Special Opportunities Fund NFO uses a well-diversified strategy with a portfolio size capped at up to -35 stocks.

-

Stop Loss Framework

This latest NFO has taken some proprietary measures to increase the profits for the investors.

Who Should Invest in Motilal Oswal Special Opportunities Fund?

You can check whether or not this latest NFO suits your long term goals in the below given points:

-

People who can handle some risk

This fund is for those who do not mind market ups and downs and are looking for better returns.

-

Long-term investors

If you are planning to invest for the long run and can wait for growth, this fund is a good choice.

-

Those looking for fresh opportunities

It’s a great option for anyone interested in sectors like telecom or those affected by government changes.

-

Investors who want variety

If you are looking to spread your investments across different types of stocks and sectors, the Motilal Oswal Special Opportunities Fund NFO offers good diversification.

To Conclude Motilal Oswal Special Opportunities Fund Review

To wrap up the Motilal Oswal Special Opportunities Fund Review, it can be stated that if investment across growth-oriented thematic funds is what you need, then this is the perfect fit.

This could be among the best NFO 2025 if you invest no. However, if you are still hesitant, start a SIP (Systematic Investment Plan) with a small amount, say Rs .500 and then you can increase with time.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)

.png&w=3840&q=75)