Table of Contents

Get ready to uncover the hidden gems with the Bandhan Small Cap Fund, with a proven track record, this fund consistently outperforms its peers and benchmarks, this fund stands out as the top performer in the small cap category, delivering an impressive 76% return in just one year, consistently surpassing its peers and benchmarks.

Though we give little importance to short-term performance, since a new fund manager took over Bandhan Emerging Businesses Fund in January of this year, we wanted to see how the scheme performed under the new fund manager.

Let's discover what makes the Bandhan Small Cap Fund a standout performer in the small cap category:

Investing Strategy

Bandhan Small Cap Fund has a unique and active investing strategy for identifying emerging ideas and sound businesses to invest in at an early stage, focusing on margin safety. The fund manager seeks out niche opportunities and potential leaders of tomorrow, rather than just tracking the benchmark. The fund maintains diversification across sectors to control risk, and its goal is to achieve long-term absolute returns rather than benchmark performance.

Fund Manager

The fund we're discussing is in good hands with Mr. Manish Gunwani an experienced and aggressive fund manager. With 28 years of experience in fund management and equity analysis, he offers valuable expertise. Under his leadership, the Bandhan Small Cap Fund has consistently outperformed its peers and benchmark in the past year. Mr Gunwani’s aggressive yet calculated approach has proven successful, making him a valuable asset to the AMC.

Manish Gunwani

(Head of Equity)

How it has performed in the past

Returns: Since the fund started in December 2020, if you had put your money in it for any 3 years, on average, you would have gotten almost 33.34% annualized returns. What's even more noteworthy is its consistency — it has a 100% track record of offering returns above 12% every single time. We compared the same investment with its benchmark, the BSE 250 Small Cap TRI, to evaluate the Mutual Funds performance. Though it has not performed in the past but this fund has started performing with the change in fund management.

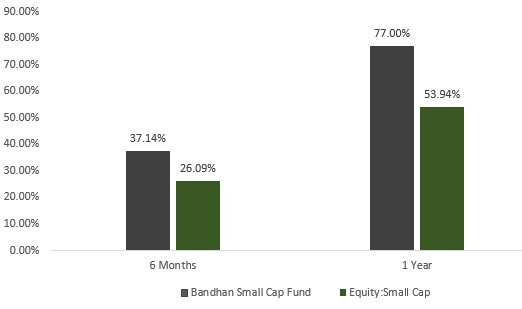

Recent improvement in performance versus peers

While short-term performance is not a major focus, we wanted to assess who took over in January. The performance has been promising as the fund has outperformed the average performance of other small-cap funds in its category. It is promising to see that the Bandhan Small Cap Fund has performed well in various market conditions. While it is still early, this is a positive start for Manish Gunwani as the fund manager of this Equity Mutual Fund scheme.

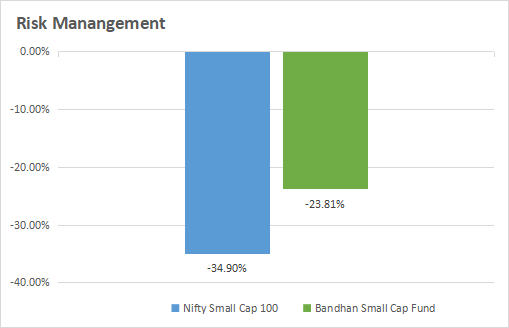

Risk Analysis

From January 2022 to August 2023, the Nifty Small Cap 100 index experienced a significant drop of 34.90%. During the same period, the Bandhan Small Cap Fund saw a lesser decline of 23.81% and a timely recovery. Risk analysis shows that the fund had lower volatility, with a standard deviation of 16.82, compared to the benchmark's 17.50. Additionally, the fund achieved a superior Sharpe ratio of 1.28, which is higher than the category average of 1.19, indicating better risk-adjusted returns.

Portfolio Allocation

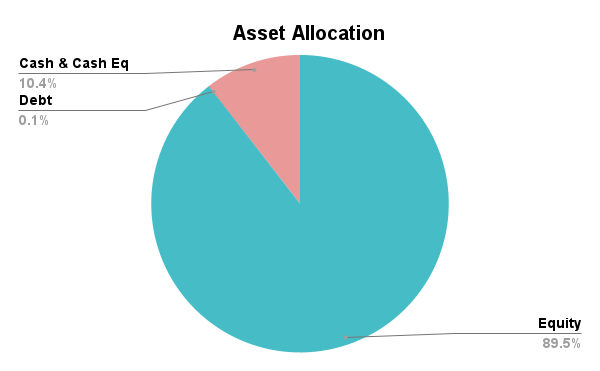

The fund invests 89.5% in equities and keeps 10.44% in cash to take advantage of market opportunities, focusing mainly on small and mid-cap stocks which are 88% of its investments. It has a diverse portfolio of 144 stocks, with the top 10 making up 18.35% of the fund. Investments are spread across various sectors like financials, consumer goods, and materials which make up 38.20% of the allocation. Even though not all these sectors did great recently, the Financial, tech and healthcare sectors are gearing up to perform well

Key themes include power capital expenditure growth in India, global energy transition, focus on niche markets, and capitalizing on sector-specific opportunities.

Now let’s have a look at its Asset Allocation

In terms of Asset Allocation, the fund invests 89.5% in equities and keeps 10.44% in cash. It aims to take advantage of market opportunities, focusing mainly on Small Cap Mutual Funds and mid-cap stocks which are 88% of its investments.

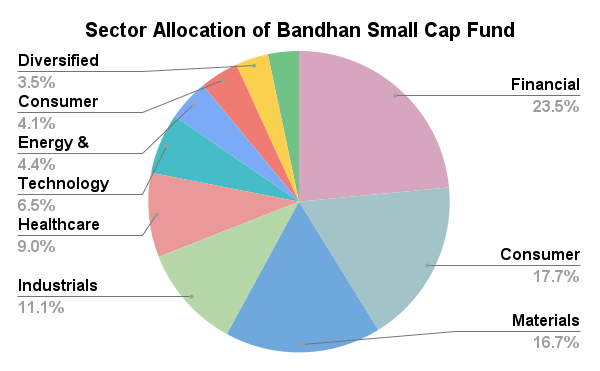

Moving on to sector allocation, the top 10 sectors holding of the fund are as follows:

Sector Holdings

Financial – 21.02%

Consumer Discretionary – 15.84%

Materials – 14.99%

Industrials – 9.94%

Healthcare – 8.09%

Technology – 5.83%

Energy & Utilities – 3.96%

Consumer Staples – 3.71%

Diversified – 3.15%

Real Estate – 2.97%

According to the above portfolio analysis, this strategy favor capitalizing on opportunities present in the market while reducing sector-specific risks.

Overweight in financial and consumer discretionary, underweight in real estate and diversified sectors. It has a diverse portfolio of 144 stocks, with the top 10 making up 18.35% of the fund. Investments are spread across various sectors like financials, consumer goods, and materials, making up 38.20% of the allocation. Although these sectors have not performed well recently, the Financial, tech and healthcare sectors have shown outstanding growth potential.

Stock Selection and Quality

While analyzing stocks selections of the fund, we look at four important things to make sure they're good quality: how fast their sales are growing, how much profit they make, how much cash they have coming in, and how their price compares to their earnings (that's the PE ratio). This fund is filled with companies that are growing fast. On average, their sales are going up by 14%, they're making a 94% profit on what they sell, their cash flow is increasing by 12%, and they have a low PE ratio of 15, which means we're getting them at a good price. All this adds up to why we think this fund is one of the best choices, with really top-notch companies in it.

Suitability

Bandhan Small Cap Fund is backed by a process-driven fund house and has an experienced fund manager at helm, the fund managers actively seek out promising, growing businesses, making it appealing to those who value aggressive and expert management.

Bandhan Small Cap Fund focuses on maintaining a well-diversified portfolio comprising identifying emerging and sound businesses small-cap stocks spread across sectors and holds them with a long-term view to mitigate market risk.

Bandhan Small Cap Fund is suitable only for investors with a high risk appetite and a long term SIP investment horizon of at least 5-7 years.