Table of Contents

Introducing you to one of the best performers in the small-cap category, the Tata Small Cap Fund which has been around for just over 5 years and 8 months. Yet, in this short span, it has managed to attract investors with an average annual return of 35% since its inception.

In this post we will delve into finding whether it's a good idea to start a SIP in this scheme and if yes then what are the returns it has generated since its inception?

Performance of Tata Small Cap Fund Since Inception

Let’s check if this fund has beaten its benchmark with the SIP returns or not.

| SIP Returns | SIP Amount | No. of Installments | Total Investment | Current Value | Gain | Returns P.A |

|---|---|---|---|---|---|---|

| Tata Small Cap Fund | 3000 | 68 | 204000 | 549356 | 345356 | 35.84% |

| Nifty Small Cap Index | 3000 | 68 | 204000 | 519102 | 315102 | 33.71% |

Since its inception in 2018, this fund has generated 35.84% annualized SIP returns. In comparison, the Nifty Small Cap Index returned only 33.71%. This means that if you had started a SIP with Rs.3,000 with a total of 68 instalments, your total invested amount would have been Rs.204,000. With a gain of Rs.345,356, this equates to a return of 36%, bringing your current value to Rs.549,356.

Even though the fund has managed to beat its benchmark, it has done so with a very close margin. Investing through SIP would be a smart choice in this situation as the fund has shown its ability to generate superior returns over the long term, despite occasional lower consistency in shorter timeframes.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

This Raises the question: what strategy is used by the fund manager that has made this scheme a huge success? Let’s find out.

Investing Strategy Applied by Tata Small Cap Fund

Tata Small Cap Fund follows a 'bottom-up' strategy to assess the valuations and fundamentals of the stocks they consider. The fund focuses on buying businesses with strong balance sheets that can grow in profitability and cash flows. These businesses are expected to surprise the markets over time in terms of earnings delivery, which can lead to a re-rating of valuations.

The fund uses a 'Growth at Reasonable Price' approach to pick stocks, aiming to maintain a well-diversified portfolio of Small Cap Funds at all times. They hold these stocks over the medium to long term to fully realize their potential.

A well-balanced asset allocation is a powerful strategy to maximize returns and minimize risk. Let's see how Tata Small Cap Fund has achieved this success.

Asset Allocation of Tata Small Cap Fund

This allocation shows that Tata Small Cap Fund's portfolio is purely invested in small-cap stocks with the highest allocation of 91.58% in small-sized companies which talks about the aggressive nature of this fund. You can refer to the below chart for more clarity:

.png)

Sector Allocation of Tata Small Cap Fund

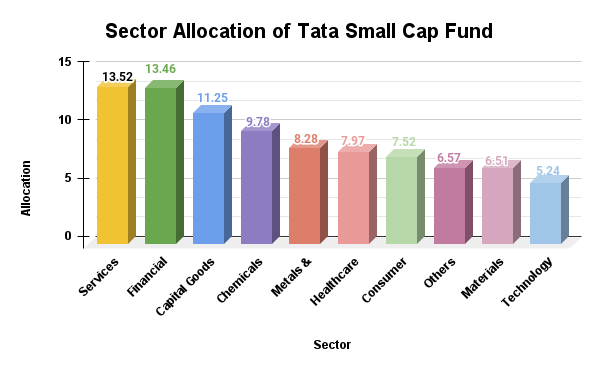

The fund has sensibly invested in top-performing sectors like 13.52% services, 13.46% financials, and 11.25% capital goods. The scheme has also identified the undervalued chemical sector keeping a 9.78% allocation in it as gives potential growth opportunity.

Likewise, it has increased exposure to metal, mining, and tech - sectors that are currently trending in Mutual Funds. This shows the manager is positioning the portfolio to capitalize on market dynamics.

While the asset allocation is well-diversified, the fund hasn't gone overweight on the highest returning sectors. As a result, the returns have been good, but there may still be room to optimize the portfolio further and drive even stronger performance. You can check the allocation with the help of the below graph:

Is Tata Small Cap Fund your ticket to quality stock investment? If such a question pops into your mind, let’s clear it out by evaluating the quality of stocks.

Stock Quality of Tata Small Cap Fund

We evaluate stock quality based on several key financial metrics: sales growth, earnings growth, cash flow growth, and price-to-earnings (PE) valuations. Let us check what the quality of Tata Small Cap Stock looks like:

| Fundamental Ratios | Value |

|---|---|

| Sales Growth | 13% |

| Earnings Growth | 12% |

| Cash Flow | 17% |

| PE - Valuations | 19.90% |

The Tata Small Cap Fund's stocks have a few areas that need improvement. Their sales and profit growth rates are a bit lower than the industry average.

However, the stocks are reasonably priced compared to the overall market. And the companies are generating good cash flow, even if it's not quite as high as the benchmark.

So while the growth numbers could be better, the fair valuations and healthy cash flows make these stocks potentially attractive investments. They offer a balanced risk and reward profile for investors interested in the small-cap market.

In our opinion, the stocks have room to grow their business, but they're fairly valued and financially stable, which makes them worth considering as part of a diversified portfolio.

Summary

Historically, the fund has provided strong returns due to the performance of small-cap stocks, often beating the small-cap index by a small margin. Currently, the portfolio is set for moderate growth, similar to its benchmark. This fund is suitable for investors comfortable with some risk and looking for steady growth in the small-cap segment. Investing through a SIP (Systematic Investment Plan) is the best approach for this scheme, as it allows for consistent investments and helps manage market volatility effectively.

Read What Experts Have To Say About Best Small Cap Funds:

1. SBI Small Cap Fund : Is It a Safe Investment Choice in 2024?

2. Nippon India Small Cap Fund: Why You Should Invest?

3. 5 Best Small Cap SIPs to Invest in 2024

.webp&w=3840&q=75)

.png&w=3840&q=75)