Table of Contents

- ICICI Prudential Multi-Asset Fund - Growth

- SBI Multi Asset Allocation Fund - Regular Plan - Growth

- HDFC Multi-Asset Fund - Growth Option

- Motilal Oswal Multi Asset Fund - Regular Plan - Growth Option

- Edelweiss Multi Asset Allocation Fund - Reg (G)

The ICICI Prudential Multi-Asset Fund Growth has a higher consistency of return delivery than the majority of the funds in its category. It has a strong capacity to limit losses in a market that is falling.

By investing primarily in equities and instruments that are related to equity, the scheme tries to increase participation capital while also producing income by investing in a variety of other asset classes.

The fund stands out for its flexibility across market capitalizations and sectors, each asset class serves a distinct purpose: Equity is organized toward capital appreciation, while debt focuses on providing consistent accrual returns. In addition, gold and silver assets aim to act as a barrier against inflation, offering stability and diversification in the portfolio. A key requirement of this fund is a minimum allocation of at least 10% in three or more asset classes, ensuring a well-balanced and diversified portfolio.

This fund consistently generates good wealth for a long time. In the hybrid category, this fund is on the top. Let’s figure out Does this fund really generates better returns or not.

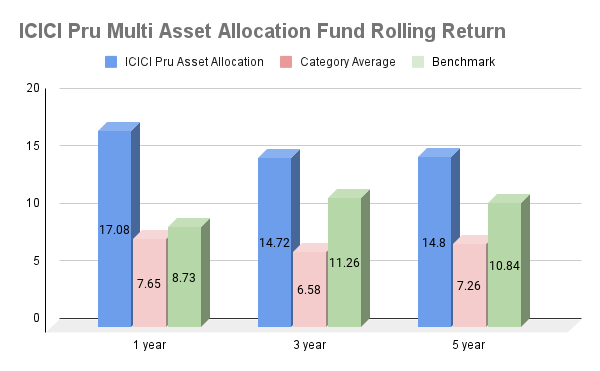

The Past Performance of ICICI Prudential Multi-Asset Fund (Rolling Return).

The past performance of this fund for 1, 3, and 5 years is 17.08, 14.72, and 14.8. Benchmark is 8.73, 11.26, and 10.84. The past performance of this fund is indeed quite impressive it consistently outperforms when compared to both its category average and its benchmark index.

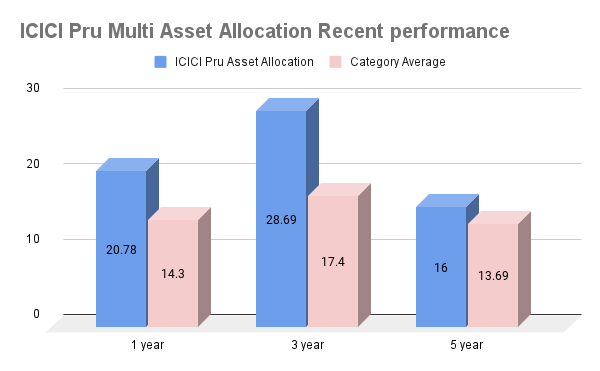

Recent Performance

Since its launch this 21-year-old fund's recent returns of 1, 3, and 5 years are- (20.78), (20.69), and (16). Its category average of 1 year (14.3), 3 years (17.4), and 5 years (13.69).

Compared to its category average, this fund is performing better than its peer market. The reason behind ICICI Prudential Multi-Asset Fund leads its hybrid category.

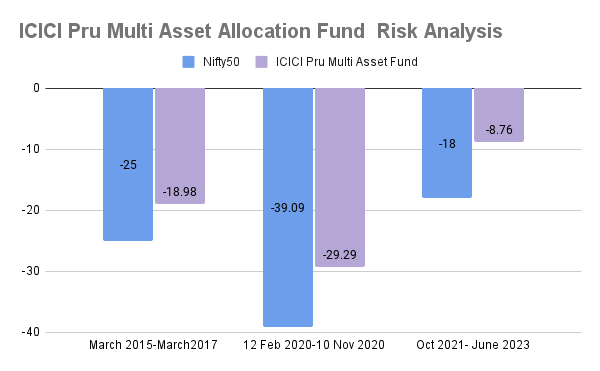

Risk Analysis

From March2015-March2017 (-18.98%), compared to its Nifty50 (-25.00%), it recovered on time. It had a positive alpha during this time frame. It serves as a reminder that while market fluctuations are inevitable, a well-managed multi-asset fund can potentially provide stability and long term growth.

Between February 12, 2020, to November 10, 2020 (-29.29%) the ICICI Prudential Multi-Asset Allocation Fund faced a volatile market. Its Nifty50 is (-39.09%) and The recovery is slow but this fund managed to recover after this difficult period.

But from October 2021 to June 2023, (-8.76%) the ICICI Prudential Multi-Asset Allocation Fund exhibited impressive performance. The Nifty50 index of the fund is (-18.00 %), this is remarkable that the fund quickly recovered.

Fund Managers Statement

Sankaran Naren has 21 years of expertise in equity research, operations, and fund management. Since February 2008, he has been employed as a chief investment officer.

Chartered accountant Mr. Ihab Dalwai began working for ICICI Prudential AMC in April 2011, he is the current equity fund manager at ICICI Prudential Asset Management.

let us see the statement regarding the ICICI Prudential Multi-Asset Fund from Mr. Ihab Dalwal and Mr. Sankaran Naren :

They consider it a “Multicap” fund, which means it invests in various sizes of companies and is diversified across different types of assets. This fund has a distinctive, “Out-of-the-box” approach, aiming to generate consistence returns over an extended period.

Equity

When it comes to investing in stocks (equity), fund managers view them as wealth creators, but they acknowledge that stocks can have ups and downs. They play a role in growing your wealth but might go through periods of combining before rising.

Debt

On the other hand, the fund also includes debt in its portfolio. Debt investments aim to provide stability and offer consistent returns over a long period.

Net Equity Levels

This fund follows a multi-asset strategy, which means it invests in at least three different types of assets. Minimum 10% in three or more asset classes. In normal times, it maintains a significant portion, around 65-75%, in stocks (equity).

Counter-Cyclical Approach

Moreover, the fund takes a countercyclical approach, which means it doesn’t exclusively focus on either value or growth stocks but adapts to market conditions.

Sector deviation

The scheme may take sector deviation compared to the benchmark.

Yield enhancement strategies

it employs yield enhancement strategies like- REITS and InvITs and uses covered call options to boost the overall returns of the portfolio.

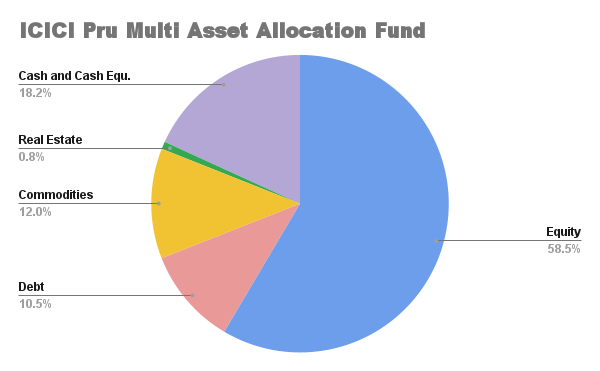

Now the ICICI Prudential Multi Asset Allocation Fund's current allocation of equity, debt, real estate, and cash is

How do you know if a fund is multi-asset?

ICICI Prudential Multi Asset Allocation Fund that follows a multi asset strategy. This means the fund invests in a diverse range of assets, including equities, debt instruments, and more. The goal is to provide investors with a balanced portfolio that can potentially yield higher returns while managing risk effectively.

Multi-asset allocation fund has a clearly defined asset allocation strategy. They specify the percentage of the fund’s assets that will be invested in each asset class. For example, a fund might allocate 60% to equity, 30% to bonds, and 10% to other assets.

This fund has the flexibility to adjust its asset allocation based on market conditions and the fund manager’s assessment of investment opportunities. This adaptability is a key feature of such funds.

Conclusion

- This fund follows a multi asset strategy and offers a blend of equities, debt instruments, and other assets.

- Its consistent performance indicates the ability to outperform both its category average and benchmark.

- The fund’s ability to recover during market fluctuations as demonstrated in various periods, underscores its flexibility and potential for stability.

- ICICI Prudential Multi Asset Allocation fund performance suggests that it’s indeed a worthy choice for those looking for diversified wealth creation and long-term growth.

- Previous Blog

Read More : What is Systematic Investment Plan? Need of SIP Calculator in 2023