Table of Contents

- ICICI Prudential Multi-Asset Fund - Growth

- Axis Multi Asset Allocation Fund - Regular Plan - Growth Option

- SBI Multi Asset Allocation Fund - Regular Plan - Growth

- HDFC Multi-Asset Fund - Growth Option

- Edelweiss Multi Asset Allocation Fund - Reg (G)

Table Of Content

Introduction

In the modern financial world, where things can shift suddenly, you need an Systematic Investment Plan that can adapt as well. TATA Multi Asset Allocation Fund is an investment option that aims to provide investors with a diversified and well-balanced portfolio.

In this blog, we will delve into the key aspects of the TATA Multi Asset Allocation Fund, helping you gain a better understanding of this investment choice.

What is the TATA Multi Asset Allocation Fund?

TATA Multi Asset Allocation Fund is an open-ended Hybrid Mutual Fund that diversifies across asset classes, including equity, debt, and money market instruments. It seeks to balance risk and return, offering investors flexibility.

Fund’s Key Features

-

Diversification

Diversification is a key goal of this fund, spreading risk across various assets to minimize the impact of a market fluctuations in any one asset.

-

Asset Allocation

The fund manager decides the allocation of assets based on market conditions and the fund’s investment mandate. This active asset allocation strategy allows the fund to capitalize on emerging opportunities and mitigate potential risks.

- Risk Management

The fund actively manages risk by adjusting its asset mix. For instance, it might increase the allocation to debt instruments for lower risk during volatile times.

-

Liquidity

Investors benefit from the liquidity of the fund as it invests in assets that are tradable in the market, which can be crucial if you need to access your money quickly.

-

Potential for Returns

While primarily focused on risk management, the fund also aims for returns by blending asset classes for potential gains while reducing potential losses.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Considerations Before Investing

While Tata's multi-asset allocation fund offers several advantages, it’s essential to consider a few factors before investing.

Consider your risk tolerance and investment goals. Understand the associated costs like management fees.

This fund is more suitable for long-term investors, and reviewing its past performance helps gauge its track record in different market conditions.

Here are the key highlights of the Tata Multi-Asset Opportunities Fund Regular Plan:

The current NAV is RS. 18.02 (as of Oct 20, 2023) for the growth option. It also has impressive trailing returns of 13.18% (1yr), 17.22% (3yr), and 17.62% (since launch), and its Expense ratio is 2.01%.’

To check how well a fund has been doing, we look at things like how much money it has made in the past, how risky it is, and other important factors. The first thing we do in this process is

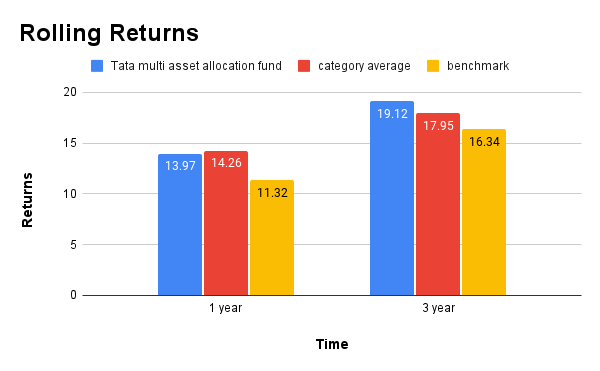

Return Analysis

To understand how well the fund has done and if it’s good at making money, we calculate something called “rolling returns.” This helps us to see if the fund is consistent and how it stacks up against similar funds.

Examining the graph, it becomes evident that the fund’s performance has been commendable, outperforming its benchmark returns. Over the past year, the fund outperformed the benchmark returns. Over the past year, the fund outperformed the benchmark, delivering a return of 13.97% compared to the benchmark’s 11.32%. In the 3-year category, while the benchmark return stood at 16.34%, the fund exceeded expectations with returns of 19.12%.

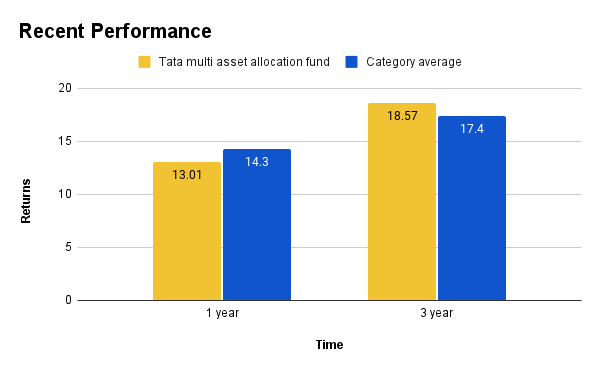

Now let’s have a look at its recent performance:

The graph above reveals that the fund’s performance is noteworthy. It has outperformed the category average in 3-year returns, delivering an impressive 18.57% return compared to the category’s 17.4%. However, in the 1-year performance, the fund’s returns were slightly below the category average, with the fund generating 13.01% while the category average stood at 14.3%.

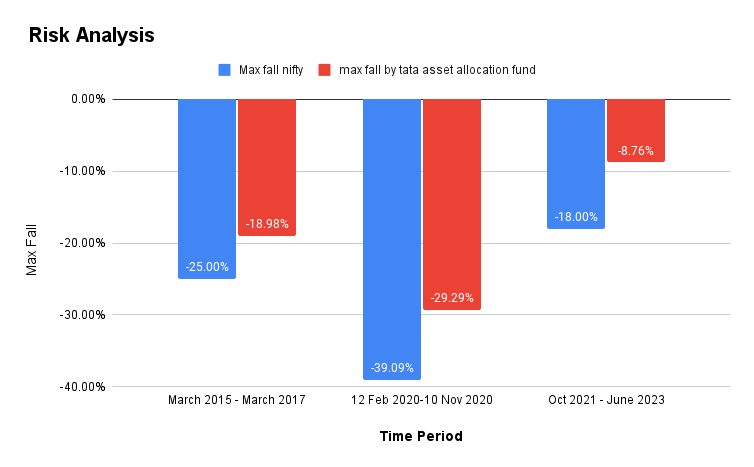

Risk Analysis

From the above graph we come to know that:

Phase 1. (March 2015 – March 2017)

Here in the first phase Nifty 50 (a stock market index) experienced a maximum decline of (-25.00%) while Tata Multi-Asset Allocation fund had a smaller decline (-18.98%) which describes that the fund showed rapid improvement that closely matched its benchmark.

Phase 2. (12 Feb 2020 – 10 Nov 2020)

In the second phase max fall by Nifty 50 had a substantial fall of (-39.09) while the Tata multi-asset allocation fund experienced a somewhat milder decline of (-29.29). However, it took the fund longer to recover due to the pandemic impact.

Phase 3. (18 Oct 2021 – 27 July 2022)

In the third phase, the max fall by Nifty 50 saw a maximum decline of (-18.00%) and the Tata multi-asset allocation fund had a smaller decline of (-8.76%) again in the third phase it recovered very fast compared to its benchmark. This remarkable ability of the fund to recover quickly indicates that the fund is managed properly and has good risk tolerance ability.

Overall, the Tata Multi-asset allocation fund remains a reliable choice for investors seeking stability and consistency in dynamic market conditions.

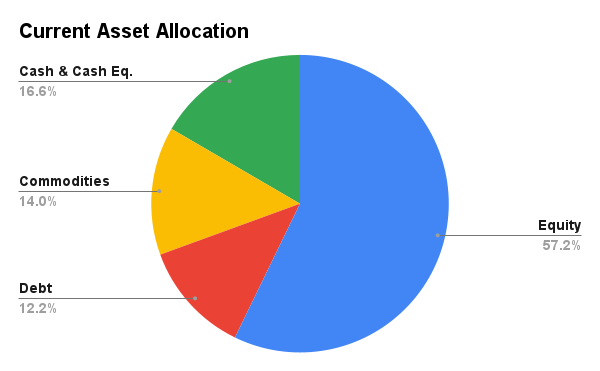

Tata Multi-Asset Opportunities fund portfolio

Current Asset Allocation

The fund has invested a total of 57.2% in equity, 12.2% in debt, 14.0% in commodities, and 16.6% in cash & cash equivalents.

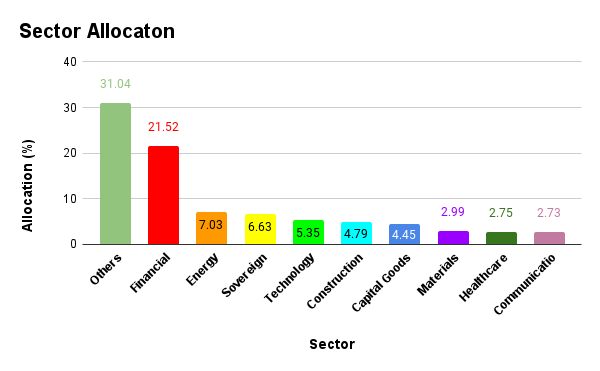

Funds top sectors where it has invested its majority of money are:

Financial – 21.52%

Energy – 7.03%

Sovereign – 6.63%

Technology – 5.35%

Construction – 4.79%

Capital Goods – 4.45%

Materials – 2.99%

Healthcare – 2.75%

Communication – 2.73%

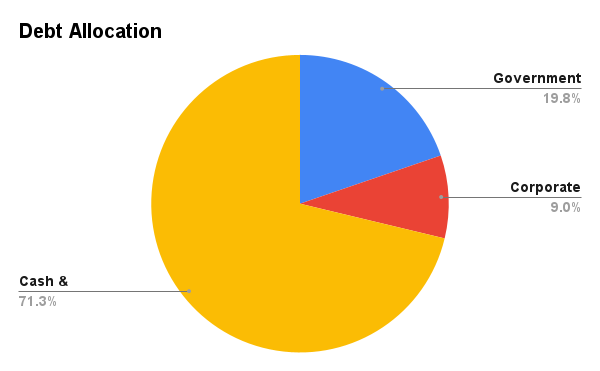

Debt Allocation

Following this it has invested a total of 19.75% in government bonds, 9.00% in corporate bonds, and 71.25% in cash and equivalents. The modified duration is 1.88, the weighted coupon is 7.11 and the weighted coupon is 7.11.

Conclusion

In summary, Tata multi asset allocation fund is a well-managed, diversified investment option. It excels in maintaining a balanced portfolio across asset classes. Before investing in it through online SIP, assess your risk tolerance and financial goals. The fund has shown strong performance, surpassing its benchmark in returns. It adapts well to market phases, demonstrating resilience and efficient recovery. It holds a balanced mix of equity, commodities, and cash, with investments in key sectors. This fund is suitable for long-term investors aiming for stability in dynamic markets.

Read More : Is ICICI Pru Multi-Asset Funds is Good For 2023 - Review and Analysis