Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- Motilal Oswal Balance Advantage Fund (MOFDYNAMIC) - Regular Plan - Growth Option

- SBI Balanced Advantage Fund - Regular Plan - Growth

- Edelweiss Balanced Advantage Fund - Regular Plan - Growth Option

ICICI Prudential Balanced Advantage Fund

ICICI Prudential Balanced Advantage Fund is a hybrid mutual fund, Which means it invests funds money in equity and bonds. However, the allocation between them is not static or fixed like other hybrid funds. The allocation is dynamically changed as per market conditions.

ICICI Prudential AMC is known for its smart allocation strategy.

This fund decides its allocation on valuation parameters and macroeconomic indicators.

This blog will do a deep analysis of its strategy and check how ICICI has performed in this fund. It will be the best fund in the category or not?

Return analysis

Let’s begin with the past performance of the fund. The best way to judge the performance is to check the consistency of beating its category average & benchmark returns. Also, it should be of multiple periods not just in the latest period performance.

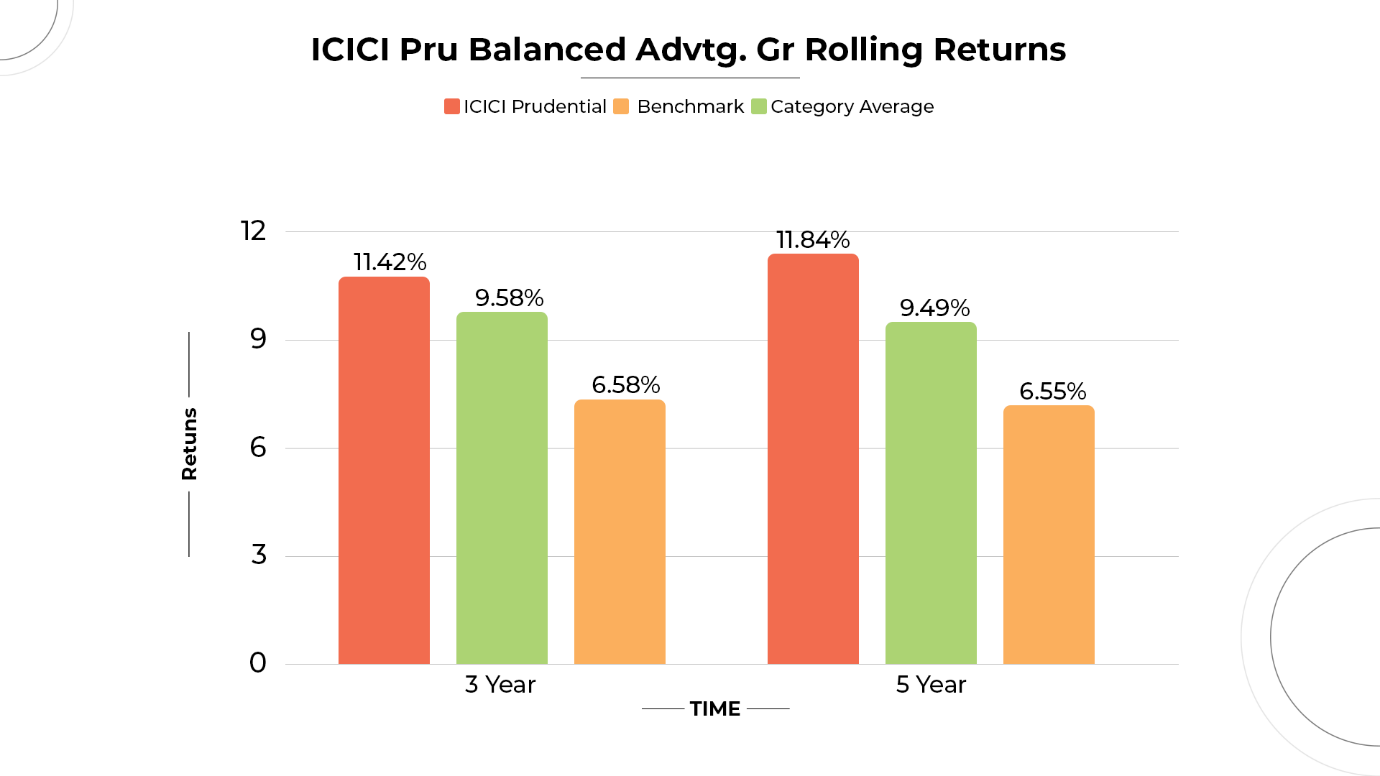

We calculate rolling returns, simply the average returns of any specific period.

like in 3 & 5 years the fund’s average returns are (11.42%) and (11.84) their category average is (6.58%) and (6.55%)

this shows the fund's return performance is much higher than its benchmark and category peers.

The consistency of 3 and 5-year is approximately the same that is - 67.79.

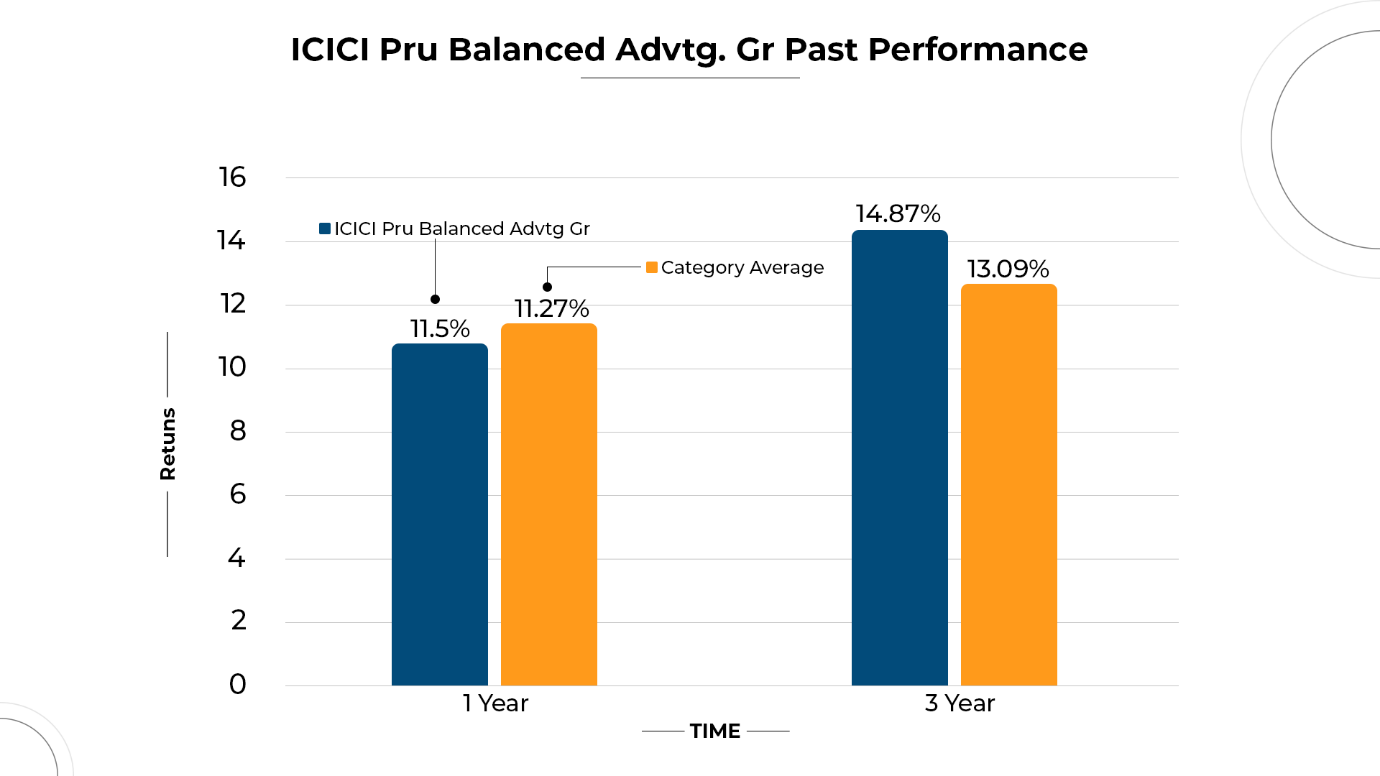

Past Performance

Talking about the recent 1 & 3-year period the fund delivered (11.5%) and (14.87%) returns. During such period the category of this fund has given (11.27%) and (13.09) returns.

Compared to its category average, the fund has outperformed but not significantly.

Risk Analysis

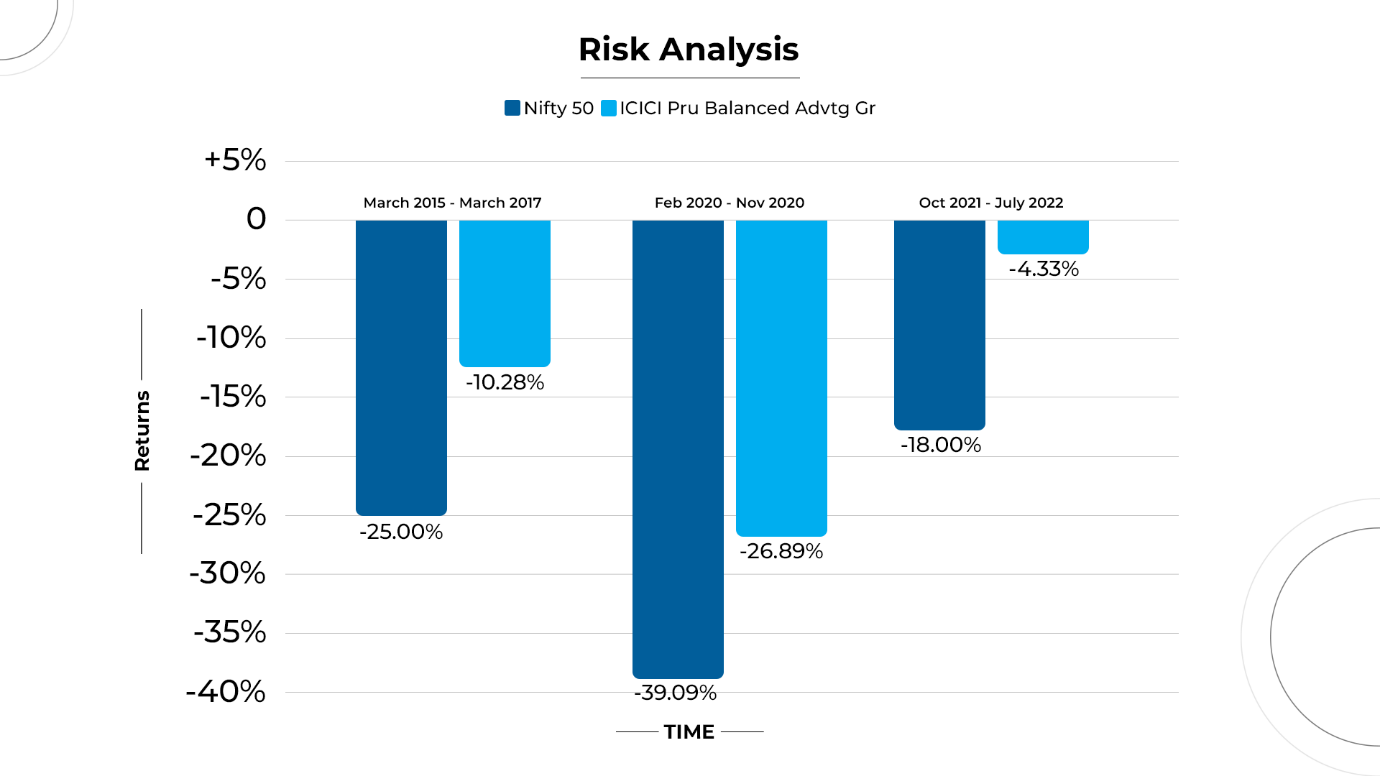

The performance is also judged in market correction and falls,

so let's check during tough market conditions how effectively fund managed the market risk.

The risk analysis of the ICICI Prudential Balanced Fund demonstrates an impressive pattern of resistance to market volatility. For instance, the fund experienced a relatively milder loss of -10.28% from March 2015 to March 2017, when the Nifty 50 experienced a decline of -25.00%, and it recovered quickly. The fun has demonstrated relative stability during the market volatility time.

Similarly, during the market downturn from February 2020 to November 2020, marked by a sharp decline of (-26.89%) in the nifty50, the ICICI prudential balanced fund experienced a challenging period but managed to recover within a reasonable timeframe

Recent examples from October 2021 to July 2022 IS (-4.33%), Compared to Nifty50 (-25.00%) the fund recovered very fast. Through its performance, it is potentially making it an appealing option for investors seeking a balanced approach to risk and returns.

Conclusion

Starting an online SIP with ICICI Prudential Balanced Advantage Fund is a wise choice for those seeking a reliable investment avenue that excels in effectively managing and mitigating risks. This fund is capable of generating strong risk-adjusted returns

It has also shown good consistency in its past performance. Currently, the fund shifted its money to debt and cash, the current allocation of the fund equity portion is 45.59%, debt is 26.08%, and the remaining 25.56% in cash. The fund holds a bearish view of the equity market.

Moreover, the ICICI Prudential Balanced Fund’s ALPHA of 4.15% is a good sign. The excess return on an investment over a benchmark is measured by alpha, which takes risk into account.

ICICI prudential advantage fund AUM nearby is 49102 Cr. That is a negative trait.

But it still remains the best fund in its category. It's an excellent choice for beginners and retirees, offering a lower risk profile while aiming for better returns.

Continue Reading : Is Edelweiss Balanced Advantage Fund Right for You? Reviews 2023.