Table of Contents

- ICICI Prudential Balanced Advantage Fund - Growth

- HDFC Balanced Advantage Fund - Growth Plan

- Motilal Oswal Balance Advantage Fund (MOFDYNAMIC) - Regular Plan - Growth Option

- Baroda BNP Paribas Balanced Advantage Fund-Regular Plan -Growth Option

- Tata Balanced Advantage Fund-Direct Plan-Growth

Motilal Oswal Balanced Advantaged Growth Fund

Many experts have noted an increase in equity market valuations. In such a scenario, many investors are turning to hybrid funds for balanced approach. One such fund is Motilal Oswal Balanced Advantage Fund, designed to invest in both equity and bonds markets based on prevailing market conditions.

This fund wasn’t always a popular choice because it didn’t consistently outperform its benchmark and category.

However, recent changes in management have made it increasingly popular, as it has delivered impressive returns in recent periods. Let’s do the detailed analysis to understand what was its past performance and recent performance. After advantages let’s explore the Consistency & Sustainability of performance:

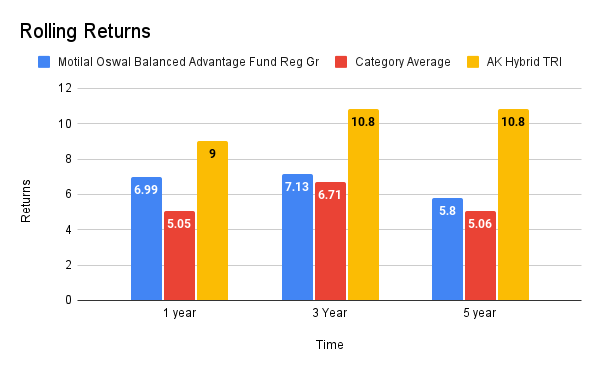

Rolling Returns

Rolling returns helps us see how well a fund performs over different time periods. Looking at the data, we can see that in the one year, the fund earned average returns of 6.99%, which is a bit less than the benchmark’s 9.00%. Over three years, the fund’s return was 7.13%, while the benchmark was at 10.8%, meaning the fund lagged behind. Even when we consider the long-term, like five years, the fund’s return of 5.8% couldn’t match the benchmark’s 10.8%. This suggests the fund struggled to outperform its benchmark over various timeframes.

This data makes it evident that the fund’s historical performance has been quite ordinary within its category, consistently falling short of benchmark returns.

But in last one-year period the fund all of sudden became top performer in the category.

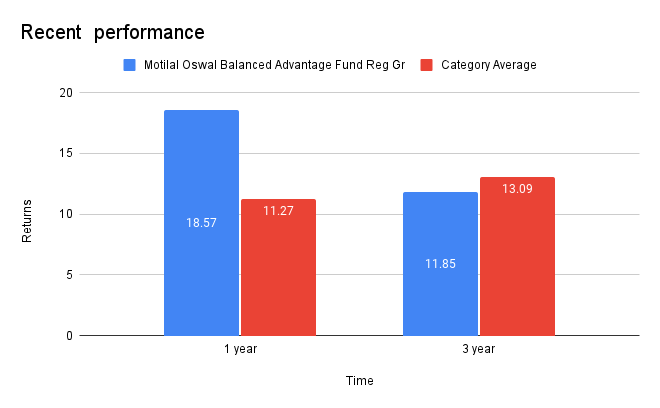

Recent Performance

Short-Term Performance

The graph clearly shows that fund outperformed the benchmark clearly with impressive returns of 18.57% where benchmark returns are only 11.27%.

Let’s check what happen suddenly to this fund.

Firstly the fund management team completely changed.

Mr. Santosh Singh joined as expert of equity and Mr. Rakesh Shetty for debt management.

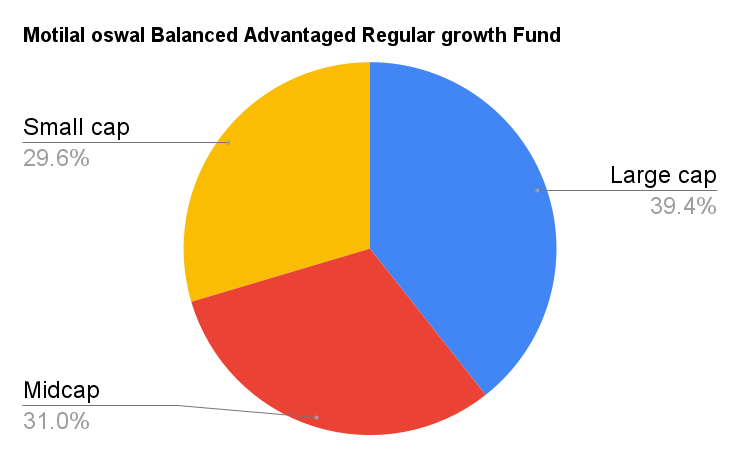

Secondly let see what are the changes made by them in the current portfolio which triggered the recent performance.

According to the current market scenario they have conservatively kept equity allocation i.e 54% and debt 17% and rest in cash 26%.

However unlike other fund the equity allocation is majorly allocated to small & mid cap stocks. As we know small & mid cap stocks rallied in recent past therefore this allocation helped fund to deliver extra performance.

Interested investors have the option to invest in these companies via online SIP.

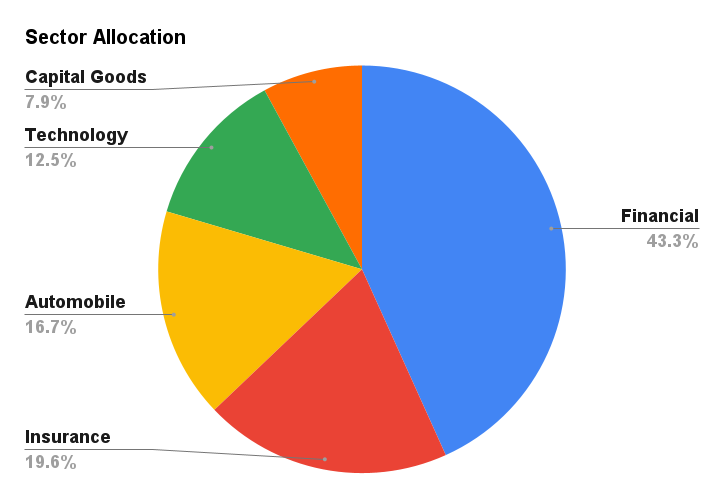

It concentrately hold only 31 stocks in the portfolio where sector wise major money is allocated to top sectors are:

Capital goods – 7.9%

Technology – 12.5%

Financial – 43.3%

Automobile – 16.7%

Insurance – 19.6%

This also illustrates its aim to invest in growing sectors to pursue attractive returns. Capital goods and auto sector were luckily the top performing sectors.

Debt Allocation

Moving on to debt allocation, the fund has allocated a total of 16.82% to debt instruments. Within this allocation, approximately 16.01% is invested in corporate bonds, and 14.68% is in government bonds. These funds have a modified duration of 0.54, an effective maturity of 0.6 and a weighted coupon of 6.84. The relatively low modified duration indicates that the bonds or the bond portfolio are less sensitive to interest rate fluctuations. And a total of 2.33% in Real estate and 26.80% in cash.

Here are the key takeaways

Motilal Oswal, an established and reputable brand in the equity market, has undergone significant changes. The firm did not perform well in the past. There has been a complete change in fund management. The new fund managers appear to be adopting an aggressive approach with a focus on generating high returns. The current portfolio reflects a smart strategy. While maintaining equity exposure according to market conditions, they have taken aggressive positions in terms of market cap and sectors. This fund is suitable for investors who can tolerate market risks in exchange for potentially high returns in dynamic asset allocation or Balanced Advantage Fund category.

Continue Reading : Is ICICI Prudential Balanced Advantage Fund good?