Table of Contents

- What investment approach has made ICICI Manufacturing Fund so popular?

- How ICICI Prudential Manufacturing Fund has performed in the past?

- Recent Improvement in Performance Vs Peers

- What's in the ICICI Prudential Manufacturing Fund's portfolio?

- How Does ICICI Prudential Manufacturing Fund Select and Evaluate Quality Stocks?

- It’s time to talk about the fund manager

- Endnote

The ICICI Prudential Manufacturing Fund would change your whole investment outlook, being from the thematic sector this fund holds the potential to boost your overall portfolio returns by double or triple digits. With an impressive AUM of Rs.3883 Crore, it showcases its growing popularity among investors.

You may find yourself asking why is that? The reason is Manufacturing theme as a whole is expected to become the best theme in the next 5-10 years. Plus, it has a lot of investment opportunities for investors. By delivering 60% returns last year, this scheme is all set to become one of the top performers among its peers.

Let's now explore the factors that have contributed to the ICICI Prudential Manufacturing Fund's standout performance in the manufacturing mutual fund category.

What investment approach has made ICICI Manufacturing Fund so popular?

ICICI Prudential Manufacturing Fund follows a balanced investing approach. It invests in a mix of value stocks with potential for improvement, as well as growth and quality stocks. The fund follows a 'buy and hold' strategy, identifying industry leaders and acquiring them at low valuations to generate strong long-term returns. The fund maintains a diversified portfolio and leverages ICICI's robust sector and industry analysis to pick the right stocks at the right time, allowing it to buy quality companies at attractive valuations. The fund maintains diversification across sectors to control risk.

You see, this determined investment approach has led to the solid performance of this scheme, let’s check it out by looking at its past performance.

How ICICI Prudential Manufacturing Fund has performed in the past?

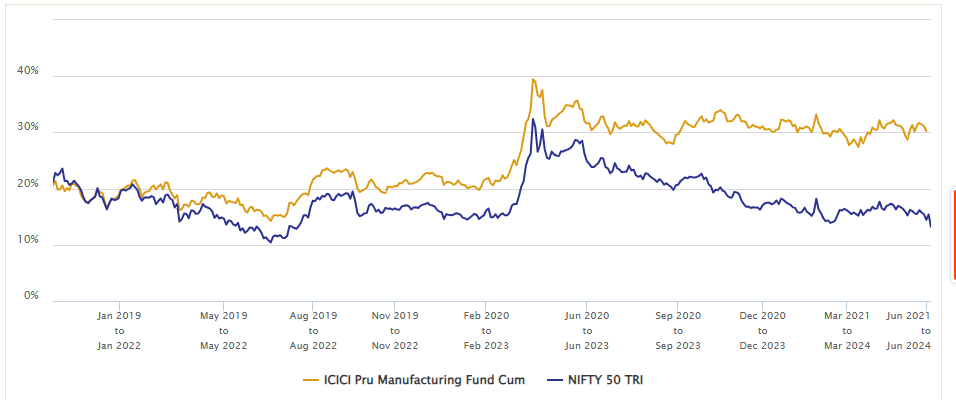

Since the fund started in December 2020, if you had put your money in it for any 3 years, on average, you would have gotten almost 23.18% annualized returns. What's even more noteworthy is its consistency — it has a 100% track record of offering returns above 12% every single time. We compared the same investment with its benchmark, the Nifty 50 TRI, to evaluate the fund's performance. The benchmark has provided 16% returns and has an 85% consistency rate. Thus, the benchmark has underperformed compared to the fund.

Well, this above graph shows us its past performance, so it is only right to cross-check it with how it is currently performing today. To see that let’s analyse recent performance.

Recent Improvement in Performance Vs Peers

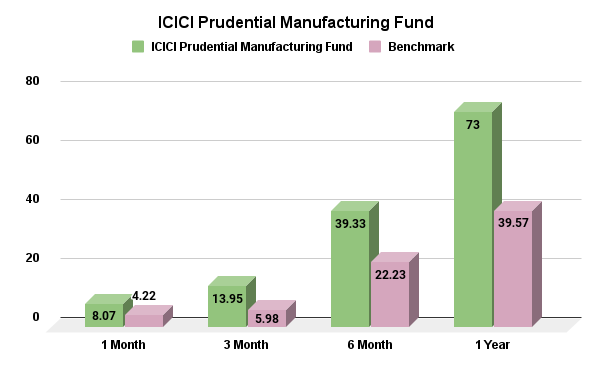

ICICI Prudential Manufacturing Fund has returned 28.15% over six months and 62.72% over one year. In comparison, the NIFTY 500 TRI benchmark has provided 10.64% over six months and 16.14% over one year, highlighting the fund's superior performance. The performance has been promising as the fund has outperformed the average performance of other manufacturing funds in its category. It is promising to see that the has performed well in various market conditions.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

What's in the ICICI Prudential Manufacturing Fund's portfolio?

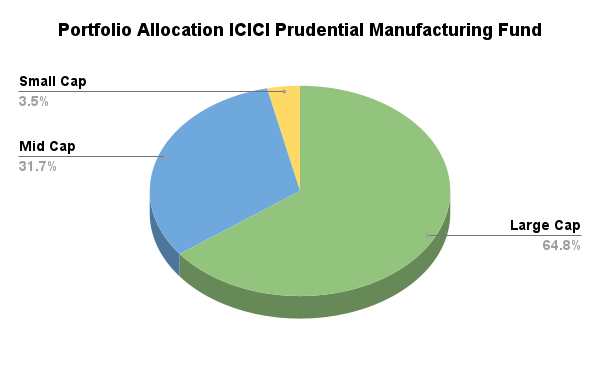

The Fund has a diversified portfolio with 93.68% in Equity and keeps 6.32% in cash to take advantage of market opportunities, focusing mainly on Large and Mid-Cap stocks which are 88% of its investments.

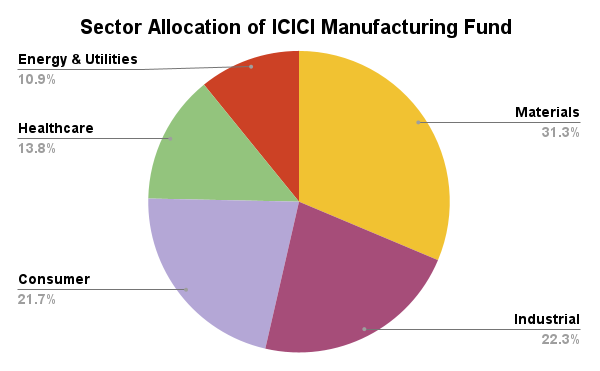

It has a diverse portfolio of 71 stocks, with the top 10 stocks making up 42% of the fund holdings. Investments are spread across various sectors like Materials, Industrials, and Consumer Discretionary which make up 49% of the allocation The fund manager actively adjusts the portfolio, increasing investments in materials, metals, and capital goods, and reducing exposure to energy and healthcare. This approach helps the fund adapt to market conditions and consistently perform well.

Moving on to sector allocation, the top 5 sectors holding the fund are as follows:

Learn : Why You Should Include Manufacturing Funds in Your Portfolio?

How Does ICICI Prudential Manufacturing Fund Select and Evaluate Quality Stocks?

While analyzing stock selections of the Manufacturing Mutual Funds, we look at four important things to make sure they're good quality: how fast their sales are growing, how much profit they make, how much cash they have coming in, and how their price compares to their earnings (that's the PE ratio).

This fund is filled with companies that are growing fast. On average, their sales are going up by 14%, they're making a 48% profit on what they sell, their cash flow is increasing by 22%, and they have a low PE ratio of 24, which means they are getting them at a good price. All this adds up to why we think this fund is one of the best choices, with really top-notch companies in it.

Well, looking at the detailed analysis, knowing the master mind behind this scheme's solid performance is necessary.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

It’s time to talk about the fund manager

The Mutual Funds we're talking about is in good hands with Mr. Anish Tawakley an experienced. With 25+ years of experience in fund management and equity analysis, he offers valuable expertise. Under his leadership, ICICI Prudential Manufacturing Fund has consistently outperformed its peers and benchmark in the past year. He follows a balanced "barbell" approach, investing in both value stocks with improvement potential and high-quality growth stocks.

Anish Tawakley

Deputy CIO (ICICI AMC)

Endnote

When compared to other themes, Manufacturing Funds have reached the tipping point where the bigger you are, the more they talk about you.

If you act on time, this scheme which is based on a thematic theme will prove to be profitable beyond your imagination. And to add more security to your portfolio, invest via a SIP plan.

.webp&w=3840&q=75)