Table of Contents

Introducing the ABSL Manufacturing Equity Fund, belonging to the thematic category it has delivered 46% SIP returns in the last 1 year. Despite its relatively long existence from 2015, the fund has attracted investors towards it.

Well in this post, we will review this scheme on several parameters so that you can decide for yourself whether it is worth the investment or not.

Moreover, we will see whether starting a SIP in this scheme is a wise decision and how it has performed in 3-5-year intervals.

Performance of ABSL Manufacturing Equity Fund

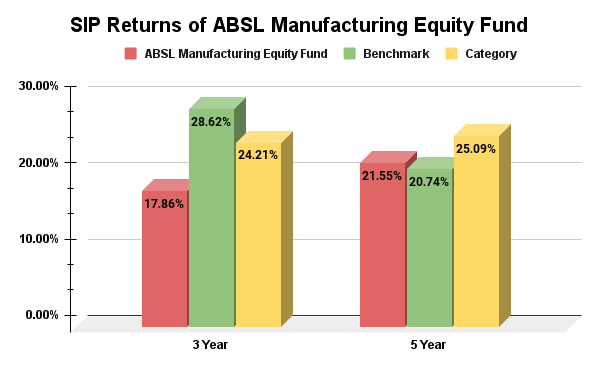

Let us see if this fund outperformed its benchmark in terms of SIP returns.

Over the 3-year and 5-year periods, the fund has underperformed compared to its benchmark category average.

Even though the fund underperformed its benchmark, its long-term performance is competitive.

In the last 1 year, this fund has generated 46% annualized SIP returns. In comparison, the Nifty India Manufacturing TRI returned only 36.97%.

Now we will suggest that investing through SIP would be a smart choice in this situation as the fund has shown its ability to generate superior SIP returns over the long term, despite occasional lower consistency in shorter timeframes.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

This raises the question of the fund manager's approach, which has led to the scheme's great success. Let us find out.

Investing Strategy Adopted by ABSL Manufacturing Equity Fund

The ABSL Manufacturing Fund follows a Buy & Hold approach. It chooses companies based on their ability to earn well, grow, and stay competitive.

The fund uses a bottom-up approach, meaning it looks closely at each company's financial health, management, industry trends, and strengths.

The focus is on companies that have good future growth potential. The fund aims to hold these stocks for the long term to make the most of their growth and manage risks effectively.

Let us have a look at how this stock has distributed its assets that make up the entire portfolio.

Asset Allocation of ABSL Manufacturing Equity Fund

The ABSL Manufacturing Equity Fund has a kind of flexi cap portfolio, including 54% large cap, 29.8% mid-cap and 16.2% small-cap Mutual Funds for potential quick returns. This aggressive strategy can offer high returns but comes with increased volatility.

For a better understanding, see the chart below:

Don’t Miss Out on Potential Gains, Use the SIP Calculator

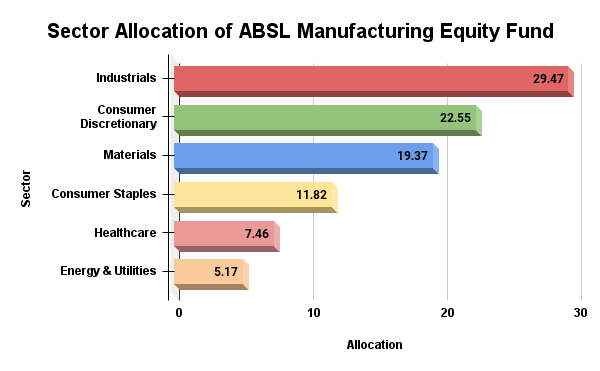

Sector Allocation of ABSL Manufacturing Equity Fund

The fund has carefully spread its investments across various sectors with 29.47% in industrials, the largest portion, highlighting a focus on industrial investments. It also invests 22.55% in consumer discretionary, 19.37% in materials and 19.37% in consumer staples, which includes smaller parts in 7.46% in healthcare and 5.17% in energy & utilities.

By targeting sectors with growth potential like 13.52% services, 13.46% financials, 11.25% capital goods and 9.78% chemicals, the fund aims to take advantage of market opportunities. It also has increased investments in trending sectors such as metal, mining, and technology.

The fund is well diversified, but it has not heavily invested in the highest-returning sectors. As a result, its returns are good, but there is potential for even better performance with further optimization.

You can check the below graph for more clarity:

If you find yourself, asking if ABSL Manufacturing Equity Fund is a good choice for quality stock investments. Let us find out by looking at the quality of its stocks.

Stock Quality of ABSL Manufacturing Equity Fund

We analyse stock quality using 4 important financial parameters, including sales growth, profits growth, cash flow growth, and price-to-earnings (PE) ratios.

Let us see what the quality of ABSL Manufacturing Equity Fund looks like:

| Fundamental Ratios | Value |

|---|---|

| Sales Growth | 11% |

| Earnings Growth | 23% |

| Cash Flow | 7% |

| PE - Valuations | 34.48% |

The ABSL Manufacturing Equity Fund's stocks have some areas of improvement. Their sales and profit growth rates are lower than the industry average.

However, the current valuation a very high indicated by a price-to-earnings (PE) ratio of 34.48. It creates a kind of caution for the investors to carefully study the fund before investing in it.

Even though the sales cash flow growth could be better, it offers promising and balanced risks and rewards for its investors.

In our opinion, stocks are financially stable and valued, with potential for business growth, making them a solid option for a diversified portfolio.

Summary- Who Should Invest?

Are you someone who thinks outside the box? This fund is best suited with its unique thematic theme. If you have a higher risk tolerance and seek to invest in diverse sectors related to manufacturing, this is it. Smartly plan your investments through SIP while keeping an investment horizon of 5-7 years.

Read Detailed Expert’s Review on Other Manufacturing Schemes

1.Quant Manufacturing Fund: Comprehensive Review and Analysis 2024

.webp&w=3840&q=75)