Table of Contents

- ICICI Prudential ELSS Tax Saver Fund (Tax Saving) - Growth

- DSP ELSS Tax Saver Fund - Regular Plan - Growth

- Kotak ELSS Tax Saver Fund-Scheme-Growth

- Quant ELSS Tax Saver Fund Regular Plan-Growth

- Parag Parikh Tax Saver Fund Regular - growth

Introduction

Parag Parikh Tax Saver Fund is a new fund that started in July 2019, so it's been around for about 4.5 years now. Despite being a newcomer in the industry, it comes from a well-established asset management company Parag Parikh, that has maintained a consistent performance record in the mutual fund industry. Their flagship scheme, the Parag Parikh Flexi Cap Fund, has had a compound annual growth rate (CAGR) of 19.72% since its inception, this fund has proven their best strategy of consistent performance and also given the success of their other schemes, there is a possibility that the Parag Parikh Tax Saver Fund may also perform well in the market.

To get a better idea of the fund's performance, let's analyse its current portfolio. This will help us determine whether this fund is worth investing in and if it has the potential to help you reach your desired financial goals.

Returns

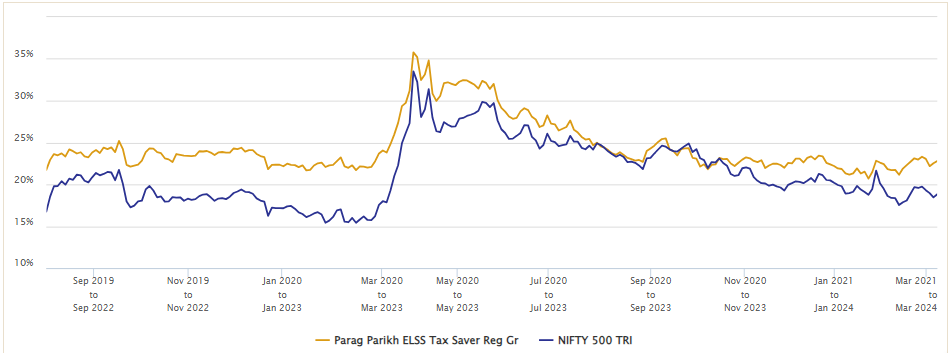

The Parag Parikh Tax Saver Fund has had such an impressive performance history, with rolling returns over the past 3 years at 23.38%, it’s clear that this fund has been doing very well. When compared to the benchmark NIFTY 500 TRI at 19.91%, it’s noticeable that the fund has outperformed its peers.

If you had invested your money in the fund since its start in 2019 and held it for any 3 years, you would have earned an average annualised return of almost 25%. Not only that, but the fund has a remarkable track record of consistently offering returns above 15% every single time.

Will the Parag Parikh Tax Saver Fund keep up with the market, or does it struggle for consistency?

Let’s begin with the strategy to find the answers:

Strategy

The Parag Parikh Tax Saver Fund invests in undervalued stocks and holds them for long periods to make money. They are highly selective in their stock selection and carry out extensive research on companies and industries before making any investment decision. They also monitor the price closely to ensure that they are getting a fair bargain. The fund concentrates on a few stocks but diversifies across various industries and geographical locations, including overseas investments. This focused and diligent approach has been the foundation of their success.

Fund Managers of Parag Parikh Tax Saver Fund

The Fund we are discussing is being managed by Mr. Rajeev Thakkar and Mr. Raunak Onkar, who are both well-known and experienced individuals in the industry with over 30 years of experience each. They have been leading the fund since its inception, utilizing their vast knowledge to ensure smooth operations. It's like having two expert captains who have been steering the ship since day one.

Portfolio Allocation

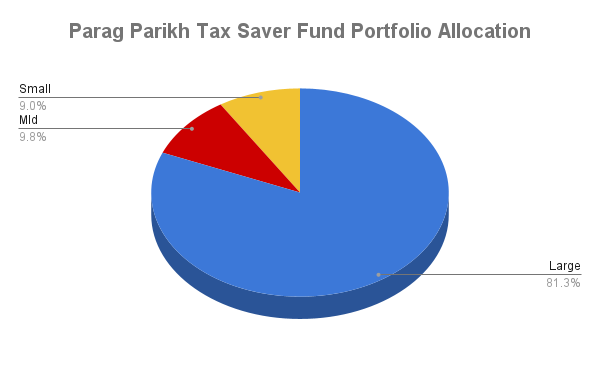

Portfolio allocation means deciding how to divide your money among different types of investments, like stocks, bonds, or cash. this allocation helps you to reduce risk.

The fund's allocation is spread across different categories or sizes of companies: large-cap, mid-cap, and small-cap. Here is the allocation of this fund.

This fund has allocated its equity investments as, 81.3% in large-cap stocks, 9.8% in mid-cap stocks, and 9.0% in small-cap stocks.

In simple terms,

The fund has currently invested most of its money in big companies, with only a few investments in smaller ones. This is a wise decision as smaller company stocks are quite expensive at the moment. With these allocations, this fund is able to perform well in the market.

Market Cap & Sector Allocation

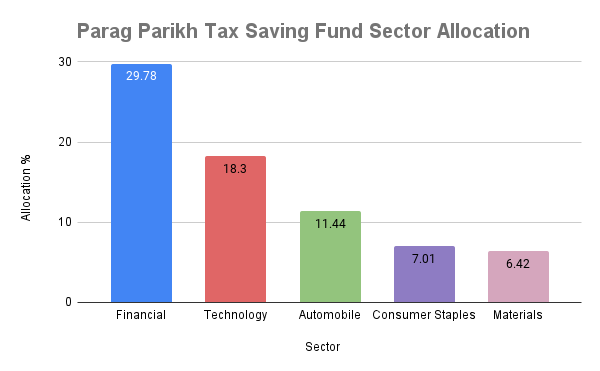

Funds allocate investments across different sectors to reduce risk and take advantage of opportunities in various parts of the economy. By spreading investments across sectors, funds can reduce the impact of downturns in any single industry and potentially capture growth in sectors that perform well.

The top sectors of the Parag Parikh ELSS Mutual Fund show the fund's goal of focusing on promising industries with the potential for high returns. remarkably, the capital goods and auto sectors outperformed over this period, which is consistent with the fund's investing philosophy.

The fund is mainly investing in companies that work in finance, technology, Auto & cars, and consumer goods. These are crucial areas for the market. Although some of these sectors have not performed exceptionally well recently, with the exception of cars, they are expected to improve, particularly during tough times. Therefore, the fund's investment strategy is cautious, yet forward-looking, anticipating good outcomes in the future.

Stocks Selections & Quality

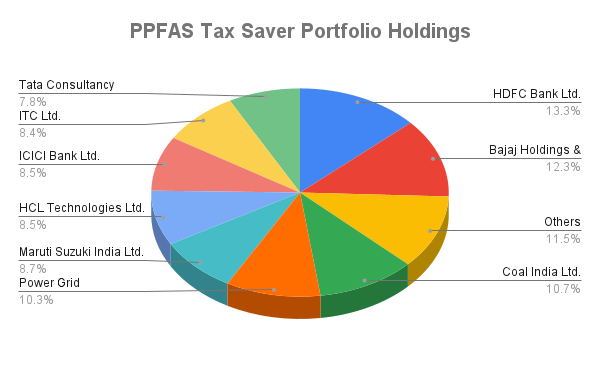

Now comes the stock selection in which the portfolio holdings of a fund refer to the specific stocks that the Mutual Fund has invested in, they reflect the specific equity and debt, or other assets that the fund owns, and are selected based on the fund's investment objectives, strategy, and analysis of market conditions.

When analyzing the stock selections of a fund, we examine four crucial factors to ensure their quality. These factors include the rate of sales growth, profit margins, cash inflow, and price-to-earnings ratio (PE ratio). The companies included in this fund are growing at a rapid pace, with average sales growth of 17%. Moreover, they are earning a profit margin of 20.88% on their sales, and their cash flow is increasing by 28%. The PE ratio of these companies is also quite low, at 16.51, which indicates that they are available at a reasonable price. All these factors considered, we believe that this fund is an excellent choice, comprising top-notch companies with strong growth potential.

|

Fundamental Ratios |

|

|

Price/Earnings |

16.51 |

|

Profit Growth% |

20.88 |

|

Sales Growth% |

17.74 |

|

Cash-Flow Growth% |

28.04 |

Conclusion

To sum it up, this fund is an excellent choice for those who are looking for long-term investments. It is specifically designed to keep the risks low and is managed by some of the best fund managers in the industry. This fund is perfect for anyone who wants to invest in high-quality funds with a buy-and-hold approach. It also has good risk management funds with a conservative investing style. By managing the dynamic nature of the market, this fund provides better returns to investors. The mutual fund provides the best and easiest way of investing with a Systematic Investment Plan (SIP) it's an excellent way to invest your money in a disciplined manner, which can generate long-term wealth.

.webp&w=3840&q=75)