Table of Contents

- What is the Investing Strategy of Parag Parikh Tax Saver Fund?

- The SIP Returns

- Time for Risk Analysis of Parag Parikh Tax Saver Fund?

- How Well Parag Parikh Tax Saver Fund Diversified Its Portfolio?

- Sector Allocation: It’s Shows Diversification of Fund Across Various Industry

- Does Parag Parikh ELSS Fund Offer Good Quality Stocks?

- Final Words

Parag Parikh Tax Saver Fund stands out as the No.1 fund in the category of ELSS and tax-saving mutual funds The fund is well-known for its high-quality research and consistent delivery of strong performance to investors. It was recently introduced in this category and since its launch, the Parag Parikh Tax Saver Fund has achieved an impressive 24% annualized SIP (Systematic Investment Plan) returns. Let's delve into a detailed analysis of this fund to see whether it will be the top performing fund for the next 3-5 years.

What is the Investing Strategy of Parag Parikh Tax Saver Fund?

The Parag Parikh Tax Saver Fund follows a straightforward strategy: purchasing quality companies at an early stage when valuations are low and holding them for the long term. The primary goal is to achieve high compounding effects. The fund's execution is consistently excellent, thanks to its research team's thorough analysis in identifying the best companies with strong management, competitive business models, and sustainable growth. This strategy, combined with smart portfolio management, ensures consistent performance and high absolute returns over the long term.

The SIP Returns

How much had Rs. 3000 Grown in the Parag Parikh Tax Saver Fund Since its Inception?

| Funds | SIP Amount | No. of Instalments | Total Investment | Current Value | Gain | Returns P.A |

|---|---|---|---|---|---|---|

| Parag Parikh ELSS Fund | ₹3,000 | 60 | ₹2,04,000 | ₹3,39,324 | ₹1,35,324 | 24.41% |

| Nifty 50 TRI Index | ₹3,000 | 60 | ₹2,04,000 | ₹3,00,264 | ₹96,264 | 16.91% |

Since its inception, the Parag Parikh Tax Saver Fund has delivered compelling SIP returns. The fund boasts annualized returns of 24.41%, significantly outperforming the benchmark by a margin of 16.91%.

As we can see over a brief timeframe, the Parag Parikh Tax Saver Fund has demonstrated impressive performance. So if you had started a SIP since the PPFAS tax saver launched with ₹3,000 over 60 instalments, your total investment would have been ₹204,000. The current value of your investment would be ₹339,324, reflecting a gain of ₹135,324 and an annualized return of 24.41%. In this case, choosing SIP investments would be beneficial because the fund has a history of consistently delivering excellent long-term returns.

Calculate How Much You Can Earn with This Simple SIP Calculator.

Time for Risk Analysis of Parag Parikh Tax Saver Fund?

| Risk Analysis | Value |

|---|---|

| SD | 9.94% |

| Sharpe Ratio | 2% |

| Alpha | 7.12% |

| Max Drawdown in 3 Yrs | -6.76% |

Based on its low volatility, this fund is well-suited for conservative investors., which means this style is careful about taking risks, focusing on preserving capital over return maximizing returns. Both its Sharpe and alpha ratios indicate an excellent risk-to-reward profile, with an impressive alpha of 7.12, outperforming the Nifty 500 market returns. The fund has proved itself effective by generating positive Alpha.

Over the past three years, it has shown a minimal drawdown of -6.76%. Furthermore, the fund also has excellent risk management techniques, as seen by its standard deviation of 9.94 compared to the category average of 12.91.

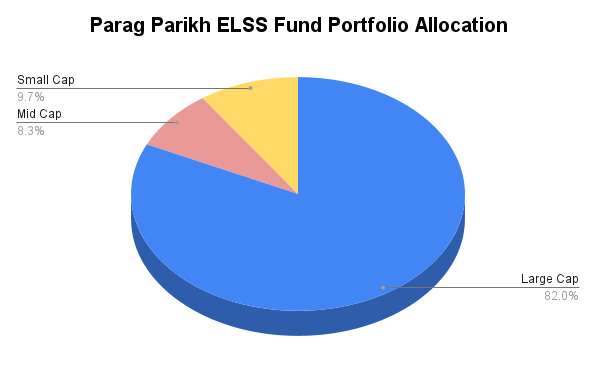

How Well Parag Parikh Tax Saver Fund Diversified Its Portfolio?

Portfolio Allocation

This portfolio focuses entirely on large-cap stocks of 82% holdings, these are typically well-known, blue-chip companies that are generally more stable and less risky compared to small and mid-cap stocks. This conservative strategy aims to prioritize stability and reliability over potentially higher but riskier returns. While it does include 9.69% exposure to small-cap stocks for diversification, the majority remains in large caps, and 8.34% of the fund's holdings are in mid cap stocks

Additionally, the fund keeps its trading activity low, with a turnover ratio consistently below 5% annually. This means it holds onto investments for longer periods, reducing costs and potentially increasing tax efficiency for investors. Overall, this approach is designed to provide steady growth with lower volatility, appealing to investors seeking a more conservative investment option.

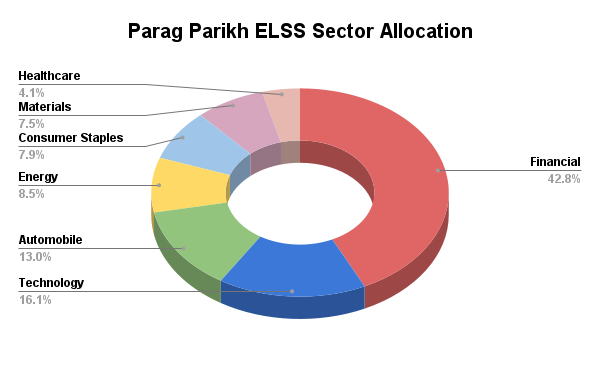

Sector Allocation: It’s Shows Diversification of Fund Across Various Industry

The Parag Parikh Tax Saver Fund saw the most significant return on its financial exposure at 42.8%, with a significant impact on technology at 16.1%, automobiles 13.0%, energy 8.5%, consumer staples at 7.9%, materials 7.5%, and 4.1% healthcare. While it maintains a well-diversified overall allocation, it avoids over-concentration in high-risk, high-return sectors such as capital goods and metal & mining. As a result, while the returns have been positive, the portfolio has not aggressively pursued opportunities in these trending sectors that could potentially deliver higher returns.

Does Parag Parikh ELSS Fund Offer Good Quality Stocks?

| Fundamental Ratios | Value |

|---|---|

| Sales Growth | 13% |

| Earnings Growth | 12% |

| Cash Flow | 17% |

| PE - Valuations | 19.90% |

- Sales Growth: (13.96%) - Indicates the companies are expanding their business.

- Earnings Growth: (22.37%) - Suggests the companies have been able to grow their profits at a healthy rate.

- Cash Flow Growth: (14.38%) - Shows the companies are generating more cash, which can be used for various purposes.

- P/E Valuation: (14.83) - Suggests the companies are reasonably valued and not overpriced.

In the above table, the data represents the earnings growth of the stocks in PPFAS tax saver fund showing promising signs of increasing profits over time. This indicates that the companies are managing their businesses well and could potentially deliver higher returns in the future.

In terms of valuation, the stocks appear to be low price, which suggests there is a good opportunity for investors to buy them at a fair price. This concept of margin of safety means that even if there are fluctuations in the market, the stocks are not overly expensive, providing protection against potential downside risks.

Overall, the combination of strong earnings growth and reasonable valuations makes these stocks attractive from an investment perspective, offering potential for both growth and safety in the portfolio.

Final Words

The Parag Parikh Tax Saver Fund has quickly built a strong reputation among its peers in the Mutual Funds category. It focuses more on safety than on chasing high returns, which means it invests in quality stocks that are financially strong and considered undervalued.

The fund places a high priority on managing risks, which is achieved by taking a long-term approach to investing. This strategy helps it navigate through volatile periods in the market without making hasty decisions.

Value investing, which is the fund's core strategy, requires patience. This means the fund may not always perform as well as others during periods when growth-oriented stocks are soaring. However, over the entire market cycle, it aims to deliver substantial returns.

The fund is managed by an experienced team, making it suitable for investors who are looking to build wealth and save on taxes over a period of 3 to 5 years.

Overall, the Parag Parikh Tax Saver Fund is designed to balance safety and growth potential, appealing to investors who prioritize long-term stability and steady wealth creation.

Enjoy reading our latest blog, where we provide expert opinions on various Mutual Funds.

1. Top 5 Tips for Tax Planning in India 2024

2. Why HDFC Flexi Cap Fund SIP is Ideal for Long-Term Growth

3. 5 Best Small Cap SIPs to Invest in 2024

4. Is Quant ELSS Tax Saver Fund Good as an Investment Option