Table of Contents

- Quant Large and Mid Cap Fund-Growth

- Quant Small Cap Fund-Growth

- Quant Flexi Cap Fund-Growth

- Quant ELSS Tax Saver Fund Regular Plan-Growth

- Quant Multi Asset Fund-Growth

Table Of Content

Quant Flexi Cap Fund

Quant is well-known for its dynamic approach to fund management, which is based on the notion that because markets are dynamic, so should management tactics. As a result, they believe in buying good stocks at the correct moment. According to them, the perfect time to buy a stock or sector is an inflation point where fear is extremely high and the exit right time is the opposite when greed is extreme. based on this approach they analyze macro, sectors, and stocks. They build and change their collection of stocks based on the dynamic market. That is why it is a proper active fund or a right Flexi Cap Category Fund.

Let's first check how this fund has performed in the past and find what is the consistency level of giving good returns. So if it has a good consistency level then it assures you that it is managing funds efficiently and could bring the same kind of performance in the future

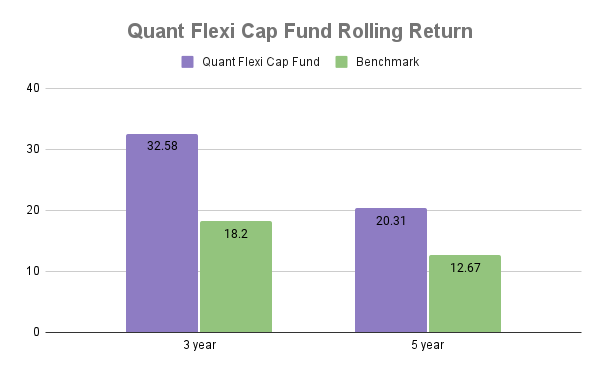

Rolling Returns

The Quant Flexi Cap Mutual Fund has shown strong past performance, with returns of 32.58% and 20.31% over the last 3 and 5 years, respectively. When we compare these figures to the benchmark returns of 18.2% for 3 years and 12.67% for 5 years, it's clear that this fund has outperformed its peer market.

This fund has shown consistent performance over the past 3 years is 87.65%% and in the past 5 years is 58.51%, which shows that this fund is giving consistent returns at 12% and more. Based on this historical rolling data & consistency the fund gives confidence that it could also perform and deliver the same kind of returns in the future.

Rolling Return- Over a given period, rolling returns are calculated continuously (or at a specified interval). It can assess how well a fund has performed over a certain period by evaluating rolling returns since its launch.

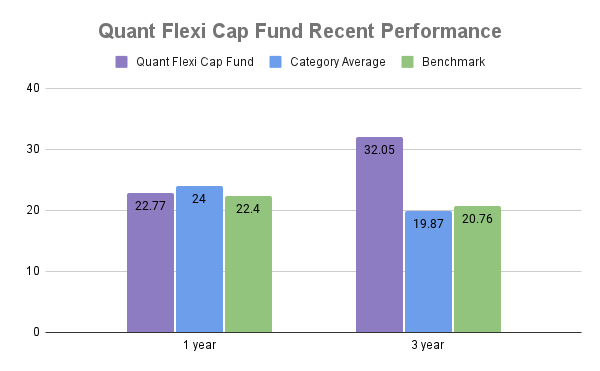

Recent Performance

The performance of this fund over 1, 3, and is 22.77%, 32.05%, and respectively. In comparison, the category average for the same periods is 24%, and 19.87%, this shows that the fund has substantially outperformed its category average over 3 and. However, when we compare this fund to its benchmark, it has outperformed its peer market.

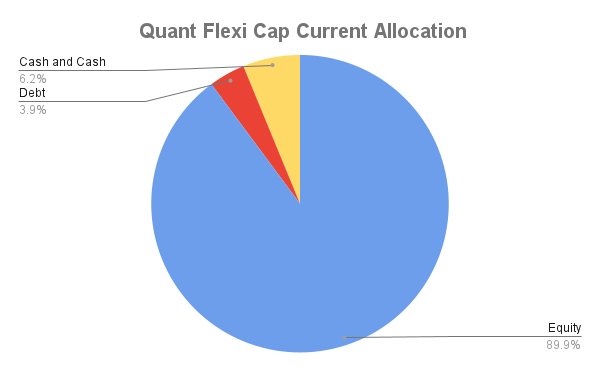

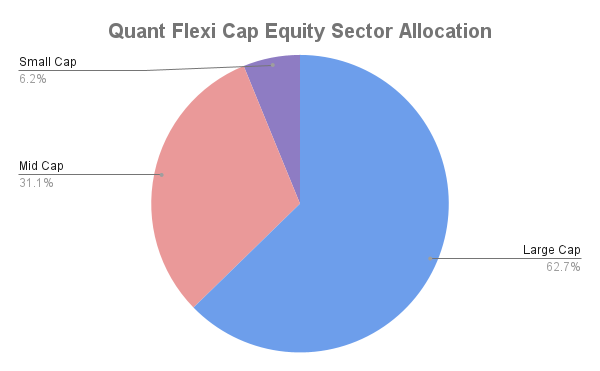

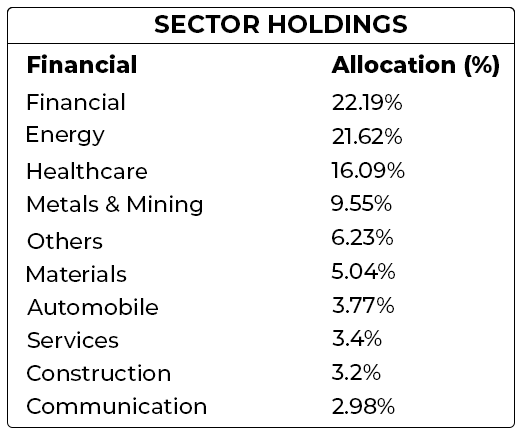

The equity asset allocation of the fund is Large Cap - 62.7%, Mid Cap- 31.1%, and Small Cap- 6.2%. This shows that the fund's large portion is invested in large-cap and a particular portion in mid and Small-Cap Funds the market is still trending but reached a level of high valuations which is why it has kept high allocation in large-cap stocks and limited allocation to Mid-Cap Stocks.

This fund has a very high allocation and is overweight on energy, financial, healthcare, metal & mining.

these sectors are fresh trending sectors and seem to have a good scope for growth. Again looking at sector allocation it is actively managing as per its strategy formed.

The most common question that comes to mind is Should Quant Flexi Cap Fund carry risk?

The risk management strategy of the fund plays a crucial role in defining its performance during volatile market conditions A key aspect to evaluate is how well the fund recovers during challenging times. This involves assessing whether the fund bounces back within a reasonable timeframe after experiencing a decline.

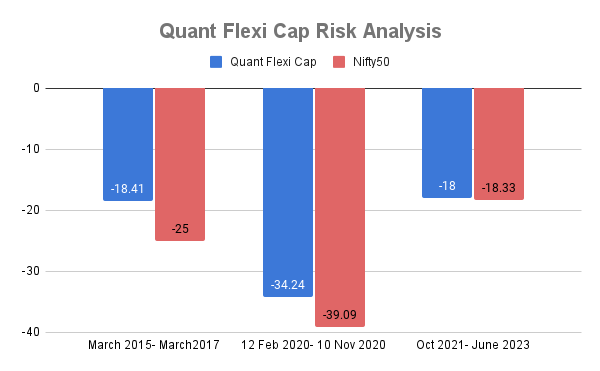

From March 2015 to March 2017, the investment fund fell by --18.41 %, while the Nifty50 index fell by -25%. During the instability in the market, the fund recovered quickly from the initial fall within 750 days.

The fund saw a significant fall of -34.24% from February 12, 2020, to November 10, 2020, compared to its Nifty50 -39.09%. The fund showed remarkable performance during this phase of time and made a fast recovery of 294 days.

Between October 2021 and June 2023, the fund faced a decline of about 18%, which was quite similar to the Nifty's drop of around 18.33%. The good news is that the fund managed to recover within 616 days, showing that it got back on track within a reasonable amount of time

The standard deviation of this fund is 17.19, and the Sharpe Ratio is 1.47, which means that the fund's performance is worth taking risks. This is for those investors who are ready to take risks for better returns.

Conclusion-

After understanding its strategy and analyzing past performance and portfolio allocation it seems like this is an actively managed fund that tries to chase returns during the market opportunity and focuses on risk management during tough market situations. Its performance also proves the proper execution of strategy. That is why it is still a good fund and can be invested by those investors who want actively managed funds for their investors. Investors also consider investing in Online SIP to maintain a disciplined investment.

Read More - Golden Portfolio 10 Reasons to Invest in Gold