Table of Contents

- Axis Small Cap Fund - Regular Plan - Growth

- Nippon India Small Cap Fund - Growth Plan - Growth Option

- Bandhan Small Cap Fund - Regular Plan - Growth

- Quant Small Cap Fund-Growth

- ITI Small Cap Fund Regular - Growth

ITI Small Cap Fund is a top choice for investors interested in small-cap stocks. Launched in February 2020, it has quickly become one of the best performers in its category. With an impressive Asset Under Management (AUM) of 1,770.83 crores as of March 31, 2024, this fund has consistently delivered strong returns, surpassing its peers and benchmarks. It stands out with an impressive 67% return in just one year, showcasing its potential for growth.

Investing Strategy

The ITI Small Cap Fund follows a straightforward strategy of picking individual stocks based on their merits, not market trends. They employ a bottom-up approach, selecting stocks based on business cycles, valuations, and growth prospects. With 80% invested in core stocks and 20% in tactical bets, they target growing companies at good prices. The fund prioritizes simplicity, focusing on emerging trends and quality companies for long-term growth. Overall, their aim is steady and continuous growth by identifying hidden gems with the potential to become larger companies in the future.

- Zero Fees

- Free KYC Check

- Best SIP Plans

- Track & Manage Investments

Fund Manager

The fund we're talking about is in good hands with Mr. Dhimant Shah an experienced and fund manager. With more than two decades of experience in fund management and Equity Mutual Fund analysis, he offers valuable expertise in Small Cap Fund and mid-cap space. Under his leadership, the ITI Small Cap Fund has consistently outperformed its peers and benchmark in the past year.

Dhimant Shah

How it has Performed in the Past

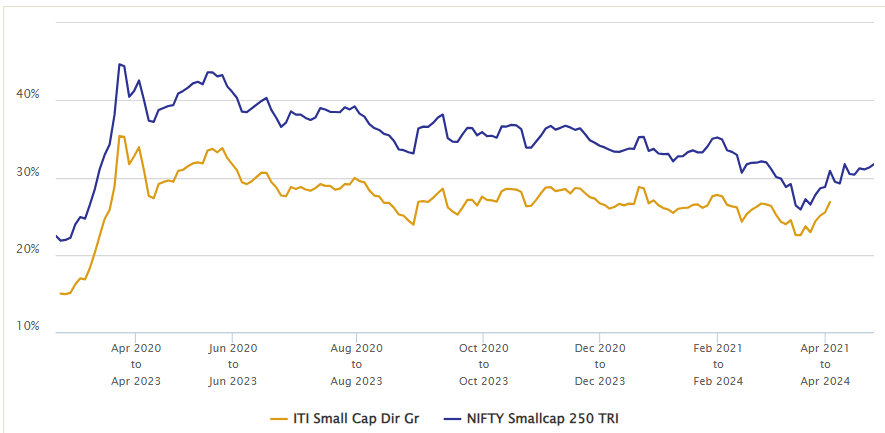

Returns: Since the fund started in Feb 2020, if you had put your money in it for any 3 years, on average, you would have gotten almost 27.24% annualized returns. What's even more noteworthy is its consistency — it has a 100% track record of offering returns above 12% every single time. We compared the same investment with its benchmark, the NIFTY Small cap 250 TRI, to evaluate the fund's performance. This fund has underperformed its benchmark, but there is a possibility that it might outperform with recent changes in fund management.

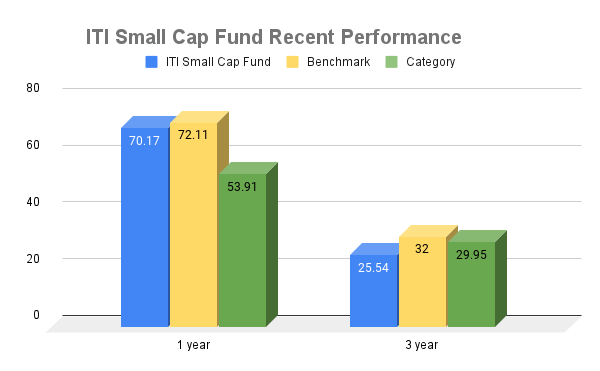

Recent improvement in performance versus peers

The ITI Small Cap Fund has shown promising performance under Dhimant Shah's management since February 2022, outperforming other Small Cap Mutual Funds on average. Over the past year, it almost matched its benchmark return of 72.11% and exceeded the category average of 53.91%. In the last three years, while trailing slightly behind its benchmark's return of 32%, it outperformed the category average of 29.95%, indicating strong performance relative to similar funds.

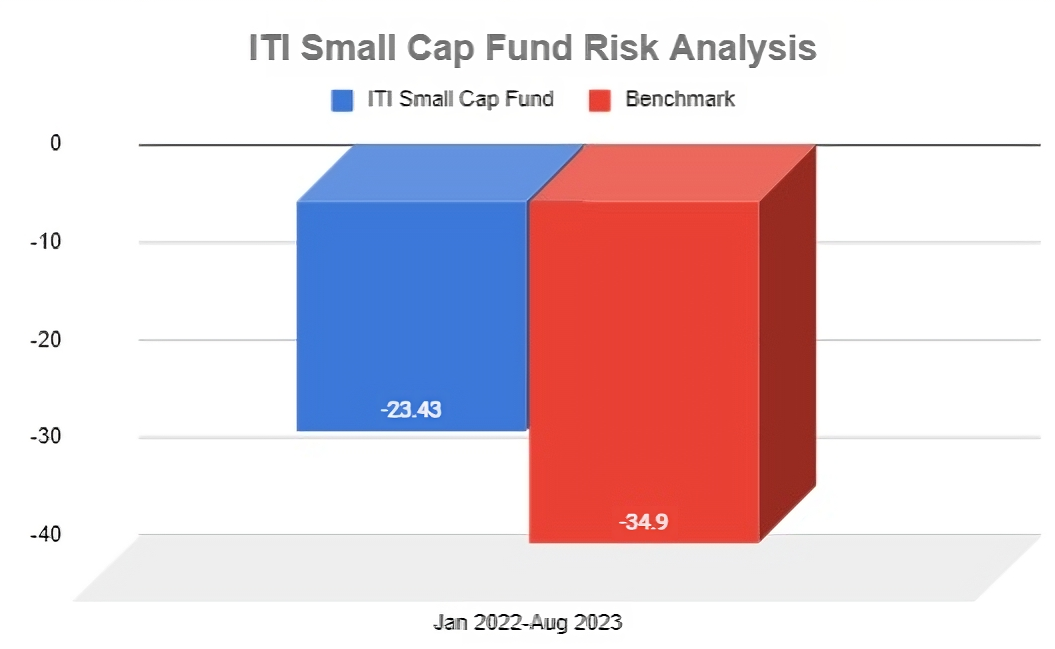

Risk Analysis

From January 2022 to August 2023, the Nifty Small Cap 100 index experienced a significant drop of 34.90%. During the same period, the ITI Small Cap Fund saw a lesser decline of 24.43% and timely recovery. Risk analysis shows that the fund had lower volatility, with a standard deviation of 16.32, compared to the benchmark's 17.50. Additionally, the fund achieved a Sharpe ratio of 1.04, which is lower than the category average of 1.35, indicating slightly less favorable risk-adjusted returns.

Portfolio Allocation

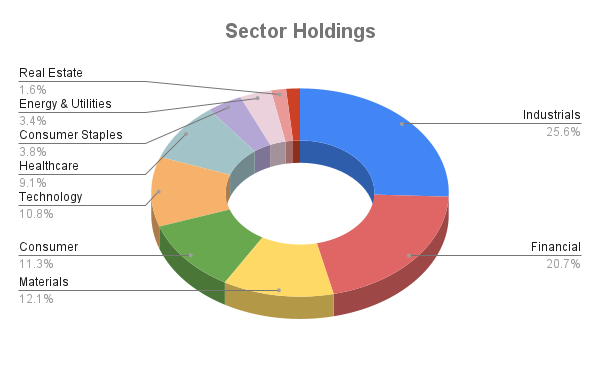

The fund invests 95.46%% in equities and keeps 4% in cash to take advantage of market opportunities, focusing mainly on small and mid-cap stocks which are 83% of its investments. It has a concentrated of 77 stocks, with the top 10 making up 20% of the fund. Investments are spread across various sectors like Industrial, Financials, and materials which make up 45% of the allocation. It invests independently of benchmarks, following a Growth at Reasonable Price (GARP) investment style. The fund diversifies across sectors to lower risk and seize growth opportunities across the economy.

Stock Selection & Quality

While analyzing stocks selections of the fund, we look at four important things to make sure they're good quality: how fast their sales are growing, how much profit they make, how much cash they have coming in, and how their price compares to their earnings (that's the PE ratio). This fund is filled with companies that are growing fast. On average, their sales are going up by 17%, they're making a 23% profit on what they sell, their cash flow is increasing by 31%, and they have a low PE ratio of 19, which means we're getting them at a good price. All this adds up to why we think this fund is one of the best choices, with really top-notch companies in it.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Suitability

The ITI Small Cap Fund is suitable for investors interested in small-cap stocks, offering strong growth potential and consistent returns. Managed by experienced fund managers like Dhimant Shah and Rohan Korde, it focuses on individual stock selection based on business fundamentals. With a balanced approach of core investments and tactical bets, it ensures diversification and long-term growth opportunities.

With a balanced strategy of core investments and tactical bets, it ensures diversification and long-term growth prospects. By spreading investments across sectors with a long-term perspective, the fund aims to mitigate market risks effectively.

Perfect for investors aiming for stable profits and wanting to tap into upcoming trends in the small-cap sector. It's best suited for those planning to invest for a minimum SIP of 5 to 7 years.