Table of Contents

Indian mutual fund companies offer investors a chance to benefit from India's goal of becoming a global manufacturing leader. As India rises in the global manufacturing scene, mutual funds focusing on this sector have done well. These funds let you invest in companies that make stuff, like cars and electronics, which helps the country grow. In this blog post, we'll explore everything you need to know about Manufacturing Mutual Funds, including how they work, their benefits and risks, and whether they're the right investment option for you. So let’s start with the basics

What are Manufacturing Mutual Funds?

Manufacturing Mutual Funds are a type of thematic mutual fund. The Thematic mutual funds focus on a specific theme or sector, such as Consumption, infra, or digital theme. In the case of Manufacturing Mutual Funds, these funds invest in companies that are involved in manufacturing various products, such as automobiles, electronics, chemicals, etc.

According to regulations set by the Securities and Exchange Board of India (SEBI), manufacturing mutual funds must invest a minimum of 80% of their total assets in equity and equity-related instruments of companies within the manufacturing sector. This means that most of the money invested in these funds is directed towards manufacturing companies.

These funds have the flexibility to invest across different market capitalizations, which means they can invest in large-cap, mid-cap, or small-cap companies within the manufacturing sector. This flexibility allows them to potentially benefit from the growth opportunities presented by companies of varying sizes within the manufacturing industry.

Why Invest in Manufacturing Mutual Fund?

Here are some key reasons to consider investing in a Manufacturing Mutual Fund:

-

Higher Growth Prospectus:

Manufacturing is a crucial part of India's economy, India's economy, contributes approximately 17% to the GDP, with expectations for it to grow to 21% in the next 6-7 years. The Indian government is actively working to position India as a global manufacturing hub. Production-linked incentives are driving increased output in key industries, thereby enhancing the growth of manufacturing companies. Furthermore, the relocation of supply chains from China by multinational companies is anticipated to further boost manufacturing in India. India's focus on technology, innovation, and skilled labor is also helping in its emergence as a global manufacturing hub. Consequently, the manufacturing sector is witnessing a surge in investments, with the potential to reach $1 trillion by 2025-26, primarily driven by industries such as chemicals, pharmaceuticals, electronics, and textiles. As a result, there is a growing trend of manufacturing funds and heightened interest in manufacturing-focused mutual funds.

-

Diversification:

Diversification in manufacturing mutual funds means they invest in various sectors and themes within the manufacturing industry. This diversity helps spread out the investment risk. This approach offers investors a broader exposure to different segments of the manufacturing sector, reducing reliance on any single industry's performance

.webp)

-

Consistency:

Manufacturing companies keep growing steadily over time, making manufacturing mutual funds consistent performers. Since the manufacturing sector is vast, there are always growth opportunities. This consistency means investors can expect consistent returns from these funds over time.

What Are the Risks and Rewards of Investing in a Manufacturing Fund?

-

Rewards

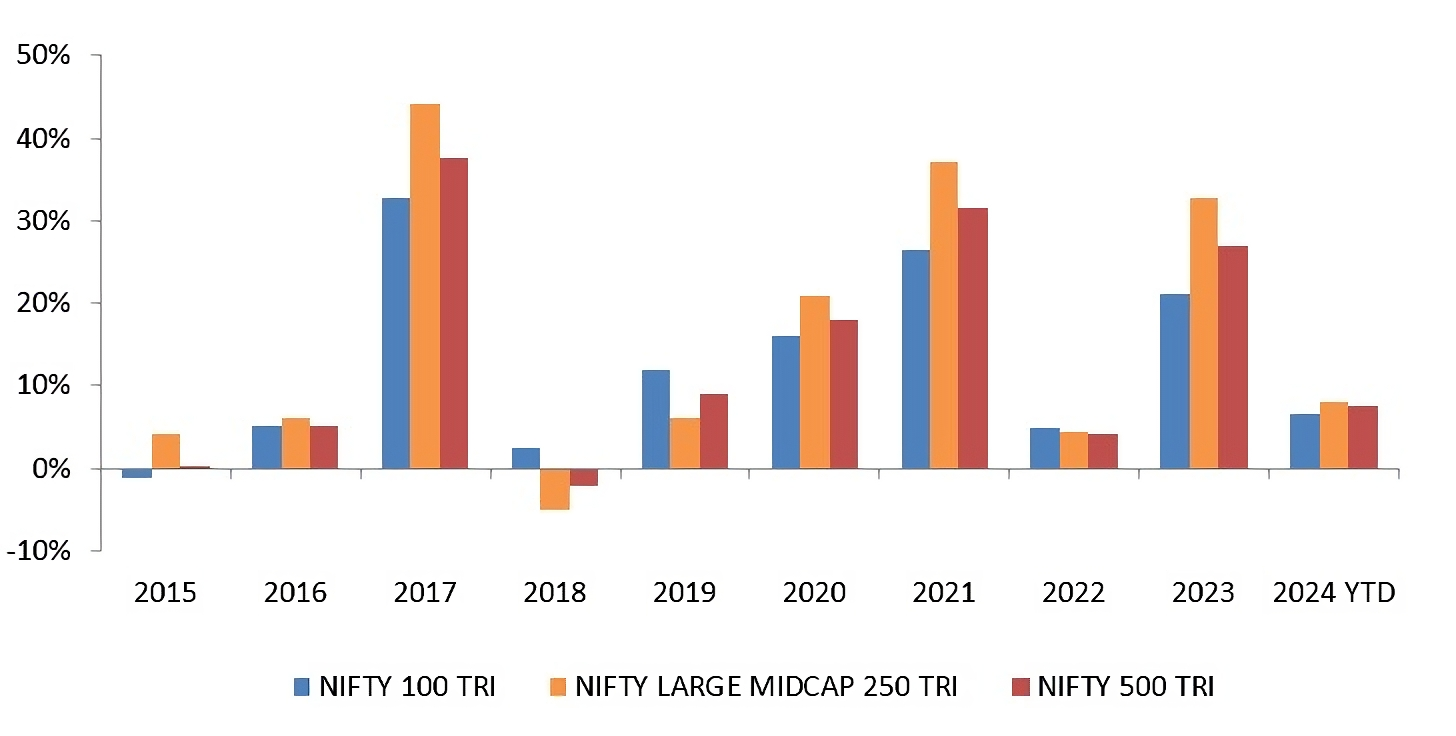

Over the past decade, there have been numerous instances where the Nifty Manufacturing index has outperformed both the Nifty 500 - TRI index and the Nifty 500 Multicap. Even in the last year, the ICICI Prudential Manufacturing Fund, one of the oldest funds in its category, has outperformed the Nifty India Manufacturing - TRI index. This demonstrates a strong track record of performance in the past.

As the manufacturing sector expands and benefits from technological advancements, it has become increasingly appealing for long-term investments. Recognizing the potential of this trend, several mutual funds are introducing new fund offers in the category. Recently, HDFC and Mahindra launched their first manufacturing funds to capitalize on the anticipated growth of the manufacturing sector.

Read: The New NFO Launch HDFC Manufacturing Mutual Fund

-

Risk

-

The first one is Concentration Risk

Manufacturing funds usually focus their investments on a specific theme or sector, which can lead to higher volatility compared to other diversified equity funds. If the manufacturing sector experiences a downturn, the fund's performance can significantly decline.

-

Second, comes the Cyclicality of the manufacturing sector

Companies within the manufacturing sector are prone to cyclicality macroeconomic factors like interest rate, inflation, and currency movements play a major role in their performance. This implies that these companies have the potential to excel during economic booms but may underperform during recessions.

-

Investing made simple – Get the app and start earning

Is Manufacturing Mutual Funds Suitable for You?

Is this thematic fund meant for you let’s see:

-

Type of Investors:

Manufacturing funds suitable for seasoned investors who have sufficient knowledge of specific sectors. These investors can handle the aggressiveness in their portfolio and aim for high returns on their investments.

Note: However, the manufacturing industry's current size and growth trends are for the long term and these funds follow a flexi cap strategy to diversify risk and produce higher returns. Therefore, these funds are also suitable for all kinds of investors or regular investors.

-

Risk Tolerance:

Typically, these sectors funds perform in cycles therefore sometimes they have long underperformance and higher volatility during any macro or political event. So investors should have at least 2-3 years of patience during negative performance and could tolerate 20-30% negative returns on sharp falls in the market.

-

Time Horizon:

These manufacturing funds will give very good returns if investments are planned for at least 5 years. So it is best suitable for the medium-term horizon.

Top Funds to Invest in Manufacturing Mutual Funds?

By looking at every parameter the experts have shortlisted here are the 7 top funds: Let's have a look:

| Scheme Name | 3 M (%) | 6 M (%) | 1 Yr (%) | 3 Yrs Returns (%) |

|---|---|---|---|---|

| ICICI Pru Manufacturing Fund | 8.75 | 28.15 | 62.72 | 28.82 |

| Kotak Manufacture in India Fund | 8.44 | 23.29 | 46.83 | - |

| ABSL Mfg Equity | 8.93 | 21.53 | 44.66 | 16.01 |

| quant Manufacturing Fund | 6.12 | 31.1 | ||

| Axis India Manufacturing | 12.86 | |||

| Canara Robeco Manufacturing | ||||

| HDFC Manufacturing fund | ||||

| Category Average | 9.02 | 26.02 | 51.4 | 22.41 |

| NIFTY 500 TRI | -0.25 | 10.64 | 29.78 | 16.14 |

The above returns are as of June 06th, 2024.

Coming Soon! Explore the best blogs selected by experts

Conclusion

Investing in manufacturing mutual funds presents an opportunity to capitalize on India's thriving manufacturing sector. These funds offer diversification and potential for growth, aligning with India's goal of becoming a global manufacturing hub. However, investors should consider risks like concentration and sector cyclicality. Utilizing a SIP (systematic investment plan) can help mitigate risks and enhance returns over time. In summary, manufacturing mutual funds offer a promising avenue for investors seeking exposure to India's dynamic manufacturing landscape.