Indian equity indices ended on negative momentum. Sensex ended marginally lower by -0.27% whereas broader equity indices, mid and small cap marred by -1.86% and -1.79%, respectively. Let’s find out in detail, what happened in the market last week.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

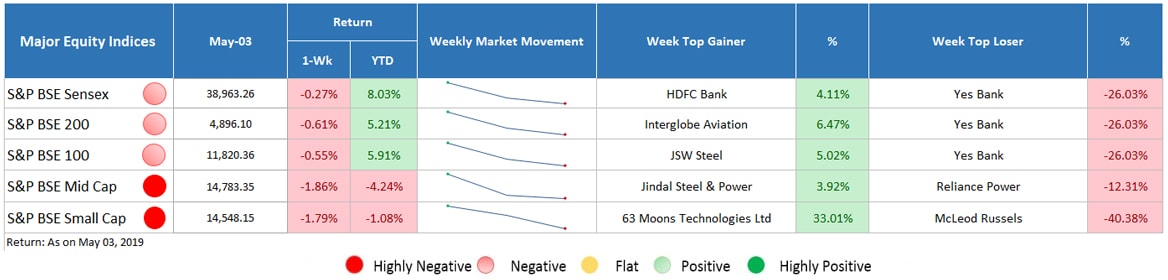

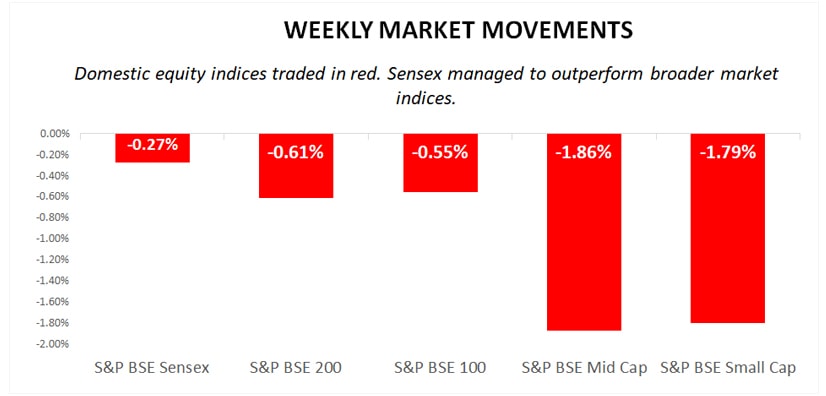

Major Equity Indices Performance

Last week, Sensex traded marginally lower by 0.27%, however, broader equity indices BSE Midcap and BSE Smallcap were down by 1.86% and 1.79%, respectively. Selling pressure in the IT, Healthcare and FMCG stocks pulled down the market. Other large-cap indices i.e. S&P BSE 200 and S&P BSE 100 fell marginally by 0.61% and 0.55%, respectively.

On the domestic front, a surge in crude oil prices was the key reason that affected investors’ sentiments. Moreover, investors stayed sidelines and traded cautiously during 3 day trading sessions. Talking about institutional investors, FIIs were optimistic and bought equities worth INR 311.45 crore and DIIs offloaded equities worth INR 4.6 crore.

During the week, economic data was released where Nikkei India Manufacturing Purchasing Managers Index fell to 51.8 in April against 52.6 in March due to weakening business activities and restricted output growth. Apart from this, Centre for Monitoring Indian Economy (CMIE) released unemployment rate data, as per which, India’s unemployment rate hiked to 7.6% for the month of April, 2019 against 6.7% in the month of March. However, on the contrary, GST collection reached INR 1.13 lakh crore, highest since its rollover in July 2017.

On the global front, the Federal Reserve’s decision to keep the repo rate unchanged affected investors sentiments. Chairman Jerome Powell commented that inflation is under control, rising job growth numbers and fall in unemployment rate justifies the decision of no change in the repo rate.

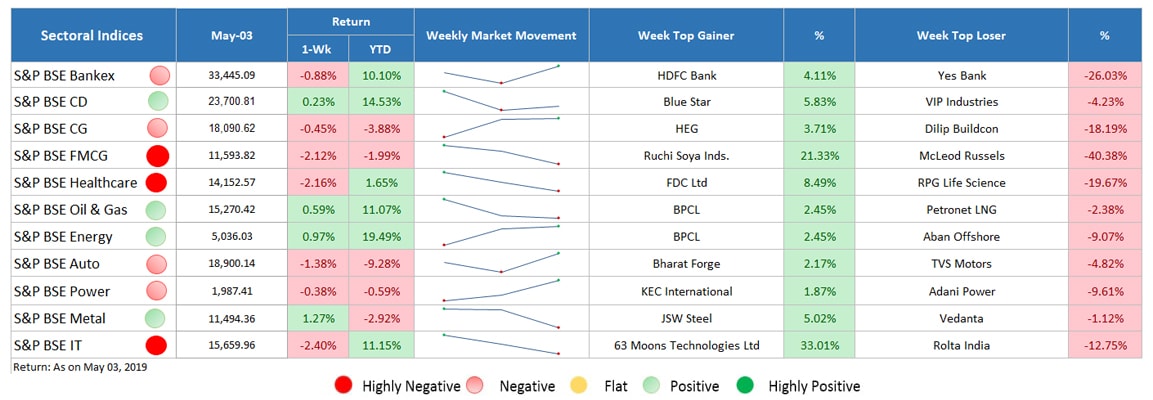

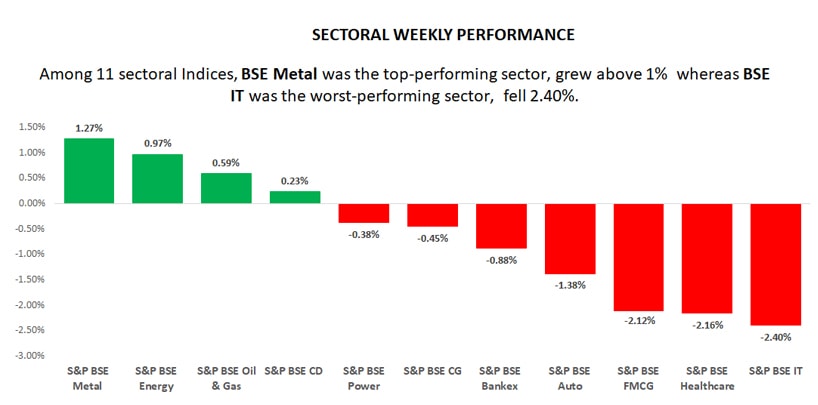

Sectoral Indices Performance

Gaining sectors

Among 11 sectoral indices, 4 sectors advanced.

- BSE Metal was the top-performing sector that grew by 1.27% during the week.

- BSE energy and oil & gas ended marginally higher by 0.97% and 0.59% respectively followed by BSE consumer durable, which gained 0.23%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing sectors

Among 11 sectoral indices, 7 sectors declined.

- BSE IT that was the top performing sector last week, but became the top loser and fell by 2.40% due to strengthening of domestic currency.

- BSE Healthcare and FMCG also traded in red, down by 2.16% and 2.12% respectively.

- BSE Auto sector was down by 1.38% after the reports stating 17% crash in passenger vehicle sales in the month of April.

- BSE Bankex, Capital Goods and Power sector declined marginally by 0.88%, 0.45% and 0.38%, respectively.

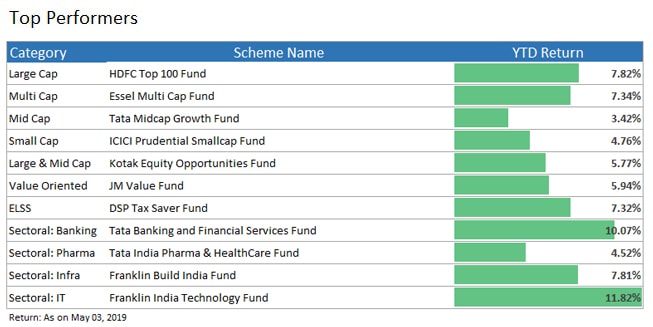

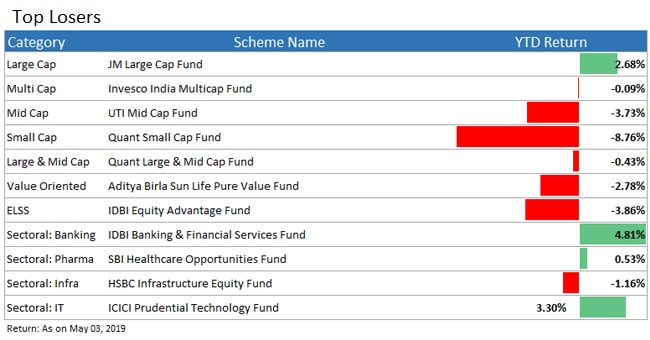

Top Performers & losers

Weekly Market Digest

The trends for the last week (29th April – 03rd May) remained unchanged from the week before that as SENSEX slipped marginally. IT sector was the major shocker while metals and oil & gas continued to advance. With contributions from Healthcare, FMCG, and Auto sector, the market ended on a negative note. Decent volatility is expected in upcoming weeks due to elections. Stay tuned for more updates in the upcoming weeks to make informed investments. For any query, allow us to assist you.

The market trends remained unchanged and resonated the performance of the week before with SENSEX showing a marginal slip. IT sector was the major shocker while, metals, oil and gas continued to advance. Further, with the underperformance of healthcare, FMCG, and auto sector, market ended on a negative note. In the coming days too, volatility can be experienced in the market because of the elections. Stay tuned for more updates on the mutual fund industry and the equity market. In case of any query, feel free to connect with the experts.

- Ask Questions

- Give Answers

- Improve Knowledge

- Invest Wisely