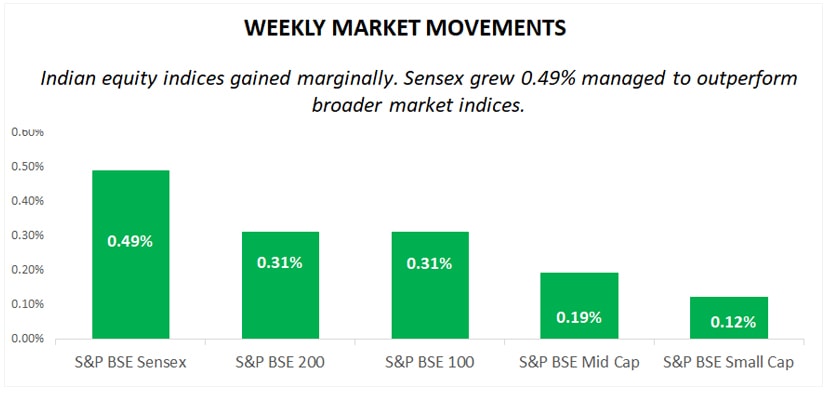

This week, all the major indices ended with marginal gains. Among key indices, Sensex gained 0.49%, outperforming broader market indices. Let’s find out what happened in the market last week.

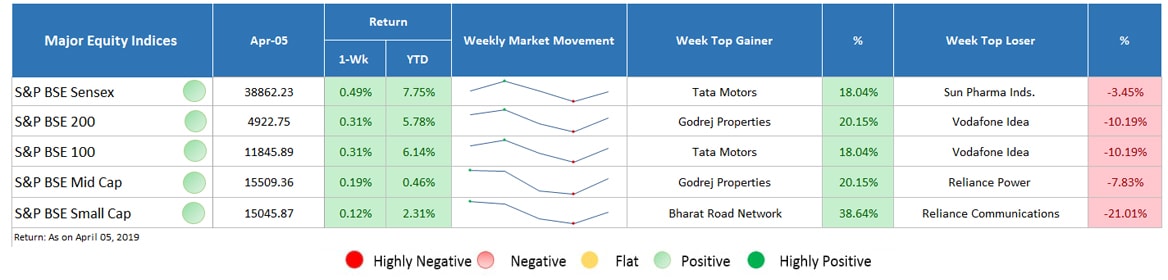

Major Equity Indices Performance

Last week, Sensex ended with modest gain of 0.49% comparatively higher than broader market indices where S&P BSE Midcap and S&P BSE small cap ended slightly higher by 0.19% and 0.12%, respectively. Other large cap indices i.e. S&P BSE 200 and S&P BSE 100 were up equally by 0.31%.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Adding to the positivity, the equity market indices touched fresh all-time highs. Sensex recorded all-time high at 39,116 mark and Nifty reached fresh high at 11,760 mark. Net inflow by institutional investors was the one of the key reasons behind improved sentiments. During the week, Foreign Institutional Investors (FIIs) remained net buyers and bought equities worth INR 973.38 crore. From the last couple of weeks, Domestic Institutional Investors (DIIs) were offloading their investment in the Indian market, however, last week witnessed some reversal and

DIIs invested capital worth INR 1394.86 crore. It acts as a positive indicator for investors sentiments.

Globally, progress in US-China trade talks and growth in Chinese manufacturing data also lifted sentiments. On the domestic front, RBI cut repo rate by 25 basis points to 6% that were in line with the expectations while MPC maintained policy stance to neutral. In the meeting, MPC also lowered the GDP growth projections for financial year 2020 to 7.2% as against 7.4% growth rate projected earlier weigh on sentiments and restricted market gains. Despite this, Nikkei India Manufacturing PMI slipped to 6-month low affected sentiments negatively. PMI dropped from 54.3 to 52.6 as lower demand took a toll over sentiments and capped gains.

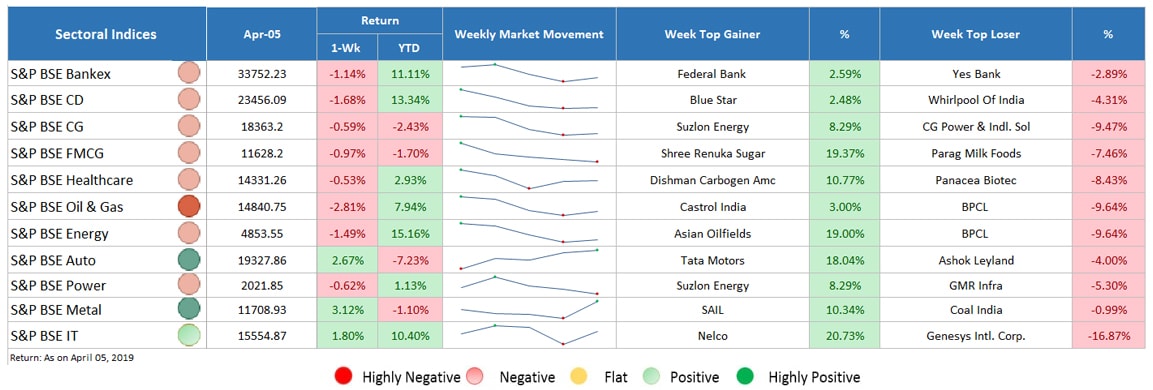

Sectoral Indices Performance

Gaining Sectors

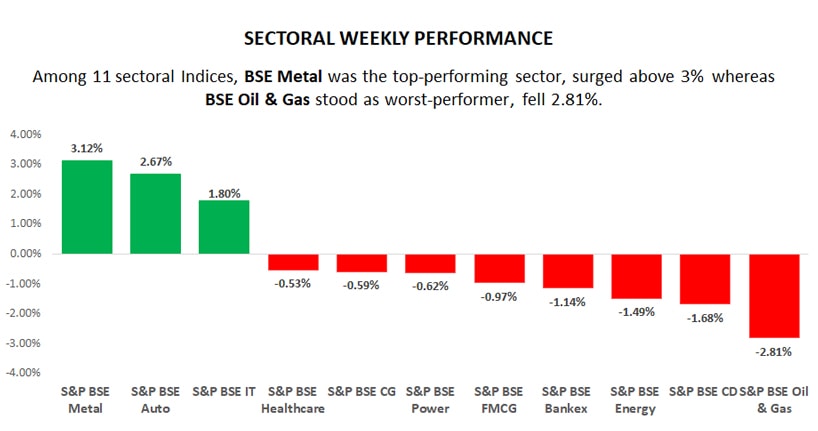

Among 11 sectoral indices, 3 sectors traded in green.

- BSE Metal was the top-performing sector, grew above 3% due to trade-talk progress between the US and China.

- BSE Auto and BSE IT sector also witnessed some buying pressure hence, ended higher by 2.67% and 1.80% respectively.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Losing Sectors

Many sectoral indices traded in red, among 11 sectors, 8 sectors ended lower.

- BSE Oil & Gas was the top laggard, down by 2.81%.

- BSE consumer durable, energy and bankex also seen some selling pressure, henceforth, down by 1.68%, 1.49% and 1.14%.

- BSE FMCG, power, capital goods and healthcare traded marginally lower by 0.97%, 0.62%, 0.59% and 0.53% respectively.

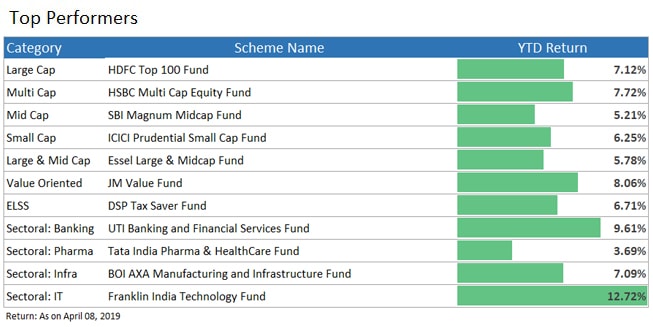

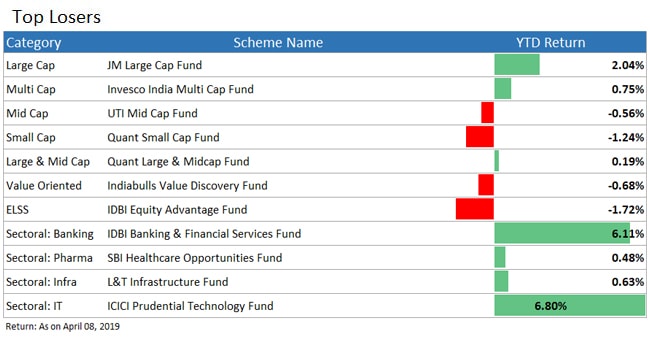

Top Performers & Losers

Overall, the market ended on a positive note and stayed above the crucial levels. Looking at the market sentiments a positivity can be expected in the coming sessions too. So, stay tuned for the next weekly mutual fund and equity market update to make informed investment decisions.