Table of Contents

- Performance Analysis of Motilal Oswal Large & Mid Cap Fund

- Portfolio Analysis of Motilal Oswal Large & Mid Cap Fund

- Goal of Motilal Oswal Large and Mid Cap Fund

- Stock Selection Strategy of Motilal Oswal Mutual Fund (2025)

- Portfolio Management of Motilal Oswal Large and Midcap Fund Review

- Impact of Fund Manager on Motilal Oswal Fund

- Comparing Risk Ratios to Benchmark and Category Average

- Analyzing the Stock Quality of Top Holdings

- Investment Sustainability of Motilal Oswal Large & Mid Cap

- Final Recap

Are you looking for a mutual fund that blends stability with explosive growth potential? The Motilal Oswal Large and Midcap Fund, with Rs.10,480 Crore AUM and a stellar 31.07% 5-year return, could be your ticket to long-term wealth.

However, “Do you know what sets it apart from its peers?" Well, this large and mid cap mutual fund is powered by the unique QGLP strategy of the Motilal Oswal Mutual Fund, which picks high-quality stocks with precision.

Now, without any further delays, let's take a dive into Motilal Oswal large and mid cap fund review 2025 to discover if this high-conviction fund is the smart investment choice for your portfolio or not.

Performance Analysis of Motilal Oswal Large & Mid Cap Fund

Now, let us move beyond theory and analyse the fund's performance in more detail, focusing on its rolling returns and consistency with SIP:

1. Analysing Rolling Returns for a Realistic Picture

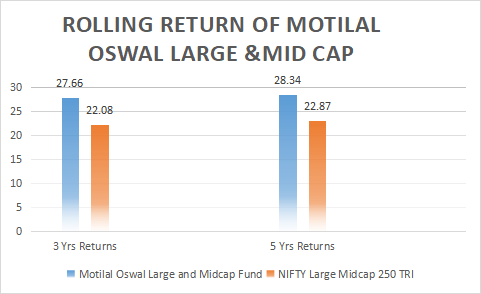

The consistency check with the rolling returns is a much easier indicator of performance than point-to-point returns. The table below shows you how the fund has performed consistently over different market cycles:

The above graph shows, this Large and Mid Cap Mutual Fund has given impressive returns of 27.66% in 3 years and 28.34% returns in the last 5 years, amazingly beating its benchmark returns of 22.08% and 22.87% respectively.

Pro Tip: Make calculations easy with SIP Calculator doing hard parts for you.

Remember: Look for consistent performance above the benchmark index.

2. SIP Returns Over Different Time Frames

If you are planning to invest through a Systematic Investment Plan (SIP), it is important to look at the fund's SIP returns. If you invest Rs 5000 monthly, then the 1-year return will be 12%, the 3-year return will be 15% and the 5-year return will be 17%. Returns of this fund are around 16% to 20% CAGR over 5 years (fluctuates with the market).

Key Takeaway: SIP returns are the perfect indicator of the fund's ability to track wealth over the long term.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Are you ready to take the first steps in investing through Portfolio analysis? Let’s cover that in the next heading.

Portfolio Analysis of Motilal Oswal Large & Mid Cap Fund

Understanding the fund's portfolio is play a major role for your investment. It is like knowing the ingredients in a recipe.

1. How Asset Allocation Aligns with Fund Objectives:

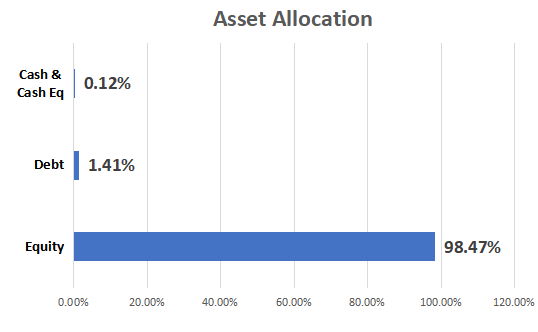

As of April 2025, the fund held 98.47% of its assets in domestic equities, 0.12% in derivative futures for hedging and 1.41% in cash & equivalents.

It is easy to visualize asset allocation by this bar graph:

Remember: Make sure that the asset allocation matches your risk profile.

Fund Fact: Expense Ratio of Motilal Oswal Large & Mid Cap is around 1% to 1.5%, depending on the plan (direct or regular).

2. Current Market Cap Allocation Breakdown:

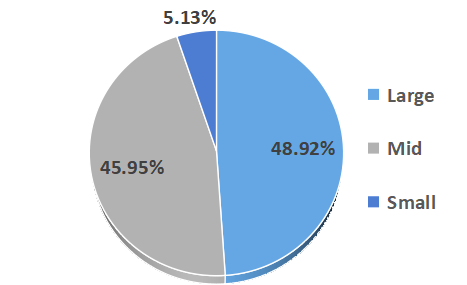

- As of 2025, the fund shows a strong tilt towards large & mid cap stocks, aligning with its investment strategy, the total Large & mid cap exposure is 94.87%, small cap exposure is 5.13%

- Investors should be aware that this also brings higher volatility and riskcompared to a pure large cap portfolio. It is suited for investors with a moderate to high-risk appetite looking for long-term capital appreciation.

To Be Noted: A higher allocation to mid-cap stocks generally indicates higher growth potential but with higher risk.

3. Diversification Across Sectors and Their Weightings

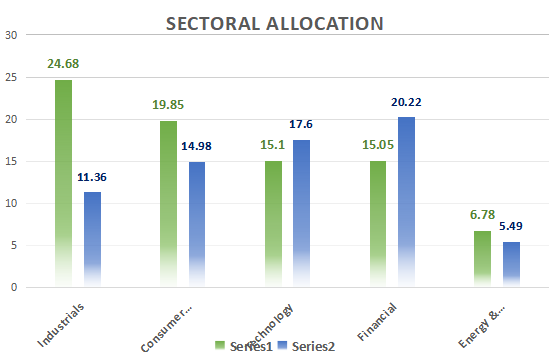

The top 3 sectors the fund has invested in are capital goods (33.6%), finance (14.5%) and retail (13.3%).

This illustration helps to simplify the sector with the fund & category

In the mutual fund,diversification across sectors can help reduce risk.

Goal of Motilal Oswal Large and Mid Cap Fund

To fulfil any of the fund goals, the Motilal Oswal Mutual Fund applies a unique principle of Philosophy, Strategy & Research Process:

-

Philosophy

- The Mutual Funds aims to grow your money over the moderate to long term by investing in large & mid-sized companies that have strong development potential.

- It tries to balance between stability (from large caps) & higher returns (from mid-caps).

-

Strategy

- It mixes growth stocks & value stocks depending on the market swings.

- QGLP Strategy helps reducing market risks.

-

Research Process

- Top-Down approach, it looks at the economy to find growing sectors.

- Bottom-Up approach, picks individual companies with strong earnings & constant cash flow.

In short, the fund alternatively selects strong companies in well-reputed sectors to help your money grow consistently over time.

Stock Selection Strategy of Motilal Oswal Mutual Fund (2025)

Motilal Oswal Best Large & mid cap funds follow the QGLP approach, a focused and disciplined method for selecting stocks. QGLP stands for:

- Q – Quality of Management: Find the companies with strong leadership, ethical practices, & clean corporate governance.

- G – Growth in Earnings: Focus on businesses that have a constant high growth potential.

- L – Longevity of Competitive Advantage: Companies with green business models & strong market reputation.

- P – Price: Investments made at reasonable valuations using different metrics like P/E & EV/EBITDA.

In short, Motilal Oswal looks for high-quality, growth-oriented companies with durable advantages at fair prices to build long-term wealth for investors.

Pro Tip: Level up your portfolio using the Step Up SIP Calculator and win big rewards.

Smart Investments, Bigger Returns

Portfolio Management of Motilal Oswal Large and Midcap Fund Review

Motilal Oswal Large and Midcap Fund focuses on quality over quantity & aims to grow your investment through patient, long-term investing in high-potential businesses.

-

Focused Portfolio

The fund holds around 31 stocks, much lower than the category average of 77.26. This shows a concentrated and high-conviction investing style, fewer but stronger bets.

-

Low Turnover Ratio

At 43.14% (compared to the category average of 134.05%), the fund follows a buy-and-hold strategy, meaning it does not usually buy/sell stocks, helping reduce costs and maintain long-term focus.

Impact of Fund Manager on Motilal Oswal Fund

The growth journey of any mutual fund depends on the people behind it. Motilal Oswal Large and Midcap Fund is guided by experienced & capable fund managers who bring their expertise & discipline to the table.

Ajay Khandelwal

- Experience: Formerly worked with Canara Robeco AMC, BOI AXA, B&K Securities and Infosys

- Expertise: Strong background in equity markets & portfolio management

Rakesh Shetty

- Experience: Has managed equity and debt ETFs and played a role in product development

- Expertise: Brings a solid view of capital markets & investment products

This fund is managed so well to ensure your investments are in smart & steady hands.

Comparing Risk Ratios to Benchmark and Category Average

Here are comparisons of risk rates to benchmark and category average:

- The fund has a "Very High" riskometer

- High risk, due to large and mid-cap stock exposure.

- The fund's risk grade is "Average," and its return grade is "High."

- The fund shows higher volatility (standard deviation) than the category average, reflecting its aggressive allocation to small cap stocks.

- Its Sharpe ratio is 1.18, slightly better than the category average, and shows strong risk-adjusted returns. The Fund has generated a positive alpha of 10.94 and a slightly greater beta than 1. Investors should be ready for slight fluctuations.

Analyzing the Stock Quality of Top Holdings

Do you also think that what kind of companies are actually in the fund's portfolio? Are they fundamentally strong, with good growth potential, or are they more speculative bets, as indicated by stock quality?

- To consider key metrics, look for companies with strong financials (revenue growth, profitability), a competitive advantage and a good management team.

- The fund’s high Price-to-Earnings Ratio(P/E ratio) indicates a focus on growth-oriented stocks with premium valuations. The category average is 17.39.

- While earnings and sales growth are slightly below the category average, its cash flow growth is significantly stronger, suggesting investments in companies with robust financial health.

Important note: In the Motilal Oswal Large & Mid Cap, there is no lock-in period (open-ended fund, can exit anytime).

Investment Sustainability of Motilal Oswal Large & Mid Cap

This fund combines long-term growth potential with a disciplined, research-driven approach, making it suitable for you if you are ready to commit for the long run:

· Ideal Investor Profile

This fund is for you If you have a high risk tolerance who are aiming for long-term capital growth. making it ideal for those with a 5–7 year duration, especially through SIP, to ride out market ups and downs.

· Risk Warning

Due to its high volatility and concentrated stock portfolio, this fund may not be suitable for conservative investors or those who want liquidity within 5 years.

· Sector Opportunity & Valuation

The fund is well established to benefit from long-term growth in sectors like capital goods, consumer cyclical & technology. But, its high P/E ratios & inherent volatility mean that investors must know their risk tolerance carefully.

· Portfolio Confidence & Tactical Adjustments

With a low turnover ratio & focused portfolio, the fund shows strong conviction in its stock picks. Adapting in sectors like specialized finance & technology shows that the manager’s ability to adapt tactically to grab opportunities.

Point to Remember: You can redeem anytime online through the app or platform where you invested.

Final Recap

To sum up, Motilal Oswal Large & Midcap Fund that If you are aiming for long-term wealth creation, have a moderate to high risk tolerance & want in quality over quantity. This fund can be a powerful addition to your portfolio.

With its consistent performance, focused stock-picking strategy (QGLP), and strong fund management with SIP. Motilal Oswal Large & Midcap Fund stands out as a high-conviction, growth-oriented choice.

Know that "This fund is kind of like planting a mango tree today & enjoying the sweet fruits for years."

Frequently Asked Questions

Q1. What is the cash holding in this fund?

It means how much cash the fund keeps aside instead of investing it all. The fund had about 1.41% in cash for flexibility and quick investments.

Q2. What is meant by 'charge of equity' in this fund?

It refers to how much the fund is invested in Equity funds (stocks). In this case, 98.47% of the fund is in equities, showing it is focused on growth through shares.

Q3. Why is Bharat Dynamics part of this fund's portfolio?

It is a defence company owned by the government. The fund includes it because it sees future growth potential in India’s defence sector.

Q4. What is Cholamandalam Investment and Finance Company Ltd., and why is it in the fund?

It’s a finance company that gives vehicle & home loans. The fund invests in it for its strong growth & trusted brand in potential.