Table of Contents

- Overview of Quant Infrastructure Fund?

- Analysing the Quant Infrastructure Performance Graph

- What Makes Quant Infrastructure Fund a Safer Investment?

- Quant Infrastructure Fund Portfolio Review 2025

- Equity Allocation of Quant Infrastructure Fund

- What are the Top 5 holdings of the Quant Infrastructure fund in 2025?

- Is Quant Infrastructure Fund Good for the Long Term?

- To Conclude Fund Review

Did you know that in the Union Budget 2025-26, the capital investment outlay for infrastructure increased by Rs.11.21 lakh crores, making 3.1% of India's GDP?

But, “How does it affect you?” One particular scheme, the Quant Infrastructure Fund, has emerged as a shining opportunity by delivering 17.41% returns in the last 3 years.

In this analysis, you will find the quant infrastructure fund review 2025 and understand how investing in this scheme could make you among the world's fifth-largest economic contributors.

This fund is a mix of smart strategies—buy & hold, value and growth investing and it’s positioning itself as a key player in this journey. But is it the right fit for your long-term goals?

Scroll on to find out if this fund fits your 2025 investment goals.

Overview of Quant Infrastructure Fund?

The Quant Infrastructure Fund has come a long way since it started in 2013. This fund has managed an asset under management (AUM) of Rs3,370 Crore and the current Quant Infrastructure fund NAV (net asset value) is Rs40.8101 as of June 2025. It is an open-ended equity scheme to provide long-term capital appreciation through growth potential in the infrastructure sector. It has delivered a 17.11% annualized return since its inception & beating both category and benchmark.

Do you hear some rumours that “Is Quant Infrastructure Fund falling?” To clear up this confusion trap, let us look at the next heading.

Analysing the Quant Infrastructure Performance Graph

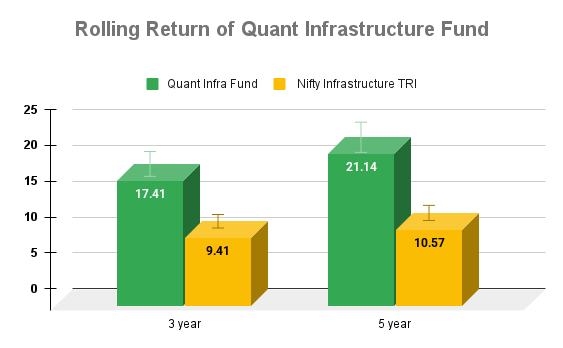

In the last 3 and 5 years, the Quant infrastructure fund has delivered 17.14% & 21.14% rolling returns; it showcases a strong performance and beats the benchmark returns of 9.41% and 10.57%, respectively.

Let’s look at the graph below to see the data in action:

The above graph shows that the stellar returns made by this Infrastructure Mutual Fund and silencing the rumours that circled around the “falling of quant infrastructure fund.”

Pro Tip: Get instant returns using the SIP Calculator free of cost.

Moving on, do you find yourself asking, “Is Quant infrastructure fund safe to invest in 2025?” If yes, the next heading will have the right answer.

What Makes Quant Infrastructure Fund a Safer Investment?

Even though the market fluctuates up & down, the Quant Infrastructure Fund stands out by bouncing back quickly. Thanks to its smart strategy, calculated risk-taking and expert management, it is considered a safe pick for long-term investment.

-

Investment Strategy

This infrastructure fund by Quant Mutual Fund uses a buy-and-hold approach to find a perfect balance between value and growth investing style. This technique helps this mutual fund scheme to pick strong businesses, not just market trends.

Similarly, if you look closely, the Quant infrastructure fund is invested in core sectors like 30.22% in energy and utilities, 34.56% in industrials and many others like construction, transport and materials. All these sectors are engaged in the development of infrastructure in some ways.

But the important question is, "How will it benefit you?" By following this investment approach, the fund will generate stable cash flow and maximize your chance to make long-term returns.

-

Risk Analysis

Standard deviation (SD) of 20.15%, which shows relatively high volatility in Mutual Funds. So it is not for the faint-hearted. On the other side, Alpha of 1.83 shows the fund manager has added value above the benchmark returns. This table shows it carries risk, but it rewards you well for it. The quick 7-month recovery after a steep fall shows the fund’s strength and flexibility.

| Risk Analysis | Standard Deviation | Sharpe Ratio | Alpha | Beta | Index | Recovery |

|---|---|---|---|---|---|---|

| Quant Infra Fund | 20.15% | 0.77 | 1.83 | 1.2 | -17.85 | 7 Months |

-

Expert Fund Manager

Managed by Ankit Pande, he is the mastermind behind the quant infrastructure fund's success, & good enough with 15+ years in asset management. He focused deeply on infrastructure for over a decade. He has done an MBA in Finance from IIM Bangalore & Known for sharp analysis and multi-angle research.

Fund Fact: The Quant infrastructure regular plan has an expense ratio of around 2.25%, which is slightly higher due to its active management style.

Also Read: Is Quant Mutual Fund Safe to Invest in 2025 in India?

Let’s find out the opportunities offered by this mutual fund in portfolio allocation.

Quant Infrastructure Fund Portfolio Review 2025

This infrastructure mutual fund is backed by a solid portfolio foundation to derive strong returns in the long term.

Let’s take a closer look at how this open-ended equity fund is allocated across sectors and market capitalization:

Asset allocation

- The fund has a 95.96% allocation in equity, showing a high-risk blend strategy & just 4.04% in debt, which adds a touch of stability to the portfolio.

- This mix reflects a bold approach, aiming for higher returns while keeping a small mitigation through debt.

- Such an asset allocation helps investors understand risk exposure and suit their investments to their financial goals.

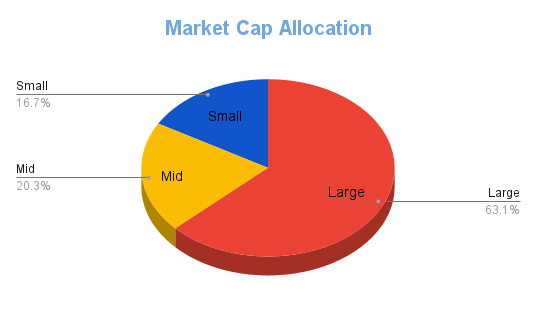

Market cap allocation

- Although the Quant Infrastructure Mutual Fund is classified as a large cap fund, its strategy leans towards growth. That is why around 63% of its portfolio is invested in large cap companies following its buy-and-hold, value and growth investing approach.

- To balance the portfolio and keep risk low, 20% is allocated to mid cap stocks for stability. Meanwhile, small cap stocks make up the remaining 16%, aiming for consistent long-term growth.

- This mix shows a smart strategy to manage long-term capital with a growth mindset. Check the chart below to see this mutual funds market cap allocation in detail.

Fund Fact: This fund has no lock-in period. You can exit anytime, but an exit load of 1% applies if redeemed within 1 year.

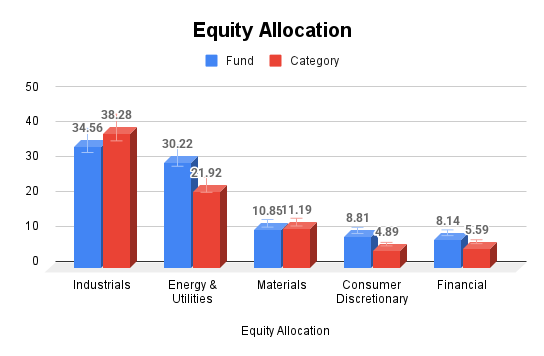

Equity Allocation of Quant Infrastructure Fund

The fund has a thematic allocation with a major allocation in the energy & utilities holds the highest shares of 30.02%, higher than the category average. It targets companies that are involved in the sector powering India's infrastructure growth.

Scroll down to view the sector allocation chart for a visual breakdown.

Compared to its peers, the fund is overweight in sectors like Consumer Discretionary and Financials, as well as pointing growth-oriented approach.

Well, this leads you to question, “What are the top 5 mutual funds holdings of the Quant Infrastructure fund?”

Keep reading to learn more.

What are the Top 5 holdings of the Quant Infrastructure fund in 2025?

Here is the list of 5 stocks held by this fund with their sector, AUM (in crores) & 1-year return:

| Stock | Sector | AUM (Rs in Crores) | 1-Year Return |

|---|---|---|---|

| Larsen & Toubro Ltd. | Construction & Engineering | Rs332.66 | –1.6% |

| Reliance Industries Ltd. | Energy | Rs323.87 | –2.7% |

| Tata Power Company Ltd. | Energy & Utilities | Rs266.36 | +12.4% |

| Samvardhana Motherson International Ltd. | Auto Components | Rs245.00 | +5.4% |

| Life Insurance Corporation of India (LIC) | Financials (Insurance) | Rs227.84 | +76.4% |

By looking at the table and analysing the performance measure of these funds, it is clear that Tata Power (+12.4%), LIC (+76.4%) led gains, Reliance (–2.7%), L&T (–1.6%) saw minor declines & Motherson showed moderate growth (+5.4%).

The top 5 stocks in India are estimated to be 41–43% of the fund’s equity allocation, demonstrating the infrastructure mutual fund's philosophy of combining quantitative screening with qualitative analysis to identify undervalued companies with strong fundamentals and long-term growth potential in the infrastructure space.

Is Quant Infrastructure Fund Good for the Long Term?

The primary objective of quant infrastructure fund growth is to produce long-term capital appreciation by investing in high-quality sector thematic companies, thereby ensuring consistent capital appreciation and risk-return holding returns.

The quality of equities is a major factor in determining whether the Quant Infrastructure Fund is a viable long-term investment with SIP in 2025.

The belwo table discusses this mutual funds stock quality in detail:

| Quality of Stocks | Quant Infra Fund | Index |

|---|---|---|

| Valuations PE | 19.34% | 18.89 |

| Earning Growth | 9.42% | 15.74% |

| Sales Growth | 12.07% | 14.14% |

| Cash Flow Growth | 9.60% | 16.71% |

The P/E ratio (Price-to-earnings) of 19.34 for the Quant Infrastructure Fund review shows that the stocks in the fund are a little bit expensive when compared to the category average, which is 18.39. However, this ratio shows that investors believe in the Mutual Fund's potential for future growth.

The earnings growth of 9.42 % indicates that the companies in the fund are making profits, but at a slower pace compared to the category average of 15.74%. Similarly, the sales growth of 12.07% is a bit lower than the category average of 14.14%, meaning the companies are growing but not at the fastest rate in the sector.

Earnings, sales & cash flow growth are lower than the index average. This suggests the fund may be targeting consistent performers rather than high-growth companies.

If you are a long-term investor looking for exposure to India’s infrastructure growth, this fund may suit you.

If your investment horizon is 5+ years & you want sectoral exposure with a risk-managed strategy.

To Conclude Quant Infrastructure Fund Review

To wrap up, the Quant Infrastructure Mutual Fund review says that it is a smart gateway to ride India’s infrastructure growth story. With a diversified sector allocation and a strong long-term strategy approach. Fund managers' philosophy allows this fund to give outstanding performance.

Quant’s sectoral expertise and disciplined approach lead to a Five-star rated and consistently outperforming its benchmark and peers; it stands out as a solid choice for long-term capital growth. You can start your SIP with just Rs 1000 and build wealth as India builds its future.

.webp&w=3840&q=75)