The boom market always has the scope of sudden corrections but this time it got an excuse from the union budget 2018 with the introduction of tax on Equity LTCG.

However, since the declaration of this budget 2018, every opportunist investor has a common question in his mind i.e., what is the best option for investment after this correction in the booming market? But then a smart investor knows very well that buying at low and selling at high is the only formula for making good profits. With that, there is equally a need to focus on the risk factors. As the possibility of continuation of correction trend is high, this can bring negative returns on the investments. Now because of this scenario, we have to be more cautious while ignoring the small and mid cap-oriented equity funds, and give scope to the large-cap equity, multi-cap and balanced funds. So, it leaves investors with an opportunity to invest in these funds.

Let us figure out why only investing in these funds is advisable right now.

Understanding the large cap funds:

Large-cap funds are those which invest in companies having large market capitalization. These companies hold a good track record over a long time in the market and have strong corporate governance quality. To be a good fit in large cap mutual fund, a company has to be trustworthy and reputable. These are mostly old companies, highly followed and most researched in the market. Large-cap funds are said to deliver steady returns at lower risks if invested for long term. Ideal investors for these funds are those who have lower risk appetite.

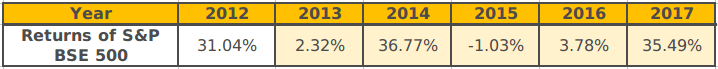

Here are three top performing funds compared with the S&P BSE 100 benchmark.

_5a82798c182db.png)

_5a82799f7fbef.png)

It can be clearly seen that the average returns of the large cap funds in past six years are comparatively better than the benchmark S&P BSE 100. So, if you tend to invest in large cap, stay patient and stay invested for long term to reap good fruits out of the seeds.

Understanding the quality of Multicap Funds:

Funds that come up with the most flexible qualities are multicap funds because they include large cap, mid cap, and small cap companies for investment. The capital investment is diversified in all the types of companies to reduce risk factor and increase the returns. The objective of the fund is to invest in those companies that have different market capitalization. Those investors who are inclined towards moderate risk and do not have time and knowledge to analyze particular fund can invest in multicap schemes for long-term wealth creation. During the bear phase in the market when small cap and mid cap go down the hill, multi-cap funds are the ones to trust upon to boost your wealth up.

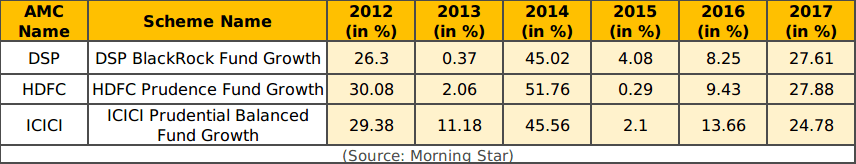

Let’s have a look at the top three multi-cap funds compared with S&P BSE 500:

_5a8279b5d55cb.png)

After having an analytical look at the tables above, the clouds of confusion gets cleared, as multicap funds have performed better than the benchmark index in past six years.

Comprehending the balanced funds:

Mutual funds that invest in stocks are equity mutual funds, those that invest in bonds are debt mutual funds, and the ones that invest in both stock and bonds are balanced mutual funds. These are also known as hybrid mutual fund and the proportional division is 65% in equity and 35% in debt funds. These funds are preeminent because they cater safety, income, and modest capital appreciation. Investors with more than one objective or goal and lower risk-taking capacity embrace the balanced fund. Typically, investors or retirees who want wealth generation that can beat future inflation get lured towards these funds.

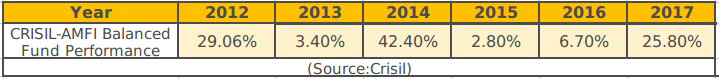

Comparing returns of the top three balanced mutual funds with CRISIL-AMFI balanced fund performance taken as bench mark:

Analyzing the returns of both the benchmark and balanced funds for past six years, it becomes evident that returns are again better when invested in balanced mutual funds.

Conclusion:

Market’s bearish behavior should not be an aberration for the investors, as investing in large cap and multi cap will yield results slowly but surely. Aforesaid, having patience is the biggest asset in today’s era of agility. We, at MySIPonline, work hard to bring the best solution to your botheration by selecting the best investment plan with respect to the market condition.

.webp&w=3840&q=75)