Table of Contents

- What is Withholding Tax?

- How Does Tax Withholding Work for Employees?

- What are the Types of Withholding Tax

- Withholding Tax Rates for Payments in India

- Withholding Tax Rates in India for Foreign Payments

- How to Compute Withholding Tax?

- What is the Due Date for Filing Withholding Tax Returns?

- How to Claim a Refund on Withholding Tax in India?

- Consequences of Non-Payment of Withholding Tax

- What are the Benefits of Charging Withholding Tax?

- What is the Difference Between Withholding Tax and TDS

- Conclusion

Have you ever thought about why a part of your salary disappears before you even see it? That is withholding tax in action, quietly making sure your taxes are correctly collected. Withholding tax is a smart move by the government to ensure smooth and on-time tax collection- right at the source of your income. But the real win is that with this, you pay taxes little by little, making your financial life easier and stress-free. Sounds fantastic, doesn't it?

But, did you know that more than 25% of India’s direct tax revenue is also collected through withholding mechanisms and Tax Deducted at Source (TDS)? Yes, over a quarter of India’s direct tax revenue comes from TDS and withholding taxes, making it a significant game-changer for both taxpayers and the government.

Does it look slightly intense? Don't worry, this guide will help you understand "What is Withholding Tax and how to set it up?" in detail. So, let us dive in and uncover the mysteries of withholding tax.

What is Withholding Tax?

The taxable amount that is deducted from the salary of the employee by the employer and directly paid to the government is withholding tax (WHT). The amount deducted by the employer is a credit against the total tax liability of the employee during a financial year.

Also known as a retention tax or TDS (Tax Deducted at Source), it is a type of income tax that is applied to payments made by Indian residents to non-resident individuals and companies. These payments are sectioned in Section 195 of the Income Tax Act, 1961.

The employers submit the withholding taxes directly to the IRS (Internal Revenue Service) in the name of the employee. The employee gets the tax refund if more withholding tax than the tax bill is collected.

Now, you must be trying to figure out, “How does withholding tax work, right? Let us uncover it in the next heading.

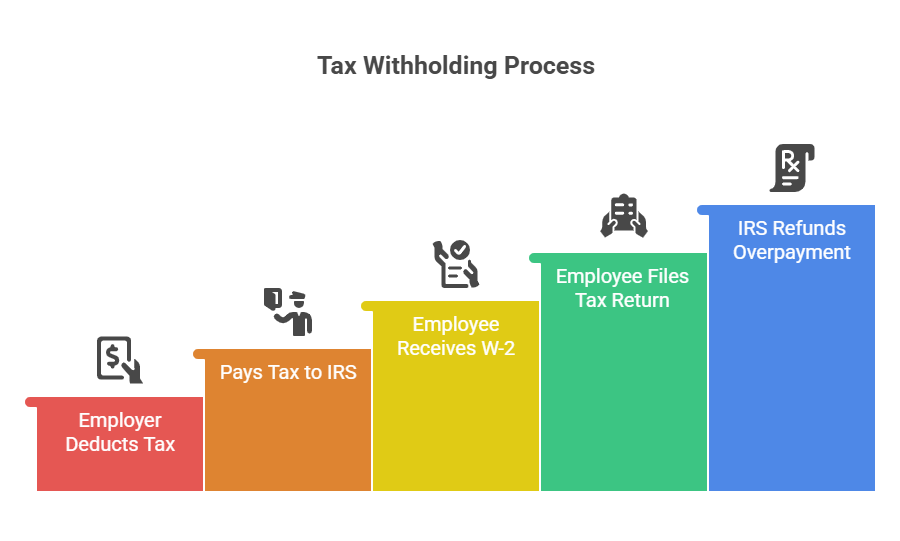

How Does Tax Withholding Work for Employees?

To maintain the pay-as-you-earn income tax system, the government uses tax withholding, where individuals are taxed at the source of their income rather than paying tax when the income is earned. Withholding tax works similarly to TDS (Tax Deducted at Source) on payments made to Indian residents.

Here is how it works for salaried employees:

Whenever the employee gets paid, the employer deducts a certain amount of money from the employee's total wages or salary and withholds it as the employee's income tax liability. The employer then pays this amount to the IRS directly on behalf of the employee.

The amount deducted as the income tax is displayed on the monthly payslips of the employee, and the annual total amount deducted is shown on Form W-2: Wage and Tax Statement. The W-2 is provided to the employees by their employers to help them file their income tax returns (ITR) every year.

If the amount deducted from the source of the employer's income is more than the total tax liability of the employee, the extra amount is paid back by the IRS as a tax refund.

These regular deductions not only ease your tax burden but also help you plan consistent investments, such as monthly SIPs in mutual funds, which offer both wealth creation and tax-saving opportunities for salaried individuals.

The employer making the payment is responsible for calculating and deducting the correct amount of tax at the defined rates in the Income Tax Act. The rules of the DTAA (Double Taxation Avoidance Agreement) can also determine the tax rate. The deducted amount should be submitted to the government within a particular period by the payer.

Also Read: Tax Planning For Salaried Employees: Best Tax Saving Options

Next, let us explore the types of withholding tax in detail.

Start Your SIP TodayLet your money work for you with the best SIP plans.

What are the Types of Withholding Tax

The classification of the withholding tax is generally done in two parts, which are:

Resident Withholding Tax

It can be described as the tax withheld at source by the payer from the payments made to the Indian residents, including individuals, companies, or any other type of person recognized in the Income Tax Regime. Commonly known as TDS, the tax rate for this depends on the kind of expense. The TDS on total salary depends on the Income Tax Slabs. These rates are defined under the Income Tax Act.

Given below is the list of the types of withholding tax in India:

- Tax on Salary

- Tax on Loan Interest

- Tax on House Rentals

- Tax on Professional and Technical Fees

- Tax on Contract Payments

- Tax on International Transactions

- Tax on Dividend Income

Many taxpayers also use mutual funds and SIPs to manage income and strategically maximize their after-tax returns.

Non-Resident Withholding Tax

It can be described as the tax withheld at source by the payer from the payments made to the non-resident payees. The term Withholding Tax is commonly used to refer to payments made to non-residents by Indians. This term is also used in the U.S. and other countries. It applies to any payments made to non-resident individuals, companies and NRIs to ensure there is no tax evasion on the income that non-residents earn within India.

Use a SIP Calculator and estimate the returns of your mutual fund investments.

So, now you will know the applicable withholding tax rates for payments to residents.

Withholding Tax Rates for Payments in India

Most Common Withholding Tax Rates for Payments to Residents (FY 2024-25):

| Nature of Payment | Threshold (INR) | WHT Rate |

|---|---|---|

| Purchase of goods | 5 million | 0.1% |

| Interest on securities | 1,000 | 10% |

| Interest other than securities | 5,000 | 10% |

| Professional services | 50,000 | 10% |

| Technical services | 50,000 | 2% |

| Director’s remuneration/commission/fee | 50,000 | 10% |

| Royalty (cinematographic films) | 50,000 | 2% |

| Perquisite from business or profession | 20,000 | 10% |

| Transfer of Virtual Digital Assets (VDA) | 50,000/10,000 | 1% |

| Commission and brokerage | 20,000 | 2% |

| Rent (plant/machinery/equipment) | 50,000/month | 2% |

| Rent (land/building/furniture) | 50,000/month | 10% |

Next, you will come across the tax rates for payments made by Indians to non-residents.

Withholding Tax Rates in India for Foreign Payments

Withholding tax rates in India for foreign payments or payments to non-residents (FY 2024-25):

| Nature of Payment | WHT Rate |

|---|---|

| Interest (foreign currency loan, infrastructure bonds, rupee bonds, etc.) | 4–5% |

| Non-specified interest (other foreign currency borrowings) | 20% |

| Royalty and fees for technical services (FTS) | 20% |

| Dividend income | 20% |

| Long-term capital gains (other than equity shares/units where STT paid) | 20% |

| Long-term capital gains (on listed equity shares/units, with STT) | 10% |

| Short-term capital gains (on shares/units subject to STT) | 15% |

| Winning from horse races or online games | 30% |

| Other income | 35% |

So, let us understand how to calculate withholding tax and its procedure through a guide next.

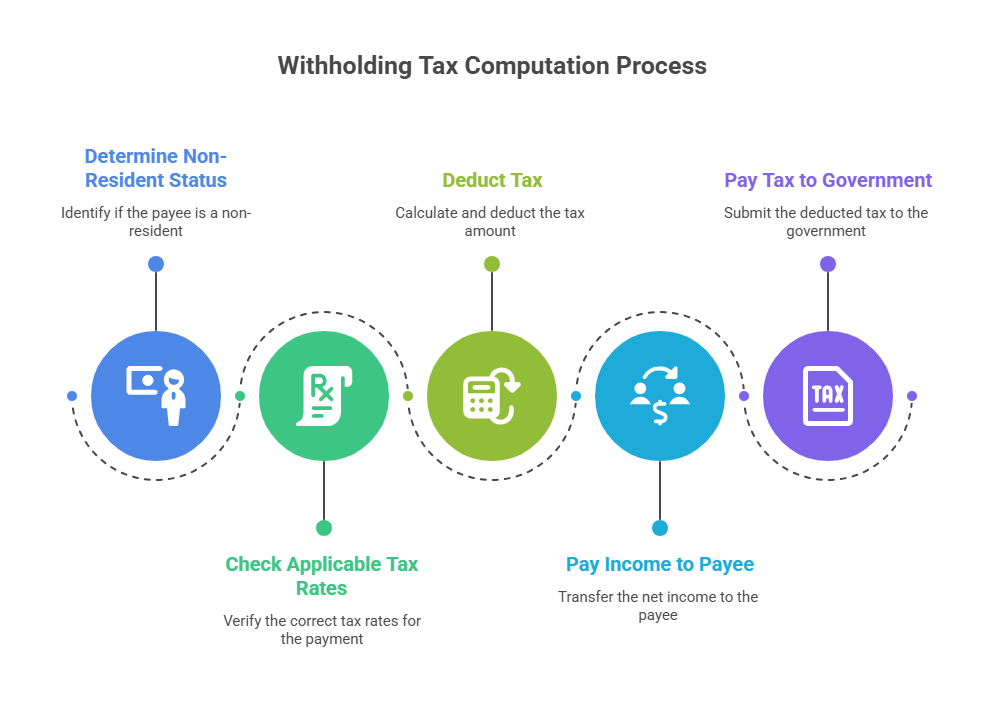

How to Compute Withholding Tax?

The procedure to evaluate the withholding tax may vary based on different types of payments, the general process is:

Step 1: The payer must determine if the payee is a non-resident (individual or company.

Step 2: The Payer should check applicable withholding tax rates for the payment to be made.

Step 3: The tax should be deducted at the appropriate rate and paid to the government by the payer.

Step 4: The payer must pay the full income after tax deduction to the relevant non-resident payee.

Step 5: The Payer must pay the deducted income tax to the government within the specified time limit.

Use a Tax Calculator to estimate the amount of your taxes quickly.

What is the Due Date for Filing Withholding Tax Returns?

The due date for filing withholding tax or TDS returns depends on the type of taxpayer and the frequency of the payments. Due dates for various categories of taxpayers are:

| Quarter | Taxpayer Category | Due Date |

|---|---|---|

| 1st Quarter (April - June) | Employers (TDS on Salary), Other Deductors (TDS on Non-Salary) | July 15 |

| 2nd Quarter (July - September) | Employers, Other Deductors, Non-Resident Deductors (TDS on payments to non-residents) | October 15 |

| 3rd Quarter (October - December) | Employers, Other Deductors, Non-Resident Deductors | January 15 |

| 4th Quarter (January - March) | Employers, Other Deductors, Non-Resident Deductors | May 15 |

Next, you will learn how you can claim a refund in the case of an extra tax deduction from your income.

How to Claim a Refund on Withholding Tax in India?

Here is how to claim a refund on withholding tax in India:

Step 1: File your ITR (Income Tax Return) by reporting your income and tax deducted at source (TDS) or withholding tax (WHT).

Step 2: Complete filing the ITR accurately and verify it online through available methods.

Step 3: Check the intimation about the computation and refund sent by the Income Tax Department.

Step 4: The refund will be credited to your bank account within 4-6 weeks after processing, through ECS, NEFT, or RTGS.

Step 5: Follow up and check the status of your refund via the Income Tax e-filing portal using your PAN and assessment year.

Step 6: In some cases, refunds may be withheld. The CBDT has prescribed procedures and guidelines for such cases.

Now, let us understand what happens if the withholding tax is not deducted in the next part.

Must Read: What is Tax Planning: Objectives, Types & Importance

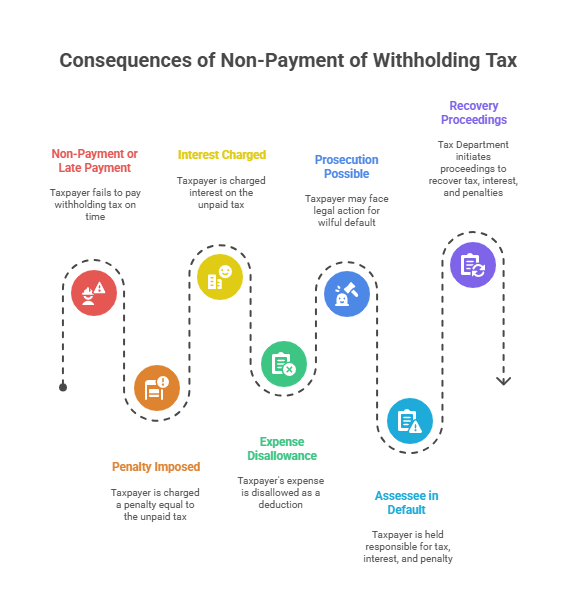

Consequences of Non-Payment of Withholding Tax

The following are the consequences of not paying your withholding tax or missing the deadline:

- Penalty: Equal to the amount of tax not deducted or paid.

- Interest: Charged on late or non-payment of withholding tax.

- Disallowance of Expense: Expense denied as a deduction if tax is not deducted/paid.

- Prosecution: Possible legal action for wilful default.

- Assessee in Default: Payer held responsible for tax, interest, and penalty.

- Recovery Proceedings: The Tax Department can recover tax, interest, and penalties

Let us dive into the benefits that a taxpayer can get from withholding tax.

What are the Benefits of Charging Withholding Tax?

There is a range of benefits of charging Withholding Tax for the taxpayers and the government:

Benefits for Taxpayers

- Simplifies the tax filing process and makes year-end tax bills more manageable.

- Spread tax across the year by regular deductions, releasing the burden.

- Provides refund opportunities if the TDS deducted exceeds the total tax liability.

- Offers easy tracking of your tax payments through Form 26AS.

- Reduce the chances of delay by helping to account for TDS properly.

- Investing tax refunds or monthly savings in mutual fundsthrough SIP can combine compliance with wealth building.

Benefits for Government

- Ensure a regular flow of tax revenue throughout the financial year.

- It reduces tax evasion by collecting taxes at the source of income.

- Allows the government to budget and allocate resources more effectively by giving stable revenue.

- Boost transparency and accountability within the tax system.

- Encourages timely filings and tax compliance.

Important: Use tax-saving Mutual Funds like ELSS to earn extra income while saving on taxes.

What is the Difference Between Withholding Tax and TDS

Here is the main difference between Withholding Tax (WHT) and TDS (Tax Deducted at Source):

| Aspect | Withholding Tax | TDS |

|---|---|---|

| Applicability | Payments to non-residents/foreigners. | Payments within India to residents/non-residents. |

| Governing Law | Section 195 of the Income Tax Act | Sections 192 to 196 of the Income Tax Act |

| Common Payments | Royalties, interest, technical fees. | Salaries, rent, contractor fees, commissions. |

| Use of Tax Treaties | Often applies (DTAA) | Rarely applies |

| Documentation | Form 15CA/15CB | TDS returns, Form 16/16A |

| Purpose | Tax on cross-border payments. | Tax on domestic payments. |

Use a Mutual Fund Screener to filter and compare your funds.

Conclusion

To wrap this up, withholding tax is an approach that keeps the tax collection process seamless, transparent and efficient. By understanding what is withholding tax, the rates for this tax and the filing method, you can avoid penalties for late filing while upgrading your tax planning process.

Withholding tax allows you to contribute to the economic development of the country while making taxation easy and stress free for you.

So, embrace the withholding tax system as your financial ally for simpler tax compliance and the growth of your financial future. Sharp taxpayers save through SIP in mutual funds, securing growth with tax efficiency.

Related Blogs:

1. Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

2. What Is AIS In Income Tax? A Simple Guide For Taxpayers

FAQs

-

Why am I being charged withholding tax?

Withholding Tax is charged because the government collects tax at the source of payments to ensure timely revenue.

-

Can you claim withholding tax?

Yes, withholding tax can be claimed as a refund if the employer deducts an extra amount for tax.

-

Who pays the withholding tax?

The person or payer (including employer, company or client) who pays the payees is responsible for deducting and paying withholding tax.

-

What percentage is the withholding tax?

Withholding tax rates vary from 1% to 30% depending on payment type and residence status.

-

Can I get the TFN withholding tax back?

If your TFN (Tax File Number) withholding tax was deducted in Australia or elsewhere, you can often claim a refund by filing a tax return there.

.webp&w=3840&q=75)