Table of Contents

- Business Cycles and Rotational Returns of Edelweiss Business Fund

- Why Only Business Cycle-Based Investing?

- How Does Edelweiss Business Cycle Fund Select their Ideal Stocks?

- Strategy Performance: How Did the Proprietary Model Perform in Back-Testing as of 31st May 2024?

- Who Should Invest in the Edelweiss Business Fund?

There are 3 rules that every smart investor knows. The very first one is that the best portfolio is invested in businesses that are growing fast and contributing to India’s growth. The second rule is that for every business, there is a right time to invest and exit. The third rule is that this ideal time to invest can be different for every business and sector.

So how can your portfolio always attempt to have the right investment at the right time? Introducing the new NFO Edelweiss Business Cycle Fund, which is offered by the Edelweiss Mutual Fund house in 2024. This is a new fund launch with the NFO start date: of 09th July 2024 and the NFO close date: of 23rd July 2024.

The Edelweiss Business Cycle Fund utilizes a smart approach to navigate economic cycles and maximize returns. In this blog, we’ll dive into the world of business cycles, and traditional investment strategies and also shed light on what makes this Business Cycle Fund different.

Business Cycles and Rotational Returns of Edelweiss Business Fund

Every business goes through distinct phases: growth, maturity, and decline. These phases create opportunities and challenges that demand a responsive investment strategy to maximize gains and mitigate risks. Traditional methods typically rely on historical data and broad market trends to predict these cycles.

In contrast, modern approaches like the Edelweiss Business Cycle Fund utilize advanced analytics and real-time information to identify when sectors or companies are likely to grow or face challenges. This proactive approach aims to capitalize on growth phases while sidestepping downturns, offering investors a more flexible and potentially rewarding investment experience.

Why Only Business Cycle Based Investing?

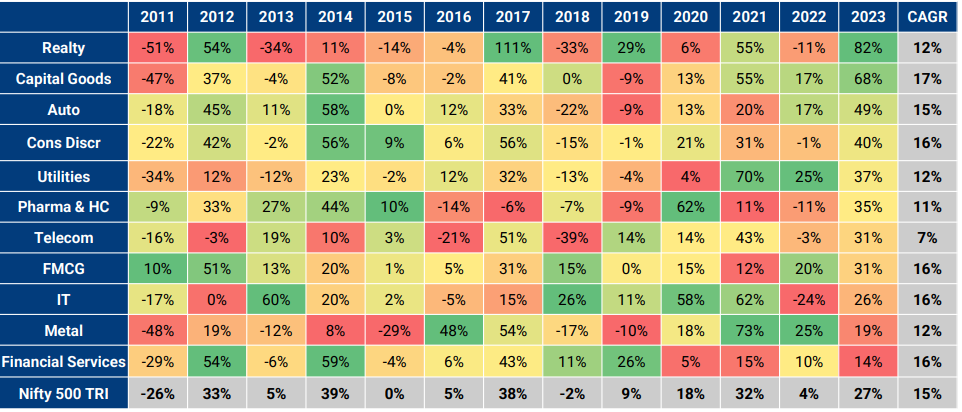

Business cycle-based investing is centered on the understanding that different sectors of the economy go through phases of growth and decline over time. In the stock market, sectors like technology, banking, automobiles, and real estate don't perform consistently, they have periods of high growth and slower times. For example, technology grows during innovative phases, while banking benefits from economic stability or recovery.

Understanding these cycles is essential for investors. It allows them to target sectors currently in a bullish phase, where growth potential is strong. The Business Cycle Fund uses this approach by studying economic trends and sector performances. By identifying which sectors are likely to outperform in the next economic cycle, the fund strategically allocates investments. This strategy aims to help investors take advantage of market opportunities, potentially increasing their returns by investing in sectors expected to grow at the right time.

Overall, business cycle-based investing offers a framework for aligning investment decisions with the broader economic climate. It seeks to optimize returns while managing risks associated with fluctuations in specific sectors, providing a more informed approach to investing.

How Does Edelweiss Business Cycle Fund Select their Ideal Stocks?

The Edelweiss Business Cycle Fund employs a strategic approach centered around growth, quality, value, and momentum factors. This ensures a balanced allocation between large caps and mid/small caps within its portfolio. This strategy allows investors to benefit from potential growth opportunities while mitigating risks associated with economic fluctuations. The fund's objective is to optimize returns by carefully selecting stocks that align with current market trends and economic conditions.

Research Process

The Edelweiss Business Cycle Fund carefully evaluates stocks using strict criteria. It starts by selecting the top 300 stocks based on market value. Each stock is then analysed for metrics such as price-to-earnings ratio, earnings growth, and return on equity. Momentum indicators, which measure price changes over 3 and 12 months, are also taken into consideration. This thorough process assigns scores to identify stocks with strong growth prospects, financial health, and market momentum. From these, about 60 top-scoring stocks are selected across different categories to create a diversified portfolio that aligns with current business trends.

Strategy Performance: How Did the Proprietary Model Perform in Back-Testing as of 31st May 2024?

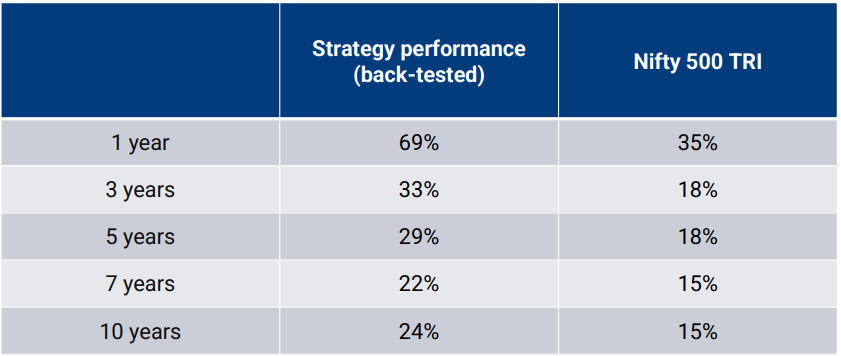

The back-tested performance data illustrates the strong performance of the Edelweiss Business Cycle Fund across different time frames. Over one year, the fund achieved a Compound Annual Growth Rate (CAGR) of 69%, compared to 35% for the Nifty 500 Total Return Index (TRI). Over longer periods such as three years, five years, seven years, and ten years, the fund also demonstrated impressive CAGRs of 33%, 29%, 22%, and 24% respectively, outperforming the corresponding CAGRs of the Nifty 500 TRI.

It's important to remember that these figures reflect historical performance and may not predict future results.

Who Should Invest in the Edelweiss Business Fund?

The Edelweiss Business Cycle Fund benefits from Edelweiss's strong experience in managing funds focused on specific industries and themes. Its strategy is designed to match the ups and downs of business cycles by rotating investments among different sectors. The fund carefully picks about 60 top-performing stocks, considering factors like how much their earnings are growing and how their prices are changing. This helps create a diversified portfolio aimed at seizing growth opportunities during various economic phases. It's a good choice for investors who are comfortable with some risk and aiming for long-term growth in specific sectors. It's an attractive option for investors comfortable with some risk, especially when investing through SIP (Systematic Investment Plans), aiming for long-term growth in targeted sectors.