Table of Contents

Table Of Content

- What is so special about Nippon India's Small Cap Investment approach?

- It’s Time to Talk About the Fund Manager

- What are the rolling returns of the Nippon India Small Cap Fund compared to its benchmark?

- How has the Recent Performance of the Nippon India Small Cap Fund been?

- Nippon India Small Cap Fund Risk Analysis: Balancing Risk and Reward

- What's in the Nippon India Small Cap Fund's portfolio?

You are here to know why Nippon India Small Cap Fund pops up every time you search on Google for the best small cap funds to invest in 2024.

To answer your question, it is India's largest small-cap stock that has become the top choice among investors. Launched on 5th September 2010, it has quickly achieved the title of best performer in Equity Mutual Fund category. With an impressive Asset Under Management (AUM) of Rs50,422.78 Crores as of April 30, 2024, this fund has shown no.1 consistency in delivering high returns.

Let’s conduct a three-point analysis of this scheme to help you decide whether it is worth the investment or not.

We will start by decoding its investment strategy which has made this scheme a huge success.

What is so special about Nippon India's Small Cap Investment approach?

Nippon India Small Cap Mutual Funds follows a strategic investment approach by keeping its focus on buying and holding stocks for long-term gains. It uses company-specific research to identify growing companies at very low valuations.

It has a very diversified portfolio, with over 150 different stocks. This is part of its strategy for managing the portfolio effectively.

Within this diverse portfolio, the fund has:

Structural growth stocks

These are companies that are expected to see steady, long-term growth. They form the core of the portfolio.

Economic revival stocks

These are companies that stand to benefit as the overall economy rebounds. They provide exposure to the economic cycle.

Tactical bets

The fund also makes some more speculative, short-term investments to try and generate higher returns.

Start early, retire wealthy : Start your SIP today!

It’s Time to Talk About the Fund Manager

The fund we're talking about is in good hands with Mr Samir Rachh with 30+ years of experience in the financial field. He is renowned as a Small Cap specialist while managing Nippon India Small Cap Mutual Funds for the last 7 years. Under his leadership, this scheme has consistently outperformed its peers and benchmark in the last 1 year.

What are the rolling returns of the Nippon India Small Cap Fund compared to its benchmark?

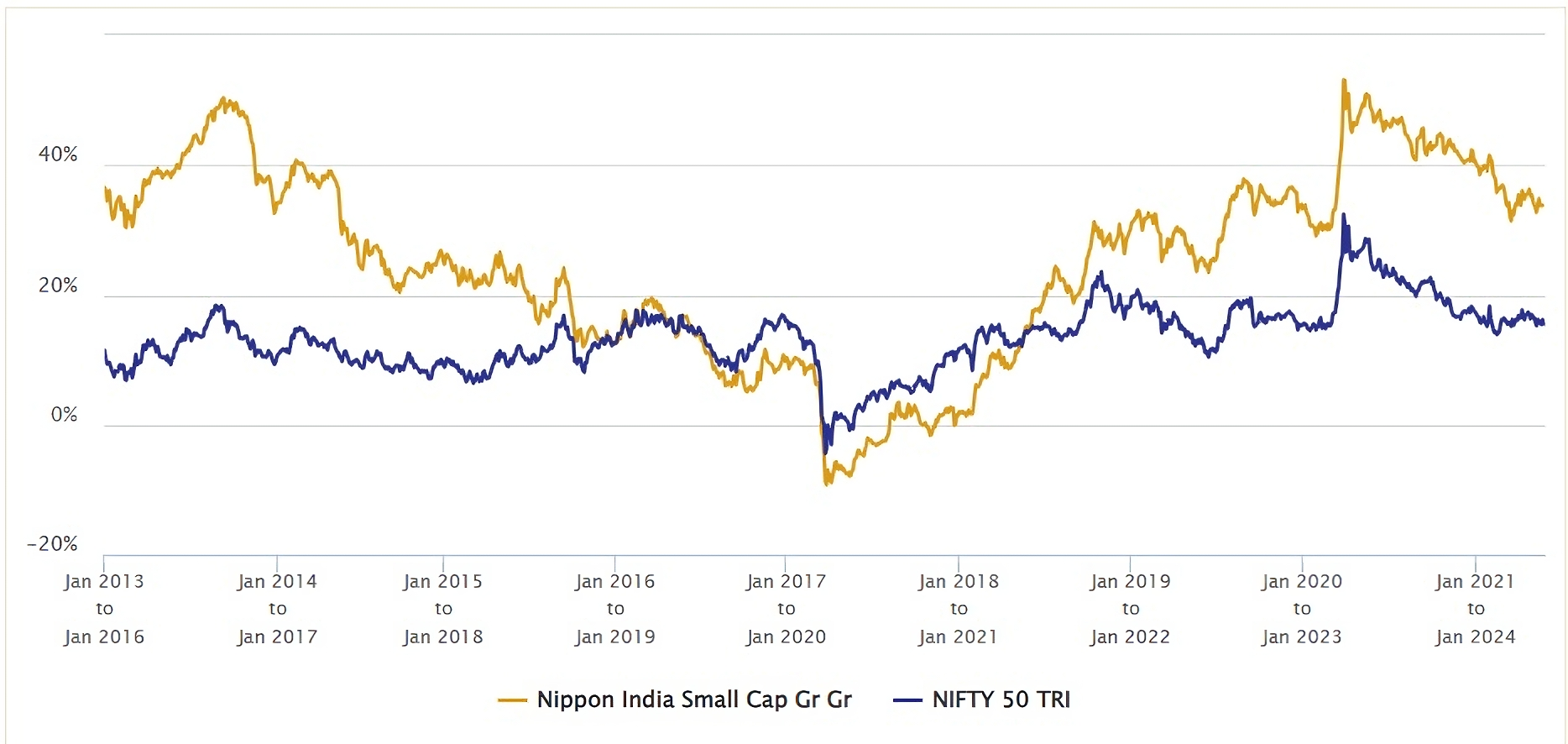

In this graph, we present the 3 and 5-year rolling returns (rolled daily) of Nippon India Small Cap Fund (yellow line) since the scheme's inception and compare it to the benchmark, Nifty Small Cap 250 TRI (blue line).

When this fund was introduced in the market in 2010, investing in it for just 3 years would have gotten you an average yearly return of about 26.58%. if we talk about consistency, it has an 84% chance of getting returns higher than 15%. Now, let's compare it to its benchmark, the Nifty Small Cap 250 TRI index. This index only gave an 18.51% return with a 65% chance of consistency. So, the key takeaway here is that the investment fund consistently outperforms its benchmark index. It's an "alpha generator," which means it generates higher returns than the overall market or index it's compared to.

Now, looking at its 5-year rolling return, it's even better. The fund's return over 5-year periods averages 21.12%, while the benchmark only manages 12.89%. This shows that the Nippon India Small Cap fund consistently performs better than its benchmark index.

How has the Recent Performance of the Nippon India Small Cap Fund been?

Let's talk about the recent performance of Nippon India small cap Fund. Over the past 6 months, it has delivered a return of 25.34%. However, when compared to its benchmark of 29.16%, this fund underperformed. However, it has the potential to generate high returns in the long term.

Looking at the 1-year returns, it has yielded 59.17%. In comparison, its benchmark returned 67.95%. This fund closely tracks its benchmark but falls short in terms of performance.

_6656fe79684b4.png)

Take Charge of Your Future, Download the App for Free

Nippon India Small Cap Fund Risk Analysis: Balancing Risk and Reward

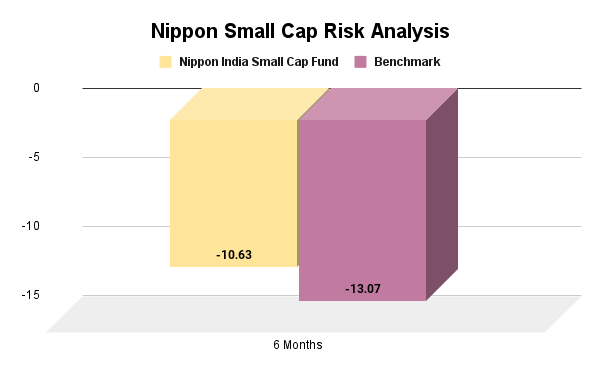

The Nippon India Small Cap Fund experienced a decline of -10.63% % over 6 months, while the average decline for similar funds in the Equity Mutual Fund category was 13.07%. This means that the Nippon India Small Cap Fund has significantly outperformed its benchmark during this period. This shows that the fund has given strong performance with more stable returns and is less affected by market changes.

The Nippon India Small Cap Fund's risk analysis shows a standard deviation of 14.92, indicating high volatility. Its Sharpe Ratio is 1.77, meaning it offers good returns for the risk taken. The fund's upside capture ratio is 94, outperforming its benchmark in rising markets, while the downside capture ratio is 58, showing it loses less than the benchmark in falling markets. Overall, the fund is volatile but provides strong risk-adjusted returns.

What's in the Nippon India Small Cap Fund's portfolio?

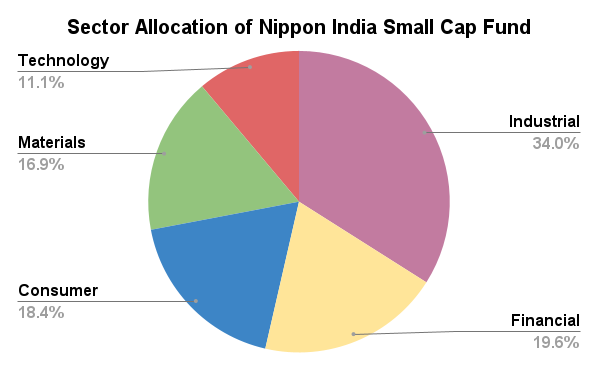

The Nippon India Small Cap Fund has an impressive AUM (assets under management) of over 50,000 crores. The fund is mainly invested in stocks, with 95.94% of the portfolio in equities.

The fund's equity investments are diversified across different market capitalization sizes:

- 40.27% in small-cap stocks

- 41.25% in mid-cap stocks

- 18.47% in large-cap stocks

This diversified approach aims to balance high growth potential from smaller companies with some stability from larger, more established firms.

The fund also keeps a small portion, 2.80%, in cash and cash equivalents. This provides liquidity and helps manage market volatility.

Overall, the Nippon India Small Cap Fund appears to be taking an aggressive, growth-oriented investment strategy by focusing heavily on small and mid-cap stocks, while maintaining some larger company exposure and cash reserves. This makes it a dynamic option for investors seeking substantial growth in the small-cap space.

How does Nippon India Small Cap Fund select and evaluate quality stocks?

When analyzing the stocks in this fund, the key things we look at are:

- How fast the companies' sales are growing

- How much profit the companies are making

- How much cash the companies are bringing in

- The price-to-earnings (PE) ratio of the companies

The companies in this Nippon India Mutual Funds are performing very well on all these measures:

- On average, the companies' sales are growing rapidly at 15.34% per year

- The companies are making a healthy 9% profit margin

- The company's cash flow is increasing by a strong 23%

- The companies have a relatively low PE ratio of 25, so we're getting them at a good price.

Altogether, this indicates the fund is filled with high-quality, fast-growing companies. That's why we think this Nippon India Small Cap Fund is one of the best options for investors seeking growth in small-cap stocks.

The combination of rapid sales growth, good profitability, strong cash flow, and reasonable valuations makes these underlying companies look very promising.

Is Nippon India Small Cap Fund suitable for investors?

Looking for Long-Term Capital Appreciation? This fund is all about achieving sustained growth via SIP it strategically plays structural themes while effectively managing risk with a diversified portfolio.

Embrace High Risk-Tolerance

If you're comfortable with volatility, this fund's strategic bets and small-cap focus offer the potential for higher returns with relatively higher levels of risk.

Invest for 5+ Years

To fully capitalize on the growth potential of small-cap stocks, we recommend a minimum investment period of 5 years, recognizing the need for patience.

Don't miss out: keep the analysis going with Best 5 Small Cap Schemes for 2024