Table of Contents

- Quant Multi Cap Fund Review

- Investment Strategy Used By Quant Multi Cap Fund

- Performance Analysis of Quant Multi Cap Fund

- Analysing the Portfolio Composition of Quant Multi Cap Fund

- Is the Quant Multi Cap Fund Good to Invest in?

- Fund Manager of Quant Multi Cap Fund

- To Conclude Quant Multi Cap Fund Review

Are you searching for a fund that gives you everything at once- small, mid and large caps exposure plus data-driven investing? Well, your search ends here with Quant Multi Cap Fund (Formerly Quant Active Fund), a multi-cap scheme launched by Quant Mutual Funds that has been helping investors grow their wealth since April 2001 with its unique, data-driven VLRT framework.

But the key question is, "How closely does it align with your financial goals?" Well, led by the talented fund manager Sandeep Tandon and his dedicated team, this fund has impressively grown to manage over Rs 9,600 crore AUM, showcasing a remarkable 5-year CAGR of 23.08%.

So, are you ready to uncover the promising opportunities that hold great potential? This post will provide you with a thoughtful Quant Multi Cap Fund review to give you a well-rounded understanding of this investment option.

Quant Multi Cap Fund Review

Quant Mutual Funds launched the Quant Multi Cap Fund (formerly Quant Active Fund) on April 17, 2001. This multi-cap mutual fund scheme invests dynamically in a diversified portfolio of small, mid and large cap stocks.

Due to its flexible asset allocation strategy, it is a compelling option for investors with a long-term horizon. This scheme by Quant Mutual Fund also provides diversified equity exposure to investors with an adaptive money management framework.

This fund delivers lower, consistent returns than other funds in the same category. Although its recent performance has lagged behind the category average, with 1-year returns of -13.79%, the fund has delivered a CAGR of 23.08% over the past five years. The Quant Multi Cap Fund also offers a convenient SIP option, allowing investors to start with as little as ₹500.

In the next part, we will understand this fund's investment style to check if it aligns with your investment goals.

Must Read: Is Quant Mutual Fund Safe to Invest in 2025 in India?

Investment Strategy Used By Quant Multi Cap Fund

The Quant Multi Cap Fund implements a dynamic and flexible investment style based on a money management framework, called the VLRT Framework, to guide investment decisions. This framework can be described as:

V - Valuation (To identify mispriced options in the market)

L - Liquidity (To analyse the flow of money across sectors)

R - Risk (To understand investor behaviour and market sentiment)

T - Timing (To capture market cycles and identify inflection points)

In other words, the investment strategy of the Quant Multi Cap Fund provides you with dynamic money management, flexibility to invest across diverse sectors and market cap categories, data-driven investment decisions, risk management, capitalising on market opportunities and delivering high portfolio turnover.

Let us analyse this mutual fund's performance based on its rolling returns in detail.

Performance Analysis of Quant Multi Cap Fund

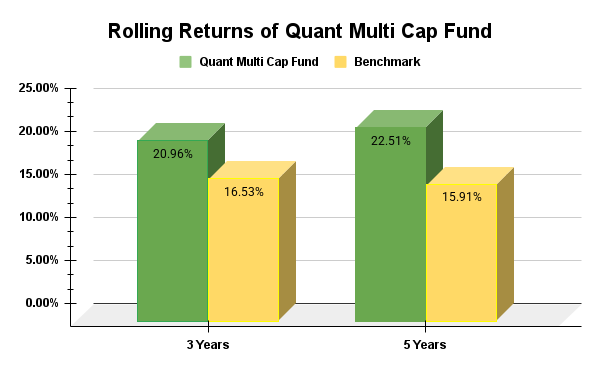

The performance of the Quant Multi Cap Fund has been showing great signals, with its rolling returns outperforming its benchmark. You can check out the rolling returns below:

Rolling Returns of Quant Multi Cap Fund

The Quant Multi Cap Fund has shown strong performance in both short-term and long-term horizons, consistently outperforming its benchmark (Nifty 500 Multi Cap TRI). The fund delivered returns of 20.96% and 22.51% over 3 years and 5 years, respectively, consistently surpassing its benchmark with an average rolling return of 20.96%.

Check out the graph given below of rolling returns by the Quant Active Fund outperforming its benchmark:

Based on the graph, the fund has delivered strong rolling returns over the years, often surpassing its benchmark and showing high growth potential.

Next, you will closely explore the portfolio and the composition of this fund.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Analysing the Portfolio Composition of Quant Multi Cap Fund

A strong portfolio shows the potential of a fund even during market fluctuations. Here is a detailed analysis of the Quant Multi Cap Fund portfolio:

-

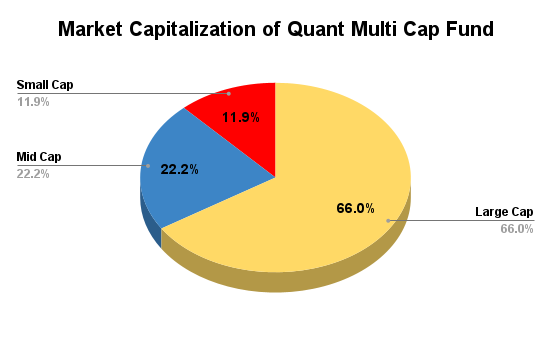

Market Cap Allocation

Most of the fund's portfolio is allocated to large-cap stocks (65.96%), providing stability and lower volatility, reducing the overall risk in the fund. The fund allocates 22.19% and 11.85% of the portfolio to mid-cap and small-cap stocks, respectively. The mid-cap allocation presents a balanced risk-return profile and the small-cap stock allocation provides significant growth opportunities to the fund. Refer to the graph given below:

This market cap allocation reflects a balanced approach, providing stability, steady growth and opportunities for high returns to investors.

-

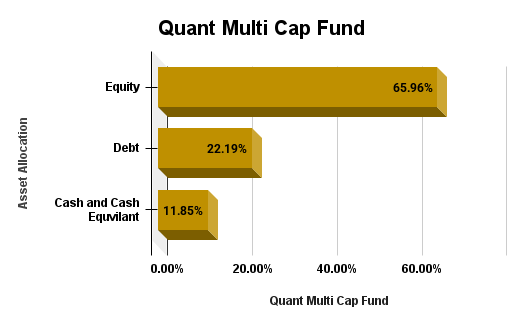

Asset Allocation

The Quant Multi Cap Fund primarily invests in equities, which is 90.30%. This exposure describes the fund's aim of higher capital appreciation, but this also increases risk. The 34.67% asset allocation in debt helps reduce overall portfolio volatility and provides a cushion against equity. The fund also holds about 7.1% cash or cash equivalents, reducing overall risk. Let us clear it with a graph:

The fund's asset allocation focuses on equity instruments for long-term wealth creation through diversification and invests in debt and cash/cash equivalents to manage liquidity and mitigate risk.

-

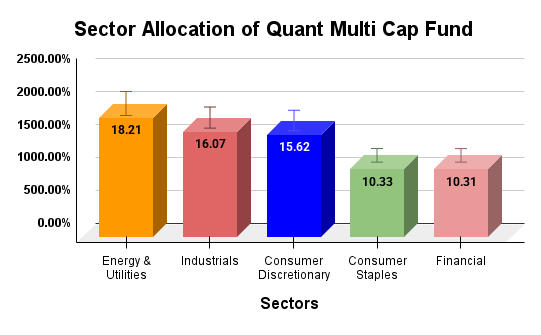

Sector Allocation

The Quant Multi Cap Fund employs a distinctive sector strategy with a considerable allocation to Energy & Utilities (18.21%). A significant investment of 16.07% in the Industrials and 15.62% in Consumer Discretionary, balancing cyclical sectors. The fund balances the portfolio by adding a defensive element, Consumer Staples (10.33%). To reduce the concentration risk, it allocates 10.31% to Financials.

This sector allocation displays a well-rounded approach, balancing cyclical and defensive sectors. Some sectors are used to diversify risk and capture growth opportunities.

Pro Tip: Use a Mutual Fund Screener to search, filter, and compare Mutual Funds.

After understanding the fund’s portfolio, you must wonder, “Is this fund worth my money?” Well, keep reading to find out.

Is the Quant Multi Cap Fund Good to Invest in?

The Quant Active Fund can be considered a good investment option for the following reasons:

-

Long-Term Performance

Since its inception (over 12 years), the fund has given an average annual return of about 18.99%, showcasing long-term growth potential.

-

Diversified Multi-Cap Exposure

The fund's well-diversified portfolio includes large (35%), mid (27%), and small-cap (29%) companies, balancing stability with growth potential.

-

Sector Diversification

The Quant Multi Cap Fund invests across various sectors to provide sectoral balance and reduce dependence on any single industry.

-

Moderate Expense Ratio

The fund remains cost-efficient compared to many actively managed funds, with an expense ratio of about 0.61%.

-

Asset Size

The Quant Active fund manages assets worth Rs 9,632 crore (AUM), gaining liquidity and trust from investors.

-

Risk Metrics

The fund has a beta of 1.04 and 16.26% volatility (measured by standard deviation), which suits investors with a high risk appetite.

-

Consistent Rolling Returns

The fund delivers strong 3-year (20.96%) and 5-year (22.51%) rolling returns with high consistency (above 83%), showing reliability.

-

Investment Through SIP

This fund allows you to invest a small amount in regular intervals through SIPand helps you to stay consistent in your investments.

Pro Tip: Use a SIP Calculator to estimate the future value of your SIP investments.

Now, the master minds who work behind the scenes for the growth of this fund. Keep scrolling to know them.

Also Read: Is Quant Small Cap Fund Good in 2025? Expert's Review

Fund Manager of Quant Multi Cap Fund

A team of experienced individuals manages this mutual fund. The lead managers of the Quant Multi Cap Fund are Sanjeev Sharma, Ankit A. Pande, Sandeep Tandon, Varun Pattani, Ayusha Kumbhat, Sameer Kate, Lokesh Garg and Yug Tibrewal.

However, several sources identify Sandeep Tandon (since October 3, 2019) as the key individual associated with the fund. He is the founder and CIO of the Quant Group, with over 27 years of experience in the capital markets, including 13 years in financial markets, specializing in identifying inflection points in securities.

Another key individual is Ankit A. Pande (since May 11, 2020), who has over 15 years of experience in equity research. He previously worked with Infosys Finacle and Kotak Equity Instruments.

Backed by an expert team with diverse expertise in various sectors, including CFA and MBA credentials, the fund managers work on enhancing well-researched investments and portfolio management.

Pro Tip: Use a SWP Calculator to withdraw fixed amounts periodically from your investments.

Smart Investments, Bigger Returns

To Conclude Quant Multi Cap Fund Review

To wrap up, the Quant Multi Cap Fund (formerly Quant Active Fund) stands out as a progressive option for investors who value diversification, dynamic allocation and sector-specific strategies for their investments.

Backed by a proven money management framework, the VLRT framework and an expert management team, the fund has generated consistent long-term returns, making it a compelling choice for those with a long-term vision and a higher risk appetite.

So, if you are looking for a fund that balances stability with high growth potential, the Quant Multi Cap Fund could be worth considering for your next investment.

Related Blogs:

- Mutual Fund Vs Stocks: Which is Better Investment in 2025

- SIP or Lump Sum, Which Is Better for You in 2025

- 10 Common SIP Mistakes to Avoid in 2025 for Maximum Returns

FAQs

-

What is the risk level of the Quant Multi Cap Fund?

The Quant Multi Cap Fund (formerly Quant Active Fund) has a very high risk level as it primarily invests in equities.

-

Is there any lock-in period in this mutual fund?

No, there is no lock-in period for the Quant Multi Cap Fund.\

-

How do I invest in the Quant Multi Cap Fund?

You can invest in the Quant Multi Cap Fund via the AMC website, mutual fund platforms, or broker apps.

-

How can I redeem my investments in the Quant Multi Cap Fund?

You can redeem your units online anytime through AMC, a broker, or an investment platform.

-

Which is the best multi-cap fund?

The top peers include Nippon India, ICICI Prudential, and Mahindra Manulife Multi Cap Funds.

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)