Table of Contents

- What is a SIP

- What is a Lumpsum Investment

- Deep Dive into the Advantages of SIPs

- Delving into the Advantages of Lumpsum Investments

- SIP vs Lumpsum: A Comparative Analysis

- Market Performance: Which Yields Higher Returns?

- SIP VS Lumpsum: Which Is a Better Mode of Investing?

- Things to Consider Before Investing

- Final Thoughts

Have you thought about what gives you better returns, SIP or lumpsum in 2025? SIP or a systematic investment plan invests in a fixed amount at regular intervals, on the other hand, lumpsum invests a large amount at once.

However, you just need to pick the one mode of investment through mutual fund schemes that supports your financial needs. But how to know you made the right choice?

In this blog, you will explore what SIP & lumpsum are, their pros and cons, risks involved & a comparative analysis that helps you smartly choose the one that best fits your financial goals and risk profile.

What is a SIP (Systematic Investment Plan)?

The full form of SIP stands for “Systematic Investment Plan,” which is a mode of investment into any mutual funds scheme of your choice. SIPs enable you to invest a fixed amount at a predetermined time, say, monthly, quarterly and yearly, building wealth over time.

Unlike lumpsum investments, which needs a large investment all at once, you can start SIP in the best mutual funds starting as low as Rs.100, which is professionally handled by expert fund manager and gives compounded returns in the long term.

If you are an early investor or someone who does not have a huge amount of money to invest all at once or prefers the discipline of monthly investing, SIPs are for you. Think of it like planting a tree. You water it consistently every month and over time, it grows strong and tall.

Don’t Miss Out: What to do if you are new to investing in SIP

On the flip side, if you have a large amount of money ready to go, you might consider a lumpsum investment.

Learn the meaning of lumpsum in the next heading.

What is a Lumpsum Investment?

A lumpsum investment, also referred to as a "one-time investment," is another way to invest a large amount of money into Mutual Funds all at once. Unlike SIPs, making small investments, a lumpsum gives you the flexibility for one-time transactions, leading to higher returns if the market performs well.

This type of lumpsum investing is best suited if you have a large sum of money to spare; otherwise, you can stick with the systematic investment plan as usual.

Market timing is a key factor in this situation. Your returns could rise if you invest when the market is falling. However, it could be a roller coaster if you come to the peak. Assume feeding a plant with a full bucket of water all at once. It can grow quickly if the soil is ready and the sun is shining. But that water may not be considered used or might even be lost if the weather unexpectedly changes.

Also Read: Best SIP Plans to Reach 1 Crore for a Rs.5000 monthly SIP?

On that note, let’s get into the benefits of starting a SIP in 2025 in the next heading.

Deep Dive into the Advantages of SIPs

SIPs are like the “Slow and steady wins the race” approach. Here is why they are loved by many first-time investors:

-

Disciplined Investing

You do not have to think about timing the market, SIP builds consistency in your investments, and aligns with your financial goals. It reduces insecurities about a large investment amount to bring to invest. -

Rupee Cost Averaging

You are faint-hearted, and the fear of volatile markets doesn't have to stress you out. Investing through SIPs helps you to invest the same amount of money to buy a higher number of units when the markets are low & vice versa. Over time, even small contributions can grow into a significant corpus with an average out on cost. This advantage is called rupee cost averaging -

Affordable Start

You can begin with as little as Rs500 a month or according to your time horizon. It can reduce stress about market volatility; it doesn’t hit as hard when your investment is spread out.

Pro Tip: Use SIP Calculator to breakdown hrs of calculations within minutes.

Lump sum investments can also be a smart move, especially under the right conditions. Here are some key advantages to consider.

Delving into the Advantages of Lumpsum Investments

If you have a 10–15-year horizon, early lumpsum investing can pay off big. Here are the key advantages of Lumpsum investments:

-

Higher Growth Potential

In lumpsum investing, the entire amount(bonus) is invested at one time & there are no investment gaps. Your investment will be active.

Earn compounding returns from day one without any further delays.

-

No Regular Commitments

No need to remember monthly deductions. In a Lumpsum investment, you are only required to invest a large sum at once, and there is no need for other contributions. Just make one investment and let it work best for your financial future.

-

Benefit from Market Opportunities

Investing during market lows can result in impressive returns. A lumpsum investment can be the best way to invest in your financial goals & generate returns. Also, it can give your portfolio a strong initial boost with diversified investment options.

But remember, risk and reward go hand in hand. You need to be comfortable with short-term market trends.

Now the big question. “Which one gives you more returns, SIP or lump sum?”

SIP vs Lumpsum: A Comparative Analysis

The table below draws a comparison between SIP and Lumpsum based on different parameters in detail:

| Parameter | SIP | Lumpsum Investment |

|---|---|---|

| Investment Approach | A sum of money is invested regularly at fixed intervals. | A large amount of money is invested together. |

| Market Timing | No need to time the market, you invest across different market cycles. | Investing at a market high time could limit returns. |

| Risk | Lower risk due to staggered investments. | Higher short-term risk if markets are volatile. |

| Flexibility | It can manage the amount or pause payments. | Less flexible, as the entire investment is made beforehand |

| Cost Averaging | Yes. Buys more units when prices are low and fewer when high. | No cost averaging, you get units based on the NAV at the time of purchase. |

| Contributions | Requires regular contributions | One-time investment. |

| Investment Horizon | Suitable for long-term investing | It can be suitable for both short-term and long-term investing, depending on the market trends. |

| Minimum Investment | Minimum investment starts with Rs100. | Requires a higher amount of Rs 1,000. |

Also Read: Pros and cons of investing in SIP?

Market Performance: Which Yields Higher Returns?

As discussed above, a SIP invests your money in parts over time, while a lumpsum puts your entire investment to work right away. So, if you are investing the same total amount at the same rate of return, which one gives you better results.

Understand this based on Shivani's example:

Let us assume that Shivani is investing through three different real-life scenarios:

Scenario 1: Comparing SIP vs Lumpsum with Equal Investment

- Let us assume that the Shivani Investment amount is Rs 12,000 with the Rate of interestof 5% per annum (compounded quarterly) & the NAV remains constant throughout the year.

- Now, Lumpsum Investment of Rs 12,000 invested at once at the beginning of the year & Returns after 1 year, approximately Rs12,989, while SIP Investment of Rs 3,000 invested every quarter (4 instalments) & Returns after 1 year, Rs 12,389 approximately

- Here, the Winner: Lumpsum. Why?Because the lumpsum gets more time in the market to grow. Every rupee is working from day one, while SIP invests slowly, reducing the average time your money is compounding.

But here is the catch: the above example assumes a constant NAV (Net Asset Value), but in real life, the market fluctuates. So let us explore what happens when NAV changes.

Scenario 2: When NAV Falls Each Quarter

- If the NAV decreasesevery quarter (say from Rs 10 to Rs 8), SIP allows you to buy more units at lower prices in each instalment.

- Winner: SIP, because you are getting more value for your money when prices are low & when the market in the end recovers, the additional units give you higher returns.

Scenario 3: When NAV Rises Each Quarter

- If NAVincreases quarter after quarter (e.g., Rs 10 to Rs 12), SIP ends up buying fewer units at higher prices over time.

- Winner: Lumpsum, becausethe lumpsum locks in the lower NAV right at the beginning & enjoys all the price appreciation.

The key takeaway from these scenarios:

- If the NAV is constant, the Lumpsum performs better due to more time in the market and more compounding.

- If the NAV decreases over time, SIP performs better due to rupee cost averaging.

- If the NAV increases over time, a lumpsum performs better due to being invested early at low prices and gains more from growth.

Pro Tip: It is about time to stop guessing your returns and use the SIP Calculator for more accurate results.

How do you select between two blades that have two edges? Let's explore it.

SIP VS Lumpsum: Which Is a Better Mode of Investing?

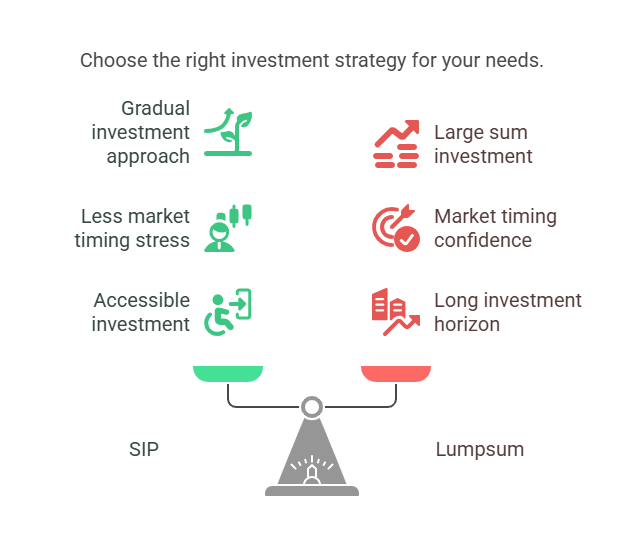

There is no " Right " choice between them. Likewise, the choice of SIP & lumpsum boils down to your financial goals, risk tolerance & duration of your investment. To know which one is for you have to invest for longer to get better returns.

- SIP: If you are just starting, do not want to stress over market ups & downs, and prefer a more accessible approach, SIP is like your finance buddy.

- Lumpsum: If you have a large sum ready to invest& are confident about market timing with a long investment horizon, a lumpsum could work in your favour.

Here are a few important things to consider that will help you make a sound decision before choosing any fund.

Things to Consider Before Investing

Before starting your investing journey, you should take notice of some crucial aspects:

-

Investment Goals

Creating financial goals, like retirement planning, financing your child's education, and an international vacation, offers you the most suitable investment approach with a time range.

-

Risk Tolerance

Now, mutual funds come with different levels of investment risk, so match your capability to tolerate risk.

-

Diversification

A well-diversified portfolio can ease and reduce risk & smooth out returns, even if one investment does not perform well.

-

Fund Performance

Analyse the past 3 years' returns & how this fund performs during market appreciation. Past performance does not guarantee future results.

-

Fund Objective

Each mutual fund has a specific investment objective & philosophy of capital. Make sure the fund’s objective suits your financial goal.

Pro Tip: Find out your withdrawal amount using the SWP Calculator tool.

Final Thoughts

To sum up, both investing methods, SIP and lumpsum offer a systematic and disciplined way to invest successfully. Even start with a small chunk of Rs 100 in a regular interval, or with a large amount of Rs 5000 at once through lumpsum mutual fund schemes.

The better one is that suits your financial goals, risk tolerance & investment horizon. In 2025, do not just follow the crowd, follow your plan. So, if you are ready to take the next step? Click Here. (start SIP link)

Frequently Asked Questions

-

Can I do a lumpsum every month instead of SIP?

Yes, you can invest a lumpsum every month, but SIP automates it & brings discipline to your investing.

-

Is it better to invest monthly or lumpsum?

Monthly (SIP) is safer for market ups and downs, while lumpsum works better if the market is low and you have extra money.

-

How to Invest in Gold Through SIP?

You can start a SIP in gold mutual funds or gold ETFs using apps or online platforms, just like a regular SIP.

-

What is the Lock-In Period in ULIPs?

It is the minimum time (usually 5 years) you must stay invested in a ULIP before you can withdraw money.

-

Which lumpsum is best for 5 years?

For 5 years, consider debt mutual funds or balanced funds that are less risky than stocks but give better returns than savings accounts.

(1).webp&w=3840&q=75)

(1).webp&w=3840&q=75)

.webp&w=3840&q=75)