Table of Contents

- Quant Small Cap Fund vs Nippon India Small Cap Fund: A Detail Review

- Investment Strategy of Quant and Nippon India Small Cap Funds

- Quant vs Nippon India Small Cap Fund: Key Metrics Comparison

- Quant vs Nippon India Small Cap Fund: SIP Returns for Long-Term Growth

- Analysing the Portfolio Composition of Quant vs Nippon India Small Cap Fund

- Who Manages Quant & Nippon India Small Cap Fund?

- Is Quant and Nippon India Small Cap Fund Good for Long Term?

- Risk Measures of Nippon India or Quant Small Cap

- Conclusion

In 2025, small-cap funds stand out for their high-growth potential. Two major players in this space are Quant Small Cap Fund and Nippon India Small Cap Fund, have consistently delivered strong performance.

The Nippon India Small Cap Fund has seen its NAV reach Rs 125.57, backed by an impressive AUM of Rs 64,827.61 Crore, driven by strategic sector allocation. Meanwhile, Quant Small Cap Fund offers a dynamic quantitative approach, with a growing AUM of Rs 28,758 Crore, focusing on active management and absolute returns for consistent growth.

But here is the burning question: what sets these two funds apart and what best small cap funds 2025will offer the best opportunity in 2025?

This post lets you dive into the top choices that could transform your portfolio with high growth potential.

Quant Small Cap Fund vs Nippon India Small Cap Fund: A Detail Review

The table below summarizes the key differences and review of the Quant Small Cap Fund and the Nippon India Small Cap Fund based on:

| Parameters | Quant Small Cap Fund | Nippon India Small Cap Fund |

|---|---|---|

| Fund House | Quant Mutual Fund | Nippon India Mutual Fund |

| Launch Date | 2013 | 2010 |

| AUM (as of 2025) | Rs 28,758 Crore | Rs 64,827.61 Crore |

| Risk Level | Very High | Very High |

| Benchmark | NIFTY Small Cap 250 TRI | NIFTY Small Cap 250 TRI |

| Exit Load | 1% if redeemed within 1 year | 1% if redeemed within 1 year |

| NAV (as of 2025) | Rs 128.50 | Rs 125.57 |

| Investment Strategy | VLRT framework — volatility, liquidity, risk and market trends. Focuses on high-growth small-cap stocks. | Growth at a Reasonable Price (GARP) strategy, focusing on high-growth small-cap companies with strong fundamentals. |

Let’s break down the unique approaches that make small cap worth considering.

Investment Strategy of Quant and Nippon India Small Cap Funds

The Quant Small Cap Fund uses a quantitative approach focusing on behavioural finance and predictive analytics to take out high-growth small-cap stocks. The fund looks for absolute returns by adjusting to market momentum and trends.

It invests in small-cap companies ranked 251st and beyond, using its VLRT framework to determine stocks based on volatility, liquidity, risk and market trends, protects the fund and gives it the ability to maximize growth potential.

On the other hand, the Nippon India Small Cap Fund follows a Growth at a Reasonable Price (GARP) strategy, focusing on high-growth small-cap stocks. It uses a buy-and-hold approach with active management, selecting stocks based on earnings growth and cash flow.

The fund combines bottom-up stock selection with top-down macroeconomic analysis, maintaining a diversified portfolio of around 230 stocks to manage risk and align with broader economic trends.

In the next part, you will explore a rolling returns of these Mutual Funds.

Quant vs Nippon India Small Cap Fund: Key Metrics Comparison

The rolling returns of Nippon India Small Cap Fund has outperformed Quant Small Cap Fund over the past 3 years with a return of 27.61%. However, Quant Small Cap Fund has shown stronger performance in the 5-year comparison with a 21.46% return, compared to Nippon India's 23.13%.

Both funds aim for high-growth small-cap stocks, but their performance change based on sector focus, market trends and management strategies. The table below shows rolling returns over 3 and 5 years:

| Fund | 3-Year Rolling Returns | 5-Year Rolling Returns |

|---|---|---|

| Nippon India Small Cap Fund | 27.61% | 23.13% |

| Quant Small Cap Fund | 10.43% | 21.46% |

In summary, Nippon Mutual Fund shows better returns in the short term as 3 years while Quant shows better long-term performance for 5 years, which could be ideal for investors with a longer investment horizon.

Also Read: Nippon India Large Cap Fund Delivers 21% SIP Returns in 5 Yrs

Now, Explore the SIP Returns for Long-term growth.

Quant vs Nippon India Small Cap Fund: SIP Returns for Long-Term Growth

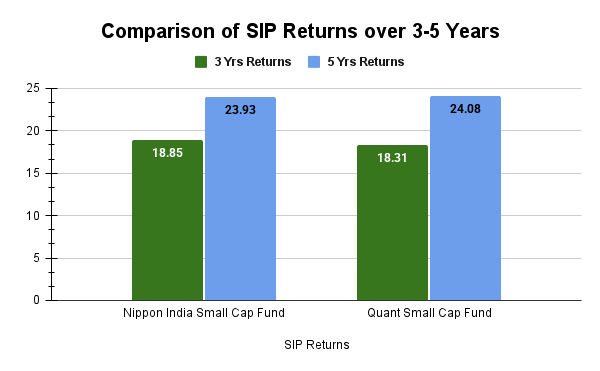

Let us compare the SIP returns of the Nippon India Small Cap Fund and Quant Small Cap Fund over 3 and 5 years for long-term growth.

In 3-year SIP returns, Nippon slightly outperforms Quant Small Cap Fund. However, Quant continues in the 5-year SIP returns, with a slightly higher return of 24.08% compared to Nippon India's 23.93%. Both funds are attractive for long-term growth, with stronger performance over a longer duration.

Pro Tip: Know your future returns using the SIP Calculator in 3 easy steps.

Next, uncover the fund’s portfolio and find out how it positioned for growth in 2025.

Analysing the Portfolio Composition of Quant vs Nippon India Small Cap Fund

1. Asset Allocation Comparison

Nippon India Small Cap Fund follows a buy-and-hold approach with a moderate turnover of 18%. It focuses on high-growth small-cap stocks while maintaining sector diversification with a small percentage of cash holdings (5.08%).

| Fund | Equity | Debt | Cash & Cash Eq |

|---|---|---|---|

| Nippon India Small Cap Fund | 94.92% | - | 5.08% |

| Quant Small Cap Fund | 93.65% | 0.65% | 5.71% |

On the other hand, the Quant Small Cap Fund uses a dynamic approach with a high turnover. The fund also holds a small portion in debt (0.65%) for added flexibility.

2. Market Capitalization Allocation

Using a bottom-up research strategy, Nippon India Small Cap Fund invests heavily in mid-cap (51.21%) and small-cap stocks (31.83%), focusing on individual company fundamentals and aligning with macroeconomic trends.

| Fund | Large Cap | Mid Cap | Small Cap |

|---|---|---|---|

| Nippon India Small Cap Fund | 16.96% | 51.21% | 31.83% |

| Quant Small Cap Fund | 24.25% | 48.07% | 27.68% |

Quant Small Cap Fund focuses on small-cap companies and has a larger exposure to large-cap stocks (24.25%) with a momentum-driven approach based on growth opportunities and market cycles.

3. Sector Allocation Breakdown

The sector allocation of Nippon India Small Cap Fund and Quant Small Cap Fund shows specific purpose.

Nippon India Small Cap Fund has a higher allocation to Industrials of 21.07% and Consumer Staples of 9.45% compared to the category average. It also has major exposure to Materials 14.97% and Financials (14.92%), though slightly below the category average in Financials 18.46%.

In contrast, Quant Small Cap Fund has a higher allocation to Financials 19.17% and consider Energy & Utilities of 16.38% and Healthcare 15.38%, which are not important in Nippon India’s portfolio. Both funds have similar exposure to Consumer Discretionary of 14.9% for Nippon and 13.82% for Quant and Materials has a lower weight in Quant (11.02%) compared to Nippon India 14.97%.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Let us know the expertise behind success of these small cap fund.

Who Manages Quant & Nippon India Small Cap Fund?

Quant Small Cap Fund has become the spotlight due to its unique VLRT strategy (Volatility, Liquidity, Risk, Trend), led by Sanjeev Sharma and Ankit A. Pande.

The mastermind of fund manager leads to hold an average Morningstar rating of 4.6 stars and shows strong risk-adjusted performance.

In contrast, Nippon India Small Cap Fund, controlled by Samir Rachh, follows a Growth at a Reasonable Price (GARP) strategy. Rachh’s 25+ years of expertise have helped the fund grow its AUM from Rs 3,000 crore in 2017 to Rs 64,827.61 Crore by 2025, showcasing investor trust.

His ability to manage market volatility, mainly during 2020, shows his risk management skills and ability to identify high-potential stocks.

Also Read: Is Quant Mutual Fund Safe to Invest in 2025 in India?

Now, check out if it is the good for long-term investment.

Is Quant and Nippon India Small Cap Fund Good for Long Term?

Quant Small Cap Fund and Nippon India Small Cap Fund are powerful option for long-term investment, provide high-growth potential in the small-cap space. Here is a comparison of their stock quality and growth metrics:

| Fundamental Ratios | Value of Nippon India Small Cap Fund | Value of Quant Small Cap Fund |

|---|---|---|

| Sales Growth | 9.99 | 8.16 |

| Earning Growth | 18.61 | 20.71 |

| Cash Flow Growth | 4.74 | 6.92 |

| P/E Valuation | 26.39 | 23.36 |

Key Insights:

- Nippon India Small Cap Fund has a higher P/E ratio (26.39), which indicates it focuses on growth stocks with strong earnings growth (18.61%). It’s suitable for investors looking for high-quality small-cap stocks.

- Quant Small Cap Fund has a slightly lower P/E ratio (23.36), focusing on undervalued small-cap stocks with superior earnings growth (20.71%) and cash flow growth (6.92%), making it attractive for those looking for high potential returns.

Know More: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

In the next heading, let us check out the risks associated with this mutual fund.

Risk Measures of Nippon India or Quant Small Cap

The Nippon India Small Cap Fund and the Quant Small Cap Fund have higher volatility than typical small-cap stocks but also offer potential for high returns. Let’s compare their risk metrics to see how they manage risk.

| Risk Measures | S.D | Sharpe Ratio | Alpha | Beta | Max Drawdown | Max Drawdown Duration |

|---|---|---|---|---|---|---|

| Nippon India Small Cap Fund | 16.46 | 0.93 | 2.19 | 0.83 | -23.42 | 5 Months |

| Quant Small Cap Fund | 17.35 | 0.93 | 3.06 | 0.84 | -23.87 | 5 Months |

Both funds show same levels of volatility, with Quant are slightly more volatile. However, both funds reflect strong risk-adjusted returns with a Sharpe ratio of 0.93, having a strong impact on risk management.

Quant Small Cap Fund stand out with a higher alpha of 3.06, showing better outperformance compared to its benchmark. Both funds have betas above 1, shows higher market sensitivity than the broader market.

Their max drawdowns are comparable at -23%, experience slightly declines during market swings. However, both funds recovered in about 5 months, showcasing their ability to bounce back from market dips.

Smart Investments, Bigger Returns

Conclusion

To sum up the review, the Quant Small Cap Fund and Nippon India Small Cap Fund are strong addition for long-term investment in 2025. Nippon India provide a diversified portfolio, making it suitable for investors looking for stable growth. At the same time, Quant Small Cap Fund offer an opportunity for higher volatility for potentially greater returns.

Additionally, your choice depends on whether you want consistent growth or are open to take on more risk for higher rewards in small-cap investments. You can also start with minimum amount of SIP investment.

Frequently Asked Questions (FAQs)

-

Which small-cap fund has a better track record: Quant or Nippon India?

Quant Small Cap Fund has a strong track record of outperformance, with superior returns and alpha. Nippon India offers more consistent growth and has a solid long-term performance history.

-

Which fund is better for SIP investment: Quant or Nippon India?

Nippon India Small Cap Fund is ideal for consistent, long-term SIP investments while Quant Small Cap Fund is suitable for investors prefer higher returns.

-

Are Quant and Nippon India Small Cap Funds SEBI registered?

Yes, both Quant Small Cap Fund and Nippon India Small Cap Fund are SEBI registered, ensuring they comply with regulatory standards and provide transparency in their operations.

-

Which AMC manages Quant and Nippon India Small Cap Funds?

Quant Small Cap Fund is managed by Quant Mutual Fund, a well-known AMC for its expertise in quantitative strategies.

Nippon India Small Cap Fund is managed by Nippon Life India Asset Management, a leading AMC with a strong track record in small-cap investments.

-

What is the best small-cap fund to invest in for 2025: Quant or Nippon India?

Nippon India is better for stable growth with a diversified portfolio, while Quant is perfect for investor prefer aggressive growth and higher risk in the small-cap segment.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)