Table of Contents

In India the Rising per capita income and a growing population of working-age young people have pushed the country to become the fourth-largest market for automobiles worldwide when considering sales within the country. After China and America, India ranks as the world's third-largest automobile sector in terms of production, with a vast number of vehicles being manufactured.

The automotive sector's contribution to India's GDP has increased to 7.1% as of February 2023 from just 2.8% in 1992. This growth has also benefited the automobile parts industry, which saw its turnover rise from Rs.3293.38 Crore in FY2016 to Rs.5811.36 Crore in FY2023.

SBI mutual fund is India’s Largest mutual fund. This fund house has introduced a new launch fund, the SBI Automobile Opportunities Fund, which is the perfect solution for investing in automobiles. The new fund offers or NFO of the scheme opened for subscription on May 17 and will close on May 31.

Let’s see what this fund brings new to the investing industry, we will proceed step by step to gather detailed information. So it begins with the investing strategy:

Investing Strategy

So first comes the category, this new launch of the SBI Automobile Opportunities Fund Falls under the Thematic Category of SBI Mutual Funds. This growth-focused fund invests in companies with strong growth potential and good financial health, regardless of their size.

It looks for companies with high-quality earnings, healthy cash flows, and the ability to adapt to industry changes. By keeping a concentrated portfolio, the fund aims to maximize its best investment ideas and generate attractive returns.

The goal is to help investors grow their money over the long term by investing in automotive industry stocks, benefiting from the sector's potential growth as more people buy cars and technology improves.

The fund is managed by Mr. Tanmay Desai. Let’s explore the different sectors where fund managers invest.

Investment Universe of the Fund

-

Original Equipment Manufacturers

The fund manager of this Mutual Fund is Mr. Tanmay Desai so which strategy does Mr. Desai look into- this fund invests in the sector of large cap mid cap and small cap companies, and managers will invest in this industry with OEM- Original Equipment manufacturers. These are those company that produces components or parts that are used in the products of other companies. -

Auto Component Manufacturers

These are those companies that build the inner parts, producing various parts for both OEMs and the after-market, including engine, electric, transmission, steering, suspension, Braking parts, as well as tires and batteries. -

Electric Mobility

Now growing focus on EVs due to emission reduction and improving economics. Opportunities exist for EV- OEMs and component manufacturers specializing in EV-specific parts like motors, controllers, batteries, and cooling systems. -

Export Potential

This fund also invests in companies outside of India that manufacture auto parts. India can utilize its large domestic market to achieve economies of scale, particularly in areas such as forging, casting, and off-highway tires.

Grow Your Portfolio with the Best SIP Plan – Start Now

The Benchmark Performance

This fund does not limit its portfolio to only 16 companies. It follows a multi-cap fund management strategy, investing in large-cap, mid-cap, and small-cap companies across various sectors, including automobiles. Time for an example- if you had invested in NIFTY Auto TRI since its inception, the value of your investment would have grown to INR 29,303, representing a CAGR of 18.1%. Over 20 years, this investment would have multiplied 29 times.

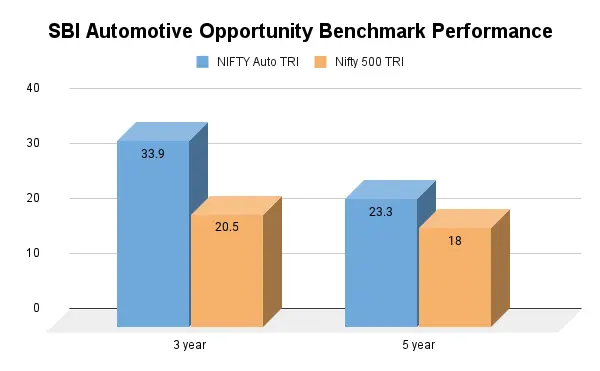

The above graph shows the automotive sector, as represented by the NIFTY Auto TRI, has outperformed the broader market, as captured by the NIFTY 500 TRI, over both the 3 year and 5 year periods.

Over three years, the SBI Automotive Opportunity fund achieved a return of 33.9%, outperforming both the NIFTY Auto TRI, which had a return of 20.5%, and the broader Nifty 500 TRI index.

Similarly, over five years, the SBI Automotive Opportunity fund achieved a return of 23.3%, outperforming the Nifty 500 TRI index. which returned is 18%, and the Nifty 500 TRI index.

The strong performance of the automotive sector highlights the fund's ability to capitalize on the growth opportunities within the dynamic automotive industry.

Key Factors The Investment Potential in India's Automotive Theme

-

Income Growth

In the US, the number of cars per 1000 people is 860, in Germany it is 627 whereas in China the is 223. In contrast, India still has around 34 cars per 1000 people. -

Industry growth projection

When we talk about 2023, the automotive industry size will be 10 lakh crore in India, and by 2029, this industry size is expected to have grown to 16 lakh crore. The reason for this growth is India’s Population and domestic demand. -

EV Market Evolution

The electric vehicle (EV) market in India is set to boom, going from about ₹41,215 Crore in 2023 to a whopping ₹2,53,486 crore by 2028. This big jump shows how more and more people are choosing eco-friendly Thematic Transportation. With the government supporting electric vehicles, it's becoming easier to find and use them. This growth means lots of chances for investors and helps make our environment cleaner. -

Vehicle Credit Expansion

As per the RBI data, vehicle finance is among the largest loan segments within retail and commercial credit. The total vehicle loan book is around Rs.15 trillion as of date, and it is growing in the mid-to-high teens over the last couple of years. -

Government Policies and Initiatives

Policies such as the production linked incentive (PLI) scheme, allowing 100% foreign direct investment (FDI), the Automotive Mission Plan (AMP) 2016-26, the Vehicle Scrappage Policy (launched in 2021), and the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are set to boost the growth and innovation in the automotive industry. These policies encourage investment, innovation, and the adoption of greener technologies, driving the industry forward.

Suitability of this Fund

This fund belongs to the thematic category, which means it focuses on specific trends or industries, that can involve higher risk. Therefore, it's best suited for investors who are in it for the long-term horizon. If you're looking to gradually add growth potential to your stock portfolio, investing via SIP in this fund could be a good fit. It's designed for those who want to take advantage of the ongoing growth in automotive demand, both at home and abroad. Plus, it offers a selection of carefully chosen stocks within the automotive theme, based on thorough research.

Discover More Top Funds in This Sector – Review of SBI Energy Opportunity Fund 2024

.webp&w=3840&q=75)