Table of Contents

- Axis ELSS Tax Saver Fund - Regular Plan - Growth

- ICICI Prudential ELSS Tax Saver Fund (Tax Saving) - Growth

- HDFC ELSS Tax saver Fund - Growth Plan

- Quant ELSS Tax Saver Fund Regular Plan-Growth

- Parag Parikh Tax Saver Fund Regular - Growth

Introduction

The HDFC ELSS Tax Saver fund has gained a lot of limelight in recent years. Since this is the month of tax planning, it is essential to take some time and think about the subject. Well, not to give too much thought as we have the HDFC Tax Plan offering the opportunity to relieve our tax liabilities. This scheme comes under the 80 C section of the Taxation Act. This fund has a total of INR13,820 Cr Asset Under Management(AUM) as of 29.02.24.

Let us learn a little more about this scheme. To start with, it is an Equity-linked scheme that falls under the ELSS category. The main purpose of this category is to provide tax benefits to its investors.

To begin, they want to build your wealth by investing in equities that have a compound annual growth rate of 15%. Second, they provide tax benefits by allowing you to deduct the invested amount from your taxable income under Section 80C of the Income Tax Act, up to a maximum limit of 1.5 lakh rupees. Simply put, ELSS funds allow you to possibly earn more from your assets while also lowering your tax burden.

In this blog post, we will analyse the risks and returns associated with this plan. We will cover the past performances of this fund at different times. Studying the recent performance of the HDFC Fund in the ELSS category. And concluding with the suitability of this scheme for you. Let us start the analysis.

Risk & Returns of HDFC Tax Plan

Let us find out if the 1 year and same-period returns will beat the benchmark and category average or not.

There is a change noted in the performance of the fund as a shift in the management is seen. This has a massive impact towards the investing approach.

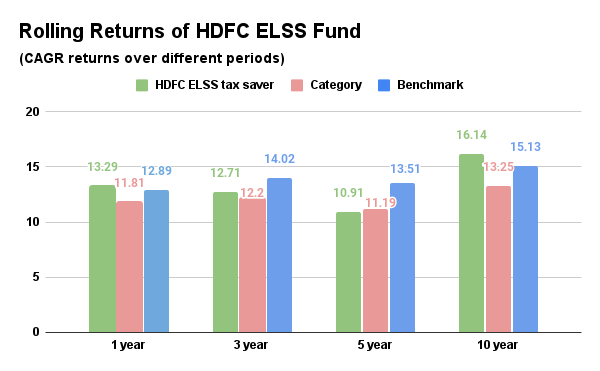

Let’s compare the rolling returns on varied time intervals.

This fund has overturned its performance of the past towards higher rates of return. It had a strong return of 13.29%, above the category average and benchmark returns of 12.89% and 11.81%, respectively. This pattern continued for three years, with the fund returning 12.71%, exceeding the category average of 12.2% and the benchmark return of 14.02%. Even after five years, the fund retained its competitive edge, achieving a superb return of 10.91%, which is above both the category average return of 11.19% and the benchmark return of 13.51 per cent. Impressively, for the past ten years, the fund returned 16.14%, greatly outperforming its peers and benchmark, which were 13.25% and 15.13%, respectively.

But what about the risks? Does this ELSS Mutual Fund take on more risk to produce higher returns?

When dealing with investment risk, there are two important facts to consider. The standard deviation is 11.82% for this fund. It measures how much the fund's performance fluctuates. A higher number signifies more ups and downs, making it riskier.

The second value is the fund's Sharpe Ratio of 1.57%. This is a good sign since it shows that the fund has delivered strong returns for the risk it implies. A higher Sharpe Ratio shows that the fund has performed well in terms of returns given the amount of risk it assumes.

When investors compare these two numbers, they can evaluate how the fund manages ups and downs and whether it matches them well.

How HDFC Tax Plan has performed?

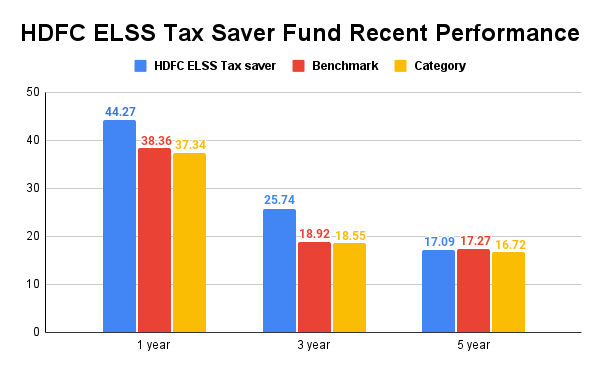

Let's take a closer look at the HDFC Mutual Fund recent performance, comparing its returns over the last year, three years, and five years. The graph displayed has some amazing figures. The fund returned 44.27% returns in the first year, which is more than the 38.36% average for its category. Over the three years, the fund returned 25.74% above both its category average of 18.92 and its benchmark of 18.55%. Over 5 years, the fund returned 17.09% topping its category of 16.72% but has moved a little closer to its benchmark average of 17.27% with only reaching 17.09%.

Identifying the Fund’s investment strategy

- Prioritizes investment in companies with strong fundamentals and long-term growth potential.

- Focuses on discovering companies that are competitively positioned in promising industries.

- To take a risk-adjusted view, consider the industry cycle's stage and trajectory.

- Strong management skills are required to seize opportunities and manage risks efficiently.

- Stock selection is based on corporate governance, ESG considerations, and transparency.

- Takes an extensive approach to valuation to ensure a suitable margin of safety.

- Prefers strategic, long-term stock selection to tactical ones.

Overall, it demonstrates a disciplined and forward-thinking investment strategy that aims to deliver long-term returns.

Analyzing Portfolio Allocation

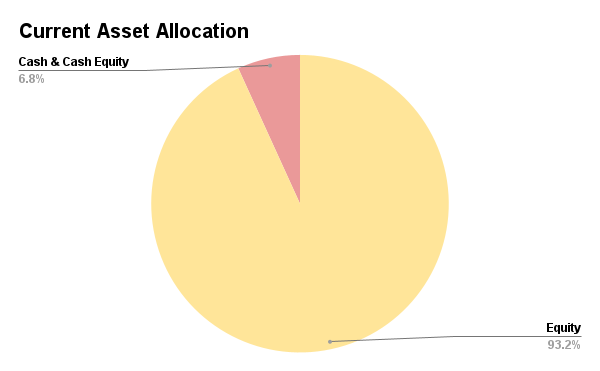

Current Asset Allocation

This portfolio primarily invests 93.19% in equities, with a tiny amount of 6.81% held in cash or other secure assets. The combination is beneficial for several reasons. First, it emphasises growth, as stocks tend to provide better returns over time. Second, having some cash gives you the flexibility to take advantage of good investment opportunities or cover unforeseen expenses. Overall, it's a well-balanced plan that aims for expansion while maintaining a financial reserve.

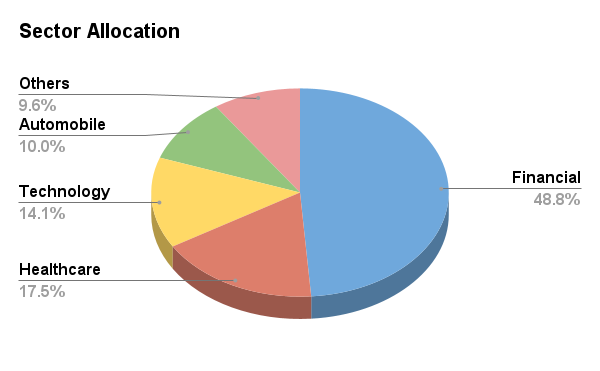

Sector-wise Allocation

Investigating the fund's investment concentration in various sectors within its total asset allocation produces the following top five sectors with various weights:

- Financials lead the way with 48.8%.

- Healthcare comes in second with 17.5%.

- With 14.1%, technology holds a major position.

- The automobile industry accounts for 10.0% of the fund's allocation.

- The other sectors, designated as "Others," account for 9.6% of the total.

- This breakdown demonstrates the fund's broad approach, with substantial investments in services, technology, and the automobile industry.

Should you invest?

Well, let’s see if this fund is suitable for you or not.

The HDFC ELSS Tax Saver Fund may not be suitable for investors who desire safety and consistent growth due to its high equity investment (93.19%). However, if you are willing to accept some risk in exchange for the possibility of higher returns, particularly in the long run, this fund may be a suitable choice. It has regularly performed well over the last one, three, five, and 10 years, outperforming its competitors and benchmarks. Furthermore, it diversifies its assets across areas such as banking, healthcare, and technology, reducing the danger of overreliance on a single field. Overall, if you're ready to take a chance at risk for potentially higher returns, this fund could be a good fit.

Conclusion

So, if you are looking for investment options to increase growth potential while saving tax, HDFC ELSS Mutual Fund is the right fit. This scheme is for investors who are willing to take higher risks for better returns. After reading the post it is understood that the scheme has shown consistent returns. It has outperformed its competitors and beaten its benchmark. Seeking to invest in a quality scheme, then you have found the right choice. To increase the appeal of the investors, it has also provided the opportunity to invest via a Systematic Investment Plan for flexibility. This scheme can be your go-to choice covering all your requirements with a single investment.

Read More - Is Quant ELSS Tax Saver Fund Good as an Investment Option