Table of Contents

- Axis ELSS Tax Saver Fund - Regular Plan - Growth

- ICICI Prudential ELSS Tax Saver Fund (Tax Saving) - Growth

- DSP ELSS Tax Saver Fund - Regular Plan - Growth

- Quant ELSS Tax Saver Fund Regular Plan-Growth

- Parag Parikh Tax Saver Fund Regular - Growth

Introduction

The Quant ELSS Tax Saver Fund, goal was to generate long-term good income and increase capital appreciation. It is a focused equity scheme which invests in equity shares having high growth potential. To begin the analysis, let us learn about its investing style and a basic intro to its category.

The Quant Tax Saver Fund is a new option in the ELSS fund category, starting in 2018. In just a short time, it has become the top-performing fund in its category for the last 3 years. The Asset Under management of this fund stands at INR 7,770 Crores as of 29 Feb 2024. This fund's dynamic approach to managing money makes it unique, setting it apart from others. Let us start by learning about its unique way of investing.

Quant’s: Quantitative Style of Investing

Quant Mutual Fund house implements a unique style of investing which sets it apart from its competitors. The fund's approach is based on actively managing money by investing in popular industries and equities, and they also know when to sell.

They employ a technique known as predictive analysis to identify equities that are about to perform very well, much like catching a rising star at the perfect time. This means searching for stocks that others may not be paying attention to yet but are beginning to receive positive attention and more money flows in. They buy these stocks and keep them until they become extremely popular, or, in their words, reach "overbought territory." This technique has been working well for them over the last four years, delivering good profits.

Now, let us learn more about 3-year returns and why you should constantly look at the 3-year performance of any Mutual Fund scheme. Also, look at this fund's 3-year performance to see how well it does.

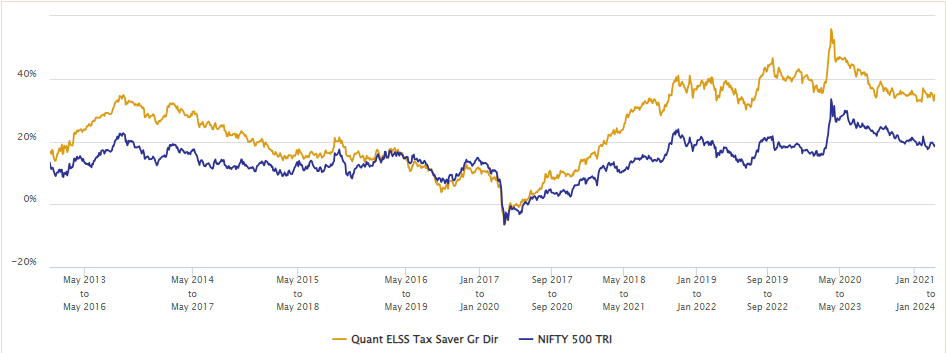

Reviewing the 3-Year Returns of Quant ELSS fund

Well, a thought may come across your mind why should you check the performance in 3 years? Why not check it in a year?

This reason is over three years, poor performance in any given year significantly affects an investment's average annual return. This is because the averaging process covers all three years. The argument is based on the idea that a one-year timeframe may not fully reflect a fund's actual performance.

Let's look at this fund's three-year performance to evaluate if it's worth investing in Quant ELSS Tax Saver Fund or not.

The Quant Tax Saver Fund has been doing extremely well since its inception. If you invested in this ELSS Mutual Fund for three years, you would have received an average annual return of 24.37%. It shows that it is quite consistent, with the fund making reliable 82% of the time. If we compare it to the NSE 500, which only gave 13.83% annually and was less consistent (68% for returns more than 12%), the difference is clear. The fund has produced exceptional gains above and beyond the average market rate, making it an outstanding choice for increasing your earnings.

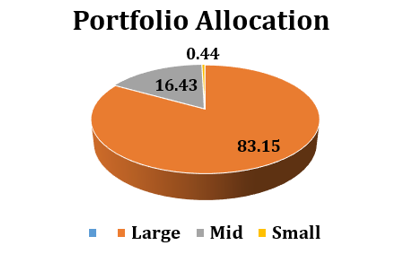

Analyzing the Portfolio Allocation

This fund invests 83% of its money in large corporations, particularly because market values are now high. What's unique about it is the way it spreads out its investments.

To make it more interesting, let's understand the data with the help of a pie chart. Now that we understand the diversification based on the size of the companies, you may wonder how it divides them into different sectors. Mutual Funds are spread across multiple sectors of the economy to take advantage of the growth and opportunities within them. This technique gives the edge to the investments made & also reduces the risk associated with a particular sector. It maintains the balance of your portfolio wherein maximizes your chances to earn good profits.

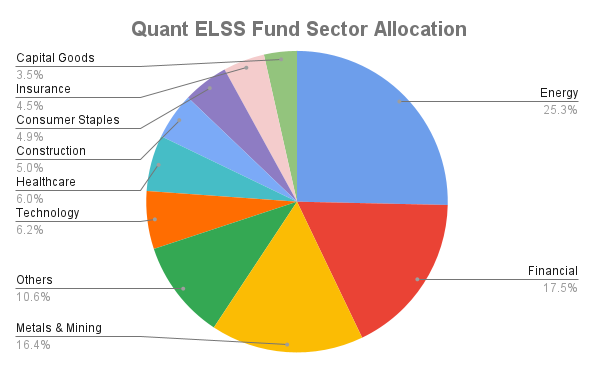

Let’s delve into the sector allocation of Quant ELSS Tax Saver Fund

Approximately 70% of the fund is allocated to four areas: energy, finance, metals and mining, and healthcare. Energy and metals are currently popular options, whereas finance and healthcare are only recently regaining popularity after being overlooked. This indicates how actively the fund adjusts its investments to capitalize on the best chances.

Stock Selection

Now let us talk about stock picking. A mutual fund's portfolio holdings are the individual stocks it has invested in. These holdings indicate the fund's specific assets, such as stocks, bonds, and other investments. They are selected based on the fund's objectives, strategy, and study of market performance.

This fund's portfolio consists of 40 carefully picked stocks. Its strategy includes evaluating firms with strong growth potential while also taking valuation factors into account to find cheap prospects. This fund has a remarkably low average price-to-earnings ratio (PE ratio) of 15.63, indicating a deliberate concentration on acquiring growth stocks at an affordable price point. This unique method emphasizes both value and growth investing ideas, differentiating it from traditional fund strategies.

Well, it’s time to discuss the mastermind behind this fund’s excellent performance. A fund manager's role is crucial in a fund's functioning.

Time to Talk about the Fund Manager

MR Ankit A. Pande (Head of Equity)

MR Ankit A. Pande has 13 years of experience in the financial industry. He began his career with the equity research department in 2011. As a technology analyst, he has won the 2014 Thomson Reuters StarMine Analyst Award for top industry stock picker. Ankit got his CFA charter from CFA Institute, USA, in 2015.

He uses mathematical models and systematic strategies to make informed investment decisions. The managers follow a set process that relies on numbers and data for making decisions. This means they don't have to make as many choices themselves. Because of this, the fund is consistent since it sticks to its data-driven process.

Conclusion

If you are looking to invest in a good fund, the Quant ELSS Tax Saver Fund gives not only high returns but also tax benefits. It’s like killing two birds with one stone. The ELSS category is specifically designed to relieve your tax burden. As seen in this blog post, it gives investors N number of reasons to say yes to this fund.

Additionally, you can start an Online SIP to include this fund under your portfolio. This way of investing encourages a great way to plan your investments and see substantial growth in the long run.

.webp&w=3840&q=75)