The trend of tax saving through ELSS funds is spreading like wildfire and the reason behind that is a large number of benefits provided by these schemes. A lock-in of just 3 years and tax saving benefits on investment amount of up to Rs. 1.5 lakhs are some of the top benefits provided by these schemes.

Now, at present, one of the top contenders of this category is DSP Tax Saver Fund. A lot of investors have come up with a common query whether to make an investment in this scheme or not. So, today, have a look at the step by step breakdown of this tax saver fund to know why this scheme is worth your investments.

| Basic Details | |

|---|---|

| Description | DSP Tax Saver Fund |

| Benchmark | NIFTY 500 TRI |

| Launch Date | 18-Jan-07 |

| Asset Size | Rs. 4,329 crore (As on Nov 30, 2018) |

| Expense Ratio | 2.08% (As on Nov 30, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Return Since Inception | 13.42% |

| Exit Load | 0%. But have 3 years lock-in |

Good Performance Track Record

| Description | Returns (As on Dec 17, 2018) | |||

|---|---|---|---|---|

| 3 Years | 5 Years | 7 Years | 10 Years | |

| DSP Tax Saver Fund (G) | 12.06% | 18.04% | 18.42% | 18.64% |

| Benchmark | 12.79% | 15.34% | 15.36% | 16.31% |

| Category | 10.76% | 16.62% | 16.41% | 16.88% |

One of the best ways to check the return generating capability of the scheme is its past performance, and DSP Tax Saver Fund has performed really well in that case. As can be seen from the above table, this tax saver fund has beaten its benchmark as well as category returns in all the long term return cycles (5, 7, and 10 years). In the past 3 years of returns, it has failed to beat the benchmark with a small difference but has managed to beat the category returns with a good margin. This shows that the fund management team has been managing the scheme with a great focus and the strategies they follow are working really good.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Great Portfolio Allocation

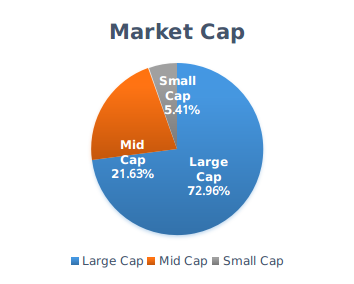

This is where DSP Tax Saver Fund has taken some extreme measures and managed to distinguish itself from the other ELSS funds. At present, it is following a diversified style of investing and has investments in 66 stocks. Let’s have a look at the market cap allocation of this fund.

With the help of the above pie chart, you can see that it is currently following a large cap approach, but a considerable allocation is also in the mid-cap space and a minimum allocation of 5.41% is in the small-cap companies. This investment approach is really great as per the current market conditions, as experts are expecting further volatility in the mid cap and especially, small cap space in the coming months and nothing can be clearly said till the effect of elections on the market is seen. Now, let’s move to the portfolio allocation of the scheme.

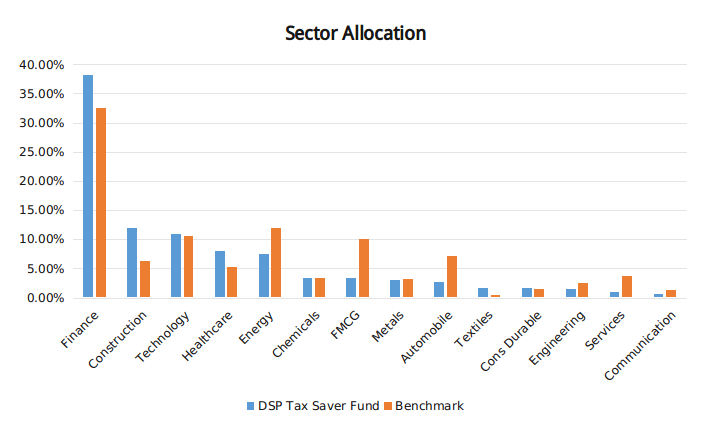

As can be seen from the above pie-chart, DSP Tax Saver Mutual Fund has an allocation of more than 38% in the finance sector, and the rest is diversified among the other equity sectors. Now, this is where it has taken some extreme steps, as finance is currently the most trending sector of the equity market, and is expected to show a great boom in the year 2019. DSP Tax Saver Fund has taken the full advantage of the recent volatility of the equity market and has added the top stocks from this sector at discounted prices. Now, when the sector will start to show a rally, the growth of the investments will be exceptional. At present, this ELSS fund has major investments in the top-notch players of the finance sector which are HDFC Bank, ICICI Bank, and State Bank of India. These stocks are the major players of not only the finance sector, but of the overall Indian Equity market, and are expected to show a spectacular growth in the next 1 year.

Terrific Risk Measures

| Risk Measures (%) | SD | Beta | Sharpe | Alpha |

|---|---|---|---|---|

| DSP Tax Saver Fund (G) | 16.51 | 1.05 | 0.35 | -0.93 |

| Benchmark | 15.17 | - | 0.31 | - |

| Category | 15.73 | 0.99 | 0.29 | -1.77 |

As per the risk measures, there should be no doubt in selecting this scheme. DSP Tax Saver Fund, however shows a bit more volatility in comparison to the benchmark as well as the category, as the SD and Beta are comparatively more. But, the rewards it provides for taking the risk with investments are really great and the high Sharpe ratio and its past returns show the same.

Hope, now your doubt, whether to invest in DSP Tax Saver Fund is cleared. One important thing you should remember is that the scheme during the volatility in the market has a tendency to show high fluctuations in the returns. So, if you are planning on investment, then make sure that you have an appetite for handling moderately high risk and an investment tenure of more than 7 years.

In case you have any query about this or any other mutual fund scheme, you can submit them in the form provided below.

Recommended Reads: Top ELSS Mutual Funds For Tax Saving Before March 2019