This time, the spotlight is on silver, the critical metal that is shining as the true safe-haven asset of 2025. Over the past decade, silver has quietly turned into one of India’s best-performing metals, delivering nearly 52% returns in ten years.

As of 2025, silver prices have touched ₹2,07,000 per kilogram, marking a historic milestone just before Diwali. This is not just a price jump "silver has taken the lead, breaking records and topping yearly returns."

In October 2025, silver prices in major Indian cities hit their highest levels ever, surpassing all previous peaks and setting a new all-time record.

This sparks the thought “Will silver price in India Climb Higher in 2025?”

Let us look at how silver has performed over the past ten years, what are the reason of this rise and how this “white metal” could shape India’s precious metal market through 2030 and beyond.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

Silver Price in India (2015–2025): 10-Year Trend, Returns & Growth Graph

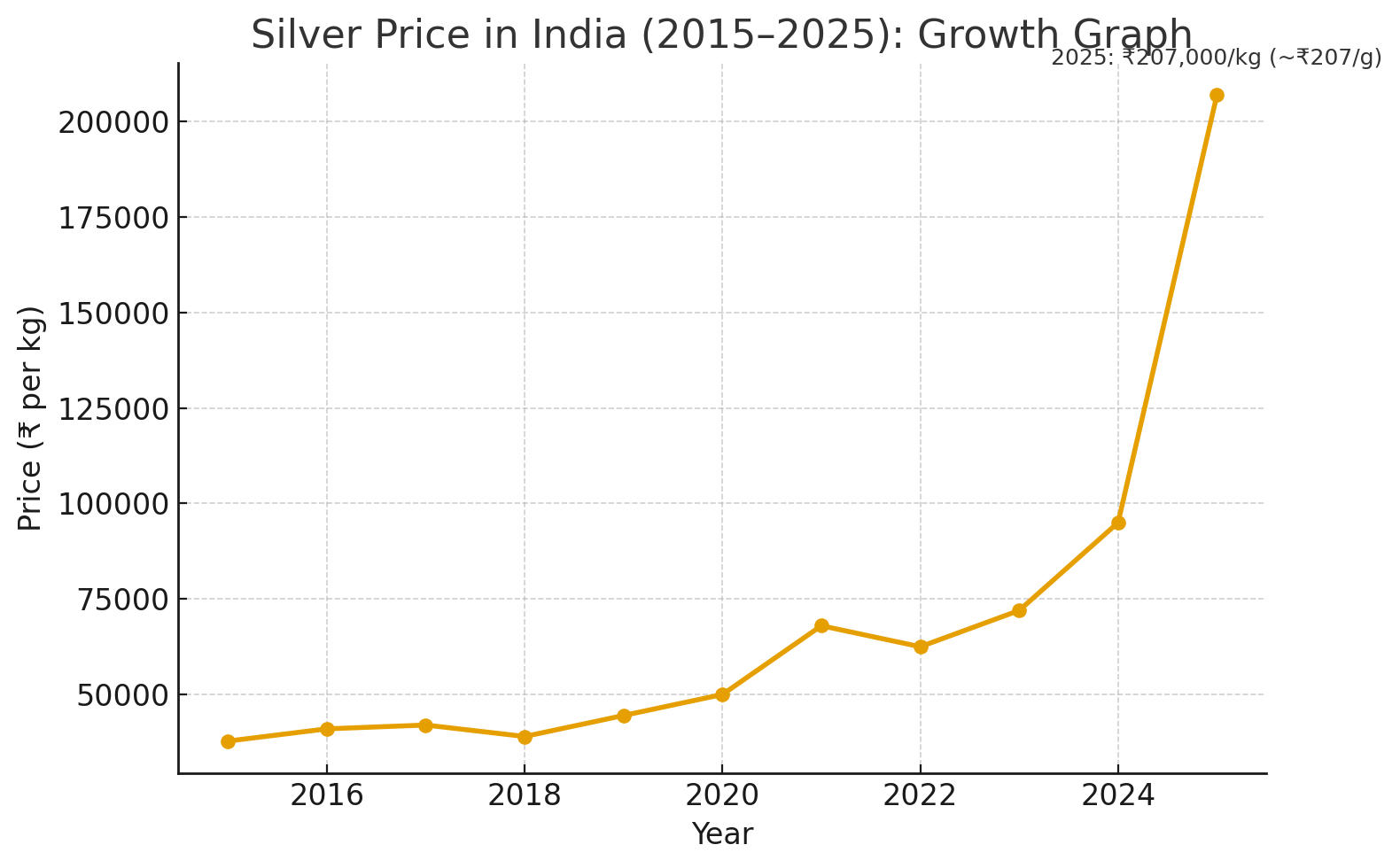

You can see the continuous rise in the silver rate in India over the past decade through the 10-year silver price trend and growth chart below.

1. 10-Year Trend of Silver Price

The silver price over the last 10 years in India has climbed to about ₹2,07,000 per kg in 2025, almost three times higher than the 2015 average of ₹37,800 per kg.

| Year | Average Silver Price (₹/kg) |

|---|---|

| 2015 | 37,800 |

| 2016 | 41,000 |

| 2017 | 42,000 |

| 2018 | 39,000 |

| 2019 | 44,500 |

| 2020 | 50,000 |

| 2021 | 68,000 |

| 2022 | 62,500 |

| 2023 | 72,000 |

| 2024 | 95,000 |

| 2025 | 2,07,000 |

*Approximate average market prices, may vary by city and purity.

The sharp rise in the silver price last 10 years in India due to strong demand and investor interest in silver as a safe-haven asset. Silver is more volatile than gold, as it reacts faster to global economic and industrial silver demand trends.

2. Silver Investment Returns Over 10 Years with Example

Let's look at how silver investments in India have performed over the past decade.

For instance, if you had bought 1 kg of silver in 2015 for ₹37,800, it would now be worth around ₹2,07,000 in 2025, that is nearly 5.5× your money in ten years, with an average annual growth of about 17–18%.

| Year | Yearly Change (%) |

|---|---|

| 2016 | +8.4% |

| 2017 | +2.4% |

| 2018 | –7.1% |

| 2019 | +14.1% |

| 2020 | +12.3% |

| 2021 | +36.0% |

| 2022 | –8.0% |

| 2023 | +15.2% |

| 2024 | +31.9% |

| 2025 | +26.3% |

Over this period, silver outperformed F.D. and matched long-term equity returns, proving its power as both an industrial and investment asset.

The journey of silver prices is full of rollercoasters. Prices fell in 2017–2018, then jumped after 2020 with boost demand from solar, EVs and electronics, besides a weaker dollar and tight supply.

So, this makes you ask, "Is silver a better long-term bet than gold?"

To solve this doubt investor should know that silver tends to be more volatile in nature, but it can deliver better returns during the bullish phase. If you can handle short-term swings, then silver remains a high-potential, long-term asset.

3. Silver Growth Graph in India

The Silver Price in India (2015–2025) shows a clear upward curve, prices rose from ~₹37,800/kg in 2015 to ~₹2,07,000/kg in 2025 (~₹207/g), with a sharp exponential growth and a strong market move in the last few years.

In 2025, the silver price in India is around ₹207 per gram, while a 1 kg silver bar costs about ₹2,07,000, with minor variations between ₹2,00,000 and ₹2,07,000 depending on the city and dealer.

Let see what experts predict for silver prices through 2030.

Best Mutual Funds for 2026 Backed by Expert Research

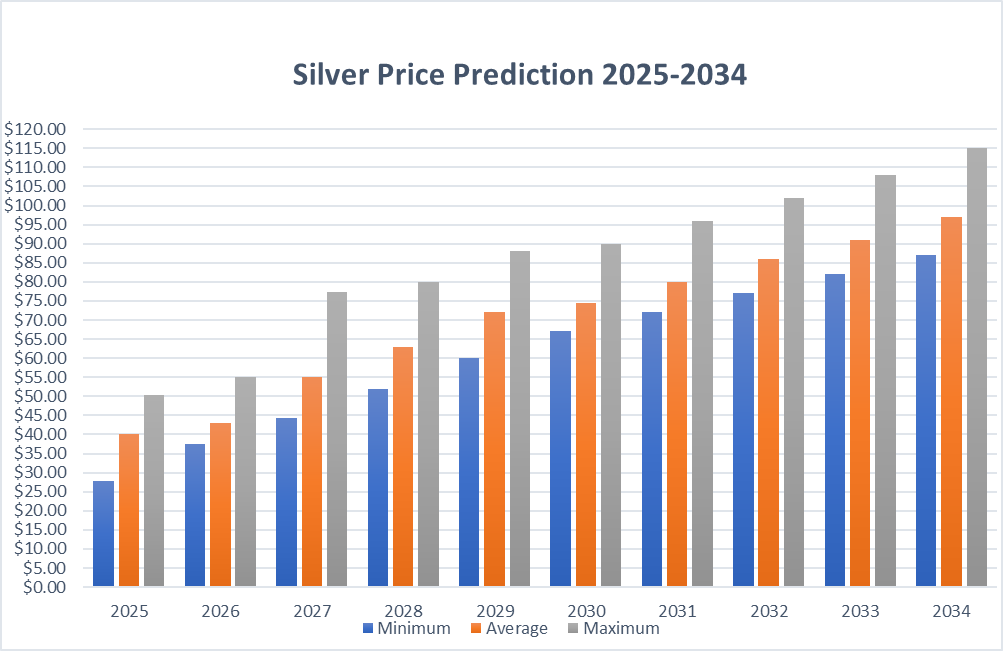

Silver Price Prediction: 2025–2034

The Forecasts suggest that by 2030, silver prices could climb between $37 to $225 per ounce, though most experts expect a realistic range of $40–$60. These predictions are supported by:

- High industrial demand from green energy and electronics.

- Continues tight supply deficits due to limited mine expansion.

- Macroeconomic trends shift, such as fluctuating interest rates & dollar strength.

Don't Miss: Why Top Mutual Funds Are Stopping Investments in Silver ETFs?

Here is how silver consumption breaks down across industries and sectors.

Global Silver Demand 2025: What’s Powering the Surge in Silver Prices?

Silver once known as the “poor man’s gold,” and now become a precious metal, for solar panels, EVs and technology while even rooted in India’s cultural and festive traditions. From 2020 to 2025, its demand has risen across industries and households proving that silver’s shine is stronger than ever.

-

Silver’s Industrial Power

- Solar panels use about 20 grams of silver each and the clean energy is pushing demand higher every year.

- Electric vehicles (EVs) depend on silver for batteries, wiring and circuits.

- Electronics and medical tools use silver for its unmatched conductivity and antibacterial properties.

- Industrial demand alone has risen from 511.9 million ounces in 2020 to 677.4 million ounces in 2025, making it the largest source of silver consumption globally.

-

Green Energy and India’s Solar Push

- India’s National Solar Mission aims for 500 GW of renewable energy by 2030 & that shows massive silver use.

- With every solar panel containing silver paste, the country’s transition to clean energy is directly fuelling the metal’s long-term rise.

-

Investment and ETFs

- Silver’s become a powerful investment asset as it is more affordable than gold, easy to liquidate and seen as a safe-haven during inflation.

- Silver ETFs and digital silver options have become highly popular, with silver-backed assets crossing $40 billion globally by mid-2025.

- These ownership holdings reduce market supply and add price pressure.

-

Cultural Demand: Silver’s Timeless Place in Indian Traditions

- In India, silver is not just an investment, it is a part of life.

- From weddings and pujasto Diwali, Dhanteras and Rakshabandhan silver holds deep emotional and traditional value.

- Its use in jewellery, gifts, and utensilskeeps demand strong year after year, proving that India’s love for silver goes far beyond markets or price trends.

-

Supply Constraints

- Silver demand has increases globally, but silver mining output has dropped 7% since 2016.

- Commonly silver is produced as a by-product of mining other metals, supply cannot rise quickly.

- Recycling helps, but not enough to cause a shortage in global deficits since 2021, which have crossed 800 million ounces.

-

Inflation and Currency Hedge

- As global inflation mounts and currencies weaken, investors are using silver as a hedge against economic downturns.

- With the gold-to-silver ratio above 90, investors find silver as an undervalued and cheaper entry into the precious metals market.

-

Technology and Innovation

- The primary wave of demand comes from innovation like 5G, AI hardware, EV charging and high-efficiency N-type solar cells, semiconductor requires more silver than before.

- Recently, silvers maintain as both a technology metal and a store of value, this way it stands out in silver market in 2025.

Must Read: SBI MF Suspends New Lumpsum Investments in Silver ETF FoF

Moving to the next heading that shows sector wise global demand.

Sector Allocation of Global Silver Demand 2025

According to the Silver Institute, global silver demand has grown from 929 million ounces in 2020 to over 1,148 million ounces in 2025.

In India, festive and cultural demand adds another layer of strength. Silver jewellery, silverware and traditional purchases during Diwali, Dhanteras and weddings continue to play a key role in keeping local demand strong.

Here is the sector-wise allocation of global silver demand (2020–2025)

| Category | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|

| Industrial (total) | 511.9 | 564.1 | 592.3 | 657.1 | 680.5 | 677.4 |

| Photography | 26.9 | 27.7 | 27.7 | 27.3 | 25.5 | 24.2 |

| Jewellery | 150.9 | 182.0 | 234.5 | 203.1 | 208.7 | 196.2 |

| Silverware | 31.2 | 40.7 | 73.5 | 55.1 | 54.2 | 46.0 |

| Net Physical Investment | 208.1 | 284.3 | 338.3 | 244.3 | 190.9 | 204.4 |

| Net Hedging Demand | 0 | 3.5 | 17.9 | 11.5 | 4.3 | 0 |

| Total Demand | 929 | 1102.3 | 1284.2 | 1198.4 | 1164.1 | 1148.2 |

*Sources: Silver Institute

Still, the air is not completely clear. If interest rates climb, the dollar strengthens or mine output improves, the silver price rise race loses. But with industrial demand leading over 60% of global consumption and India's cultural appetite still strong, silver's position in 2025 looks as solid as ever.

If rates rise, the dollar strengthens or supply improves, silver's rise could cool. Still, with industrial demand above 60% and India's cultural buying strong, silver's position in 2025 looks as solid as ever.

Must Read: Best Mutual Funds to Invest in 2025: Low-Risk Options for High Return

Key Reasons Behind the Rise in Silver Price in 2025

Here are the key reasons behind the silver price in India 2025:

-

Effect of the Russia-Ukraine War

The ongoing Russia-Ukraine clash has disrupted global supply chains, including silver. Reduced international supply has caused prices to rise.

-

Inflation Worries

Rising inflation worldwide has increased demand for safe-haven assets. Silver, includes as a traditional hedge, has seen stronger buying as investors want to secure their wealth.

-

Industrial Demand in Renewable Energy and Technology

The industry uses most of the silver demand. In 2025, solar panels, electric vehicles (EVs) and 5G devices are use up more silver than ever. Green energy projects and EV growth are boosting industrial demand.

-

Reserve Bank of India (RBI) Policies and Rupee Position

Interest rate changes by the RBI and a weaker rupee make imported silver expensive, boosting domestic prices.

-

Trade Policies and Tariffs

President Trump’s tariff actions and trade disruptions, including tariff policies from past US administrations, have created uncertainty in global metal supply chains.

Silver Fact: Hallmarking is the certifies silver purity under BIS, ensuring authentic, government-approved quality.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Silver Price Outlook 2030–2040: Is Silver the Next Gold?

Now day, every investor has one common thought that can silver take the place of gold or silver is the next gold.

Explore the experts outlook for 2030, prices in India could reach ₹2.5–3 lakhs/kg and by 2040, ₹4 lakhs/kg if demand for silver strong and supply remains tight. Silver price graph bring investors to shifting towards silver ETFs and digital silver.

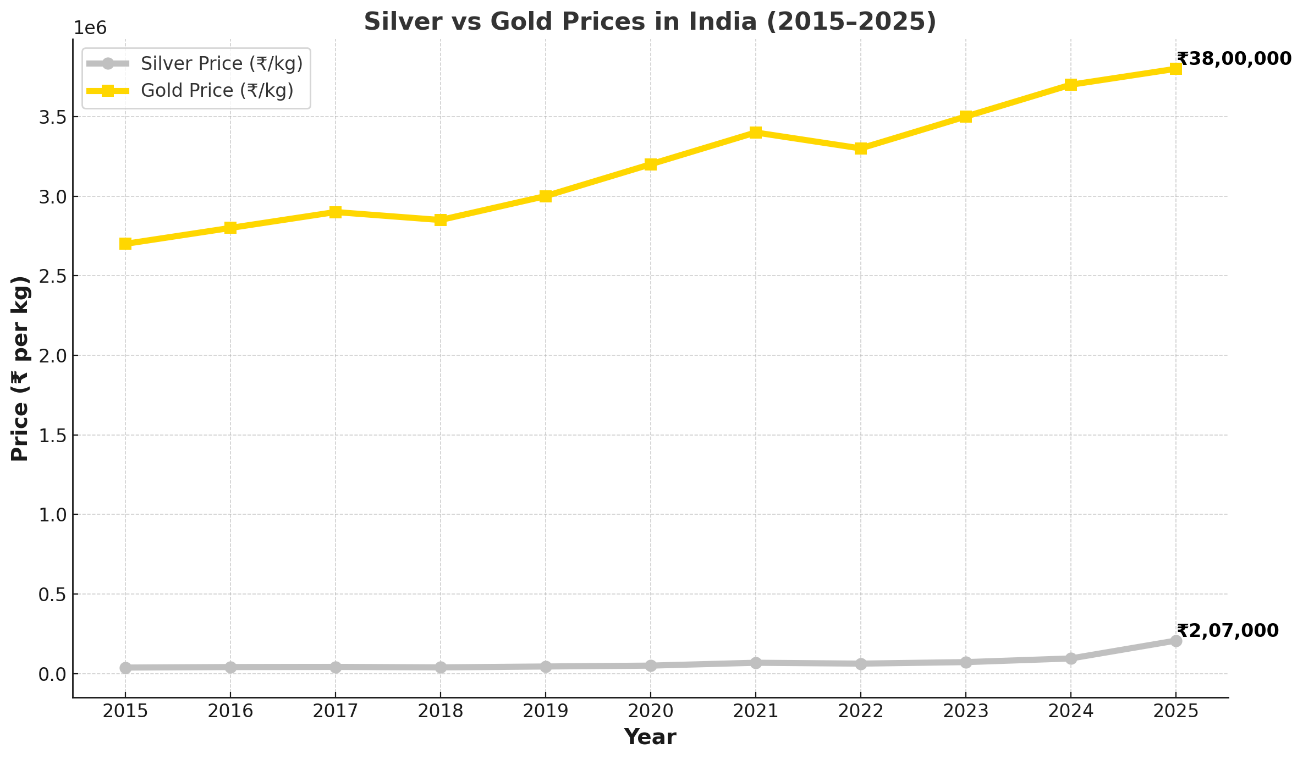

Here is the graph shown Silver Vs Gold Prices in India 2015–2025

Silver's growth since 2020 has outperformed gold, supported by their demands and it a strong investment alongside gold.

Moving forward to know best way to invest in silver.

Best Ways to Invest in Silver in India 2025

In 2025, silver offers a range of convenient investment options for every type of investor:

- Silver ETFs: Tradeable on stock exchanges and backed by physical silver.

- Digital Silver: Buy and sell silver online in small quantities anytime and anywhere.

- Sovereign Silver Bonds: Government-backed bonds that pay interest over time.

- Silver Mutual Funds & SIPs: Invest in funds holding silver and related asset instruments, with the option of Systematic Investment Plans (SIPs) to build wealth consistently.

These options make silver easy to access, flexible and a smart addition to your investment portfolio.

Don't Miss: Best SIP Plan for 20 Years: With Equity, Debt & Hybrid Funds

Let us quickly recap a list of the best-performing silver funds you can invest in this year.

Top Silver Mutual Funds in India for 2025

In 2025, silver remains a strong investment option, with several mutual funds offering exposure to this precious metal. Here is the list of top silver mutual funds in India for 2025, you can invest in them via a minimum amount of SIP.

| Scheme Name | Launch Date | AUM (₹ Cr) | 1 Year Return (%) |

|---|---|---|---|

| HDFC Silver ETF Fund of Fund | 28-10-2022 | 1,273 | 94.64 |

| Nippon India Silver ETF FOF | 05-02-2022 | 1,854 | 85.88 |

| Axis Silver FOF | 10-09-2022 | 366 | 88.17 |

| ABSL Silver ETF FOF | 02-02-2022 | 532 | 84.73 |

| SBI Silver ETF Fund of Fund | 11-07-2024 | 997 | 82.79 |

Silver can be volatile, so a long-term investment horizon and portfolio diversification are a better preference. Silver Mutual Funds provide an accessible way to invest in silver, but investors should stay updated on fund availability.

Point to be Silver: Silver purchases attract 3% GST with other applicable taxes.

Smart Investments, Bigger Returns

Conclusion: Final Thought on Prices Climb Higher in 2025?

In short, silver prices in India in 2025 are balanced by a mix of industrial demand, geopolitical tensions, inflation, currency movements and domestic factors. While predicting exact prices is challenging, investing in top silver mutual funds, ETFs, digital silver or sovereign silver bonds can be a smart way for your portfolio.

Moreover, using the SIP method allows you to plan your investments for the long term. Silver offers both industrial and safe-haven value remains an attractive option.

“Silver does not just shine, it powers your portfolio and the future of technology.”

Frequently Asked Questions

-

Where can I Invest in Silver in India?

You can invest through digital silver apps, silver ETFs, physical coins, bars, or MCX silver futures conveniently.

-

Where Can I Buy Silver Bars in India?

From certified jewellers, banks, Mint-authorised dealers and online bullion portals offer secure, hallmarked silver bars for purchase.

-

What is the return of silver in 10 years?

Silvers 10-year journey shows over 100% gains, outperforming gold recently due to industrial and retail investment demand.

-

Will the silver price go up in 2030?

Experts predict silver may touch ₹2.8–₹3 lakh/kg by 2030, supported by green tech and rising global consumption.

-

What will the price of silver be in 2040?

Predictions suggest silver might exceed ₹4 lakhs/kg by 2040 if industrial and investment demand continue increasing globally.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)