Table of Contents

- PAN India presence across 247 locations.

- Wide range of products to select from.

- Provides smart solutions and user-friendly services.

- Sound investment performance.

Aditya Birla Sun Life Mutual Fund has engraved its presence in the mutual fund market by launching a number of innovative investment solutions. There are its numerous schemes that have made their way to the list of top performing funds 2018. This has been possible as the result of the hard work and dedication with which the team works here. There are continuous efforts that are put in to provide the investors with best services along with the smart investment products. To know the top funds of this fund house, keep reading this blog.

Table of Content

Amidst various changes going on in the mutual fund investment market in the form of re-categorization guidelines by SEBI, correction phase of equities, sudden drop of the Sensex, etc., it has become tough for investors to select the right scheme to invest in. Therefore, in the coming blog, we will be sharing with you the top performing funds by ABSL MF that have been shortlisted after conducting intensive research by the experts at MySIPonline.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Top Performing Funds by ABSL Mutual Fund

The top performing funds are selected on the basis of different parameters such as their past performance, risk measures, investment strategies, fund managers, asset allocation, etc. Following are the top five schemes which are unique in their own way.

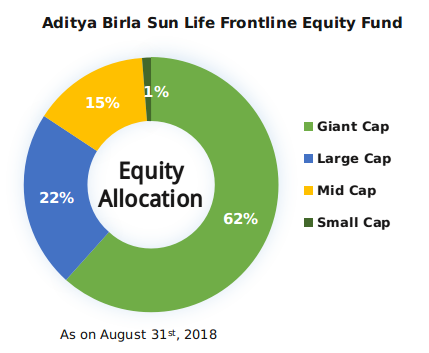

Aditya Birla Sun Life Frontline Equity Fund (G)

The investment objective of this scheme by Aditya Birla Sun Life Mutual Fund is to generate long-term capital appreciation by investing 100% of the assets in equity across industries and sectors with their chosen benchmark as NIFTY 50.

Its secondary objective is to generate income and distribute dividend among the investors. This open-ended scheme predominantly invests in the large cap stocks. Large cap stocks are the stocks of the top 100 companies in terms of full market capitalization.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Frontline Equity Fund |

| Category | Equity: Large Cap |

| Benchmark | NIFTY 50 Total Return |

| Launch Date | 8/30/2002 |

| Asset Size | Rs. 20,227 crore(As on Sep 30, 2018) |

| Fund Manager | Mahesh Patil |

| Expense Ratio | 2.18%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Exit Load | 1% for redemption within 365 days |

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Aditya Birla Sun Life Frontline Equity Fund | -7.64% | 8.46% | 14.92% | |||

| NIFTY 50 Total Return | 0.69% | 10.17% | 12.80% | |||

| Category | -2.88% | 8.91% | 12.90% | |||

| As on October 12th, 2018 | ||||||

- The three year returns generated by Aditya Birla Sun Life Frontline Equity Fund are less than both its benchmark and category.

- The five year returns of 14.92% yielded by this fund is more than the return rate generated by the benchmark and category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Aditya Birla Sun Life Frontline Equity Fund | 13.77 | 0.96 | 0.31 | |||

| NIFTY 50 Total Return | 13.91 | - | 0.47 | |||

| Category | 14.30 | 0.99 | 0.36 | |||

| As on September 30th, 2018 | ||||||

- The standard deviation of this scheme is lower than the SD of its benchmark and category. Even its Beta is less than that of the category. Both these factors show that it is less prone to fluctuations comparatively.

- The Sharpe ratio of the scheme is 0.31 which is less than the others. This states that the returns generated with the per unit risk taken are less comparatively.

Who Should Invest?

This scheme is for investors who are willing to earn long-term capital appreciation by investing in the owner’s fund of companies and sectors with their benchmark as NIFTY 50. It is typically meant for aggressive investors as the risk involved under it is high on the principal amount invested.

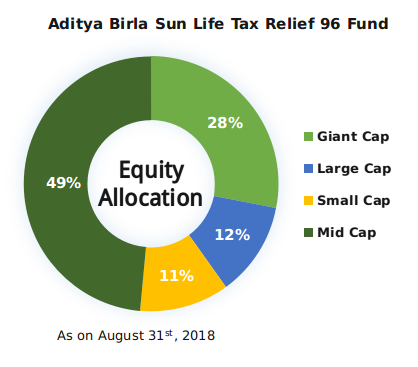

Aditya Birla Sun Life Tax Relief 96 Fund (G)

The investment objective of this scheme is to generate long-term capital appreciation by investing in equity and equity related instruments. It is an ELSS scheme that helps investors avail tax benefit under Section 80C of the Income Tax Act, 1961.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Tax Relief 96 Fund |

| Category | Equity: ELSS |

| Benchmark | S&P BSE 200 TRI |

| Launch Date | 3/29/1996 |

| Asset Size | Rs. 6,628 crore(As on Sept 30, 2018) |

| Fund Manager | Ajay Garg |

| Expense Ratio | 2.26%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Exit Load | NIL |

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Aditya Birla Sun Life Tax Relief 96 Fund | -8.50% | 11.33% | 20.21% | |||

| NIFTY 200 TRI | -4.10% | 10.29% | 14.28% | |||

| Category | -10.75% | 8.54% | 16.42% | |||

| As on October 12th, 2018 | ||||||

This scheme has managed to outperform both the benchmark and category in three and five-years time period.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Aditya Birla Sun Life Tax Relief 96 Fund | 14.31 | 0.90 | 0.50 | |||

| NIFTY 200 TRI | 14.55 | - | 0.45 | |||

| Category | 15.45 | 0.99 | 0.30 | |||

| As on September 30th, 2018 | ||||||

- The Standard deviation of the Aditya Birla Sun Life Tax Relief 96 Fund is less than the benchmark and category’s SD and its Beta is also less than the category’s indicating that it is less prone to fluctuations.

- The Sharpe ratio of the scheme is 0.50 which is better than the others indicating that it generates better returns with the per unit of the risk taken.

Who Should Invest?

If you are looking for a scheme by ABSL MF to add to your portfolio to help you save tax, then this scheme is the answer. Investors with high risk appetite willing to invest in an equity scheme to earn capital appreciation along with tax benefits may invest in it.

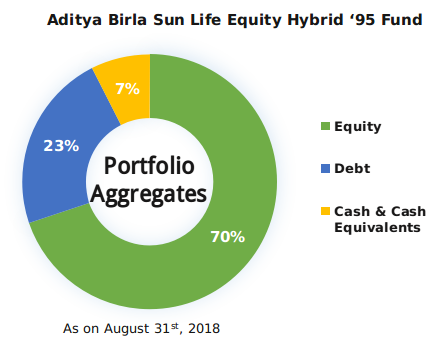

Aditya Birla Sun Life Equity Hybrid ‘95 Fund (G)

This scheme by Aditya Birla Sun Life Mutual Fund is an open-ended hybrid scheme that invests in a mixture of stocks such as equity, debt, and money market instruments. It facilitates an investor to earn capital appreciation along with income.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Equity Hybrid ‘95 Fund |

| Category | Hybrid: Aggressive Hybrid |

| Benchmark | CRISIL Hybrid 35+65 Aggressive |

| Launch Date | 2/10/1995 |

| Asset Size | Rs. 13,827 crore(As on Sep 30, 2018) |

| Fund Managers | Dhaval Shah, Mahesh Patil, and Pranay Sinha |

| Expense Ratio | 2.29%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Exit Load | For units in excess of 15% of the investment,1% will be charged for redemption within 365 days |

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Aditya Birla Sun Life Equity Hybrid ‘95 Fund | -8.29% | 7.95% | 15.10% | |||

| VR Balanced TRI | 1.07% | 9.44% | 11.78% | |||

| Category | -6.58% | 7.92% | 14.12% | |||

| As on October 12th, 2018 | ||||||

This scheme has been successful in outperforming the benchmark and category in five-years return. In three-year returns, Aditya Birla Sun Life Equity Hybrid ‘95 Fund has surpassed the return rate generated by the category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Aditya Birla Sun Life Equity Hybrid ‘95 Fund | 11.18 | 0.89 | 0.27 | |||

| VR Balanced TRI | 11.42 | - | 0.45 | |||

| Category | 11.25 | 0.90 | 0.27 | |||

| As on September 30th, 2018 | ||||||

The SD of this scheme is less and so is Beta which indicate that it is less likely to fluctuate. Its Sharpe Ratio is same as that of the category but less than the benchmark’s ratio.

Who Should Invest?

Investors who are looking for investment opportunities that involve an investment in a mix of stocks including equity, debt, and money market instruments may invest in it. It should be noted that the risk involved in this scheme is high on the principal amount invested.

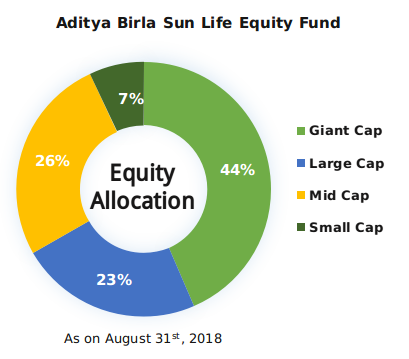

Aditya Birla Sun Life Equity Fund (G)

The investment objective of this scheme by Aditya Birla Sun Life Mutual Fund is to help investors earn long-term growth by targeting an allocation of 90% assets in equity and 10% in debt and money market instruments.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Equity Fund |

| Category | Equity: Multi Cap |

| Benchmark | S&P BSE 200 TRI |

| Launch Date | 5/22/2004 |

| Asset Size | Rs. 9,419 crore(As on Sep 30, 2018) |

| Fund Manager | Anil Shah |

| Expense Ratio | 2.24%(As on August 31, 2018) |

| Minimum Lumpsum | Rs. 500 |

| Minimum SIP | Rs. 500 |

| Exit Load | 1% for redemption within 365 days |

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Aditya Birla Sun Life Equity Fund | -9.19% | 11.16% | 19.83% | |||

| NIFTY 200 TRI | -4.10% | 10.29% | 14.28% | |||

| Category | -9.65% | 8.73% | 16.63% | |||

| As on October 12th, 2018 | ||||||

The three and five year returns of the scheme are 11.16% and 19.83%, respectively which is much more than that generated by the NIFTY 200 TRI and category.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Aditya Birla Sun Life Equity Fund | 15.60 | 1.00 | 0.41 | |||

| NIFTY 200 TRI | 14.55 | - | 0.45 | |||

| Category | 15.46 | 0.98 | 0.32 | |||

| As on September 30th, 2018 | ||||||

This scheme by Aditya Birla Sun Life Mutual Fund is likely to fluctuate more compared to its NIFTY 200 TRI and the category. The Sharpe ratio of Aditya Birla Sun Life Equity Fund is though more than the benchmark’s but less than the category’s ratio.

Who Should Invest?

You can add this scheme to your portfolio if you are looking for an investment product that invests across equity. The risk involvement in this scheme is moderately high on the principal amount invested.

Aditya Birla Sun Life Medium Term Plan (G)

Aditya Birla Sun Life Medium Term Plan is an open-ended scheme that mainly invests in debt and money market instruments to facilitate investors earn regular income and capital appreciation. The investment made has a macaulay duration between 3 to 4 years.

| Basic Information | |

|---|---|

| Parameters | Aditya Birla Sun Life Medium Term Plan |

| Category | Debt: Medium Duration |

| Benchmark | CRISIL Composite AA ST Bond |

| Launch Date | 3/25/2009 |

| Asset Size | Rs. 10,983 crore(As on Sep 30, 2018) |

| Fund Managers | Maneesh Dangi and Sunaina Da Cunha |

| Expense Ratio | 1.68% (As on August 31, 2018) |

| Minimum Lumpsum | Rs. 1000 |

| Exit Load | For units in excess of 15% of the investment,1% will be charged for redemption within 365 days |

| Return Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | YTD | Last 3 Years | Last 5 Years | |||

| Aditya Birla Sun Life Medium Term Plan | 3.25% | 7.44% | 8.90% | |||

| VR Bond | 3.05% | 5.98% | 7.31% | |||

| Category | 3.29% | 6.93% | 8.19% | |||

| As on October 12th, 2018 | ||||||

It has been successful in generating returns better than its benchmark VR Bond and category in three as well as five-year time period as on October 12th, 2018.

| Risk Analysis | ||||||

|---|---|---|---|---|---|---|

| Scheme Name | SD | Beta | Sharpe | |||

| Aditya Birla Sun Life Medium Term Plan | 2.07 | 0.81 | 0.43 | |||

| VR Bond | 2.27 | - | -0.23 | |||

| Category | 2.42 | 0.94 | 0.23 | |||

| As on September 30th, 2018 | ||||||

Seeing the standard deviation and Beta of the scheme, it can be said that it is less likely to fluctuate comparatively. Here, the sharpe ratio is much better than that of the other two.

Who Should Invest?

Investors who are looking forward to investing in a scheme that further invests in debt and money market instruments, to park money for a medium term period may invest in it. The risk involved in this scheme is moderate, therefore only those investors should invest in it who have such risk bearing appetite.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Conclusion

These were the top schemes of Aditya Birla Sun Life Mutual Fund in which investors may invest according to their portfolio’s requirement. If there is anything that you would like to discuss or need clarification on related to regular funds, you can post the same here. Further, you may invest in these funds via MySIPonline, an online portal that helps one save time and money. In case you have any query that you would like to talk about, you may consult our experts anytime absolutely free of cost.

Must Read: