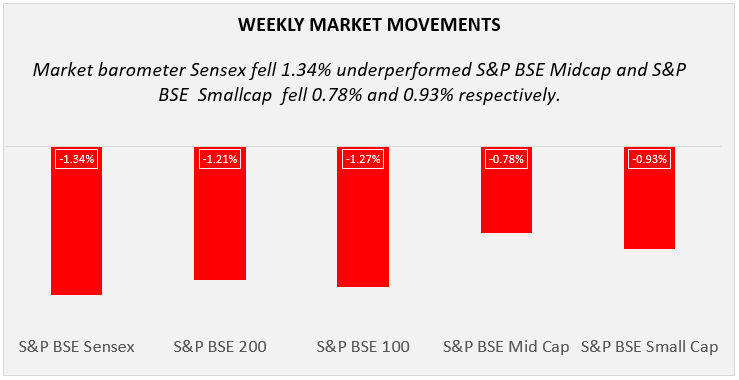

Sensex reversed earlier week’s gain by posting a weekly loss of 1.34% followed by S&P BSE 100 and S&P BSE 200 plunged by 1.27% and 1.21%, respectively. S&P BSE Midcap and S&P BSE Smallcap fell marginally down by 0.78% and 0.93%, respectively. Let’s find out what occurred during the week and how it can effect our future.

Table of Content

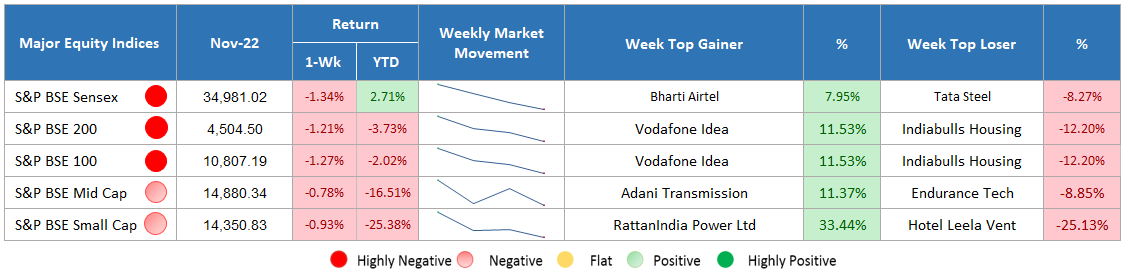

Major Equity Indices Performance

Domestic equity indices reversed the past week’s profit by trading in red. The market barometer, Sensex posted a weekly loss of 1.34% followed by S&P BSE 200 and S&P BSE 100 which fell by 1.21% and 1.27%, respectively. On the other side, S&P BSE Midcap and S&P BSE Smallcap posted a marginal weekly loss of 0.78% and 0.93%, respectively.

Initially, on the first trading session, the market gained ahead of expected optimistic outcome of RBI and the government meeting where key issues relevant to liquidity, excessive surplus, and lending rules have been discussed. Investors expected that the meeting will reduce the ongoing tussle between both the parties. However, the next day, gains were reversed because of the global meltdown in technology stocks. On the Wall Street, technological stocks witnessed fall, which in turn, pulled domestic tech companies lower. In addition to this, the misconduct charges against Japanese multinational automaker’s chairman and pessimism over the US-China trade talk marred investor’s sentiments. On the third trading session of the week, losses were extended on the account of the weak global cues. The fall in overnight US market ahead of escalating trade tensions and fear over global growth rate added to the woes. Furthermore, the rebounded crude oil also affected market participants. On the last day, the market continued to trade in red. Sensex closed down by 218.78 points at a closing value of 34981.02. S&P BSE Midcap and S&P BSE small cap also ended lower, plunged by 0.74% and 0.44%, respectively.

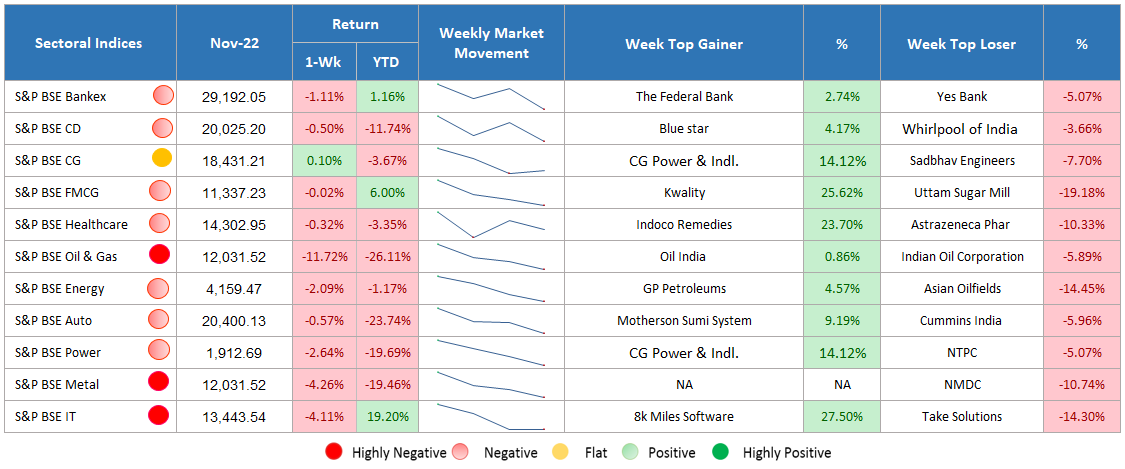

Sectoral Indices Performance

Gaining Sectors

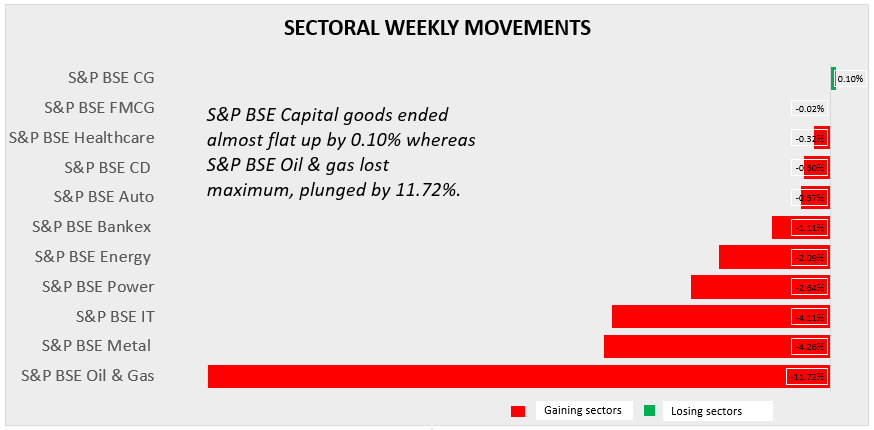

On the BSE Sectoral note, S&P BSE capital goods ended almost flat, surged by 0.10%.

Losing Sectors

Among 11 sectoral indices, all sectors except for capital goods were traded in loss. Among all, Oil & gas lost the maximum; fell by 11.72%. Barring oil & gas, S&P BSE Metal, S&P BSE IT, S&P BSE Power, and S&P BSE Energy plunged by 4.26%, 4.11%, 2.64%, and 2.09%, respectively. IT sector was mainly affected by the decline in the technological stocks on the Wall Street and strengthened rupee against the US dollar. Other than this, Bankex, Auto, Consumer durable, Healthcare and FMCG witnessed the selling pressure reported weekly loss of 1.11%, 0.57%, 0.50%, 0.32% and 0.02%, respectively.

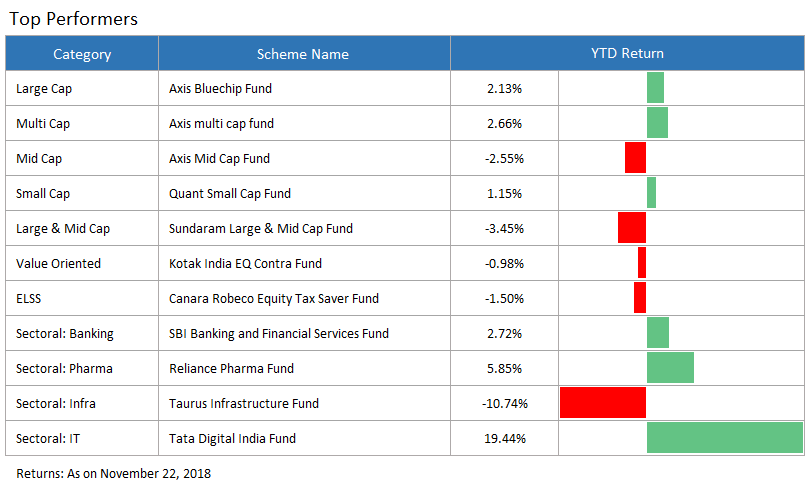

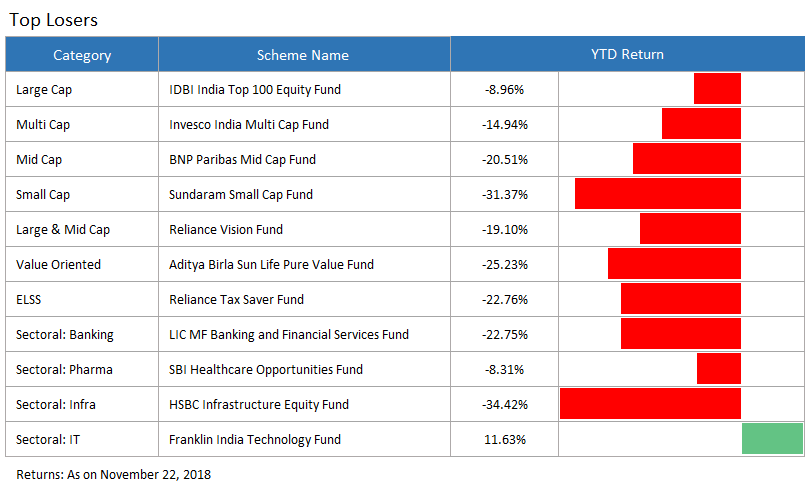

Top Performers & losers

Conclusion

With all the volatility and correction going on in the stock market, one thing that even Warren Buffet would fear doing is trying to time the market, even though he has a very strong view on the price levels appropriate to individual shares. Going with the view of report, several investors would try doing the opposite, even when their financial advisors warned them to avoid, thus end up losing their hard-earned money in the process. It is important to note that catching the tops and bottoms is a myth which can even make one lose more money than what they have made. To prevent yourself from all such instances, connect with the experts at MySIPonline today to seek recommendation on the best mutual funds to invest in now.

Invest in the Best Mutual Funds

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure