Table of Contents

Curious to know if a fund based on a business cycle is worth investing in? It gives you a dual advantage by targeting companies at their growth phase of any sector where the economy is highly rewarding with limited risk. These funds target distinct stages of the economic cycle, investing in businesses that are expected to carry out well during each phase. This strategy can give high returns if timed correctly.

However, is this the right decision for you?

Knowing the risks and how these funds function is vital before making a decision. In this blog, we'll discuss these funds in detail, along with their benefits and best business cycle schemes to invest in and help you decide whether they are worth investing in or not.

Read until the end for a special announcement that will change your whole portfolio for good.

So, let's start by understanding, "What is a Business Cycle Fund?"

What is a Business Cycle Fund?

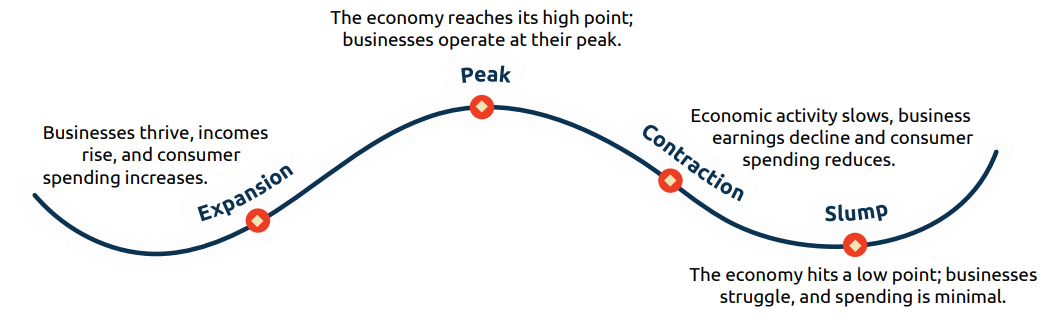

To understand these funds, you must understand what is a business cycle. In easy words, a business cycle means the different phases of the economy. Each phase influences economic growth, which in turn affects investment decisions.

Let's understand these 4 phases of the business cycle:

- Expansion Phase: The initial start, also called the recovery phase, happens right after a period of economic downturn. At this stage, the business grows very quickly and you see a rise in income due to more spending by the consumers.

- Peak Phase: The second phase comes when the business cycle has reached a point where economic activity is booming. It encourages investor's sentiment and the prices and other economic indicators like GDP remain stable.

- Contraction Phase: The next phase is the recession, meaning the economy goes towards decline. It results in poor and decreased growth of the GDP. Ultimately, you will see slow activity in the economy where business earnings decline with reduced consumer spending.

- Decline Phase: It is the last stage where the economy takes a huge hit reaching its lowest point where businesses struggle and spending is close to nothing.

Well, you now have good insights; let’s delve into what advantages these stocks have to offer.

Key Benefits of Investing in a Business Cycle Fund

The goal is to make good returns and for that, you need to learn the key merits of these stocks:

- High Returns Opportunities: You can grab the chance to invest in the Best Business Cycle Funds and make high returns from the outperforming sectors of the Indian economy. For example, during expansion, you allocate capital in stocks, wherein in the declining phase you shift your assets to defensive funds.

- Sector Rotation: By timing the business phases correctly, fund managers smartly shift your investments in those sectors, which are performing well. For example, during the expansion of the IT sector and financial services. This technique helps in capturing the potential gains in your Mutual Funds more easily.

- Helps in Long-term Planning: The business cycle that has an economic factor involved gives a lot of room for the stock to reach its full potential. This helps you plan for a longer investment period of at least 7 years, giving time to carry out a strong investment philosophy.

Now it is time to check out the top-performing mutual fund scheme to invest via a systematic investment plan.

5 Best Business Cycle Funds in India for SIP

Here are the 5 Best Business cycle Funds to solidify your portfolio:

| Scheme Name | AUM (Crore) | 6 Months Returns (%) | 1 Yr Returns (%) | 3 Yrs Returns (%) |

|---|---|---|---|---|

| Baroda PNB Paribas Business Cycle Fund | 609 | 19.3 | 47.3 | 21.42 |

| ICICI Prudential Business Cycle Fund | 11215 | 14.61 | 46.91 | 26.12 |

| Kotak Business Cycle Fund | 2687 | 25.14 | 38.54 | 31.45 |

| Quant Business Cycle Fund | 1499 | 25.16 | 64.85 | 69 |

| Tata Business Cycle Fund | 2776 | 18.84 | 46.37 | 26.75 |

| Category Average | 20.8 | 45.5 | 43.39 |

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Now, it begs the logical question, will this special category suit you? Let’s shed some light on the suitability of this category.

Who Should Invest in Business Cycle Mutual Fund?

Check the below points to see if these stocks suit your needs or not:

Risk Takers: If you do not shy away from taking risks now and then, these cyclic funds are a perfect investment option. All you need is timing the market correctly, plan and adjust your strategy according to the market shifts.

Investing for Long Term: If your investment plan is 5-7 years, a business cycle stock is a good match. Starting investments with a SIP is the best strategy for a successful portfolio.

Seeking to Generate High Returns: You can invest a certain percentage of your overall portfolio in business cycle funds to act as a kicker for your portfolio returns.

Finally, it’s time for the Special announcement, let’s hear it out.

New NFO Alert: Business Cycle Fund

One of the best investment opportunities of 2024 is here. You will read about a new NFO launch based on the business cycle of investing.

Are you ready for the big reveal? Yes!

With great excitement Bandhan Mutual Funds, one of the biggest Asset Management Companies dominating the domestic market of India is introducing this new fund offer, Bandhan Business Cycle Fund. The subscription period is from September 10 to September 24, 2024.

Let me tell you that you haven't heard the best part yet.

Stay tuned for the upcoming details about this NFO.

.webp&w=3840&q=75)

.webp&w=3840&q=75)