If you like the idea of investing in companies before they become big names, small cap funds might catch your attention in 2026. Now you must be thinking that what are small cap mutual funds? Well, these are the investment instruments take your money and invest it in smaller, rising companies that are still in their growing phase, but have high growth potential.

Today, many investors are looking at these funds because they want their money to work harder. Since these companies are smaller, they can often grow much faster than a giant corporation. When these companies succeed, the people who invested in them can see some pretty impressive gains.

But here is the catch: these funds are a bit of a roller coaster. They can go up fast, but they can also drop as quickly. These funds are perfect for those investors who do not mind the rise and fall ride over time. What if you could add a roller coaster engine to your portfolio that works while the giants are sleeping? Let us check it out.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What is Small Cap Fund?

A small cap fund is a type of mutual funds that primarily invests your money in small companies, typically those that rank below the top 250 companies by market capitalization. When you put money into a small cap fund, the fund manager uses that money to buy shares in companies that are usually in their early stage of growth.

For further clarification, let us point out some main features of these funds.

Features of Small Cap Funds

We can have a quick overview of what these funds are and how they work by looking at the features below.

- Small cap mutual funds invest in young companies that can grow quickly& offer higher return potential in the long term.

- Smallcap funds tend to swing more sharply, reacting quickly to market news, economic changes and even industry trends.

- These funds work best when kept for the long term. Companies need time to grow, expand and deliver returns.

- A small cap mutual fundnormally invests across various sectors. This reduces the impact if one company or industry does not perform well.

- Experts choose potentially successful small cap stocks in order for investors to avoid research into each company individually.

- Small cap mutual funds are those that offer the potential for larger gains, but they are also associated with higher levels of uncertainty.

The above features provide an overview of how small cap funds work. Let us discuss in detail the actual process of these funds.

Best Mutual Funds for 2026 Backed by Expert Research

How Small Cap Funds Work?

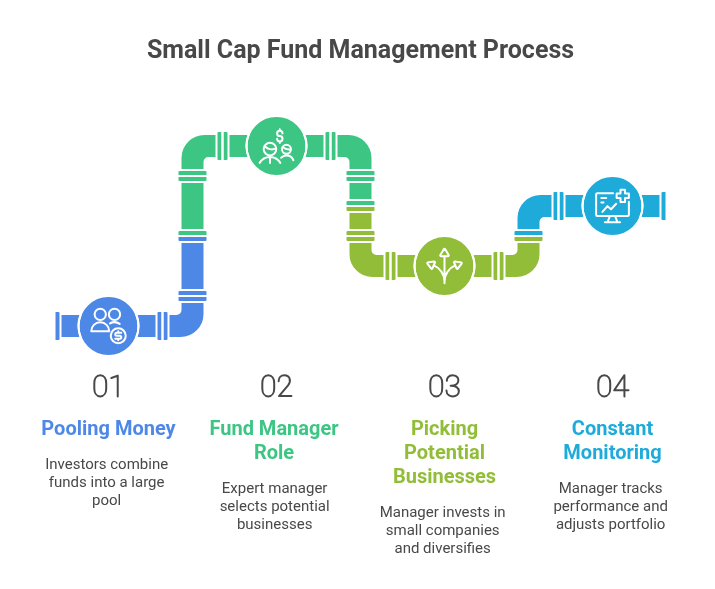

You must be wondering how small cap funds put your money to work. Actually, it is a mix of teamwork and expert management of money. Here is a step by step breakdown:

-

Pooling the money

Think of a small cap fund as a mega wallet. Instead of you trying to buy stocks in several different small companies yourself, thousands of investors like you combine their money.

-

The Expert Role (Fund Manager)

Every fund has a professional fund manager since small companies do not have much exposure, so the fund manager searches and tries to pick the unexplored businesses.

-

Picking the Potential Business

Managers pick the best performing business, but they must invest at least 65% of the fund in small companies and spread the rest across different sectors to keep their money safe from single sector crashes.

-

Constant Monitoring

Managers always watch the fund performance. If any company loses, the fund manager removes it and if a company is winning, then he sells for profit and adjusts the portfolio for newcomers.

This process works perfectly for you as it gives you a chance to enter with a low amount while managing funds by experts. Now, let us see what the benefits these funds give under expert observations are.

What Makes Small Cap Funds Beneficial?

If you are thinking that your money should work as hard as you do, then small cap funds offer some unique advantages. Here are some benefits that investors consider to include in their portfolio:

- Small companies have provisions and potential for expansion,which means they have the most space to grow and expand much faster than giant corporations.

- Many small companies are undiscovered,which gives a chance to fund managers to buy great businesses at a lower rate before they become famous.

- Small businesses can adapt quickly to new trends,helping them to beat the general market's performance during growth cycles.

- These funds let you invest in specialized niche industries like new age tech or local brands that big name funds usually overlook.

Did You Know? : SWP Calculator can show how quickly increasing your withdrawal rate from 4% to 6% may cut your portfolio’s life by nearly half in certain market conditions.

Small cap funds have massive potential to multiply your investments, but it is one side of the coin. The other side shows the risk associated with the investments. Let us have a look.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Risks Associated with Small Cap Funds

Although rewarding, investing in small cap mutual funds does carry some major risks.

- High Volatility –These funds swing more than large or mid cap funds. Many companies recorded negative returns in 2025, averaging about 11.7%.

- Liquidity issues –Small cap funds often trade in low volumes, which makes it difficult to exit quickly or at a good price when the market is unstable.

- Business Risks -Smaller companies may have limited resources, unstable revenue & weaker balance sheets.

- Overvaluation risk -A Sharp price increase may overprice the small caps and leave them easily affected by setbacks if growth turns negative.

- Long recovery periods –These funds take a longer time to recover in case of a crash, hence these funds are most suitable for long term investors who usually have a time frame of 5-10 years.

Also read: Best Small Cap Mutual Funds for Long Term Investment in 2026

After careful consideration, we can say that the small cap funds are worth investing in. Let us confirm our choice to invest by the historical performance given below by these funds.

Best Small Cap Mutual Fund You May Consider to Invest in 2026

These funds have kept their appeal for long-term investors in search of high growth. Here is a list of some best small cap funds that investors can look at for 2026.

| Fund Name | Launch Date | AUM (₹ Cr) | 3 Yrs Avg Returns | 5 Yrs Avg Returns |

|---|---|---|---|---|

| Bandhan Small Cap Fund | 08-02-2020 | 17,380 | 29.70% | 27.79% |

| Edelweiss Small Cap Fund | 01-02-2019 | 5,297 | 19.38% | 25.49% |

| HSBC Small Cap Fund | 12-05-2014 | 16,548 | 18.38% | 26.16% |

| Invesco India Small Cap Fund | 05-10-2018 | 8,720 | 24.69% | 27.91% |

| Tata Small Cap Fund | 02-11-2018 | 11,792 | 18.86% | 25.92% |

| Category Average | — | — | 19.01% | 24.91% |

| NIFTY Smallcap 250 TRI | — | — | 20.94% | 25.36% |

The above list is just a glimpse of what small cap funds do. If you are thinking of investing now, then wait and just go through the steps that will guide you through the process.

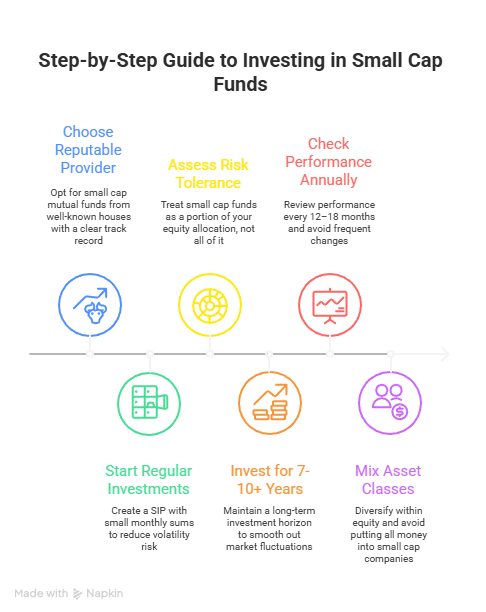

How to Invest in Small Cap Funds?

Investing in small cap funds can be rewarding if done thoughtfully. Below is a simple guide to help you select the right fund for your investments.

- Explore the range of different small cap mutual funds. Compare their performance, fees & risk levels.

- Decide your investment goal whether itis for long term growth, retirement or another purpose.

- Begin with a smalland regular investment (Rs 100–500) to spread risk & build wealth gradually.

- Track your fund’s performance periodically to ensure it matches your expectationsand rebalance your portfolio if necessary.

- Follow news and trends related to small cap stocks and mutual funds to make informed decisions.

Did You Know? Your SIP calculator can show how just Rs 5,000 can grow to over Rs 10 lakh in 10 years.

This approach helps you invest in small cap funds systematically, balancing growth potential with informed decision-making. Below are the taxation rules that you must follow.

Taxation Rules of Small Cap Mutual Funds

Most small cap funds are equity-oriented, so they follow the tax rules for equity mutual funds in India. Here is how taxes work in 2026 and what you need to know.

| Holding Period | Tax Type | Applicable Tax Rate (After July 23, 2024) |

|---|---|---|

| Less than 12 months (Units sold within 1 year) |

Short-Term Capital Gains (STCG) | 20% on gains (+ applicable cess) |

| More than 12 months (Units sold after 1 year) |

Long-Term Capital Gains (LTCG) | Gains up to ₹1.25 lakh per financial year are tax-free. Gains above ₹1.25 lakh taxed at 12.5% (No indexation benefit) |

Note: The rates above apply to equity-oriented funds, which include most small cap mutual funds because they invest mainly in Indian stocks.

Also read: Tax on Mutual Funds: Complete Guide with Smart Saving Plans

Who Should Consider Small Cap Funds?

Small cap funds are more risky than other investments, they fit best with specific financial goals and personalities. Here is a careful consideration of who should add them to their portfolio:

- These funds are perfect if you can leave your money untouched for 7 to 10 years. This gives small companies enough time to grow.

- You should invest only if you stay calm when your portfolio value rises or falls in the short term.

- If you are a younger investor, you have the time advantage to ride out market dips and benefit.

- If you already have stable large cap funds, then adding a portion of small cap can act as a growth booster for your overall portfolio.

- They are ideal for those who prefer investing small, regular amounts. This strategy helps to buy more shares when prices are low.

Smart Investments, Bigger Returns

Conclusion

In short, small cap funds offer significant potential for generating wealth when approached with the right mindset. They offer high growth potential by investing in newly emerged companies but they also come with higher risk.

If you have a long term horizon, can handle market volatility & already have a stable and balanced portfolio then these funds can be a booster for your portfolio. The key is to invest thoughtfully, stay disciplined & give your investment enough time to grow.

Related Blogs:

- What is Risk in Mutual Fund and Its Types?

- 2026 Finance Goals: 5 Key Personal Finance Rules for Better Money Management

Frequently Asked Questions

-

Are small cap funds still worth investing in 2026?

Yes, they offer strong long term growth but are highly volatile, making them best for investors with an aggressive, long term approach.

-

How risky are small cap mutual funds compared to other funds?

Small cap funds are very high-risk, with prices that can drop sharply during corrections but rise strongly during recoveries.

-

Who should invest in small cap funds?

Investors with a 7–10+ year horizon, appetite for high returns, ability to handle volatility, and existing large or mid cap exposure.

-

What should be the minimum investment in a small cap fund?

Most allow SIPs starting from Rs 100-500, making them accessible even for new investors. A SIP Calculator can help plan your contributions.

-

How are small cap fund returns taxed?

They follow equity mutual fund tax rules: STCG (sold within 1 year) at 20%, LTCG (over 1 year) exempt up to Rs 1.25 lakh, beyond that taxed at 12.5%.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)