Table of Contents

- Overview of the Mutual Fund Taxation System in 2025

- Factors to Determine Tax on Mutual Funds

- What is the Capital Gains Tax on Mutual Funds?

- Long-Term and Short-Term Capital Gains Tax on Mutual Funds

- Taxation of Capital Gains on Different Types of Mutual Funds

- Tax Saving Strategies for Mutual Fund Investors in 2025

- Understanding the Dividend Distribution Tax in Mutual Funds

- Recent Tax Changes and Budget 2024 Highlights

- Common Mistakes to Avoid in Mutual Fund Tax Planning

- Conclusion

Did you hear about the new rules for tax on Mutual Funds after the 2024 Union Budget? Yes, they have changed quite a bit for 2025, affecting how equity, debt and hybrid funds are taxed. Now, if you make more than Rs 1.25 lakh long-term gains on your equity funds, you will pay 12.5% tax instead of the old 10% and short-term gains are taxed more too, 20% instead of 15%. And guess what? Even debt and hybrid funds saw changes, like longer holding periods and no more indexation benefits. These changes force everyone to think about what the effects of these changes will be on their investments in 2025.

Well, no doubt it is a lot to take in, but if you plan smart, these updates can actually help you save more and this post will help you save more from your mutual fund investments in 2025. So, dive in and explore everything you need to know about tax on mutual funds in 2025.

Overview of the Mutual Fund Taxation System in 2025

The mutual fund taxation rules 2025 are governed based on the guidelines from the July 2024 Union Budget and the Finance Act 2023. Mutual funds are primarily divided into two categories- equity funds and non-equity (debt, hybrid, gold, etc.) funds. The taxation on these funds depends on their type and the holding period of the investments. Hence, both types of mutual funds have different taxation rules.

If the mutual funds are held for one or more years, the gains on these funds are considered as long-term capital gains (LTCG) and are taxed at the rate of 12.5%. However, if the fund is held for less than a year, it is considered to be a short-term capital gain and is taxed as per the income tax slabs of the taxpayer without any indexation benefits. Dividends from mutual funds are also taxed as per individual income tax slabs.

Must Read: Old vs New Tax Regime 2025: Key Differences & Best Choice

Let us explore the essential factors that are used to calculate tax on mutual funds.

Factors to Determine Tax on Mutual Funds

The primary factors that determine the mutual fund tax 2025 in India include:

-

Type of Mutual Fund

Tax rates vary based on the type of fund (like equity-oriented, debt-oriented, hybrid, gold or international funds).

-

Holding Period

It defines whether the gains of the fund are short-term or long-term, as they affect the tax rates.

-

Nature of Gains

The gains on a fund can be of different types- capital gains and dividend income. The taxation system for each one is different.

-

Individual Income Tax Slab

The tax liability of the dividend income depends on the investor's income tax slab rates.

-

Investment Date

Mutual Fund tax rules may differ based on the date of investment due to budget updates.

-

Capital Gains Classification

The gains on mutual fund investments are classified as short-term and long-term gains, each taxed differently.

-

Regulatory Changes

Taxation can be affected by the recent regulatory changes, like the removal of indexation benefits or changes in the Dividend Distribution Tax.

Now, let us understand what the capital gains tax on mutual funds is in the next part.

What is the Capital Gains Tax on Mutual Funds?

Capital Gains Tax on mutual funds is the tax imposed on the profits you earn when you sell your mutual fund units for more than their purchase cost. Based on the holding period of funds, capital gains are of two types:

-

Short Term Capital Gains (STCG)

If you sell your mutual fund units before the specified holding period, it falls under STCG. STCG of equity funds (if held for less than 12 months) is taxed at a rate of 20% with a cess tax. At the same time, STCG for other funds (if held for less than 24 months) is taxed as per the individual's income tax slabs.

-

Long Term Capital Gains (LTCG)

Your gains are considered as LTCG if you sell them after holding for a specified period. For equity mutual funds, the LTCG tax rate is 12.5% if gains exceed Rs 1.25 lakh in a year. For non-equity funds, LTCG is taxed at 20% with indexation benefits for units held over two years.

Other Key Factors of Capital Gains Tax

- Indexation Benefit- This benefit, which adjusts the purchase price for inflation to reduce taxable gains, has been removed for most mutual funds as of July 23, 2024.

- Exemption Limit- The limit is Rs 1.25 lakh on LTCG for equity-oriented funds. Gains over this limit are taxed at 12.5%. There are no exemptions for STCG or non-equity funds.

- Securities Transaction Tax (STT)- A tax of 0.001% is levied on the sale/redemption of equity-oriented funds.

- Mutual Fund Tax Loss Harvesting- You can use capital losses to reduce capital gains. If you still have losses after this, you can carry them forward for up to 8 years to offset future gains.

Pro Tip: Use a Tax Calculator to quickly estimate tax liability on your mutual fund gains.

Next, you will explore the holding period and the tax rates for capital gains tax.

Long-Term and Short-Term Capital Gains Tax on Mutual Funds

The tax rates for 2025 reflect the budget 2024 mutual fund tax changes, including increased tax rates and the removal of indexation benefits for most non-equity funds.

Holding Period of Long-Term vs Short-Term Capital Gains

This period varies by asset type and determines the classification of the gain.

| Fund Type (Asset Allocation) | Short-Term (STCG) Holding Period | Long-Term (LTCG) Holding Period |

|---|---|---|

| Equity-Oriented MFs (65% equity exposure) | 12 months or less | More than 12 months |

| Non-Equity / Debt MFs (acquired after Apr 1, 2023) | Any period (always STCG) | Not applicable |

| Hybrid, Gold, Intl. Funds (35–65% equity) | 24 months or less | More than 24 months |

Tax Rates for Long-Term vs Short-Term Capital Gains

The applicable tax rate depends on whether the gain is short-term or long-term and the specific asset class.

| Fund Type | STCG Tax Rate | LTCG Tax Rate | Key Exemptions & Benefits |

|---|---|---|---|

| Equity-Oriented MFs (≥65% equity) | 20% flat rate | 12.5% | Gains up to ₹1.25 lakh per financial year are exempt. No indexation. STT applicable on sale. |

| Debt MFs (acquired after Apr 1, 2023) | As per income tax slab rate | N/A | No indexation benefit and no LTCG classification. |

| Hybrid, Gold, Intl. Funds | As per income tax slab rate | 12.5% | No indexation benefit for sales after July 23, 2024. |

Also Read: Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

In the next part, you will learn the tax rates for different types of mutual funds.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Taxation of Capital Gains on Different Types of Mutual Funds

Taxation of capital gains on mutual funds is based on the fund's asset allocation, the holding period and recent changes from the July 2024 Union Budget. Here is the taxation of gains for different types of mutual funds:

Tax for Gains Provided by Equity Funds

- These mutual funds invest at least 65% in stocks.

- The STCG for these funds is taxed at 20% (held for 12 months or less). The LTCG is taxed at 12.5% if gains exceed Rs 1.25 lakh (held over 12 months).

- Gains below Rs 1.25 lakh are free from LTCG tax.

Taxation Provided by Debt Funds

- These funds primarily invest in fixed-income securities.

- STCG is taxed as per the income tax slab (held for 24 months or less).

- LTCG is taxed at 12.5% without indexation benefits (effective from FY 2024-25).

Taxation for Hybrid Fund Gains

- These funds allocate assets between equity and debt.

- If the fund allocates more than 65% in equity, it is taxed similarly to equity funds.

- If it has more debt exposure, it is treated as a debt fund for taxation.

Taxation for SIP (Systematic Investment Plan) Investments

- Each SIP instalment is treated as a separate investment for taxation.

- For SIPs in equity, LTCG is taxed at 12.5% on gains of more than 1.25 lakh and STCG is taxed at 20%.

- For SIPs in debt funds, any gains will be taxed based on the investor's income tax rate, no matter what the holding period is (effective FY 2024-25).

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Now the most crucial question is, "How to save on the taxes imposed on mutual fund investments?" Keep reading to know the strategies.

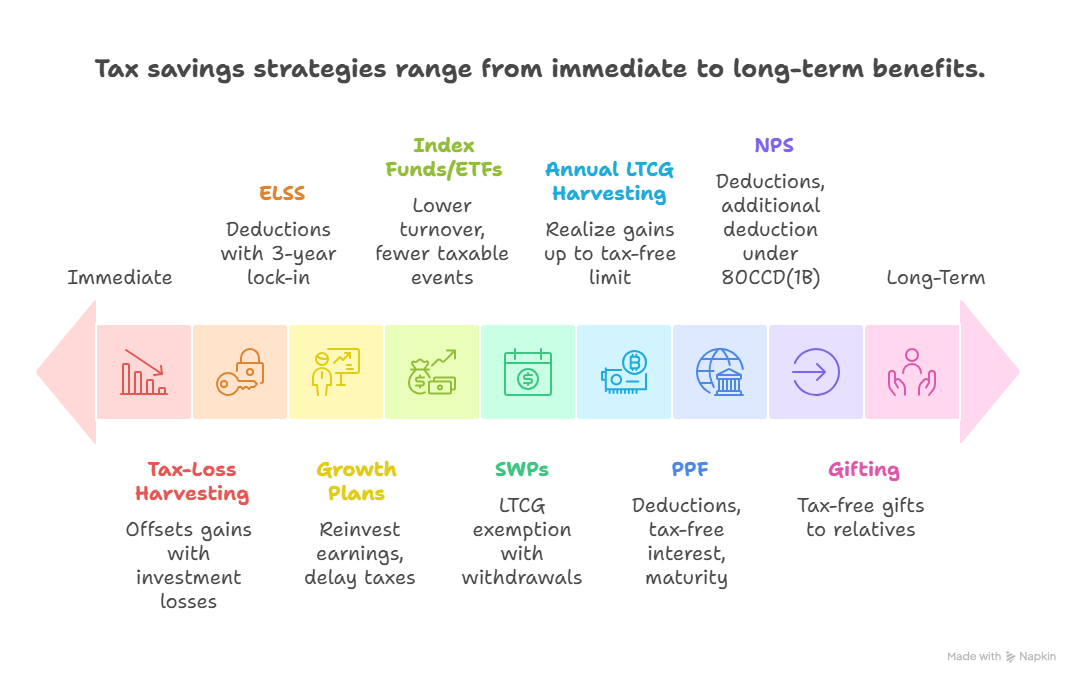

Tax Saving Strategies for Mutual Fund Investors in 2025

Here are the best strategies to enhance your tax savings in 2025:

Strategy 1: Choosing Tax-Efficient Mutual Funds

Choose the funds that provide several benefits against your tax liability. Here are some tax saving mutual fund options-

-

Equity-Linked Savings Schemes (ELSS)

Allows direct deduction up to Rs 1.5 lakh from your taxable income under Section 80C. They have a 3-year lock-in period.

-

Growth Plans

Allow you to reinvest your earnings and delay paying taxes until you redeem your fund units.

-

Index Funds and ETFs

The fund has lower portfolio turnover, resulting in fewer trades and capital gain distributions, leading to fewer taxable events for investors.

Strategy 2: Timing Your Investments for LTCG Benefits

This means holding your investment for the required holding period or more, which will directly reduce your tax liability. You can consider one of the given approaches-

-

SWPs (Systematic Withdrawal Plans)

With SWP, you can benefit from the annual LTCG exemption limit of Rs 1.25 lakh (for equity), just make sure that each withdrawal comes from long-term units.

-

Annual LTCG Harvesting

With this, you can sell fund units to realize gains up to the annual tax-free limit of Rs 1.25 lakh for equity funds. After that, you can reinvest your earnings.

Strategy 3: Tax-Loss Harvesting to Offset Gains

It is the practice of selling underperforming investments to realize a loss. This loss can help reduce taxes by offsetting profits from other successful investments. Things to keep in mind-

- Follow the offsetting rules of short-term and long-term capital losses.

- Carry your losses forward if your losses are greater than your gains.

- After selling a fund at a loss, buy a similar fund but not the same one and maintain your portfolio exposure.

Strategy 4: Investing Through Tax-Advantaged Accounts

Opt for other investment vehicles that offer several tax benefits and complement mutual fund strategies. The options include-

-

Public Provident Fund (PPF)

It offers deductions under Section 80C and is entirely tax-free on interest earned and maturity proceeds (EEE status).

-

National Pension System (NPS)

Besides Section 80C deductions, NPS allows an additional deduction of up to Rs 50,000 under Section 80CCD(1B), over and above the Rs 1.5 lakh limit.

Strategy 5: Utilizing Family Tax Planning for Savings

You can use tax rules about gifting and family situations to reduce your family's overall tax burden.

-

Gifting to Lower Tax Bracket Relatives

You can give mutual fund units as gifts to certain relatives, without any tax for the recipient.

-

Hindu Undivided Family (HUF)

If your family shares income, it is a good option, as it can claim deductions under Section 80C, 80D and more.

Now, let us understand the taxation on dividends in mutual funds.

Understanding the Dividend Distribution Tax in Mutual Funds

In India, the DDT (Dividend Distribution Tax) is no longer applicable. It has been abolished since April 1, 2020. Now, any dividends earned from mutual funds are taxed as regular income based on the investor's income tax slab rate.

Taxation of Mutual Fund Dividends in 2025

-

Investor's Tax Liability

Now, the tax burden has shifted to the investor receiving the dividend from the fund house because of DDT elimination. In 2025, the dividend is added to the investor's total income and taxed based on their personal tax slab.

-

TDS (Tax Deducted at Source)

In 2025, fund houses must take TDS from dividend payments made to resident investors. For FY 2024-25, if the total annual dividend amount is more than Rs 5000, a 10% TDS is deducted. From April 1, 2025, this TDS threshold has increased to Rs 10,000.

-

No Indexation Benefit

In 2025, dividends are considered income from other sources. Hence, they are not classified as capital gains, so you cannot use indexation benefits on them.

In the next part, you will learn about the recent changes made to the taxation system. So, keep scrolling to update yourself.

Recent Tax Changes and Budget 2024 Highlights

The Union Budget 2024 made some changes to how mutual funds are taxed, starting on July 23, 2024. The main highlights are higher tax rates on profits from equity funds, the removal of inflation adjustments for most non-equity funds and updated holding periods.

The recent changes in taxation that affect mutual fund investments are:

| Feature | Old Rule (Till July 22, 2024) | New Rule (From July 23, 2024) |

|---|---|---|

| Equity MF STCG Rate | 15% | 20% |

| Equity MF LTCG Rate | 10% | 12.5% |

| Equity MF LTCG Exemption | ₹1 Lakh per year | ₹1.25 Lakh per year |

| Indexation Benefit | Available for long-term debt/hybrid funds (pre-Apr 2023 investments) | Removed for all mutual funds |

| Holding Period (Non-Equity) | 36 months for LTCG | 24 months for LTCG (for specified hybrid funds) |

Apart from these, for debt fund taxation, the rules remain the same on or after April 1, 2023. At the same time, the dividend taxation rules are also unchanged.

Important: How to Calculate Tax On Mutual Fund Redemption?

Do not miss out on the list of mistakes investors and taxpayers commonly make. Read further.

Common Mistakes to Avoid in Mutual Fund Tax Planning

The following are the mistakes you should avoid while doing your tax planning:

- Do not wait till the last minute to plan taxes. Start early investments to benefit from best SIP

- Do not invest just for tax benefits. Do your research and choose funds that match your financial goals and risk endurance level.

- Understand all the rules imposed on the capital gains tax before you sell your investments to avoid unexpected situations.

- Go with the growth option instead of the dividend option for long-term wealth, as dividends get taxed immediately.

- Use tax-loss harvesting by selling underperforming funds to offset gains and carry forward any losses.

- Do not sell your mutual fund units too soon. Hold your investments for the specified period to avoid higher taxes.

- Do not invest in funds based on the advice of your friends or social media. Instead, consult a personalized financial advisor for better knowledge.

- Keep insurance separate from investments. Use term insurance for protection and mutual funds for building wealth.

To get the most out of your mutual fund investments and save on taxes, avoid these common mistakes.

Smart Investments, Bigger Returns

Conclusion

Wrapping up, if your 2025 goal is to invest smart and save more, the first move is to understand how tax on mutual funds works. For fulfilling your investment goals, make sure that you hold your investments for the right amount of time and use tax saving mutual funds (like ELSS funds) and tax-loss harvesting to boost your returns.

The only mistake you do not want to make for effective investment planning in 2025 is to choose a fund just for tax benefits. Always choose funds that fit your goals and risk level. Stay informed and plan well to grow your wealth in 2025.

Related Blogs:

1. Tax Rebate & Marginal Relief u/s 87A: Smart Tax Planning

2. Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

3. What is Tax Planning: Objectives, Types & Importance

FAQs

-

How to calculate capital gains tax for mutual funds?

Capital gains are taxed based on the holding period of an asset (STCG or LTCG), each with different tax rates and potential exemptions.

-

Do SIP investments affect the taxation on mutual funds?

Each SIP instalment is considered a separate investment for tax purposes, with the same LTCG and STCG rules applied.

-

How much tax is paid on mutual funds?

You pay 12.5% LTCG tax on mutual fund gains above Rs 1.25 lakh and 20% STCG tax or as per income tax slabs.

-

How to avoid taxes on mutual fund gains?

To avoid taxes on your investment gains, you should hold it for the long term, invest in ELSS, plan with SWP and use tax-loss harvesting.

-

What is the limit of the mutual fund tax-free?

The exemption limit of mutual fund (equity) investments is Rs 1.25 lakh per year on long-term gains.

_(1).webp&w=3840&q=75)

.webp&w=3840&q=75)