Table of Contents

- Quant Large and Mid Cap Fund-Growth

- Quant Large Cap Fund Regular - Growth

- Quant Flexi Cap Fund-Growth

- Quant Multi Asset Fund-Growth

- Quant Mid Cap Fund-Growth

The Quant Flexi cap, goal was to actively manage investors' money based on market conditions and opportunities. The primary goal of this fund is to generate consistent returns for investors. To begin this fund, let us learn more about what 3-year returns are and why you should always check the 3-year performance of any mutual fund scheme. Also, look at this fund's 3-year performance to see how well it performs.

Why should you always check the performance of funds for the 3 years?

This means that over a three-year period, poor performance in any given year significantly impacts the average yearly return of an investment. This is because the averaging process includes all three years. The argument is based on the notion that a one-year timeframe may not accurately reflect the true performance of a fund.

Let’s take an example to see if you invested your money 3 years back in Quant Flexi Cap what is the current return amount you get-

Certainly! If you invested Rs.1000 each month in Quant Flexi Cap through a Systematic Investment Plan (SIP) three years ago on December 18, 2020, your total investment would be Rs.36000.

The current value of your Investment is Rs.51,165.95, and you would have received the following annualized returns 24.2%

Total Investment- Rs.36000

Current Value- Rs.51,165.95

Annual Returns- 24.2%

Time period- 3 year

Earning more money is a good idea, especially when you look at the total amount you get from investments that grow over time. Choosing investments that offer better returns is like making a smart deal because it means you end up with more money in the long run.

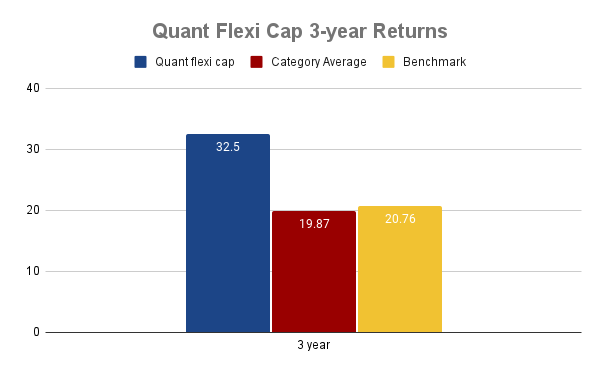

Now let’s delve into this fund's 3-year performance and see whether it is worth investing in Quant Flexi Cap or Not.

The fund’s robust 3-year return performance of 32.5% positions it as a standout player in the market. In comparison to its category peers, where the average return stands at 19.87%. this fund significantly outshines the completion. Additionally, when measured against the benchmark of 20.76%, the fund shows its strength by doing better than this benchmark as well. This shows that the fund is doing better than most other funds in the market, and it's a strong indication of its superior performance.

While pursuing better returns is appealing, it's crucial to acknowledge that higher returns often come with increased risks. Consider an example where a fund's performance may experience a downturn but recover in a short period-

In the past, the investment strategies of Quant Mutual Fund were characterized by a substantial allocation of funds into companies affiliated with the Adani Group. This particular investment approach resulted in noticeable fluctuations in returns over time. The presence of a significant portion of the fund's assets in Adani group companies contributed to both ups and downs in performance. Notably, there was a visible increase in the Net Asset Value (NAV) in the short term. Investors may find the fund to be a dynamic option with the potential for short-term gains, as reflected in the increased NAV. The fund may vary in risk, but if it recovers on time during a market downturn, it should be considered for investment and can outperform market volatility.

The fund's approach to risk management is key in determining how well it performs in volatile market circumstances. By analyzing the risk and return of the fund you can figure out whether this fund is suitable for your investment objective or not, this example serves as information to caution against making blind investments without thoroughly assessing the associated risks, returns, and overall fund performance

Conclusion

If you are seeking a long-term investment with the potential for better returns, you can choose this fund. The fund objective is to actively manage investors' money according to market situation and opportunity. Due to its extraordinary performance, it came into the limelight investors and many investors appreciated the performance, before investing you have to evaluate the risk of the fund, in this blog, you have seen, why we are examining the 3-year return of the fund, providing insights into its performance. Additionally, you'll find information on the 3-year returns of this fund and an illustrative example involving an Adani group company. What are you waiting for, Download the Mysiponline Application on your smartphone to experience the best expert advice, and you can start with a small amount, as SIP doesn't require a large sum of money.

Read More - What is the 8-4-3 rule of Mutual Funds?