Table of Contents

- What Is the 8-4-3 Investment Rule in SIP?

- 8 4 3 Rule of Compounding Example Explained

- How the 8-4-3 Rule Works in Practice?

- How You Can Use 8-4-3 SIP to Grow Rs 1 Crore Corpus in 15 Years?

- Strategies of 8-4-3 Rule to Get Maximum Interest / Returns

- The Advantages of the 8-4-3 Rule

- Using the Rule to Fit Your Needs

- To Conclude 8 4 3 Rule

Did you know that having the right strategy is just as important as picking the right Mutual Funds? But is there a rule you can follow? Yes, there is.

Have you heard of the 8-4-3 Rule for SIP? If not, it’s time to add this powerful strategy to your investment plan for better returns.

This approach is designed to help you build wealth effectively, harnessing the full potential of compounding over time.

Let’s break down what the 8-4-3 Rule is and how it can work wonders for growing your wealth steadily.

What Is the 8-4-3 Investment Rule in SIP?

The 8-4-3 rule in SIP is a compounding rule or guideline that supports the diversification of your mutual fund investments across different industries or sectors.

It works by allocating your mutual fund investments in a manner that contains various diversified fields. Here is how it allocates the investment money to various funds:

| Funds | Investment Ratio |

|---|---|

| Large-Cap Funds | 80% |

| Mid-Cap Funds | 40% |

| Small-Cap Funds | 30% |

Now, after seeing the above distribution, you might be thinking, that it sums up to 150%, this is a bit confusing, right?

Well, let me clear that for you. The percentages of the investment distribution are relative, not absolute. This is not about investing more than your 100% portfolio, but using these ratios to manage the distribution of your investments across diverse market securities.

The 8-4-3 compounding rule of mutual funds in SIP shows the potential of compounding in the long term, offering a clear route for the solid growth of returns.

Pro Tip: Map your financial future—use our SIP calculator for clarity.

8 4 3 Rule of Compounding Example Explained

Consider this scenario: if you invest, Rs. 500 per month in an Equity Mutual Fund through SIP for 4 years, assuming an average SIP return of 10%, your gains will amount to Rs. 5,606.

Now, if you decide to continue your SIP for an additional 2 years, your gains increase significantly to Rs. 13,465.

The difference in earnings between the first 4 years & the next 2 years is Rs. 7,859. This portrays the power of compounding. The longer you invest, the more compounding works in your favor, leading to greater returns over time.

It highlights the importance of staying invested for an extended period to make use of the full potential of compounding & maximizing your gains.

Must Read: Don't Underestimate The Power Of Compounding

Now, you might be wondering, “How do you actually use this rule?” So, let us look at the process of using this rule in your investment with an example.

How the 8-4-3 Rule Works in Practice?

Let us assume, you have Rs10,000 to invest in mutual funds. According to the 8-4-3 rule, your investment distribution could look something like this:

- Large-cap funds: Put approx Rs5,333, that is 80% of your money (8/15∗10,000).

- Mid-cap funds:Put approx Rs2,667, that is 40% of your money (4/15∗10,000).

- Small-cap funds:Put approx Rs2,000, that is 30% of your money (3/15∗10,000).

Here, the amount of money is distributed based on ratios 8:4:3 and it is not the percentage of your total amount of money.

Important Note: The 8-4-3 rule is a guideline, not a fixed law. Your actual investment should depend on your individual risk tolerance, investment goals and time duration.

Must Read: Best SIP Plans for 1 Year: Grow Your Money Fast

How You Can Use 8-4-3 SIP to Grow Rs 1 Crore Corpus in 15 Years?

To build a corpus of Rs 1 crore in 15 years, you can invest Rs 21,250 every month. With a reasonable return rate of 12%, Let's see how your investment will grow over time:

| Year | Beginning Balance | Monthly SIP | Money Invested | Interest Earned | Ending Balance |

|---|---|---|---|---|---|

| 1 | 0 | 21,250.00 | 2,55,000.00 | 2,48,253.19 | 2,69,503.19 |

| 2 | 2,69,503.19 | 21,250.00 | 2,55,000.00 | 2,82,432.94 | 5,73,186.13 |

| 3 | 5,73,186.13 | 21,250.00 | 2,55,000.00 | 3,20,947.54 | 9,15,383.67 |

| 4 | 9,15,383.67 | 21,250.00 | 2,55,000.00 | 3,64,346.75 | 13,00,980.42 |

| 5 | 13,00,980.42 | 21,250.00 | 2,55,000.00 | 4,13,250.07 | 17,35,480.48 |

| 6 | 17,35,480.48 | 21,250.00 | 2,55,000.00 | 4,68,355.55 | 22,25,086.04 |

| 7 | 22,25,086.04 | 21,250.00 | 2,55,000.00 | 5,30,449.79 | 27,76,785.83 |

| 8 | 27,76,785.83 | 21,250.00 | 2,55,000.00 | 6,00,419.14 | 33,98,454.97 |

| 9 | 33,98,454.97 | 21,250.00 | 2,55,000.00 | 6,79,262.34 | 40,98,967.31 |

| 10 | 40,98,967.31 | 21,250.00 | 2,55,000.00 | 7,68,104.84 | 48,88,322.15 |

| 11 | 48,88,322.15 | 21,250.00 | 2,55,000.00 | 8,68,214.79 | 57,77,786.94 |

| 12 | 57,77,786.94 | 21,250.00 | 2,55,000.00 | 9,81,021.19 | 67,80,058.14 |

| 13 | 67,80,058.14 | 21,250.00 | 2,55,000.00 | 11,08,134.27 | 79,09,442.40 |

| 14 | 79,09,442.40 | 21,250.00 | 2,55,000.00 | 12,51,368.46 | 91,82,060.86 |

| 15 | 91,82,060.86 | 21,250.00 | 2,55,000.00 | 14,12,768.33 | 1,06,16,079.20 |

Don’t Miss Out: How to Make 1 Crore from SIP of Rupee 5000?

Strategies of 8-4-3 Rule to Get Maximum Interest / Returns

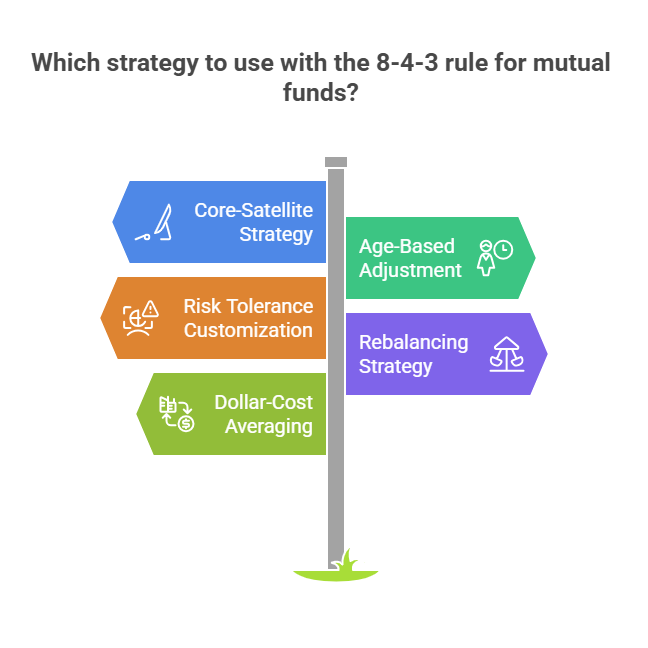

Let us look into the strategies you can utilize while using the 8-4-3 rule of mutual funds in SIP:

-

Core-Satellite Strategy

Start with the 8-4-3 rule for the main part of your portfolio to keep things stable. Then, you can add some smaller investments for higher returns or specific goals. Allows for more active management and customization.

-

Age-Based Adjustment Strategy

Change the rule based on how old you are and your investment timeline. If you are younger, you can take more risks. If you are older, you should focus on keeping your money safe. It aligns your portfolio with your changing risk tolerance and investment goals.

-

Risk Tolerance Customization Strategy

Change the 8-4-3 rule to fit how much risk you can tolerate. This way, your portfolio matches your comfort level, making it easier to stay calm and not make careless choices when the market turns down.

-

Rebalancing Strategy

Constantly, make sure to adjust your portfolio back to the 8-4-3 ratio or your personalized ratio to keep your investments in your control. It helps you maintain your desired risk level and potentially improve returns by selling high and buying low.

-

Dollar-Cost Averaging Entry Strategy

Use dollar-cost averaging to gradually invest in mutual funds according to the 8-4-3 rule. It reduces the risk of investing a large sum at the wrong time and helps you take advantage of market fluctuations.

Now, there must be a question roaming in your mind, “Why should you even consider using this rule?”

Well, let's see some benefits of 8 4 3 rule that will lead to your massive compounding growth with time.

The Advantages of the 8-4-3 Rule

Described below are some key benefits of using the 8-4-3 rule in your investment planning strategy:

- Diversification: It spreads risks associated with your investments in diverse funds or companies (including large, mid and small).

- Risk Management: You reduce your overall risk by allocating the biggest portion of your investment in large-cap stocks.

- Potential for Higher Returns: The small-cap has the potential for higher returns, although they contain some risks. This rule allows you to participate in this potential growth while still maintaining a relatively stable portfolio.

- Simplicity: It is easy to understand and apply even for new investors.

If you are curious about, “How to use 8 4 3 investment rule to fit your investment needs?” Then just keep reading to know how.

Using the Rule to Fit Your Needs

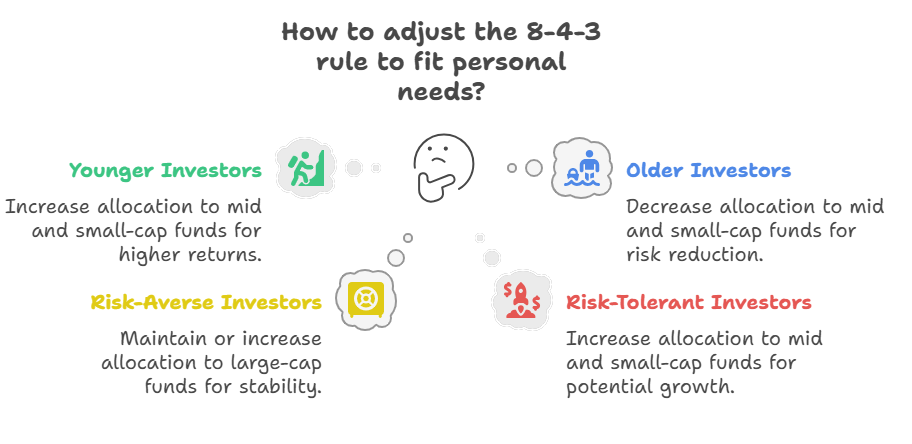

The 8-4-3 rule is not a one-size-fits-all solution. You can and should alter it to fit your conditions.

- Younger Investors: If you are young and have a long time horizon, you might consider increasing your allocation to mid and small-cap funds. You are capable of taking on more risk in exchange for higher returns.

- Older Investors: If you are closer to retirement, you might want to decrease your allocation to mid and small-cap funds and increase your allocation to large-cap funds. This will help protect your money & reduce your risk.

- Risk Tolerance: If you are naturally risk-averse, stick closer to the 8-4-3 rule or even increase your allocation to large-cap funds. If you are comfortable with more risk, you can expand your allocation to mid & small cap funds.

Pro Tip: While the 8-4-3 rule focuses on market capitalization, remember that diversification is about more than just that. Consider diversifying across asset classes, sectors and Geographic Regions.

To Conclude 8 4 3 Rule

In short, the 8-4-3 investment rule for SIP is a useful guideline for creating a balanced mutual fund portfolio for you in 2025. It is straightforward technique and can help you manage risks while pursuing growth. However, you need to think about your situation and adjust this rule according to your goals.

With some basic knowledge and a good investment plan, you can reach your financial goals with mutual funds. So, use this rule and start building your portfolio that suits you the best. You can also consider taking guidance from a financial advisor for customized advice.

FAQs

-

What is the 8-4-3 investment rule?

It is a simple guideline for spreading out your investments in mutual funds: put 80% in large-cap funds, 40% in mid-cap funds and 30% in small-cap funds. The aim is to keep a good mix of risk and growth.

-

What are the key requirements to follow the 8-4-3 rule?

You should understand market capitalization, pick the right funds and make sure to rebalance your portfolio from time to time to stick to the target.

-

Can market volatility affect the 8-4-3 rule?

Yes, changes in the market can throw your asset mix off track, so you might need to rebalance to stay in line with the 8-4-3 guideline.

-

Is the 8-4-3 rule applicable to all types of investments?

Not really. It’s mainly meant for mutual funds, especially equity funds based on their market size.

-

What is the 8-4-3 rule for SIP?

In a Systematic Investment Plan (SIP), it shows how compounding works and how your money could double over time.

-

What is the 8-4-3 rule of investing?

Just like we said before: it’s a way to diversify your mutual fund investments with 80% in large-cap, 40% in mid-cap, and 30% in small-cap funds.

-

What is the 8-4-3 rule of compounding?

It’s a straightforward way to see how your investment can double several times over due to compounding returns.

-

What are the strategies to get the maximum interest/returns?

Start investing early, keep at it consistently, spread out your investments, rebalance when needed and keep your risk level along time frame in mind.

-

Can I apply the 8-4-3 rule to a shorter investment period?

The 8-4-3 rule is less helpful for short-term investments. It’s more about showing potential for long-term growth.