There is a sharp spike in the fees of the colleges; thus it is a wakeup call for the parents who are willing to save for the higher education of their children. It’s high time for all the parents out there to realize the fact that this is indeed going to be an expensive affair. Thus, the right investment strategy is what you need!

Today’s story is aimed at those parents who are willing to save for their child’s education. But before getting started, let’s put some focus on the statistics that led us here!

Numbers Say it All

It is believed that a class of 2018 of IIT Ahmedabad will pay Rs 19.5 lakhs approximately for their two-year course. Going with the previous years' report, it is 400% times higher as that was in the year 2007. If the fees continue to rise by an average of 20% annually, it will cost around Rs 95 lakhs in 2025. Besides, this is just one stat.

The idea of sharing this instance is not to frighten you. It is to make you understand the importance of early financial planning. If you do not plan well, there are high chances for you to suffer from a rude shock.

Well, if you are wondering how to do that, then here are we, the experts at MySIPonline, with the answer!

The key Rules of Planning

- Set a goal amount you wish to accrue.

- Identify the same goal amount concerning years.

- Do a reverse calculation to estimate the amount you need to invest periodically to reach out to your goal.

- Do proper asset allocation from time to time.

- Include a fixed income asset in your portfolio that will give you steady investment experience and also equity assets that will provide you with the right growth experience in your investment.

How to Invest the Money?

It’s seen that parents who are saving with a view of child’s education often opt for the safest of all options, and this strategy is not at all wrong. On going with the fixed returns instruments such as FD and RD, you end up with a rough return of around 6-7%. Therefore, experts suggest you to also go for an instrument like equity which can give inflation-beating returns. It has been observed that over the extended period, equities deliver around 15% return. This can help you in achieving your goal within a given period.

A More Concrete Plan- Experts’ View

- If your child’s age is 1-5 years and investment horizon 10-18 years

Start early to accrue the benefit of the power of compounding. Increase your investments as your income goes up and invest largely in growing assets, typically equity funds. Equity fund is best for you if your risk appetite is high, or else you can invest in balanced and hybrid funds in case you don’t want to expose yourself to high volatility. - If your child’s age is 6-12 years and investment horizon 5-9 years

Other than early investing, you can invest a lump sum amount in the hybrid fund if you have a sudden cash inflow. Prefer investing in equity or balanced funds if you can stomach high risk. You can even go for MIPs if you want medium-risk exposure. - If your child’s age is 13-18 years and investment horizon 1-4 years

Gradually shift your money out of equity. You can put your money in debt funds or go for RD to prevent your capital. If you face a shortfall, don’t dip into your retirement savings. Instead, it is better to take a student education loan. If you wish to make investments, go for MIPs in mutual funds that are less risky. Short-term debt funds can also be a good option for investors falling in this category.

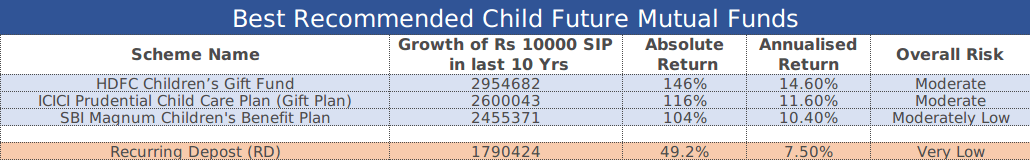

Recommendation: Best Child Future Plans

Lastly, if you’re still unclear about your plans and are willing to seek expert’s suggestion in this regards, connect with us at MySIPonline and wave goodbye to all your concerns related to your child’s higher education. To initiate an investment, you just need to create a smart savings account with us. We will be more than happy to serve you!

.webp&w=3840&q=75)