Table of Contents

Did you know? The Mirae Asset has made the history in 1998 by becoming the first Asset management company of South Korea to provide investors an incredible option of mutual funds.

A Mutual Funds has also open the door to invest in consumption funds that’s where the Mirae Asset Great Consumer Fund comes in with its outstanding performance, a well-rounded portfolio and strong downside protection. As a leading thematic fund, it concentrates on the important and powerful Indian FMCG (fast moving consumer goods) market.

If you had invested a monthly SIP of Rs.10000 over the past 10 years then now you would have grown a corpus of 35 lakhs with an annualized SIP returns of 21.04%. Build your desired corpus with this Mirae Asset Consumer Fund.

Is Mirae Asset Great Consumer Fund Performed Good?

This consumer sector mutual fund has given its best since inception with a compound annual growth rate (CAGR) of 18.86%. Let’s see the SIP returns performance of this equity fund.

Mirae Asset Great Consumer Fund has an amazing Asset under management (AUM) of Rs. 4,230.85 crores, giving a remarkable SIP annualized return of 35.22% over the past 3 years, and outperforming its peers by 23.51% against the benchmark index.

In the past 5 years of this thematic fund gives 29.67% and outperforms its benchmark index of 22.1% this shows the fund has an ability to generate high return for your quality portfolio. Let’s just simplify with an example if you had invested Rs.3000 over the past 5 year then your now your investment worth would be of Rs. 3,66,218.

Wondering How Your SIP Can Grow ? Try the SIP Calculator and Find Out

How Mirae Asset Great Consumer Fund Distributes its Asset Classes?

Portfolio Allocation

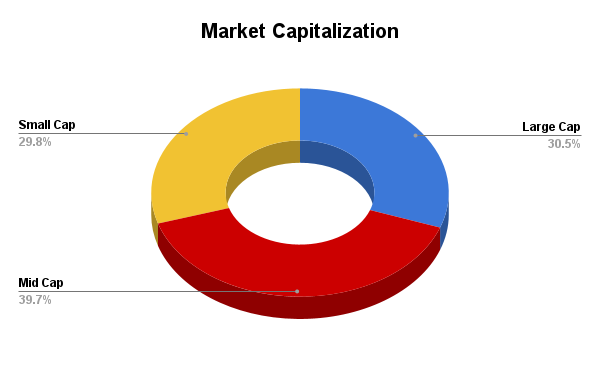

The Mirae Asset Great Consumer Fund has shown a specific allocation across various rang of market cap with 30.5% of its portfolio is in large cap stocks, 39.7% is in mid cap stock, the small cap stocks have a 29.8%. By applying a diversified strategy, the fund may benefit from the stability and growth of large cap companies, and also capitalizing on the dynamic opportunities offer by the mid and small cap companies. It will allow to establish this consumer sector fund even in the market fluctuations.

Sector Allocation

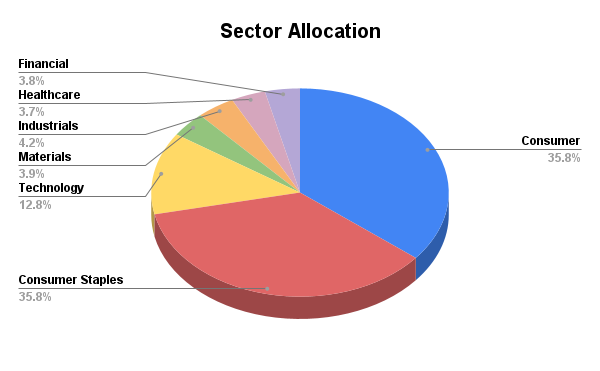

The Mirae Asset Great Consumer mainly focused on invest on those companies which stand to benefits from increased consumer spending and changing consumption pattern in India, this fund showcases a sector allocation of 34.06% invested in consumer discretionary which involves Maruti Suzuki, Trent, Titan, TATA Motors etc.

In consumer staples it invested 34.09%, such example of this are ITC, Hindustan Unilever, United Spritis, Britannia Ind, to gain the benefits from both cyclical and non-cyclical. It can take advantage from these two this opportunity brought about by chance in consumer spending habits.

However, the allocation of 12.15% is in technology sectors which includes Bharti Airtel, Zomato, this shows an importance of tech innovation enhancing consumer experiences.

Some other sector allocation is in materials of 3.7%, industrials has 3.95%, healthcare 3.56% and financial has 3.62% to offer stability and growth potential across various economic conditions. This fund aim is to not only diversified its portfolio in top consumer companies but also reduce risk for better growth potential, and making it attractive option for investors.

Is Mirae Asset Great Consumer Fund Risky?

Risk Analysis

| Risk Measures | Ratio |

|---|---|

| Alpha | 5.03 |

| Beta | 0.85 |

| Sharpe Ratio | 1.26 |

| Standard Deviation | 12.58 |

A well balanced strategy is adopted by the Mirae Asset Great Consumer Fund, which aims to manage risk while generating consistent returns, so when we look at the Sharpe Ratio of 1.26%, we can see that it has the capacity to deliver an amazing return for a certain level of risk, and the standard deviation of 12.58% shows that the funds volatility is modest. It also outperformed its benchmark with an Alpha of 5.03%, showing that effective management could result in high returns, and a 0.85% beta shows that the is less volatile that the broader market, making it an excellent choice for the investors throughout the market ups and downs.

Is Mirae Asset Great Consumer Fund Meant for Your Mutual Fund Portfolio?

This consumer scheme of Mirae Asset Mutual Funds is best suited for the investor who are looking for opportunities in the consumer sector thorough a combination of large mid and small cap companies, it also suited for those who are searching for stability as well as consistent development, but who can also tolerate a bit more risk.

This fund is an excellent choice for investors who invest with an SIP (systematic investment plan) and also trust the long term growth of the FMCG sector with its focus on the sector experiencing some volatility. Just make sure that it helps spread out risk by being line with your overall investment plan.

Also Read : ICICI Prudential Bharat Consumption Fund: Delivered 30.34% Annualised SIP Returns

.webp&w=3840&q=75)