Table of Contents

- SIP Returns of ICICI Prudential Bharat Consumption Fund

- What Is the Risk Level of ICICI Prudential Bharat Consumption Fund?

- How Has ICICI Prudential Bharat Consumption Fund Diversified Its Portfolio?

- What Is the Stock Quality of ICICI Bharat Consumption Fund?

- Is ICICI Prudential Bharat Consumption Fund Suitable for You?

The ICICI Prudential Bharat Consumption Fund is an equity mutual fund launched on April 9, 2019. It invests in Indian companies that benefit from increasing consumer spending, such as those in consumer goods, retail, and e-commerce. It manages Rs. 2,433.87 crores in assets and has provided strong annual returns of 22.50% over the past three years. Let’s see how SIP in this fund makes it a good option for investors interested in India's growing consumer market.

SIP Returns of ICICI Prudential Bharat Consumption Fund

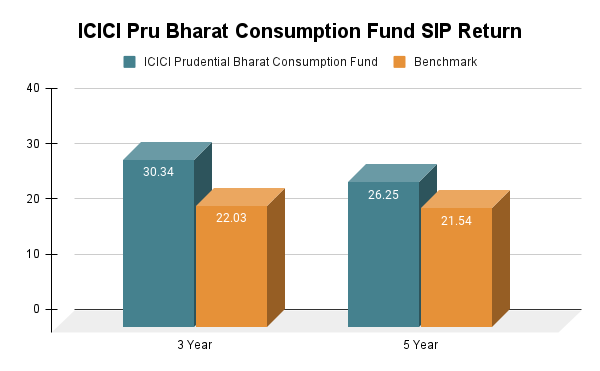

The ICICI Prudential Bharat Consumption Fund has shown strong performance recently while maintaining a low-risk portfolio Over the 3-year period, the ICICI Prudential Bharat Consumption SIP returns have reached an impressive with 30.34%, significantly outperforming its benchmark of 22.03% during the same time frame. It just shows a clear indication that the fund has been able to generate superior returns for its investors even in challenging market environments.

While looking at the longer 5 year period, the fund SIP returns continue to impress, reaching at 26.25%. This is also higher than the benchmark returns of 21.54% over the same 5 year timeframe. This consistent ability to outshine its benchmark shows the manager's ability to understand the Indian consumer market and identify attractive investment opportunities.

Here's a simple example: If you had invested Rs. 3,000 monthly for 3 years, your total investment would amount to Rs. 1,80,000. At the end of the period, the current value of your investment would be Rs. 3,29,608. If you want to calculate your own SIP returns, you can use an SIP Calculator to estimate the potential growth of your investments.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

What Is the Risk Level of ICICI Prudential Bharat Consumption Fund?

Risk Highlights of the ICICI Prudential Bharat Consumption Fund:

| SD | Sharpe Ratio | Alpha | Max Drawdown in 3 Years |

|---|---|---|---|

| 10.31% | 1.59 | 7.33 | -5.85% |

-

Effective Risk Management

- The ICICI Consumption Growth Fund risk management is commendable, as evidenced by its low standard deviation and stable returns.

- This allows the fund to provide attractive returns while managing risk effectively.

-

Low-Risk Profile

- The ICICI Prudential Bharat Fund is suitable for low-risk investors due to its low volatility.

- The strong Sharpe and alpha ratios demonstrate an excellent risk-to-reward profile.

-

Impressive Outperformance

- This consumer sector fund has generated a significant alpha of 7.33, indicating it has strongly outperformed the broader market (Nifty 500).

-

Consistent and Stable Performance

- The ICICI Consumption Fund has had very small declines from its highest to lowest points over the past three years, showcasing its stability.

- The low standard deviation of 10.31 reflects the fund's consistent performance and low volatility.

The ICICI Prudential Bharat Consumption Fund is ideal for low-risk investors, providing a good balance of risk and reward with steady returns and strong performance.

How Has ICICI Prudential Bharat Consumption Fund Diversified Its Portfolio?

Let’s see how ICICI Prudential Bharat Consumption Fund Allocate its portfolio:

- The ICICI Consumption sector fund maintains a Diversified portfolio across equities of 89.18%, debt is 1%, commodities is 3.50%, and cash at 6.10% to provide flexibility and respond to market changes.

- The majority of equity allocation that is 75.91% is in large-cap stocks, which provides stability and reliability.

- Meaningful allocation to mid-cap stocks of 15.93% for potential higher growth.

- Small allocation to small-cap stocks of 8.16% to add variety.

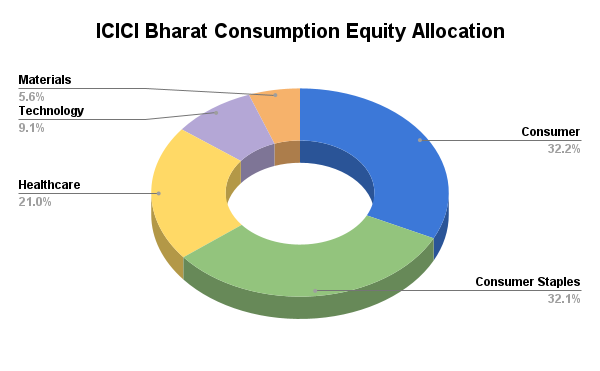

If we talk about Sector Allocation then:

- The fund mainly invests in Consumer Discretionary 26.04%, Consumer Staples 25.92%, and Healthcare 16.99%, which are sectors that meet everyday needs and healthcare needs.

- It also invests in Technology 7.31% and Materials 4.51% to add variety to its investments.

The fund's investment strategy is well-diversified and careful with a focus on stability and development in the consumer and healthcare sectors.

What Is the Stock Quality of ICICI Bharat Consumption Fund?

| Fundamental Ratio | Value |

|---|---|

| Sales Growth | 15.25% |

| Earning Growth | 22.36% |

| PE Valuations | 34.64% |

| Cash Flow Growth | 30.25% |

- High-Quality Holdings: The IPBCF mutual fund invests in stocks with strong sales and earnings growth. Its PE ratio of 34.64% is a bit higher than the category average of 31, which shows higher valuations.

- Strong Growth Metrics: The India Consumption Sector Funds shows impressive growth with a 15.25% sales increase, 22.36% earnings growth, and 30.25% cash flow growth.

- Active Management: With a high turnover ratio of 138%, the fund manager actively adjusts the portfolio by buying and selling stocks.

- Balanced Approach: The fund's higher valuation reflects its focus on high-quality, growth-oriented companies, which are priced at a premium.

Overall, this shows the fund performance but also higher valuation compared to some peers.

Is ICICI Prudential Bharat Consumption Fund Suitable for You?

This fund is an excellent choice for investors seeking low risk and high returns. It has delivered impressive SIP returns and created substantial wealth due to the skillful management of its team of fund managers and analysts.

With a balanced approach to portfolio management, the fund remains safe amidst high market valuations while being poised to capitalize on market downturns.

It focuses on risk management and is well-suited for long-term investors who are interested in capital appreciation from India’s consumption growth, especially those with a high risk tolerance and a minimum investment horizon of five years. ICICI Mutual funds expertise in managing sectoral funds adds to its credibility.

Read More Latest Blogs

1. ABSL Manufacturing Equity Fund: 46% Annualized SIP Returns

.webp&w=3840&q=75)