Table of Contents

- What are Mid Cap Mutual Funds?

- Listing the Best Mid Cap Mutual Funds for 2026 in India

- Analysing the Performance of the Best Mid Cap Mutual Funds

- How to Choose the Best Mid Cap Fund for Your 2026 Portfolio?

- Benefits of Investing in the Best Mid Cap Mutual Funds in 2026

- Key Considerations Before Investing in Mid Cap Mutual Funds

- How Risky Investments are in Mid Cap Mutual Funds in 2026?

- Who Should Invest in the Best Mid Cap Mutual Funds in 2026?

- Conclusion

Do you remember when mid-cap stocks got too expensive in 2024 and everyone was chasing 40%+ returns? Then in 2025, prices suddenly dropped, creating great opportunities for the Mid Cap Mutual Funds in India as we head into 2026.

According to the experts, 2026 is looking like a promising year for mid-cap stocks, with PEG ratios below 1, consistent benchmark outperformance and the AUM rising from Rs 904 billion in 2020 to Rs 4.34 lakh crore in 2025. Analysts have also forecasted over 15% earnings growth in FY27.

Are you also planning to grow in 2026 by investing in mid cap mutual funds, but do not know which funds are best to invest in? Well, you are at the right place. This guide gives you the list of the best performing mid cap mutual funds for 2026 in India, with their performance analysis and strategies to build wealth in 2026. So what are you waiting for? Dive in to unlock the potential of these funds.

What are Mid Cap Mutual Funds?

Mid Cap Mutual Funds are Equity Mutual Funds that primarily invest in the stocks of the mid-sized companies. According to SEBI's guidelines, these companies are ranked between 101-250, based on their full market capitalization, with market caps ranging from Rs 5,000 crore to Rs 20,000 crore in India. They offer a balance between growth potential and stability. These are equity-oriented schemes that are required to allocate at least 65% of their assets to mid-cap stocks.

Why are These Mid Cap Funds Attracting Attention in 2026?

These Mutual Funds are gaining interest in 2026 because of their improved prices after drops in 2025. Investors' expectations of strong growth are high for mid-cap companies.

The expectations are due to better growth potential, appealing valuations and a history of strong performance during recovery periods. The funds have also grown their AUM from Rs 904 billion in 2020 to Rs 4.34 trillion in 2025, showing that these funds can give steady inflows and consistent outstanding performance in 2026.

Now, let us look at the list of top mid cap mutual funds for 2026.

Listing the Best Mid Cap Mutual Funds for 2026 in India

The following is the list of the best performing mid cap mutual funds in India that are good options for investments in 2026.

| Fund Name | Launch Date | AUM (in cr) | Expense Ratio | Fund Manager |

|---|---|---|---|---|

| Edelweiss Mid Cap Fund | 26-12-2007 | ₹13,197 | 0.40% | Dhruv Bhatia |

| HDFC Mid Cap Fund | 25-06-2007 | ₹92,137 | 0.71% | Chirag Setalvad |

| HSBC Midcap Fund | 09-08-2004 | ₹12,549 | 0.64% | Mayank Chaturvedi |

| Invesco India MidCap Fund | 19-04-2007 | ₹9,978 | 0.54% | Aditya Khemani |

| ICICI Pru MidCap Fund | 10-10-2004 | ₹7,056 | 1.03% | Lalit Kumar |

| Kotak Midcap Fund | 30-03-2007 | ₹60,467 | 0.37% | Atul Bhole |

| Mahindra Manulife Mid Cap Fund | 05-01-2018 | ₹4,259 | 0.45% | Krishna Sanghavi |

| Motilal Oswal Midcap Fund | 02-02-2014 | ₹37,984 | 0.73% | Swapnil P Mayekar |

| Nippon India Growth Mid Cap Fund | 05-10-1995 | ₹42,009 | 0.73% | Divya Dutt Sharma |

| Quant MidCap Fund | 26-02-2001 | ₹8,383 | 0.77% | Sameer Kate |

Must Read: Top 10 Mutual Funds for SIP in 2026: Best Picks to Grow Wealth

Next, let us analyse how these top funds performed in the market.

Analysing the Performance of the Best Mid Cap Mutual Funds

Mid Cap Mutual Funds have given a fantastic performance over long-term periods by outperforming large cap funds. Many funds also beat their benchmarks in the last year. However, in 2025, these mutual funds have seen some ups and downs in performance, partly because valuations are returning to more normal levels.

Here is an analysis of the best mid cap funds listed above:

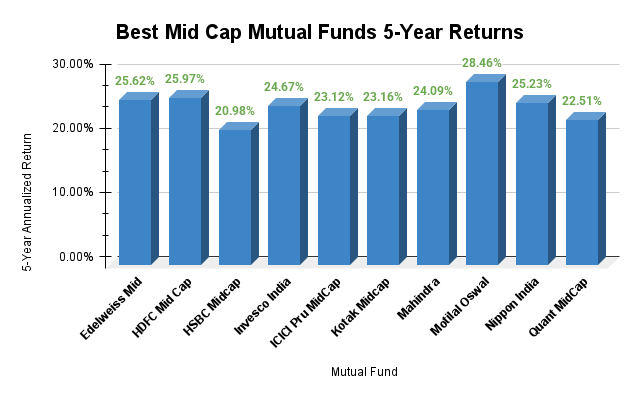

Based on 5-year Returns:

All of the top 10 mid cap funds for 2026 have delivered impressive returns ranging from 20%-28% over 5 years. For this period, Motilal Oswal Midcap Fund leads with 28.46% returns, nearly 3% ahead of the next best. HDFC and Edelweiss funds are right there too, both hanging around 25-26%, proving consistency pays. Look at the graph below that compares the best mid cap mutual funds last 5 years return:

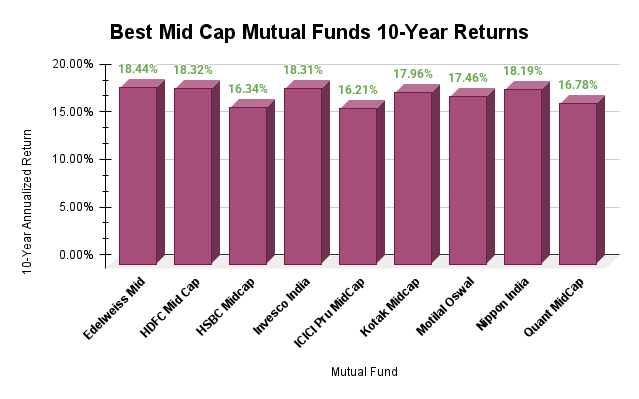

Based on 10-year Returns:

For the last 10 years, all 10 mid cap funds have given returns ranging from 16%-18%, which takes the 10-year returns average to 17.5%, outperforming fixed deposits and most large cap funds. For this period, Edelweiss Mid Cap Fund tops at 18.44% returns, followed by HDFC, Invesco and Nippon India Funds that are all above 18%. Refer to the graph below that compares the best mid cap mutual funds last 10 years return:

Note: This graph compares only 9 funds because the 10-year returns for the Mahindra Manulife Mid Cap Fund are not specified.

In the next heading, let us know how you can choose the best mid cap fund for yourself in 2026.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Choose the Best Mid Cap Fund for Your 2026 Portfolio?

Here is a detailed process of selecting the best mid cap mutual fund that goes best with your 2026 portfolio:

Step 1: Clear your investment goals, risk comfortability and investment horizon first.

Step 2: Look for a fund that suits your portfolio. Look for a fund that has been consistent across different market cycles.

Step 3: Check the risk-adjusted performance metrics of the fund.

Step 4: Evaluate the fund manager's track record, experience, strategy and expertise.

Step 5: Check the costs related to the fund, like expense ratio and exit load. Go with direct plans for lower charges.

Step 6: Review the portfolio of the fund and check the diversification of the fund.

Step 7: If the fund aligns with your requirements and goals, choose an investment method and place your investment. You can invest in the best SIP plans of the fund or do a lump sum, according to your financial condition.

Pro Tip: Use a SIP Calculator and estimate the future returns of your SIP investment easily.

Let us move on to explore the benefits of placing an investment in mid caps in 2026.

Benefits of Investing in the Best Mid Cap Mutual Funds in 2026

The following are the benefits you can get by investing in a mid cap mutual fund in 2026:

- Mid-cap companies have high growth potential. They are growing quickly and can expand faster than large-cap companies.

- After 2025 market corrections, the valuations of mid-cap stocks have become more reasonable, improving the risk-reward balance in 2026.

- These funds provide a balance between the stability of the large-cap funds and the higher volatility of small-cap funds.

- These mutual funds invest across various sectors, providing broad diversification for your portfolio.

- Analysts expect mid-cap companies to see strong earnings growth of over 10% in FY2027, giving a good growth chance to investors.

- These funds are handled by experienced managers who are responsible for your growth in the 2026 market cycles.

- Mid-cap funds can be a big help in your long-term wealth creation. Historically, they have also outperformed large-caps over time.

Also Read: Top Performing Equity Mutual Funds 2026: Highest Return Picks

Let us understand the factors to consider before placing your money in these funds in the next part.

Key Considerations Before Investing in Mid Cap Mutual Funds

Here are the main factors that are important to check before you start your investments in the best mid cap mutual funds in 2026:

-

Risk Profile

These funds are risker than large-cap funds but have less risk than small-caps.

-

Investment Horizon

The funds are best for a long-term investment horizon, that is, 5-10 years or more.

-

Manager's Expertise

The fund's success heavily relies on the fund manager's skill in identifying promising companies.

-

Liquidity Risks

The mid-cap stocks are less liquid than large-cap stocks, making it difficult to buy or sell shares quickly.

-

Diversification

Ensure that the mid-cap fund you have chosen is a part of a well-diversified portfolio that also includes other asset classes.

-

Consistency

Check if the fund delivers consistent performance over longer periods or not.

-

Tax Implications

Understand the tax rules for short-term and long-term capital gains related to the fund.

Now, let us analyse how risky these funds are for your 2026 portfolio.

How Risky Investments are in Mid Cap Mutual Funds in 2026?

In 2026, mid cap mutual fund investments may carry a moderate to high risk profile. They are more risky than large-caps but less than small-caps. The following are the main risk factors for 2026 investments:

-

Market Volatility

Mid-caps can have large price fluctuations due to market changes, which is why experts suggest stable investments like SIP in 2026.

-

Economic Sensitivity

Mid-sized companies are more vulnerable to economic downturns than large and established firms.

-

Liquidity

Mid-cap stocks are less liquid than others, making it harder to buy or sell them quickly without impacting the prices.

-

Valuation Concerns

Although the fund's valuations have decreased after the 2025 corrections, some stocks still sell for more than large-cap stocks.

-

Business-Specific Risks

Mid-cap companies are not well-established as large-cap companies and they may have problems with management quality or competition.

For managing these risks in mid cap mutual fund investments, you need to have a long-term investment horizon, a well-diversified portfolio and a disciplined investing approach, such as SIP.

Pro Tip: Use a Step-up SIP calculator to estimate your growing investments for faster wealth growth.

Lastly, let us know who should invest in these funds and if you are in the same category.

Who Should Invest in the Best Mid Cap Mutual Funds in 2026?

In 2026, investments in the best mid cap mutual funds can be ideal for the following investor profiles:

- Investors with a high-risk tolerance and market volatility.

- Those who are willing to invest for the long term (more than 5-10 years).

- Investors whose primary goal is growth over time.

- Individuals who want to diversify their portfolio in 2026.

- Individuals who are committed to making regular contributions via SIPs.

Pro Tip: Use a Mutual Fund Screener to filter and compare mutual funds for investments.

Smart Investments, Bigger Returns

Conclusion

To conclude, the best mid cap mutual funds are the most suitable option for growing wealth in 2026 if your goal is high growth with long-term investment horizon.

Even though they struggled a little in 2025, they can make a quick comeback in 2026 with better valuations, AUM and earnings over time. Pairing them with SIP, a 7+ year horizon and smart diversification can do the magic in 2026.

Related Blogs:

- Top 5 Mutual Funds for Lumpsum Investment 2026: Expert Picks

- Best Small Cap Mutual Funds for Long Term Investment in 2025

FAQs

-

Which mid cap fund is best for SIP in 2026?

HDFC Mid Cap Fund is one of the best options with consistent 25.97% 5Y returns, a low 0.75% expense ratio and a proven record.

-

What is the minimum investment for mid cap funds?

For mid cap mutual funds, the minimum SIP amount is Rs 100-500 and the minimum lump sum amount is Rs 1000-5000.

-

What are the mid cap fund taxation rules in 2026?

Its long-term gains are taxed at 12.5% (held for more than a year) if cross Rs 1.25 lakh and short-term gains at 20% (held less than a year).

-

Which mid cap fund beat Nifty Midcap 150 in 2025?

Despite the 2025 corrections, 8 out of 10 funds outperformed the index and the toppers were Motilal Oswal, Invesco and Kotak.

-

Can beginners invest in mid cap mutual funds?

Yes, beginners can invest in these funds, but only 20% of their portfolio. It is recommended to invest via SIP with a more than 7-year horizon.

.webp&w=3840&q=75)

.webp&w=3840&q=75)