Table of Contents

- What are Equity Mutual Funds?

- Top Performing Equity Mutual Funds in India for 2026: Performance Comparison

- Overview of the Top Equity Mutual Funds

- Factors to Consider Before Investing in an Equity Mutual Fund

- How to Choose the Best Equity Mutual Fund in 2026?

- Benefits of Investing in Equity Mutual Funds Through SIP

- Conclusion

With the Nifty reaching 29,120 by December, experts are calling 2026 a year of Indian Equities, with the economy growing at 7-8%. It is your time to hit the right spot, because 2026 can bring a twist in your investment world, too.

So, what are you waiting for? Start investing in the top performing equity mutual funds in India now, which have delivered both stability and growth over time and can also help you in your wealth creation in 2026.

But the best equity investment in 2026 requires something more than a top-performer list. So, dive into this post that will not only list the top equity mutual funds for you, but will also tell you the benefits of these equity funds, along with the process of choosing the best one for yourself in 2026. Let us unlock your growth.

Buy Digital Gold Online Safely and Start Your Gold Journey at Just ₹100 now

What are Equity Mutual Funds?

Equity Mutual Funds are the investment instruments in India that primarily invest in stocks or equities of publicly traded companies. These Mutual Funds aim to provide long-term capital by investing in a diversified portfolio, but come with higher risks. The fund managers are the ones who will make investment decisions on your behalf for the investments in equity funds, ensuring your growth over time.

In India, SEBI mandates investors to allocate at least 65% of their money to equity and equity-related investments. These funds offer diversification across various sectors and market capitalisations.

There are basically seven types of equity funds based on the market cap:

- Large Cap Funds- These are less risky than other equity funds and invest in large companies with a strong track record.

- Mid Cap Funds- These funds focus on medium-sized companies.

- Small Cap Funds-They invest in small companies and give the highest returns, but also carry the highest risk.

- Multi or Flexi Cap Fund-They allow a dynamic allocation of assets across large, mid and small market caps as per the market condition.

- Sector Funds-Invest in a particular industry or sector only.

- Thematic Funds-Similar to sector funds, but focus on large themes like green energy or infrastructure.

- Growth/Value Funds- Target companies that are expected to grow faster than average. Value funds look for companies that are undervalued.

Now, let us look at the list of the top equity funds in India for 2026.

Top Performing Equity Mutual Funds in India for 2026: Performance Comparison

Here are the top performing equity mutual funds in India with their 3 and 5 years SIP returns that are best for your 2026 portfolio:

| Fund Name | Category | Expense Ratio | 3 Yrs SIP Returns | 5 Yrs SIP Returns |

|---|---|---|---|---|

| Bandhan Small Cap Fund | Equity: Small Cap | 0.42% | 22.72% | 23.03% |

| Invesco India Mid Cap Fund | Equity: Mid Cap | 0.54% | 25.33% | 23.51% |

| ICICI Pru Large & MidCap Fund | Equity: Large & Mid Cap | 0.77% | 18.71% | 20.41% |

| Nippon India Multi Cap Fund | Equity: Multi Cap | 0.71% | 16.55% | 20.18% |

| ICICI Pru India Opportunities Fund | Equity: Thematic - Others | 0.65% | 19.84% | 22.04% |

According to the SIP returns, these funds have so much better in the 5-year time period as compared to the 3 years, which shows that the equity mutual funds work best for long-term growth and investing through SIP can boost this growth with easy investments.

Pro Tip: Use an XIRR calculator to measure true SIP returns with irregular cash flows.

Next, let us look at the details of the top equity funds for 2026.

Best Mutual Funds for 2026 Backed by Expert Research

Here is the detailed analysis of each of the funds listed above for your informed investments in 2026:

1. Bandhan Small Cap Fund

Launched on February 8, 2020, by Bandhan Mutual Fund, it is a scheme that has taken its AUM to Rs 18,125 Crore. It has delivered impressive returns over time, beating its benchmark.

Under Manish Gunwani (since 2023), the fund runs on the GARP (Growth at Reasonable Price) approach and has a disciplined investment style with effective risk management.

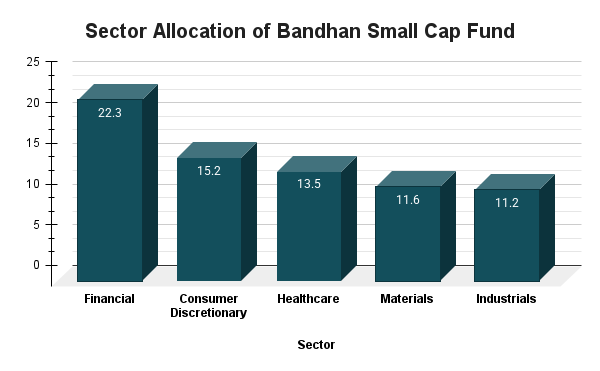

The fund provides a lump sum investment at Rs 1000 (min) and SIP at Rs 100 only. The fund invests most in small-cap (68.81%), followed by large-cap (9.63%) and mid-cap (8.68%). Look at the graph below for its top 5 sector allocations:

2. Invesco India Mid Cap Fund

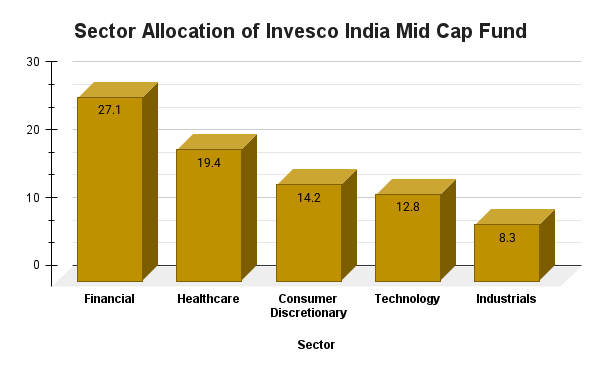

This fund, by Invesco Mutual Fund, focuses on the long-term appreciation and grows of the potential of the mid-cap companies (101-250 by market cap). Aditya Khemani, the fund manager, and his team employ a research-driven process to build a portfolio (around 40-60 stocks), often in the top 5 sectors shown in the graph:

The fund allows SIP investments starting from Rs 500 and a lump sum of Rs 1000 (minimum). The fund was launched on April 19, 2007, and has an AUM of Rs 9,978 crore. Most of the fund investments are made in mid caps (65.36%) with a bit of exposure to small caps (19.38%) and large caps (13.27%).

3. ICICI Pru Large & MidCap Fund

With an AUM of Rs 26,918 crore, this fund by ICICI Prudential Mutual Fund has the following market cap allocation:

| Market Cap | Value |

|---|---|

| Large Cap | 43.25% |

| Mid Cap | 39.6% |

| Small Cap | 11.82% |

The fund was introduced on July 9, 1998, and runs on the investment strategy of primarily investing in a diversified portfolio of equity and equity-related securities of both large and mid-cap companies, aiming to generate long-term wealth. The fund allows SIP with a minimum amount of Rs 100 and a lump sum of Rs 5000.

The fund manager, Ihab Dalwai, has diversified the fund's allocations across the following top 5 sectors:

4. Nippon India Multi Cap Fund

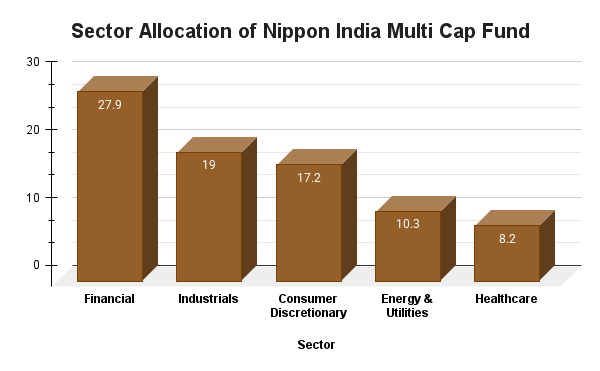

Nippon India Mutual Fund launched this multi-cap scheme on March 25, 2005, and now it runs under the guidance of Divya Dutt Sharma. She has taken the AUM of the fund to Rs 49,314 crore with an investment strategy offering long-term growth by investing a minimum of 25% in each market cap, large, mid and small. The fund manager can adjust the allocation based on the market conditions.

As of November 30, 2025, the fund has 47.51% assets in large cap, 25.31% in small cap and 25.7% in mid cap. The minimum SIP amount of the fund is Rs 500 and a minimum lump sum is Rs 1000. The top 5 sector allocation of the fund is shown in the graph below:

5. ICICI Pru India Opportunities Fund

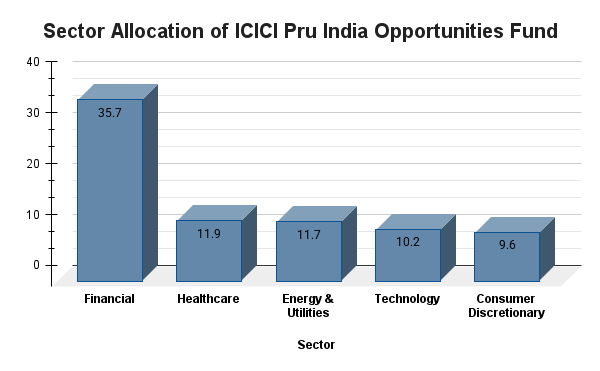

Launched on January 5, 2019, the fund has an AUM of Rs 33,907 crore. The following graph shows the top 5 sector allocation of the fund:

It allows a Rs 100 minimum SIP and a Rs 5000 or more lump sum. Managed by Divya Jain, this fund by ICICI Prudential Mutual Fund has the following market cap allocation:

| Market Cap | Value |

|---|---|

| Large Cap | 70.76% |

| Mid Cap | 12.89% |

| Small Cap | 9.95% |

This mutual fund aims to achieve growth over time by focusing its investments on unique events and temporary challenges affecting companies, sectors or themes in the Indian equity market. The goal is to find companies that may not be popular right now but have strong long-term potential.

Must Read: Best Small Cap Mutual Funds for Long Term Investment in 2025

In the next heading, let us see the factors that are crucial to know before investing in these funds.

Factors to Consider Before Investing in an Equity Mutual Fund

The following are the main factors to consider before placing an investment in the best mutual funds in India:

Personal Investment Alignment Factors

- Knowing your financial goals and investment objectives.

- Understand your risk tolerance and its alignment with the chosen fund.

- The time duration you want to invest regularly or investment horizon (for the SIP method only).

Factors to Evaluate the Fund

- Fund performance and consistency over various timeframes and across different market conditions.

- Check the fund manager's experience, track record, tenure with the fund and investment style.

- Check the costs associated with the fund, like expense ratio, exit load, etc. Go for a fund with a lower expense ratio for higher returns.

- Review the portfolio composition and diversification of the fund.

Practical Considerations

- Tax Rules- Long-term gains (held for over a year) of these funds are taxed at 10% on gains above Rs 1 lakh and short-term gains (sold in a year) are at 15%.

- Liquidity- Most of the equity funds are liquid, but tax-saving funds, like ELSS (Equity Linked Savings Schemes), have a lock-in period (3 years). So, check before you invest.

- SIP (Systematic Investment Plan)- SIP is the best option for investing in equity funds for both new and experienced investors, as it reduces market risk with rupee cost averaging.

- Advice from Experts-If you are confused about where and how much you should invest, consider taking advice from a certified financial expert.

Let us discuss how you can choose the best equity fund for your investment in 2026.

Start Your SIP TodayLet your money work for you with the best SIP plans.

How to Choose the Best Equity Mutual Fund in 2026?

For choosing the best equity mutual fund in 2026, only a top-performer list is not enough. Here are the things you should do:

- Match categories with your goals, risk appetite and horizon instead of directly looking for a fund.

- After deciding on the category, look for a fund within the category that goes best with your goals.

- Analyse how the fund performed when the market was taking a downturn and an upturn.

- Check the sector allocation and see if the fund has an exposure to high-growth sectors that are set as ideal sectors for 2026 trends.

- Evaluate the cost associated with the selected fund, like expense ratio, tax implications, etc.

- Once you have selected a fund that fulfills your every need, the suggestion is to use SIP for disciplined and automated investing.

Pro Tip: Use a CAGR calculator to measure mutual fund growth accurately over time.

Let us explore the benefits of investing in equity funds through SIP in the next part.

Benefits of Investing in Equity Mutual Funds Through SIP

The following are the benefits you will get by investing in an equity mutual fund through SIP in 2026:

1. Financial Discipline

SIP allows you to set up an automated and regular investment system (like a monthly investment). This ensures that you consistently contribute to your financial goals.

2. Rupee Cost Averaging

It is the biggest benefit of SIP investments, especially in volatile markets. With this, you can buy more units in the low market values and fewer in the high market values, with the same amount.

3. Power of Compounding

Compounding allows you to reinvest the returns you made from your SIP investments. The power of compounding works like magic when you start an SIP early and maintain it for the long term.

4. Reduces Emotional Biases

SIPs automate your investments, which means you keep investing no matter what the market is doing. By doing this, you avoid emotional traps and stick to your long-term investment plan.

5. Flexibility and Affordability

You can start SIP with only Rs 100-500 per month in most of the funds and can also increase, decrease, pause or stop your SIP anytime you want based on your financial situation.

Also Read: 3 Best Performing Flexi Cap Mutual Funds: Expert Picks for 2026

Lastly, let us compare equity funds with other mutual funds and see how they are different from them.

Smart Investments, Bigger Returns

Conclusion

To conclude, equity mutual funds can be an excellent choice for investors with a long-term investment perspective and high risk tolerance. Starting an SIP in these mutual funds in 2026 can boost the growth potential.

Some of the top performing equity mutual funds are Bandhan Small Cap Fund, Invesco India Mid Cap Fund, ICICI Pru Large & MidCap Fund, etc. You can choose one from the list and create wealth in 2026.

Related Blogs:

- Top 10 Mutual Funds for SIP in 2025: Best Picks to Grow Wealth

- Best Debt Mutual Funds in 2026 for Stable and Safe Returns

- Top 10 Hybrid Mutual Funds: Perfect for Your 2026 Portfolio

FAQs

-

Which equity funds give the highest returns in 2026?

Small-cap funds give the highest returns as they have generated 25-30% amid GDP growth, outperforming large-caps at 15-20%.

-

Are small-cap equity funds better than large-cap for 2026?

Small-caps offer higher 25%+ returns than large caps but very high risk and you can allocate 20-30% for higher growth.

-

What are the risks of top performing equity funds?

Equity funds risk includes market risk, volatility risk, concentration risk, liquidity risk, fund manager risk, high fees, etc.

-

What is the minimum investment for equity mutual funds?

Most equity funds allow Rs 100-500 SIP and Rs 1,000 lump sum. There is no upper limit and it is ideal for salaried investors building 2026 portfolios.

-

Can beginners invest in high-return equity mutual funds in 2026?

Beginners can consider using aggressive hybrid blends or flexible funds for a moderate investment in 2026.

.webp&w=3840&q=75)

.webp&w=3840&q=75)

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)