Table of Contents

Best Retirement Mutual Funds is important for ensuring long term financial stability and wealth creation. In 2024, several mutual funds stand out for offering consistent performance, a solid retirement corpus, and the power of compounding. This fund that you rely on for retirement is designed to help you with your financial stability. Let's explore these top funds to see which ones are best suited for your retirement goals

Top SIP Retirement Mutual Funds

| Fund Name | Launch Date | AUM (crores) | Since Inception |

|---|---|---|---|

| HDFC Retirement Savings Fund- Equity Plan | 07-02-2016 | 5,554.68 | 20.9% |

| ICICI Prudential Retirement Fund- Pure Equity Plan | 21-02-2019 | 870.85 | 23.99% |

| NIPPON INDIA RETIREMENT FUND – Wealth Creation Scheme | 11-02-2015 | 3,325 | 11.68% |

| TATA RETIREMENT SAVINGS FUND – Progressive Plan | 01-11-2011 | 2,002.73 | 15.77% |

| ICICI Prudential Retirement Fund – Hybrid Aggressive Fund | 21-02-2019 | 546.95 | 19.54% |

-

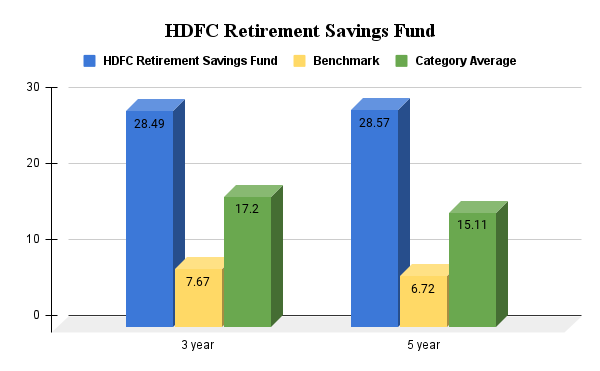

HDFC Retirement Savings Fund – Equity Plan

HDFC Retirement Savings Fund, launched on February 7, 2016, has shown impressive performance. If you had invested Rs. 3,000 monthly over 5 years, your total investment would have been Rs. 1,80,000. As of now, this investment would be valued at Rs. 3,56,371, with an SIP return of 28.57% annualised return, remarkably outperforming its benchmark return of 6.72% and the category average of 15.11%.

The Equity Plan is ideal for investors who are looking to invest for the long term 15 to 20 years and can handle moderate to high levels of risk. This type of fund can experience significant fluctuations in the market, leading to both potential gains and losses.

-

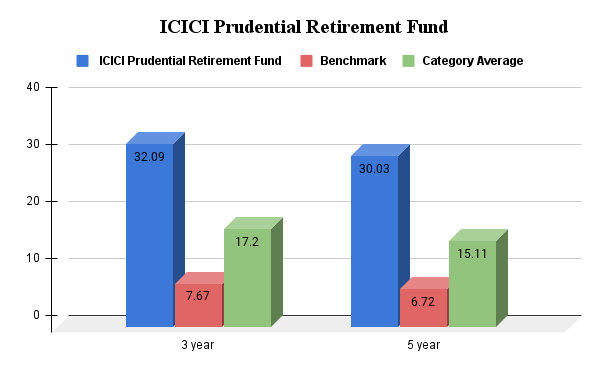

ICICI Prudential Retirement Fund – Pure Equity Plan

The ICICI Prudential Retirement Fund was launched on February 1, 2019. Over the past 5 years, it has shown strong performance. For example, if you had invested Rs. 3,000 monthly, your total investment of Rs. 1,80,000 would now be worth Rs. 3,68,606, with an SIP return of 30.03%, ICICI Pru Retirement fund is outperforming its benchmark and category average of 6.72% and 15.11%.

This Pure Equity fund is best for investors who are comfortable with high risk as the fund performance might see higher volatility compared to its average return. and want to invest for more than 7 years. It focuses on growing your retirement savings by investing in stocks.

Ready to Watch Your Money Grow? Try the SIP Calculator Now

-

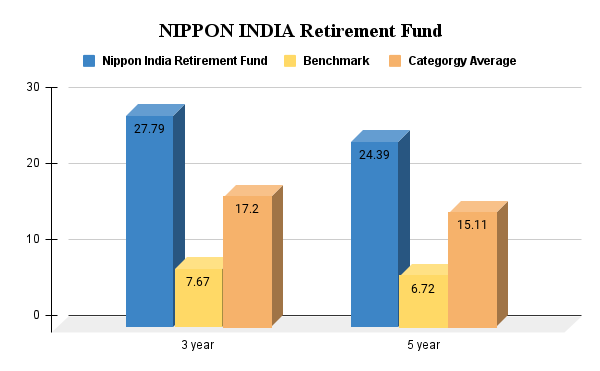

Nippon India Retirement Fund - WEALTH CREATION SCHEME

The Nippon India Retirement Fund, launched on February 11, 2015, has provided strong long-term returns. Over the past 3 years, the SIP return has been 27.79%, and over 5 years, it's been 24.39%, both outperforming its benchmarks and the category average. To give you an example of potential growth, if you had invested a regular monthly amount of Rs.3000 for the full 5 years, your investment would now be worth around Rs. 3,23,419.

The standard deviation reflects the volatility of the fund so this fund is of medium risk level investors who want to invest for a minimum of seven to ten years can choose the Nippon India Retirement Fund Scheme.

-

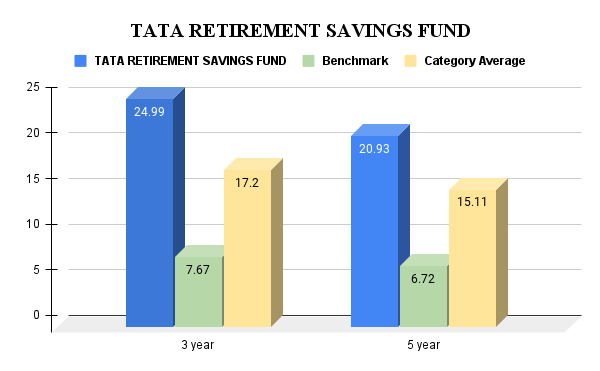

Tata Retirement Savings Fund - PROGRESSIVE PLAN

This fund was launched on November 1, 2011. This fund has been a strong performer for long-term investors looking to build their retirement corpus. If you had invested Rs. 3,000 per month through a SIP over the past 5 years, your investment would now be worth around Rs. 2,98,222.

This is an impressive result! TATA Retirement fund has delivered an impressive 5-year SIP return of 20.93%, remarkably outperforming its benchmark return of 6.72%. this fund is a combination of strong absolute returns.

This Mutual Fund is perfect for those who are okay with a little risk and wish to invest for a period of five to seven years. Because of the low standard deviation, the fund offers modest returns to assist you in achieving your retirement objectives.

-

ICICI Prudential Retirement Fund – Hybrid Aggressive Fund

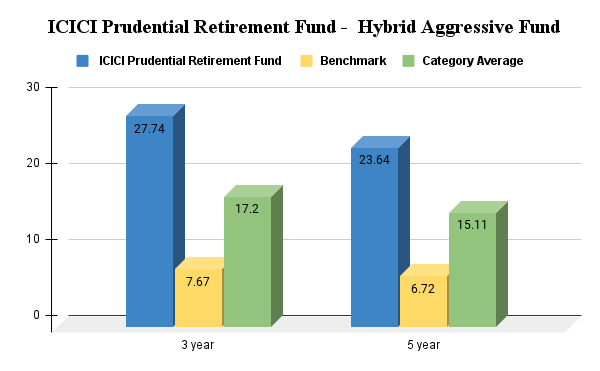

Since its introduction on February 21, 2019, the ICICI Prudential Retirement Fund - Hybrid Aggressive Fund has performed well for investors growing their retirement assets. The fund outperforms both its benchmark and the average return of funds of a similar kind during a three- and five-year period, respectively, with SIP returns of 27.74% and 23.64%.

For example, your investment would be about Rs. 3,17,776 currently if you had contributed Rs. 3,000 a month through a SIP in this fund for five years. For those who can tolerate a moderate level of risk and plan to invest for a minimum of five to seven years, the fund is a suitable option. By making investments in a variety of stocks, bonds, and other assets, it seeks to offer consistent returns and long-term growth.

What SIP Amount is Required for Retirement Based on Your Current Monthly Expenses?

This question is common among investors, so let’s look at it with a simple example:

For example, if you’re currently 28 years old and plan to retire at 60 with a life expectancy of 80 years, and your current monthly expenses are Rs. 25,000, here's how it works:

With an expected return on investment of 12% and an inflation rate of 7%, your annual expenses at retirement would be Rs. 26,14,584. To cover this, you would need a retirement corpus of Rs. 3,40,83,064. To achieve this amount, you should start an SIP of Rs. 7,558.

Bullet Points:

- Balance Growth and Income: Choose funds that offer both steady income and growth.

- Top Funds: Consider HDFC, ICICI Prudential, Nippon India, and TATA Retirement funds.

- SIP Returns: High returns are key for growing your retirement savings.

- Investment Strategy: Match funds to your risk tolerance and investment period.

- Calculate SIP: Determine the SIP amount needed based on current expenses and future goals.

.webp&w=3840&q=75)

_(1).webp&w=3840&q=75)