Table of Contents

5 SIP Plans that have shown great success and created wealth with more than 16% annualised returns on mutual fund investment, these Best SIP plans may protect your financial future if you invest with discipline over time.

It's also good for retirement planning, protecting your child's future, and more. SIP plans provide various options for investing to meet your financial objectives and risk tolerance. By investing consistently in these high-performing SIPs, you can build a solid financial foundation for your future requirements.

5 Best SIPs Plan to Invest in 2024

-

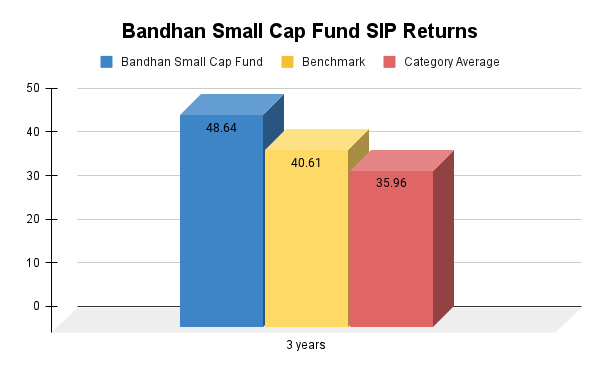

Bandhan Small Cap Fund

The Bandhan Small Cap Fund is doing really well, its 3 year SIP annualised return is 48.64%, and it also outperforms both its category average and benchmark index. The fund's strategy of buy hold with value investing approaches has shown to be effective because its earnings growth of 21.44% indicates that the companies within this fund are making good profits, which is a positive sign for future returns.

For example, if you had invested Rs. 3,000 every month for 3 years, your total investment of Rs. 1,08,000 would have grown to Rs. 2,04,096, which indicates the fund's potential to build significant long-term wealth, possibly this amount is enough to pay your child’s university fees.

-

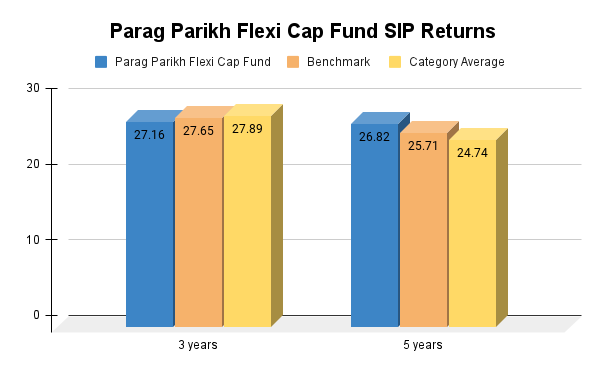

Parag Parikh Flexi Cap Fund

The Parag Parikh Flexi Cap fund has delivered strong performance 3 years and 5 years SIP annualised returns are 27.16% and 26.82%, these returns are slightly close to its benchmark and category average.

The fund PE ratio is 16.55% and it also follows a bottom up investment strategy. Parag Parikh combines growth and value investing with a buy and hold approach, with a focus on long term returns rather than consistent income.

Let’s understand with an example, if you had invested in this fund of Rs. 3000 over the past 10 years then your total invested amount would be Rs. 3,60,000, and your current value would be Rs. 10,71,319. This growth will help you to save for your retirement.

-

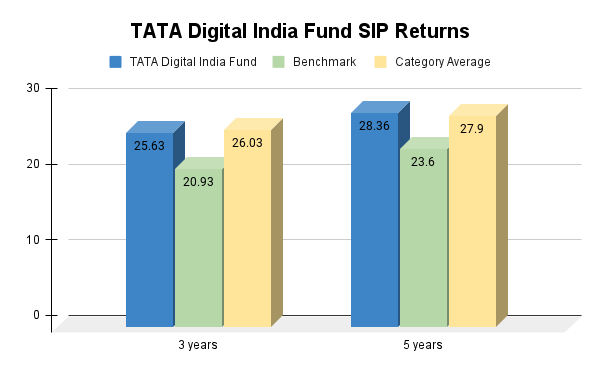

TATA Digital India Fund

This fund has a proven track record as it delivered an impressive SIP annualised return over the past 3 and 5 years of 25.63% and 28.36% beating both its benchmark and category average. At least 80% of the fund's investments are made in large-cap equities in the IT industry. TATA digital India Fund is suitable for long-term investors looking for stable returns, the fund is an ideal option because it continuously shows minimal volatility and excellent liquidity.

If we understand it with an example, over the past 5 years if you had invested Rs.3000 in this fund then your invested amount would be 1,80,000 and your recent value would be worth Rs. 3,61,959. Maybe this amount would be contributed when purchasing your house.

-

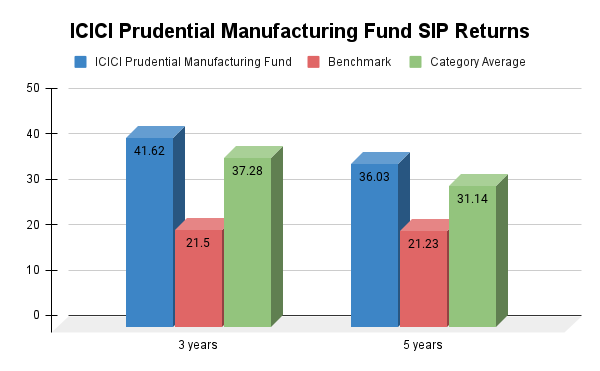

ICICI Prudential Manufacturing Fund

ICICI Prudential Manufacturing Fund has shown an amazing SIP annualised return of 3 years is 41.62% and 5 years is 36.03% both outperformed their category average but underperformed the benchmark index over the same period. The PE ratio of this fund is 23.59%, which makes investments in high-profile businesses, mostly in the metals and mining, automotive, and capital goods industries. ICICI Prudential Manufacturing Fund uses bottom up strategy and value investing.

Let’s get a clear understanding with an example, if you had invested Rs.3000 over the past 5 years every month, then your total investment amount would be Rs. 1,80,000, and your current value would be Rs. 4,24,914. This value may be a wonderful addition to your or another big event.

-

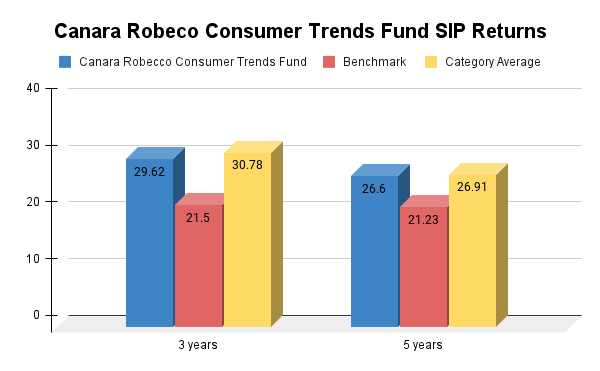

Canara Robeco Consumer Trends Fund

The fund has delivered a strong SIP annualised return of 29.62% over 3 years and 5 years of 26.6%. It underperforms its category average and benchmark index in both periods, but has the potential to actively manage strong businesses and capitalize on the economy. Canara Robeco Consumer Trends Fund also has 16.87% revenue growth and uses a bottom-up, buy-and-hold strategy along with quality management.

For example, if you had invested monthly in this fund over the 10 years then your invested amount would be Rs. 3,60,000, and your current value is Rs. 10,19,491. You might be able to pay off debts and loans with this amount.

Advantages of Investing Through SIP in Mutual Funds?

Here are some benefits SIP offers while investing in Mutual Funds:

-

Rupee Cost Averaging

The rupee cost averaging is an investing method where you make regular and fixed amounts of investments no matter what is the condition of market. This also helps you balance out your purchasing cost over time even when the price is low and fewer when it is high. This will reduce the cost of your assets over time, also mitigate the market volatility.

-

Easy Investment Option

A SIP mutual fund managed by experts that provides an easy-to-invest choice; you may begin with a small amount and grow it over time. It will also give diversification, which helps to lessen the risk in your investing portfolio.

-

Power of Compounding

Compounding power is the ability of your mutual fund investment returns to grow on their own over time. The profit of reinvestment in mutual funds allows you to increase your investment more quickly over time and grow your wealth if you start investing early.

-

The Creation of Wealth

Over time, mutual funds may be a successful plan for building wealth. You may diversify your investment risk as well as outperform inflation by creating a diverse portfolio. Through time the consistency of investment can help you generate significant wealth, especially with growth oriented funds.

-

To Reach Your Financial Objectives

Investing in mutual funds can help you in reaching your financial goals, such as retirement planning, home ownership, or supporting your child's education. To match your investments with your goals and risk tolerance, you may create a plan that will help you reach your objectives in a systematic and disciplined manner.

Final Statement

To conclude, SIP investing is a wise choice for securing your family's financial future. The funds we have discussed show how consistent, systematic investing may eventually result in significant gains. You may take advantage of compounding, control risk with diversification, and slowly make money by starting early and continuing with it. SIPs offer an effective path to achieving your financial objectives, whether you're saving for retirement, purchasing a home, or making plans for your child's education.

Read Our Latest Blogs on Mutual funds SIPs

1. Why People Hesitate to Invest in Mutual Funds

_(1).webp&w=3840&q=75)