Table of Contents

If you are ready to turn your investment habits into a wealthy corpus of Rs.1 Crore, you need prerequisites like disciplined investing, good growth potential and Mutual Funds with at least 12-14% CAGR returns where volatility remains medium, while keeping good long-term patience to keep your portfolio balanced.

Let’s explore the best investment plan with which you can easily create a wealth of more than 1 Crores.

We will break down the investment into 4 easy steps while suggesting different categories to make your portfolio solid.

Step 1: Investing in Large and Mid Cap Funds

Firstly, you need to invest Rs.1500 in a large and mid cap fund. In this category, there are mainly quality and stable growth companies, which will give stable earnings to your portfolio.

The top 2 Large and Mid Cap Mutual Funds are:

ICICI Prudential Large and Mid Cap Fund

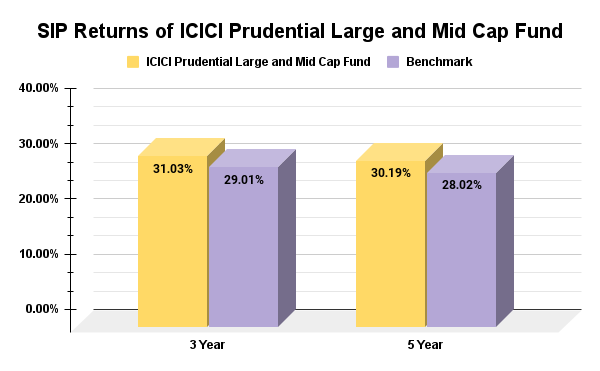

After the launch of the ICICI Prudential Large Cap fund in 1998, it has delivered impressive 31.03% and 30.19% annualised returns in the last 3 and 5 years respectively.

If you started a SIP of Rs.3000, 5 years ago, you would have spent a total of Rs1,80,000 and had made it worth Rs.3,69,900 today’s date.

Let’s look at the graph for the SIP returns:

Bandhan Core Equity Fund

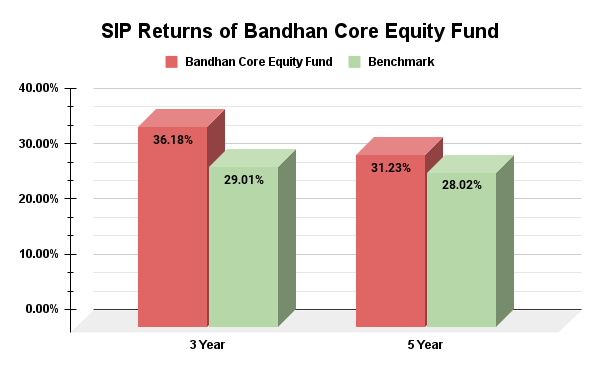

Being introduced on 9th August 2005, the Bandhan Core Equity Fund has given high returns of 36.18% SIP annualised returns in 3 years. The good news is the minimum SIP investments in it are starting at just Rs.100.

Let’s say you started a SIP of Rs.3000 in this fund 10 years ago, your total investment amount would be Rs.3,60,000 and had made a whopping investment worth Rs.10,22,000 to date.

Learn the SIP returns from the below graph:

Step 2: Investing in Small Cap Funds

Secondly, you have to invest Rs.1500 in a small cap fund; this will generate high returns for your portfolio.

The top 2 Small Cap Mutual Funds are:

Bandhan Small Cap Fund

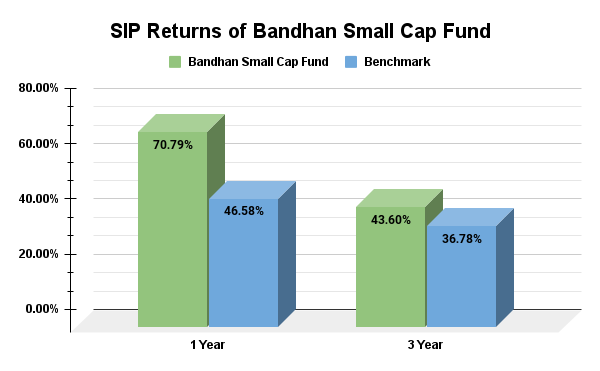

Since starting on February 25, 2020, the Bandhan Small Cap Fund made a record-breaking 70.79% annualized SIP return in just one year. It uses a top-down approach to pick quality stocks and has a low SIP requirement of just Rs.100, making it easy for investors to start. With its strong management and potential for growth, this fund could be a big wealth builder in the future.

- 100% Paperless

- No Transaction Charges

- Easy to Invest

- Safe & Secure

Now let’s check the graph for SIP returns:

Quant Small Cap Fund

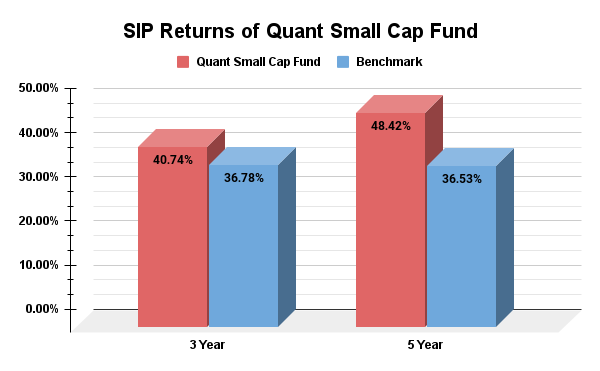

The Quant Small Cap Fund has delivered strong returns, averaging 40.74% annually over 3 years and 48.42% over 5 years, with consistent gains above 20%. Managed by Sandeep Tondan, the fund's strategy involves buying and selling small-cap stocks at the right times, using predictive analysis to spot opportunities. It has kept a minimum SIP of just Rs1000 for its investors.

Let’s Check the SIP returns from the below graph:

Step 3: Investing in Multi Asset Allocation Funds

Next, you have to invest Rs.1000 in a multi asset allocation fund. This category has investments in equity as well as bonds and gold investments. This will help in keeping your portfolio safe and will make higher returns than FD. It can be useful in unplanned emergencies.

The best Performer in Multi Asset Mutual Funds is:

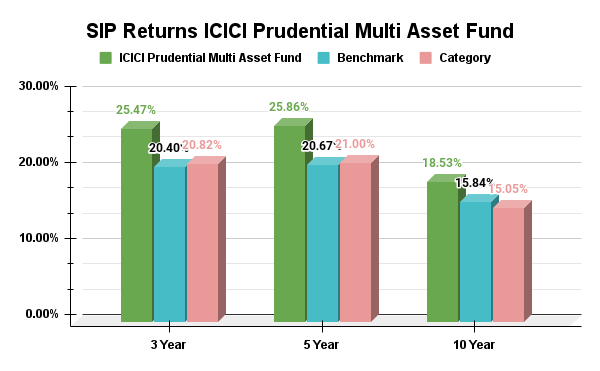

ICICI Prudential Multi Asset Fund

The ICICI Prudential Multi Asset Fund, launched on April 11, 2007, manages Rs.41,159.52 crores in assets. Over the past 5 and 3 years, it has consistently delivered strong returns of 25.86% and 25.47%, outperforming its benchmark.

Currently, the fund is well-positioned to handle high market valuations and take advantage of any market drops. For a bright outlook, you can start an early SIP at just Rs.500.

Check the graph below for SIP returns:

Step 4: Investing in Thematic Mutual Funds

Lastly, you have to invest Rs.1000 in two funds of any trending theme that will quickly make high returns for your portfolio.

Right now, two major themes trending in the mutual fund industry, manufacturing and IT funds.

2 Best Performing Manufacturing Mutual Funds are:

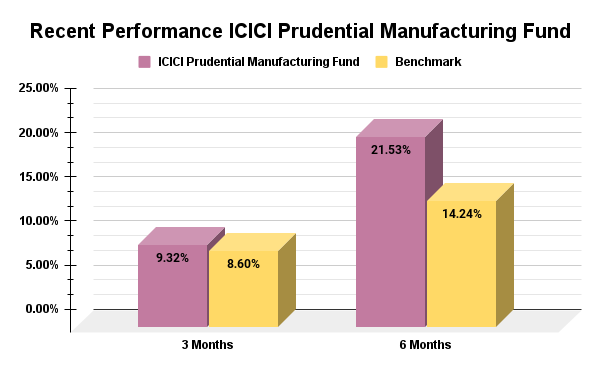

ICICI Prudential Manufacturing Fund

Launched in 2018, the ICICI Prudential Manufacturing Fund has delivered a strong 29.35% annual return over 5 years. Managed by Anish Tawakley, who has 26+ years of experience, the fund has performed consistently well. All it takes to begin investing is 500 rupees.

For example, a SIP of Rs.3,000 since inception would have turned Rs.2,13,000 into Rs.5,25,588 today. Starting a SIP with Rs.500 could be a simple step toward building wealth.

Check the below graph to track the performance:

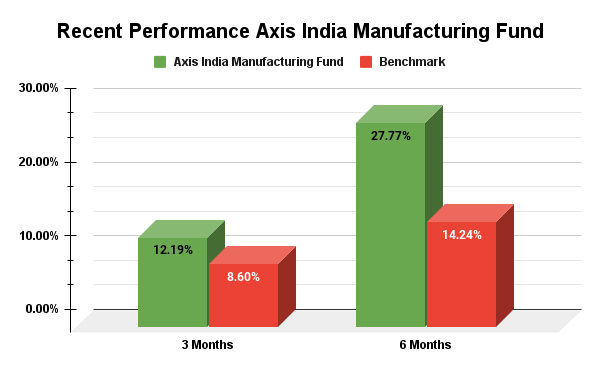

Axis India Manufacturing Fund

The Axis India Manufacturing Fund, launched on 21st December 2023, has achieved 27.77% returns in just six months by smartly picking quality companies, outperforming its category and benchmark. With an AUM of Rs. 5,909 Crores, you can start a SIP with just Rs. 500.

For example, a Rs. 3,000 monthly SIP for 15 years could turn an investment of Rs. 5.4 lakh and had made it worth Rs.15 Lakh in the long run.

Look at the below graph for SIP returns:

Final Note

You can make your wealth to over Rs. 1 crore, even with a monthly salary of Rs. 25,000, by following the above four steps. The key is consistent investing, choosing the right funds for SIP, and staying focused on the long term. Start with small amounts, stick to your plan, and watch your investments grow.

Read More Related Blogs with Expert Review

1. Best Mutual Funds for Retirement in India 2024

_(1).webp&w=3840&q=75)