Table of Contents

Did You Know that every time you pay tax, you are actually helping build the nation! From taxes, your contribution keeps the country running. India’s tax system works through two types: direct taxes (like income tax from your salary) and indirect taxes (like GST hidden in your shopping bills). Whether you are earning or spending, you are playing an essential part in powering the economy!

In this blog, we will explore these taxes, discuss their types, pros and cons and how they differ.

Understand Direct Tax and Its Types in India

Direct tax is on the rise. This means that the tax burden increases with your income. In other words, an individual who makes a high income will contribute an unequal part of the tax burden, while someone who makes a smaller income will experience a lesser tax burden.

Types of Direct Taxes in India

Here are the types of direct Taxes:

-

Income Tax

The most common direct tax is income tax, which one pays directly to the government. A person with a high income pays a larger share of the tax burden. In contrast, someone with a lower income faces a smaller tax burden. Profit tax applies to revenues from a financial year. The tax amount depends on the IT department's income tax range.

-

Capital Gains Tax

Anyone generating capital gains must pay the government a charge on those returns. The tax on these gains relies on how long you hold the investments. Investors classify them as long-term capital gains (LTCG) or short-term capital gains (STCG).

-

Securities Transaction Tax (STT)

If anyone is engaged in securities trading, then the individual must pay a securities transaction tax, even if they gain from it. For example, when buying and selling stocks, you would pay an additional fee in STT.

Start Your SIP TodayLet your money work for you with the best SIP plans.

Understand Indirect Tax and its Types in India

Indirect taxes are applied to goods and services. When you buy something, you pay this tax, but the seller sends it to the government. You don’t pay it directly as income tax. Examples include taxpayers paying these indirect taxes to the government through a go-between. This means they indirectly support government revenue.

The Central Board of Indirect Taxes and Customs (CBIC) is charged with the collection and administration of indirect taxes, which are regulated by the Department of Revenue.

Types of Indirect Tax in India:

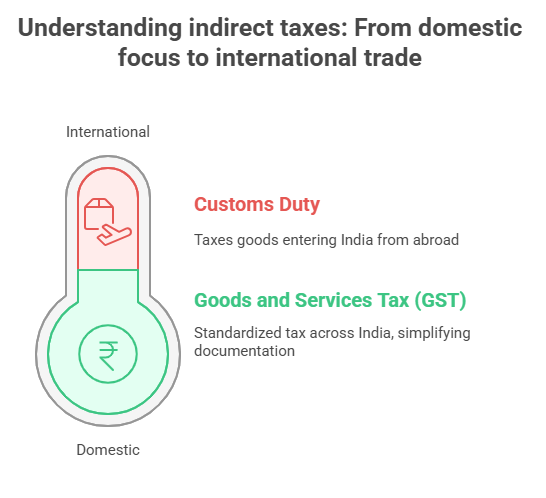

Goods and services tax & customs are the major types of indirect tax in India. To understand both here are explanation:

1. Goods and Services Tax (GST)

GST is the most standard indirect tax in India today. It replaced many older taxes like value-added tax (VAT), service tax, excise duty, and sales tax. GST is the only national tax that applies to the majority of goods and services. It is based on different tax rates set by the GST Council of India. GST simplifies tax documentation for businesses.

2. Customs Duty

Customs duty is a tax you pay when you buy goods from outside India. You must pay this tax whether the product arrives by air, sea, or land. It is an indirect tax that ensures foreign items are taxed before they enter the Indian market.

As GST was launched, India tax system has become more aligned. Older indirect taxes like VAT, service tax, and sales tax are no longer used. GST sticks to the theme of One Nation, One Tax, One Market.

Pros and Cons of Direct and Indirect Taxes

Here are the important aspects of the pros and cons of direct and indirect taxes:

| Aspect | Direct Taxes | Indirect Taxes |

|---|---|---|

| Pros | Balanced Taxation: Higher earners pay more, easing burden on lower-income people. No Covert Costs: Consumers know exactly what they pay in taxes on earnings and assets. Supports Savings: No direct tax on essentials helps consumers manage costs fairly. |

Accessible Payment: Tax is included in product prices, so no separate tax filing is needed. Encourages Reduced Luxury Spending: Higher taxes on non-essential items promote responsible use. Joint Contribution: Everyone pays tax through purchases, not just income earners. |

| Cons | Lowers Spendable Income: Reduces money available to spend, affecting buying power. Complex Filing: Tax returns can be time-consuming and difficult. Higher Burden Risk: Increases financial pressure, restricting investments and savings. |

Less Fair to Low-Income Groups: They spend a bigger portion of their income on taxed goods. Hidden Costs: Consumers may not realize how much tax is included in prices. Raises Living Costs: Increased indirect taxes push up prices, reducing purchasing power. |

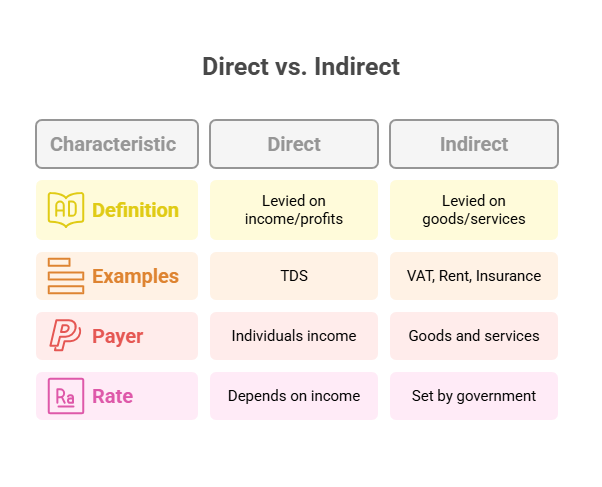

Major Differences Between Direct and Indirect Taxes with Examples

This table shows some major differences between direct & indirect taxes with examples:

| Aspect | Direct Tax | Indirect Tax |

|---|---|---|

| Meaning | Paid directly to the government | Paid to the government via an intermediary |

| Levied on | Profits & income | Goods & services |

| Taxpayer | Individuals and businesses pay direct taxes. | End-consumers of products, goods, and services. |

| Tax Rate | Based on the net income of the taxpayer. | Same for all taxpayers. |

| Tax Burden | Cannot be shifted; the person who earns pays the tax. | Can be shifted – passed on to the final consumer. |

| Transfer of Liability | Not transferable | Can be transferable |

| Tax Collected from | Individuals, companies, property owners | Consumers (through sellers or service providers) |

| Types | Income Tax and STT | Goods and Services Tax (GST) |

| Evasion | Possible | Not possible |

Smart Investments, Bigger Returns

Conclusion

Understanding the direct and indirect taxes with distinguished differences helps us become more informed and responsible citizens. Direct taxes are handed over directly to the government based on income or property, while indirect taxes are added to the price of goods and services we buy. Due to the establishment of GST, India's taxation system has become more methodical and efficient.

After all, knowledge is power, and when it comes to taxes, knowing how they work can help you make smarter financial decisions and stay on the right side of the law.

Also Read :

- What is Input Tax Credit? Examples, Eligibility and GST Rules

- What is TCS Tax? Full Form, Meaning & Example Explained

- Real Estate Vs Mutual Funds: Which Is Better For Long-term?

- Top 10 Highest Taxpayers in India 2025: Who Pays the Most?

Frequently Asked Questions(FAQs)

-

Is VAT an indirect tax?

The government applies Value Added Tax (VAT) as a form of indirect taxation on goods & services during the production and distribution process.

-

Is insurance a direct or indirect cost?

Insurance is considered into indirect expense.Generally,

insurance, utilities, and general home repairs. Since you would pay these expenses for the entire home, you consider them indirect expenses.

-

Which is better, direct or indirect tax?

Governments charge indirect taxes on goods and services, while they charge direct taxes on profits and income.

-

Is TDS a direct tax?

Yes, Tax Deducted at Source (TDS) is a direct tax deducted from an individual's income before it is deposited to their account.

-

What is the tax rate for NRIs in India?

The tax rate for NRIs in India depends on their income and the applicable tax category. The government taxes income earned in India, such as rent, salary or capital gains according to direct taxation and indirect taxation laws.

.webp&w=3840&q=75)

(1).webp&w=3840&q=75)