Table of Contents

Ever noticed an extra charge labelled TCS on your invoice and been confused about what it means? Well, the TCS full form stands for “Tax Collected at Source.”

In other words, it is a type of tax which is collected by the buyer by selling certain goods like alcohol, timber, minerals etc.

Now, the most interesting part to know is, TCS is the payment that is deposited to the government, which is ultimately considered as an advance tax paid on your behalf.

If your interest is piqued, wait till you reach the end as it is just the tip of the iceberg. Ready to dive in?

Bonus Points: Get the answer to the most asked query, “What is the applicable TCS rates in India?”

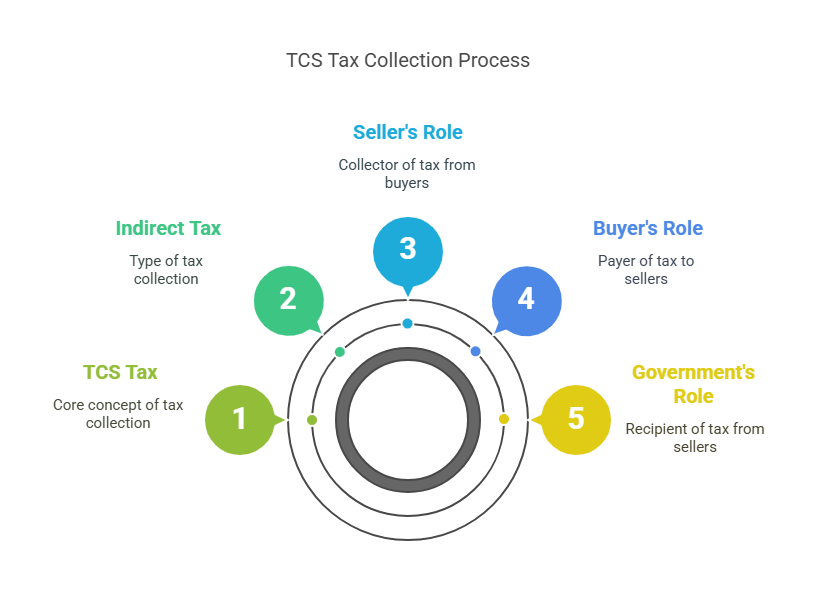

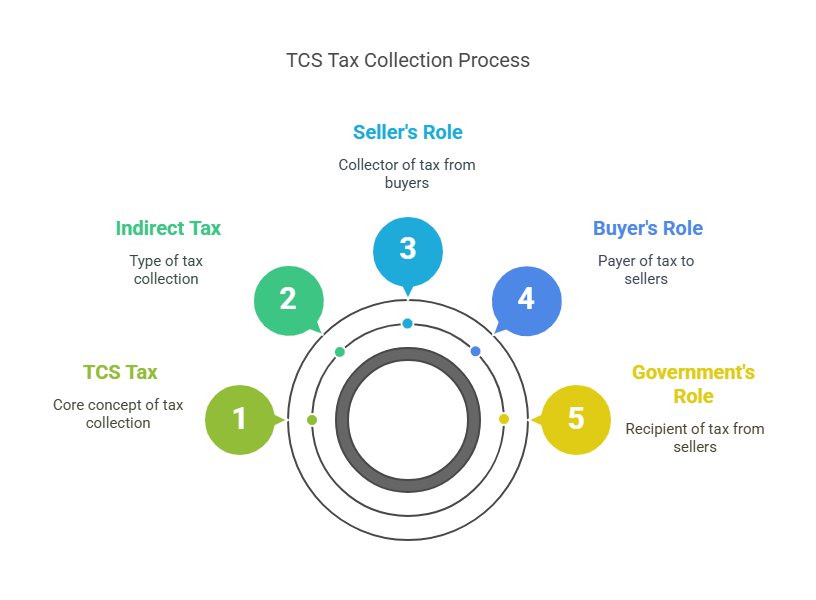

What is the TCS Tax?

The TCS Tax Collected at Source is a type of indirect tax. This tax is calculated when sellers collect from buyers on the sale of certain goods or services. The seller then pays this tax to the government. The aim behind the TCS is to improve compliance with the tax system & make sure taxes are collected.

The TCS applies to high-value goods like cars, scrap, timber, bullion & even foreign remittances and overseas tour packages. For instance, if a seller sells goods worth Rs 1,00,000 & the TCS rate is 1%, the seller will collect Rs 1,000 extra as TCS from the buyer. This Rs 1,000 is then deposited with the government.

Taxpayers must know that TCS is not applicable on Mutual Funds investments or SIPs Systematic Investment Plans, unless the investment involves foreign remittance such as through LRS Liberalised Remittance Scheme.

What is TCS Tax with Example?

Let’s take an example to get a better understanding about the TCS Tax (Tax collected at source):

Imagine a car dealer selling a car worth Rs 12,00,000 to a customer. Since the sale of a motor vehicle above Rs 10,00,000, TCS tax applies here.

- TCS rate = 1%

- TCS amount = Rs 12,000 (1% of Rs 12,00,000)

- Total amount collected from the buyer = Rs 12,12,000 (Rs 12,00,000 + Rs 12,000 TCS)

The car dealer collects Rs 12,000 as TCS from the customer & deposits it with the government.

Here, the dealer does not pay this tax himself. He simply collects it on behalf of the government. As TCS is an indirect tax.

Get a clear picture of your taxes- Use the Tax Calculator now.

Having understood the example, now let's bring up the benefits in the next heading.

Benefits of TCS for Buyers and Sellers

Here is a list of key benefits offered by TCS for buyers and sellers:

Benefits for Buyers:

- Proof of Tax Payment: Buyers receive a recorded tax statement on high-value purchases, useful for filing tax returns or claims.

- Tax Adjustment: TCS paid can be adjusted against the final tax liability at the time of income declaration.

- Cost Transparency: Buyers know the exact tax paid on goods, helping with accurate budgeting and financial planning.

- Promotes Tax Discipline: Since tax is collected at the point of purchase, it encourages buyers to stay compliant with tax laws.

Benefits for Sellers:

- Improved Record-Keeping: Encourages sellers to maintain accurate and timely sales records, aiding proper income reporting.

- Supports Tax Avoidance Prevention: Issuing TCS certificates at the time of sale ensures taxes are collected and reported correctly.

- Simplifies Tax Transfer: This makes it easier for sellers to handle tax payments, as tax is collected upfront and deposited to the government.

- Builds Trust with Tax Authorities: Timely and correct compliance boosts credibility with revenue departments, helping in audits and future dealings.

Also Read: What is the Professional tax in salary? Learn tax slabs, deductions.

TCS rates differ for various goods in India. Let's take a closer look.

What are the TCS Rates Applicable in India?

The TCS in income tax is paid only when the goods are used for trading purposes & Always check the TCS rate and applicable threshold before making high-value purchases or foreign investments.

The rates of goods are considered under the Tax Collected at Source categories in section 206C (1):

| Product | TCS Tax Rate |

|---|---|

| Liquor | 1.00% |

| Scrap | 1.00% |

| Minerals | 1.00% |

| Bullion/Jewellery | 1.00% |

| Motor Vehicle | 1.00% |

| Parking/Toll/Mining | 2.00% |

| Timber (Leased Forest) | 2.50% |

| Timber (Other Mode) | 2.50% |

| Forest Produce | 2.50% |

| Tendu Leaves | 5.00% |

Remember: Buyers should ask for a TCS certificate (Form 27D) as proof of tax collected.

Did you realize that seller and buyer fall under separate classifications? Let’s cover that in the next heading.

Seller and Buyer Classifications of TCS

Under the TCS tax, there are only particular categories of sellers who must collect tax at the source while selling certain goods:

- The Central Government, State Government, Local Authorities, Official Corporations, companies registered under the Companies Act, Business Partnerships, cooperative societies, and individuals or participants whose accounts the Income Tax Act reviews for a specific financial year include these sellers.

A buyer is someone who purchases goods or gets the right to receive them through sales, tenders, or auctions. But not all buyers must pay TCS.

- Exempted buyers include Public Sector Companies, the Central and State Governments, High Commissions, Consulates and foreign trade representations, and clubs, like sports or social clubs.

Note: Late payment or non-payment of TCS can lead to interest, penalties, and prosecution under the Income Tax Act.

What are Interest and Penalties?

The Tax authorities charge interest & penalties on Tax Collected at Source (TCS). This ensures sellers collect, deposit, and report tax on time and accurately. The Income Tax Act describes specific outcomes for delays or failures in TCS compliance. Such as:

1. Aim of Penalties

- Timely tax payments and returns help fund public services. To encourage compliance, the Act imposes penalties for delays in payments or incorrect returns.

2. Penalty for Non-Payment or Incorrect Payment

- If a taxpayer cannot TCS or Tax Deducted at Source (TDS), the tax officer will calculate the penalty. The penalty will not go beyond the amount of tax owed for late payments.

3. Deadline for Filing Updated Returns:

- After 36 months from the end of the audit year, a person who receives a notice under Section 148A cannot file an updated return.

4. Penalty for Incorrect or Missing TDS/TCS Statements

- Not providing a TDS/TCS statement or submitting it wrongly can result in a penalty from Rs. 10,000 to Rs.1,00,000.

5. Future Amendments to TCS (Section 206C(1H))

- Starting April 1, 2025, sellers will not need to collect TCS on goods sold, as Section 206C(1H) will be removed.

Tax Tip: If you are sending money abroad to invest in foreign mutual funds, TCS under section 206C(1G) may apply, usually 5% for amounts above Rs 7 lakh/year.

When Should TCS be Collected?

The company has to pay the TCS by the 7th of every month. Within seven days after the closing day of the month in which the tax was collected (monthly), the seller has to pay the TCS amount.

The seller will be responsible for paying interest of 1% each month or a part of the month if he disregards TCS's collection and payment guidelines.

Tax Tip: If TCS has been collected from you, make sure to claim it in your “income tax return (ITR)”. It appears in Form 26AS.

The table below clears your doubts about TCS & TDS.

What is the Difference Between TCS and TDS?

The table below is drawn to comparison between TDS & TCS with different parameters:

| Parameter | TDS (Tax Deducted at Source) | TCS (Tax Collected at Source) |

|---|---|---|

| Meaning | Tax is taken out by the payer while making a payment | Tax is collected by the seller during the sale of goods |

| Who Deducts/Collects | Deducted by the payer at the time of payment | Collected by the seller at the time of sale |

| Collected From | Payee (recipient of income) | Buyer (purchaser of goods) |

| Applies To | Payments like salary, rent, interest, commission, etc. | Sale of specific goods like alcohol, scrap, timber, etc. |

| When Applied | At the time of payment or credit, whichever is earlier | At the time of sale or receipt of payment |

| Form Used for Filing | Forms like 24Q, 26Q | Form 27EQ |

| Certificate Issued | Form 16 / 16A (to the deducted) | Form 27D (to the buyer) |

Conclusion

To sum up, TCS (Tax Collected at Source) has a key part in the Indian tax setup by taking tax at the sale of certain goods or services. It benefits both buyers and sellers by boosting tax transparency and compliance. With clear classifications, applicable rates, and when to collect TCS, it helps simplify tax collection.

Figuring out the contrast between TCS and TDS is key to proper financial and tax planning.

Frequently Asked Questions

-

Is the TCS tax refundable?

Yes, TCS (Tax Collected at Source) is refundable.

You can recover it by presenting your Income Tax Return if your total tax dues are less than the TCS threshold.

-

How can I avoid TCS Tax?

You can avoid TCS by staying under the transaction limits set (like sending less than Rs.7 lakhs abroad in a year).

-

How can I reduce my tax on my salary in TCS?

You can reduce tax on your TCS salary by investing in tax-saving options like 80C (PF, LIC, ELSS) and claiming deductions like HRA and 80D (health insurance).

-

Should sellers collect TCS on an amount inclusive of GST?

Yes. TCS needs to obtain the value of the sale consideration, which usually includes GST.